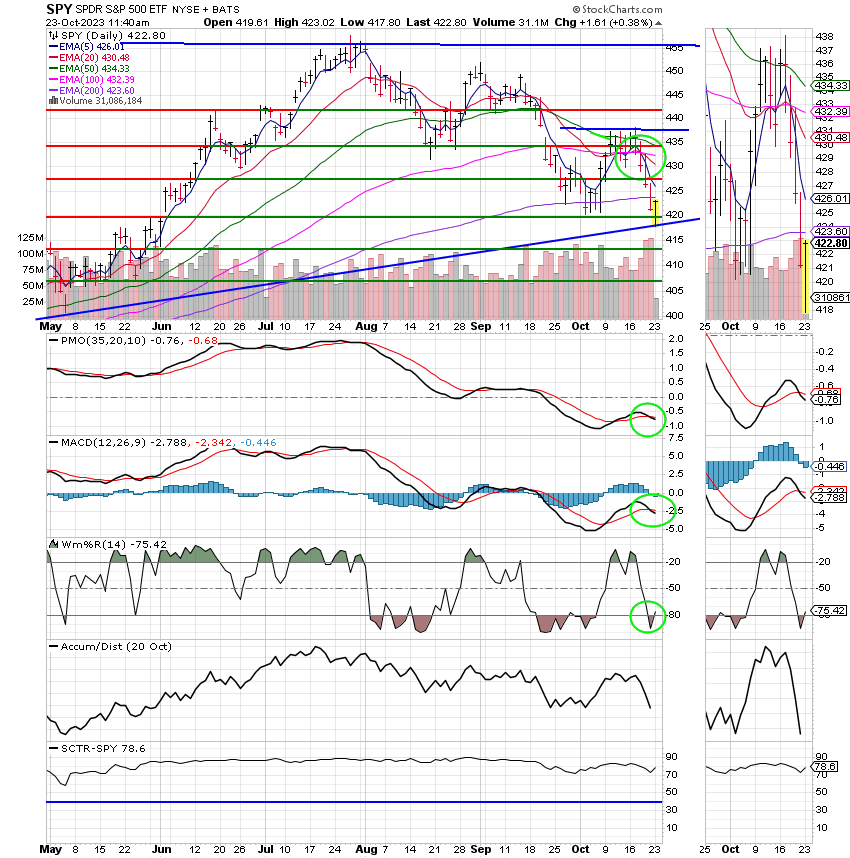

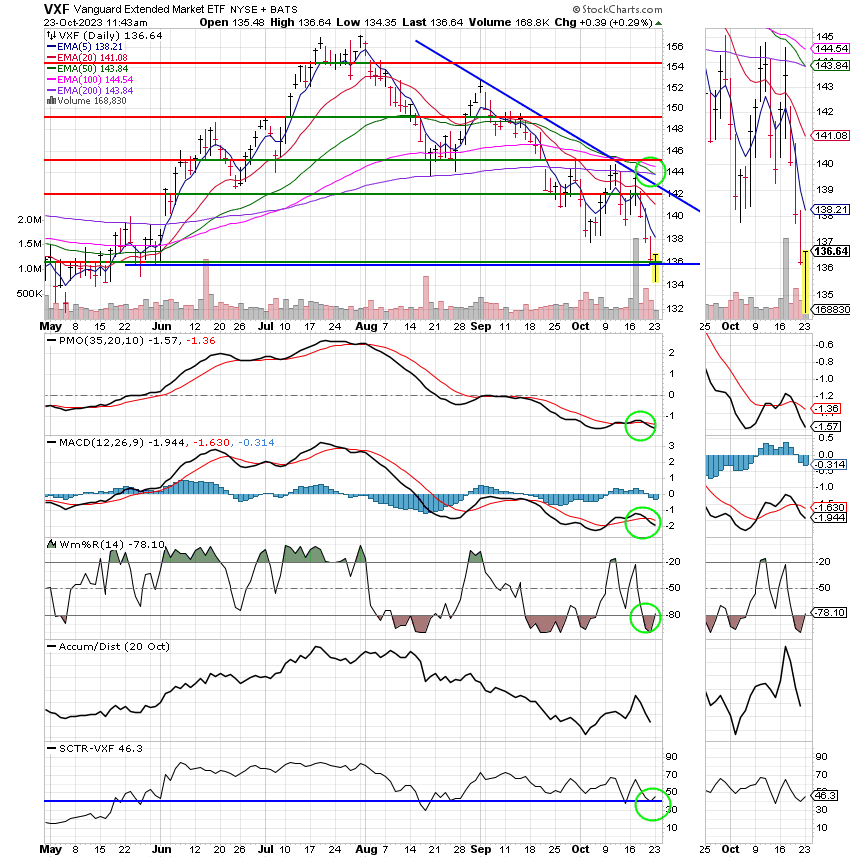

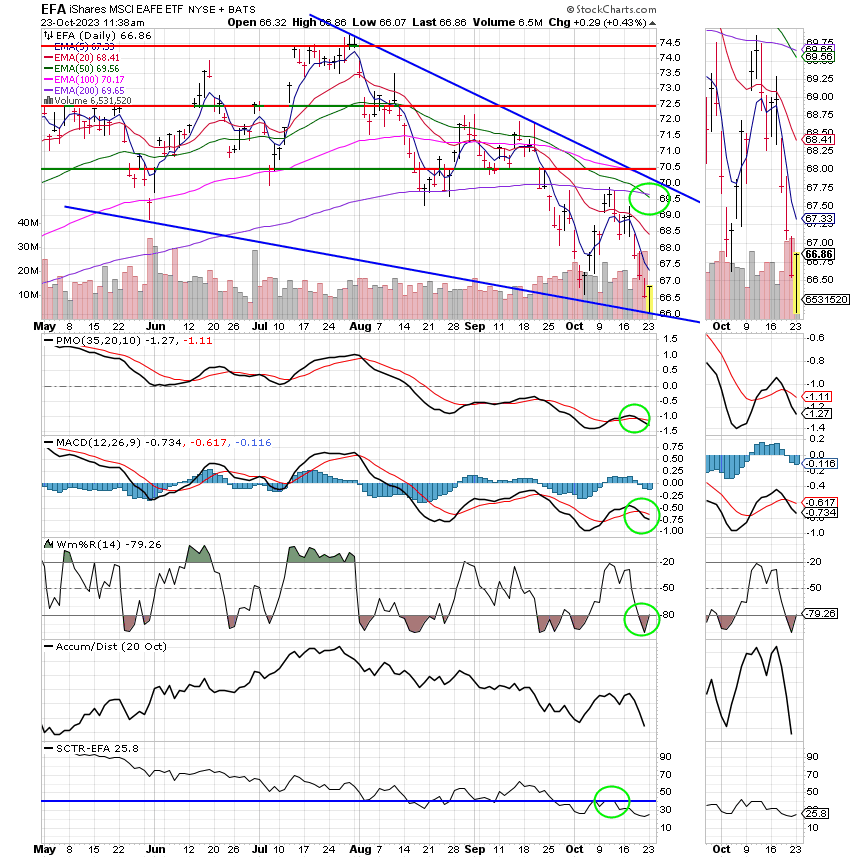

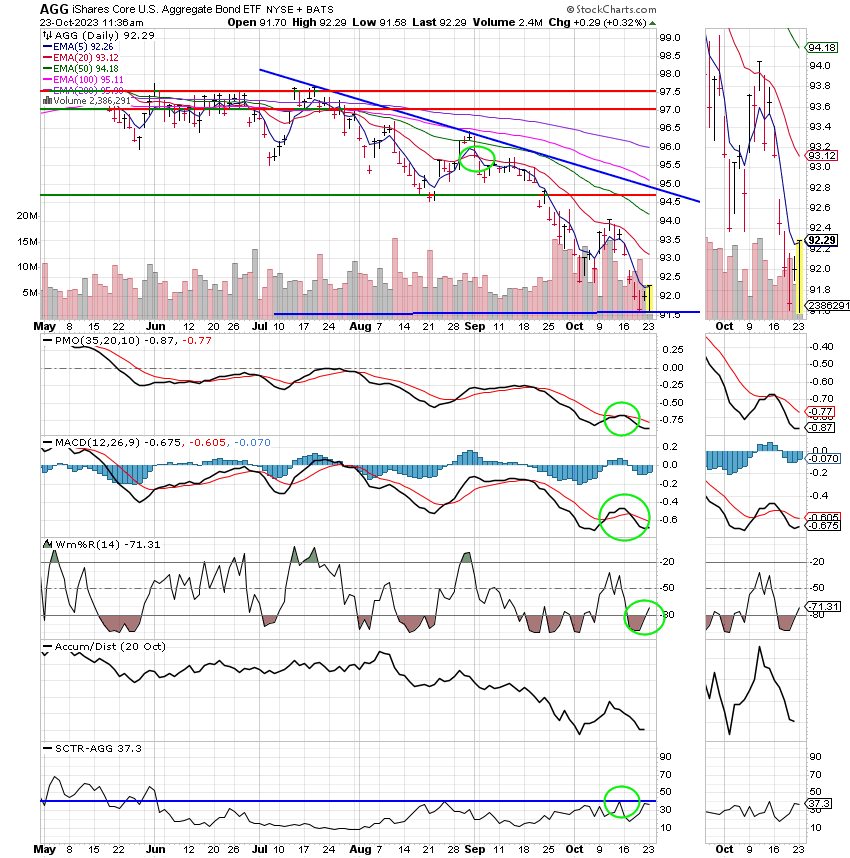

Good Afternoon, This week it’s pretty simple see what’s influencing the market. Bond yields. Each time the 10 year bond yield rises above the key phycological level of 5% the market sells off. Each time the 10 year bond yield falls below 5% the market rises. Of course inflation ultimately effects bond yields and bond yields end up effecting interest rates. It’s a little more complicated than that but for the purpose of this blog that explanation will suffice. Many investors panic at that level as higher interest rates have a negative effect on all stocks but especially growth/tech stocks. You will usually see them sell off first. While a lot of these growth/tech stocks are small cap stocks many of them are not and have a large sway on the major indices. I’m thinking of such stocks as Alphabet (the parent company of Google), Amazon. Nvidia, the mighty Apple and the list goes on and on. At any rate this volatility in bond yields effects everything else which is exactly what you are experiencing at this time. Do I think all the selling is justified? Not really, but then again who am I. The volatility continues and is evident by the current level of the VIX (volatility index) which currently sits at the critical level of 20, Anything above 20 usually results in a downtrending market. Above 30 usually accompanies a bear market…. just food for thought. So what’s our take on all this? After reviewing my charts I determined that solid support exists at 420 on the SPY. Given that support the market at the worst should trade sideways until it eventually rallies and recovers. That considered, we decided that there is a high level of risk of missing out on any subsequent rally should we sell at this time. So, given the support at 420, we have decided for the second time this fall to ignore the sell signals that have been generated on our equity based charts. Our analysis leads us to believe that the lows put in during the first week of October will hold and allow us to remained positioned for the next rally. Had we thought that prices would go even lower we would have sold but sooner or later you have to call a bottom and for us this is it.

The current trading is generating the following results: Our TSP allotment has reversed and is currently trading in the green at +0.38%. For comparison, the Dow is up +0.01%, the Nasdaq is +0.78%, and the S&P 500 is +0.38%. Praise God for the reversal!

Stocks are little changed Monday as 10-year Treasury yield dips back below key 5% level: Live updates

Recent action has left us with the following signals: C-Sell, S-Sell, I-Sell, F-Sell. We are currently invested at 100/C, Our allocation is now -7.42% on the year not including the days gains. Our allocation is currently -1.42% on the month. Here are the latest posted results:

| 10/20/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.7951 | 17.6679 | 65.6473 | 63.6398 | 35.0579 |

| $ Change | 0.0024 | 0.0564 | -0.8348 | -0.8564 | -0.3855 |

| % Change day | +0.01% | +0.32% | -1.26% | -1.33% | -1.09% |

| % Change week | +0.09% | -1.73% | -2.38% | -2.52% | -2.72% |

| % Change month | +0.26% | -1.94% | -1.42% | -4.97% | -3.41% |

| % Change year | +3.25% | -2.96% | +11.45% | +3.43% | +3.29% |