Good Morning, I’ll keep this as brief as possible this morning as I had a total left hip replacement five days ago and I’m feeling a little rough to say the least. I had too much fun in the USDOJ and USMC and now I’m paying for it…. We’ve all got our crosses to bear. I wouldn’t change a thing except maybe the current discomfort if that were possible. Anyway…. We find ourselves bracing for more volatility in the market moving into the year end as we deal with bond yields, oil prices, sticky inflation, and a war in the middle east between Hamas and Israel. However, the main focus remains earnings and what the Fed will do with iterest rates. I honestly think the end of the Fed’s rate hiking campaign is being priced in. It will be interesting to see if we get one more rate hike in the first week of November. In the event that does take place I’m pretty sure the market will have a negative reaction. After that it’s pretty much a foregone conclusion that the rate hikes will be over at that point. That noted, it is also evident that persistent inflation will keep rates higher for longer which means in the long run that we will have to endure more volatility. I know that I say it every week but it’s the most revelent thing to consider. It needs to be said in order that we don’t bring our expectations to the point of that the market can’t possibly fulfill them. The market will not make a meaningful move higher until the rate of inflation begins to approach two percent. Yes, we got a little bump when the rate of inflation started to decrease but now we need more. Will we get it in 2024? I certainly hope so, but I would be amiss not to point out that we’ll be packing a lot of baggage into the new year. The War in the Ukraine, the War in the middle east. a contensious presidenial election, likely more budget negotiations, the border crisis…..the list goes on and on. Folks, there’s only one thing we can do other than pray and that’s watch our charts and react to what we see. No one will be able to accurately predict this mess. It’s simply going to be more of the same type of action… So prepare yourself for it. I’m not saying that there is zero potential to make gains, but what I am saying is that you will have to work extemely hard for any that you get.

The days action so far has generated the following results: Our TSP allotment is trading higher at +1.11%. For comparison, the Dow is up +1.15%, the Nasdaq +1.07%, and the S&P 500 +1.11%. Praise God for a day in the green!

Stocks rally to start the week, Dow up nearly 400 points

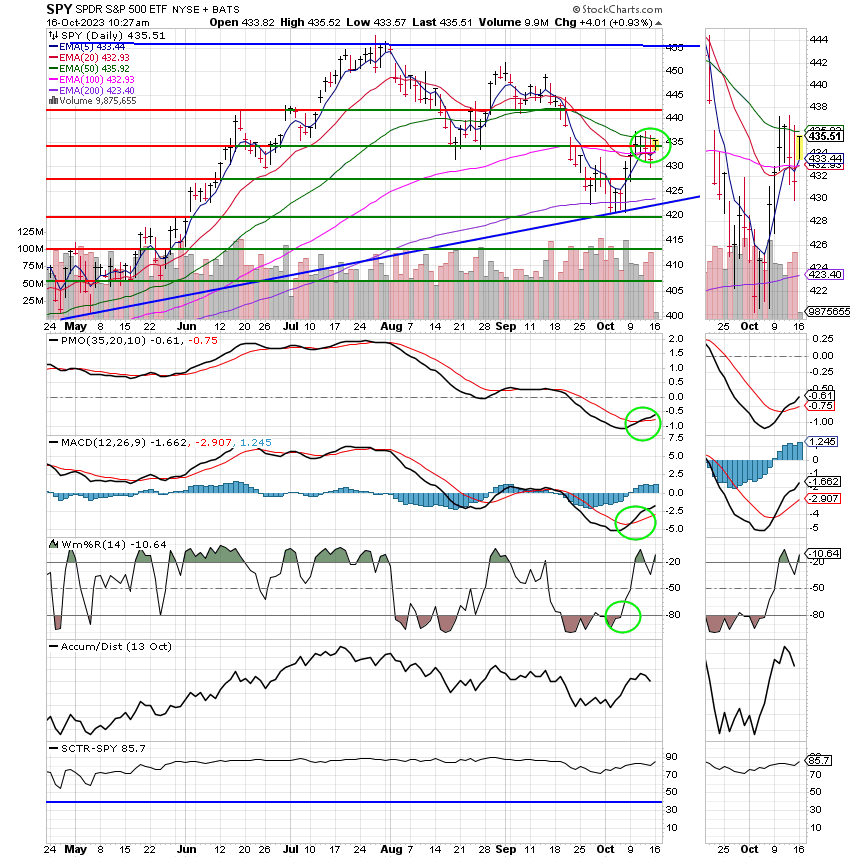

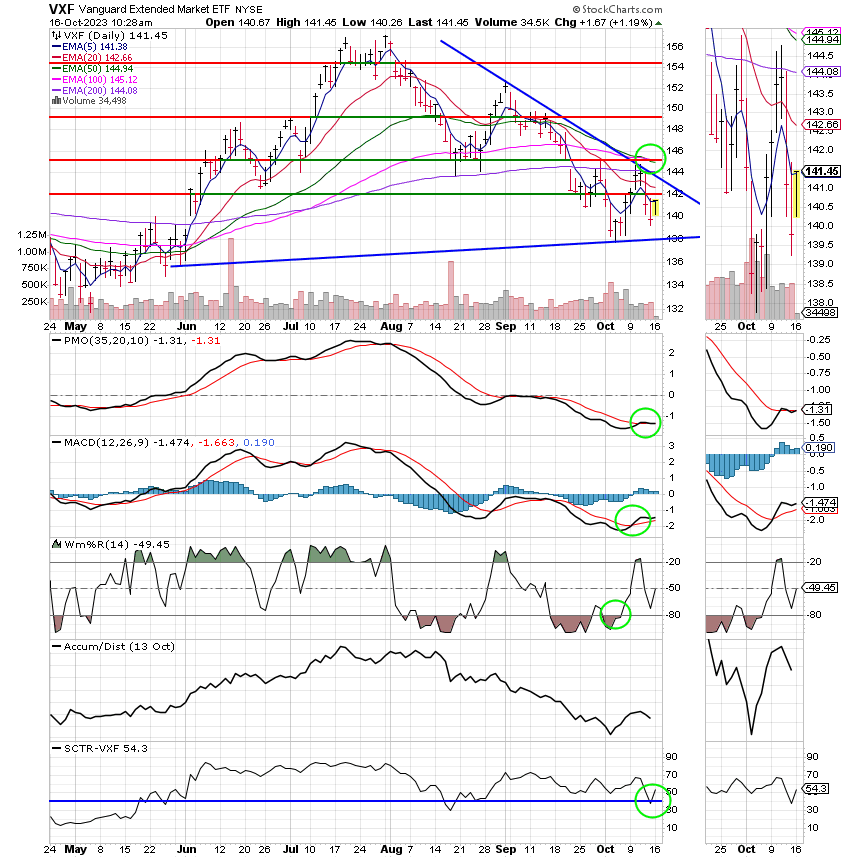

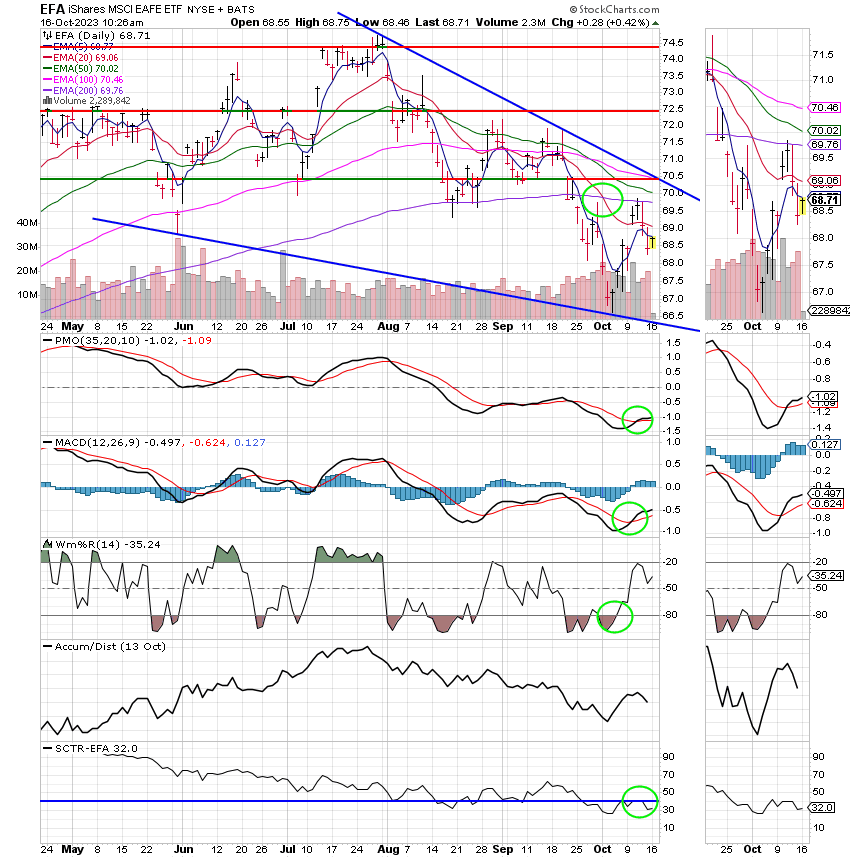

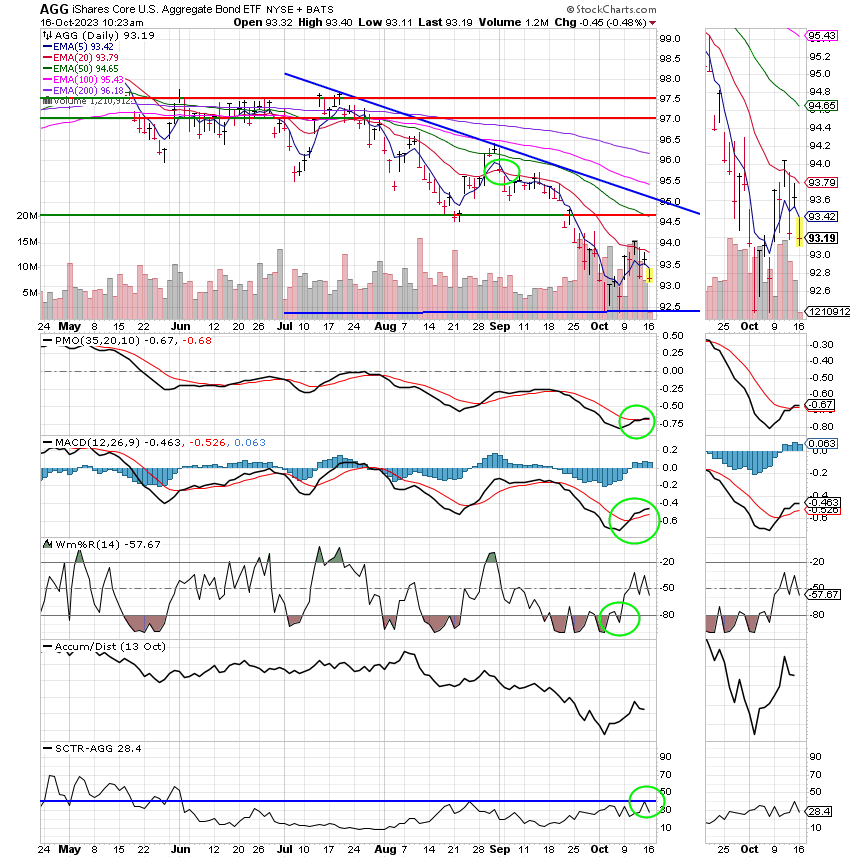

Recent action left us with the following signals: C-Hold, S-Hold, I-Hold, F-Hold. We are currently invested at 100/C. Our allocation is now -5.43% for the year and +0.99% for the month not including the days results. Here are the latest posted results:

| 10/13/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.7788 | 17.9787 | 67.2484 | 65.2881 | 36.0398 |

| $ Change | 0.0024 | 0.0859 | -0.3380 | -0.6251 | -0.3749 |

| % Change day | +0.01% | +0.48% | -0.50% | -0.95% | -1.03% |

| % Change week | +0.09% | +0.97% | +0.47% | -1.03% | +0.13% |

| % Change month | +0.17% | -0.21% | +0.99% | -2.51% | -0.71% |

| % Change year | +3.15% | -1.26% | +14.17% | +6.11% | +6.18% |