Good Evening, The market closed modestly higher on hopes that an economic stimulus bill will be passed before the election. Make no mistake, trading right now is totally focused on a stimulus bill. Today House Speaker Nancy Pelosi and Treasury Secretary Steven Mnuchin both indicated that progress had been made toward an agreement between Democrats and the GOP. Nancy Pelosi had previously set today as a deadline in which an agreement had to be reached prior to the election. Nevertheless, in spite of the fact that no agreement was reached talks will continue tomorrow as the House Speaker said that sufficient progress had been made to continue the talks. “It isn’t that this day was a day that we would have a deal, it was a day that we would have our terms on the table to be able to go to the next step,” Pelosi told Bloomberg. So it’s all about stimulus right now. The winner of the election could have implications on where this market will go in the long term but the short term it will be determined by this stimulus package. It says here we will ultimately get a stimulus package and the market will move on from that point. There is no doubt that the market will be turbulent until an agreement is reached. As far as the long term goes, if a market friendly administration is elected then the market will rock on, if not, then the market will deteriorate over time as taxes and regulations increase…… That sounds simple because it is. We’ll continue to put our faith in God and see what happens.

The days trading left us with the following results: Our TSP allotment slipped -0.20%. For comparison, the Dow added +0.40%, The Nasdaq +0.33%, and the S&P 500 +0.47%. Stocks closed well off there highs for the day. We will see where the stimulus winds blow us tomorrow.

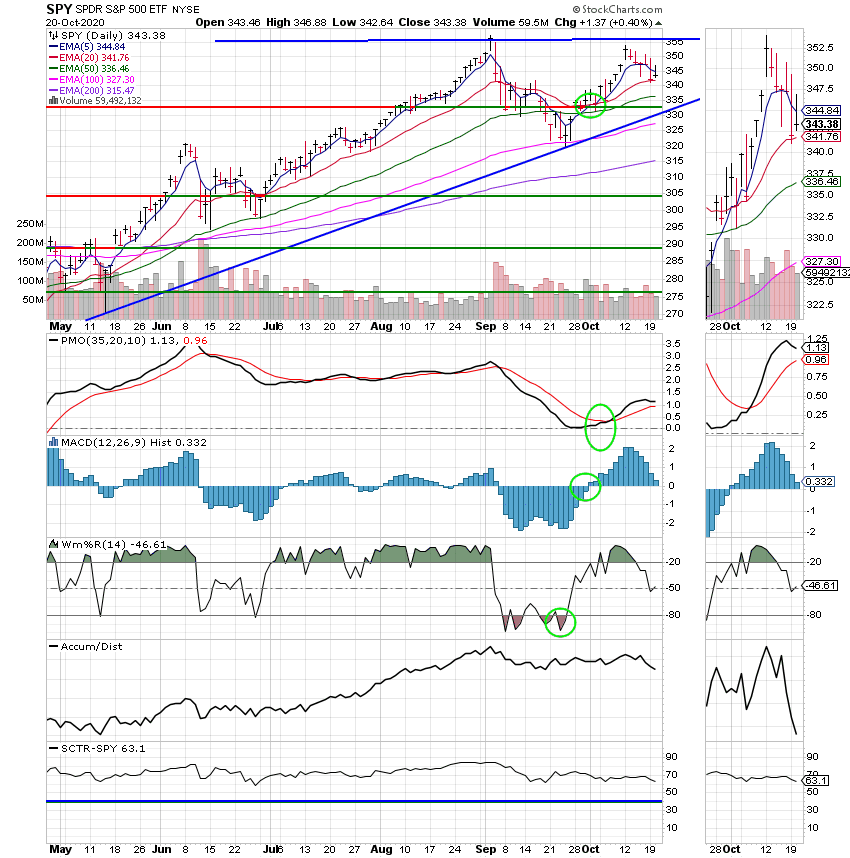

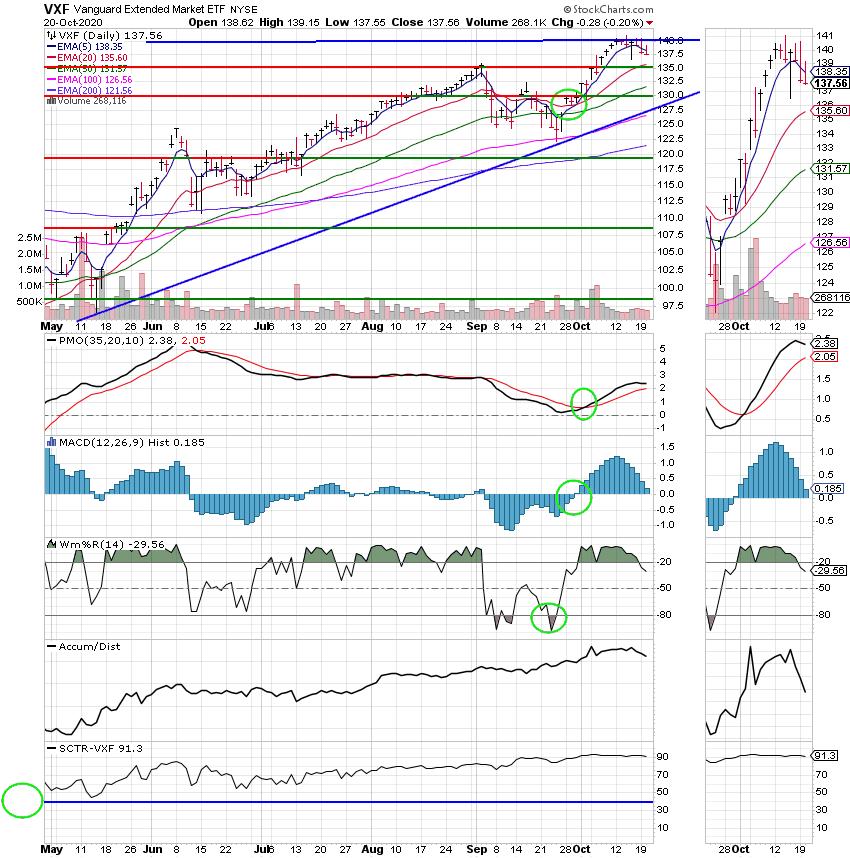

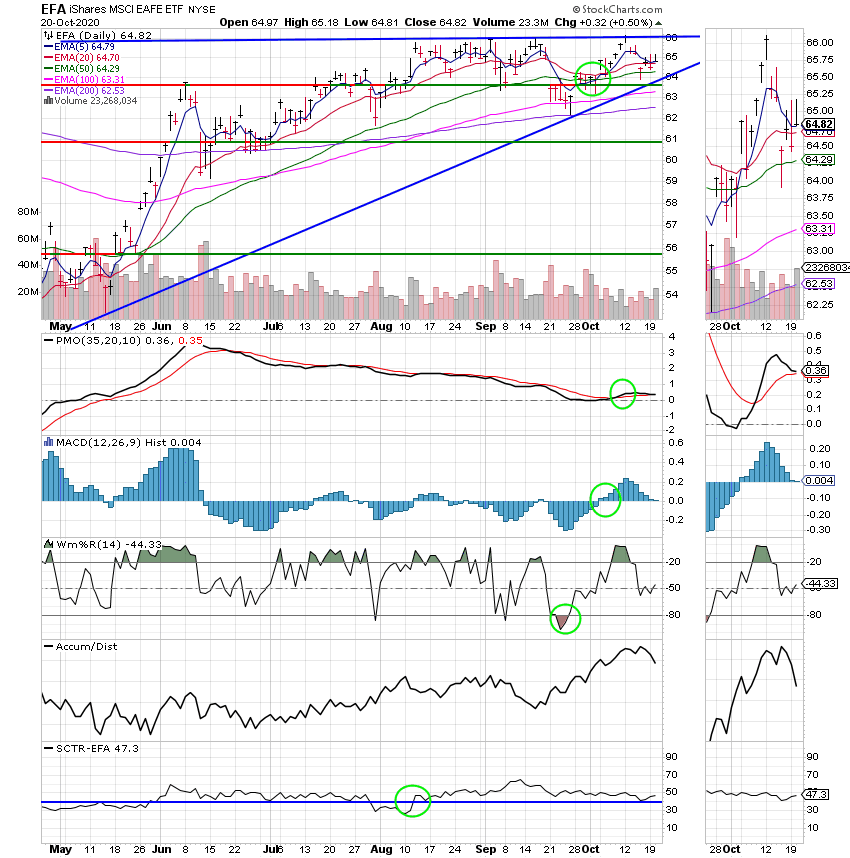

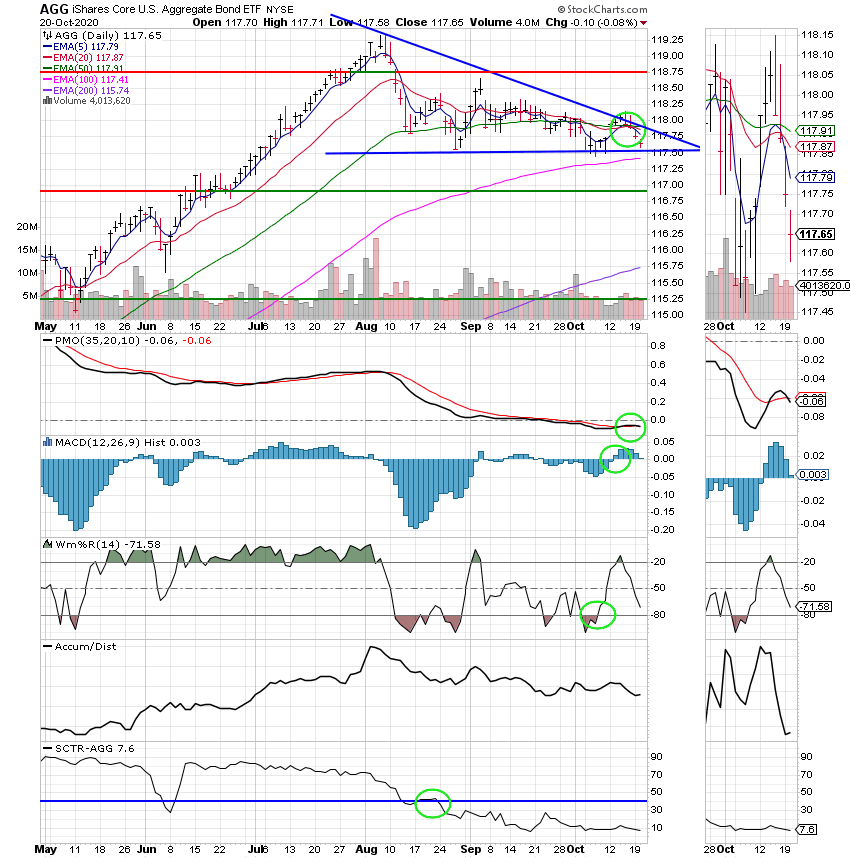

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Neutral. We are currently invested at 100/S. Our allocation is now +23.25% for the year. Here are the latest posted results.

| 10/19/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4812 | 21.0387 | 50.8413 | 61.8859 | 30.8921 |

| $ Change | 0.0011 | -0.0151 | -0.8422 | -0.6533 | -0.0497 |

| % Change day | +0.01% | -0.07% | -1.63% | -1.04% | -0.16% |

| % Change week | +0.01% | -0.07% | -1.63% | -1.04% | -0.16% |

| % Change month | +0.04% | -0.05% | +1.97% | +6.30% | +1.35% |

| % Change year | +0.80% | +6.70% | +7.58% | +9.97% | -5.58% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 21.6396 | 10.4956 | 35.9721 | 10.6555 | 39.7673 |

| $ Change | -0.0501 | -0.0535 | -0.2257 | -0.0732 | -0.2972 |

| % Change day | -0.23% | -0.51% | -0.62% | -0.68% | -0.74% |

| % Change week | -0.23% | -0.51% | -0.62% | -0.68% | -0.74% |

| % Change month | +0.54% | +1.16% | +1.43% | +1.57% | +1.72% |

| % Change year | +2.14% | +4.96% | +3.21% | +6.56% | +3.48% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 10.7653 | 23.3048 | 10.984 | 10.984 | 10.9841 |

| $ Change | -0.0859 | -0.1977 | -0.1122 | -0.1123 | -0.1123 |

| % Change day | -0.79% | -0.84% | -1.01% | -1.01% | -1.01% |

| % Change week | -0.79% | -0.84% | -1.01% | -1.01% | -1.01% |

| % Change month | +1.85% | +1.98% | +2.41% | +2.41% | +2.41% |

| % Change year | +7.65% | +3.66% | +9.84% | +9.84% | +9.84% |