Good Morning, For the past four sessions we have seen a nice countertrend rally develop. So now I’m starting more questions than I could possibly answer unless maybe I had a secretary to help me. Perhaps I should enlist Mrs. Grimes? No, I think not. she is quite busy and enjoying her retirement from the BOP so I best not bother her LOL. This inheritably happens when the market moves up or down. Folks are either running their own system and see the movement or they read about some analyst or the other that is making a recommendation based on whatever system they are running. This is where everyone gets partially if not totally messed up, often to their detriment. While some folks are experienced investors and understand exactly what they are doing, most don’t even realize they are mixing systems and make no mistake mixing systems can be dangerous. Occasionally it will come out right but most often it will not. I responded to a question on our Facebook page today where a member of our group asked whether we we’re going to change our allocation to invest in the C Fund given the current up turn. It was in a comment to the opinion of an analyst that we posted in which he stated that buying now would pay off in the next twelve months. The first and foremost thing you must realize when reading his opinion is that he uses a fundamental investment style. Here is what he had to say:

Buying now should pay off in the next 12 months, says Leuthold’s Paulsen

Many investors spend their time trying to time the market, waiting for a precise bottom before they buy.

But that strategy may lead investors to miss out on a decent payoff over the next year, said Leuthold Group’s Jim Paulsen said.

“To me, I would say if you buy somewhere around here, you’re probably going to feel pretty good over the next 12 months,” the chief investment strategist said.

Investors over the last few trading days have bet that the Federal Reserve is likely nearing a slowdown in its pace of tightening, pushing the major averages higher.

Some shifts in the market do indicate that a bottom may have hit. Defensive areas are underperforming while more aggressive investments like cyclicals and small caps have shifted into leadership positions. But Paulsen cautions timing the bottom.

“I don’t worry too much about trying to pick bottoms,” he said.

Our group member read this opinion and asked a good and valid question which is are we moving to the C Fund? My response could be a simple yes or no but would anyone learn anything or benefit from that? Probably not. Here was my response:

That is that authors opinion and in and of it’s self it is not a bad strategy. However, he is a fundamental investor and we are technical investors. There is a huge difference. He is waiting for certain fundamental changes to the market and we are waiting for technical changes on our charts. We are waiting on the math and he is waiting on the news. For him it’s about being positioned for the next trend. For us it is about waiting for the next trend to begin before we make our investment. Which of these styles of investment is best is a matter of personal opinion. Moreover, I would even say it’s a matter of what works best for you. What will allow you to make the most money while taking into account your skill level and tolerance for risk? Again, what is best for you! I agree with his analysis in that if you buy in at this point you will eventually make money. I also agree that you should not try to catch the exact bottom. That is a fools errand, but there is a huge difference between trying to catch the bottom and trying to catch the next trend. What we endeavor to do is to catch the next uptrend that is long enough to trade and eventually to catch the uptrend that we can ride back to the market top and hopefully new highs. Inversely, we try to avoid the down trends that will reduce our capital. I will add that this year has been the most difficult year that I have experienced since I started investing in 1987. The large price swings that we have seen have been unprecedented due to quantitative tightening. You know the rest of that story in that we were forced to back off of indicators we had used for decades and develop new ones. We did that. We adapted and here we are. Now to answer your exact question. I am looking for two things in my charts that can be summed up in one term. Reduced risk. Those two things are a low percentage chance that the market will have a downtrend that will result in a new low and a high percentage chance that a new up trend will result in new highs. Remember its all about the math. We look at a lot of indicators and we take the path of the greater mathematical weight of evidence that gives us the greatest reduction of risk to our portfolios. As of this time my charts are moving in the direction of a buy signal but they have yet to generate one. I still have a significant percentage of charts that indicate that a lower low is still possible. As a new uptrend emerges and is confirmed those indicators showing a possible leg lower will become nonexistent while the ones favoring a strong uptrend will become prevalent. That is the point at which we will make the decision to reenter the equity market. It is a fluid process and changes with the ebb and flow of the market. At this moment the charts are moving closer to that buy signal you are asking about, but they are not there just yet. A surge in the market one way or the other can make a big difference. Given this volatility and the fact that we were fooled three times already this year (prior to retooling our indicators) we are approaching this possible uptrend with an abundance of caution. Should the market continue to trade as it has the past four sessions we could get an overall buy signal as early as tomorrow…….but until then we must sit tight and be wary of a reversal. After all its not like we haven’t seen a few of those this year and with the Fed meeting coming in November………you get the picture.

I hope that helps you folks understand our strategy and helps you to develop one of your own that you are both comfortable with and confident in! The main point I’m trying to make here is know what your system/strategy is and stick with it. If in fact you discover that what you are using is not working the way you want, then use another style. While some folks have success with hybrid systems marrying multiple investment styles, that does not work for the majority of us. To reiterate what I have already said. You need to find the system that works best for you. There are multiple ways to make money, but there is only one way that best fits your goals and preferences. One last thing I would highly recommend is to earnestly seek God in prayer in that he will guide you in developing your system. You cannot overcome anything in this world without Him.

The days trading so far has left us with the following results: Our TSP allotment is steady in the G Fund. For comparison, the Dow is up +0.80%, the Nasdaq +1.93%, and the S&P 500 +1.26%. Folks our indicators are starting to become favorable. Now is where we need to be both cautious and patient.

Nasdaq rises 1% as traders await key tech earnings

Recent action has left us with the following signals: C-Hold, S-Hold, I-Hold, F-Hold. We are currently invested at 100/G. Our allocation is now -27.37% for the year. Here are the latest posted results:

| 10/24/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.1064 | 17.4427 | 58.0579 | 60.722 | 29.7725 |

| $ Change | 0.0057 | -0.0175 | 0.6815 | 0.1721 | 0.0275 |

| % Change day | +0.03% | -0.10% | +1.19% | +0.28% | +0.09% |

| % Change week | +0.03% | -0.10% | +1.19% | +0.28% | +0.09% |

| % Change month | +0.26% | -2.55% | +5.99% | +3.74% | +3.76% |

| % Change year | +2.21% | -16.49% | -19.30% | -27.23% | -24.52% |

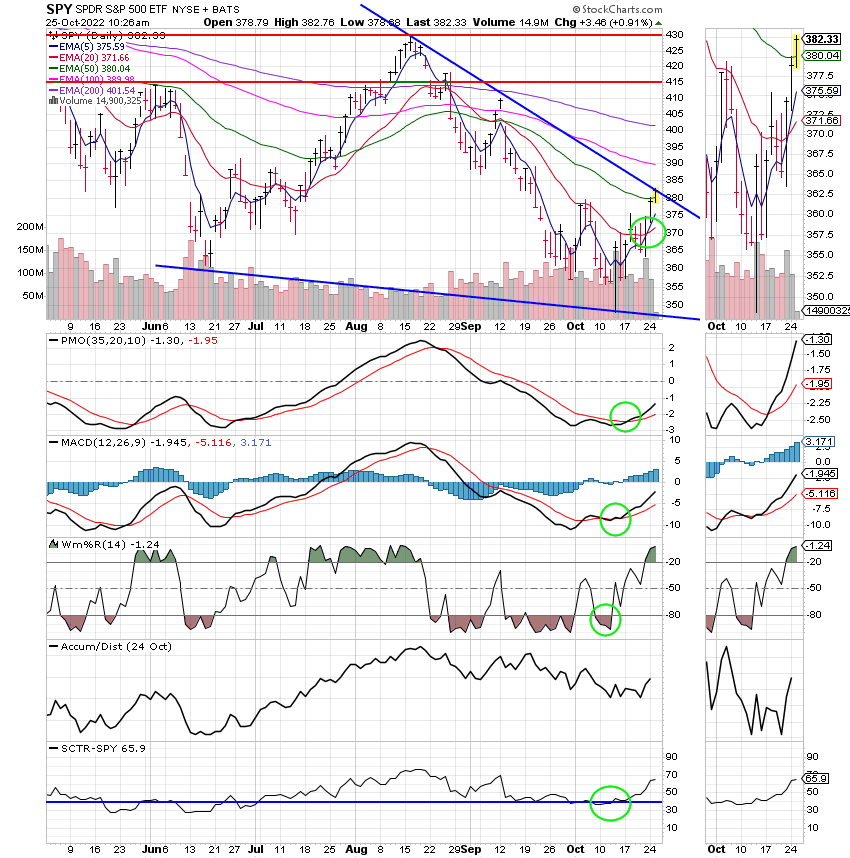

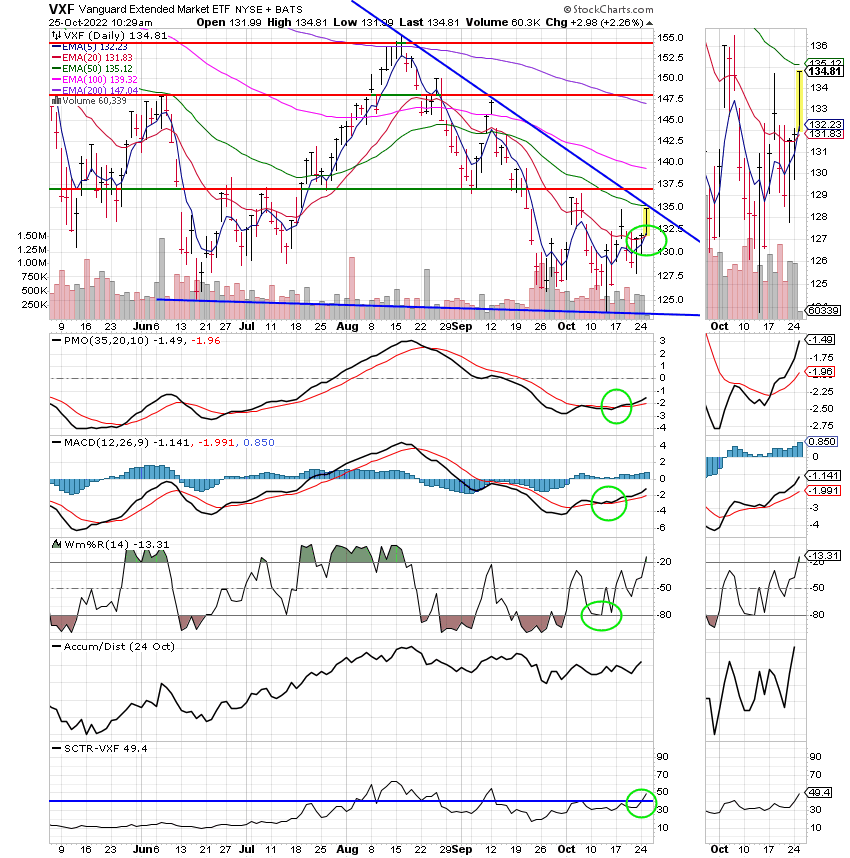

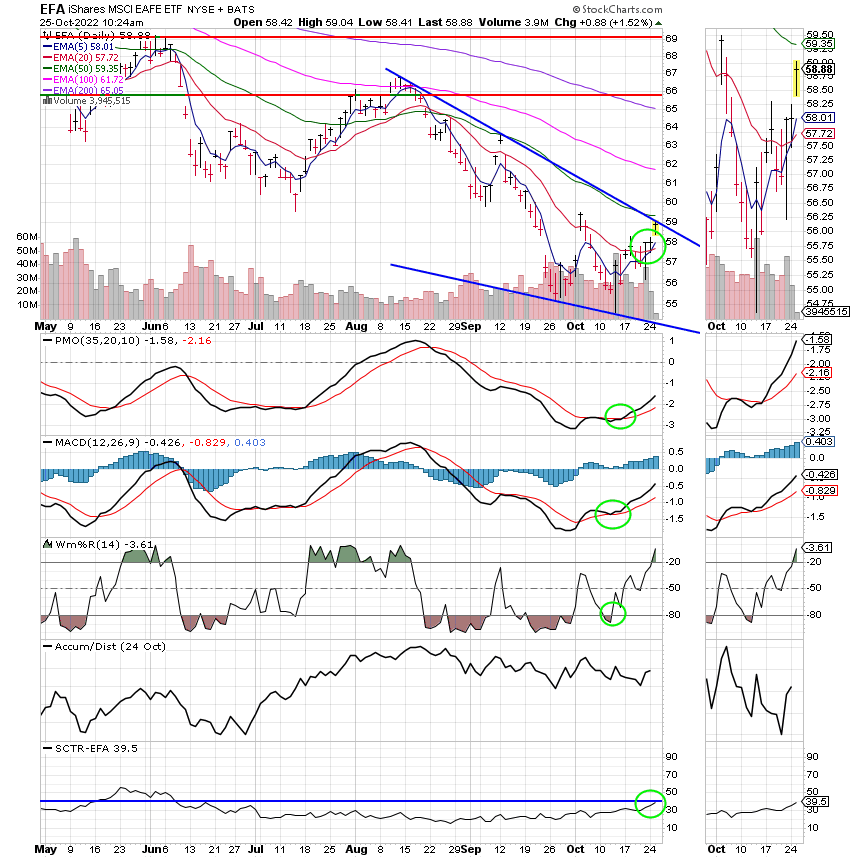

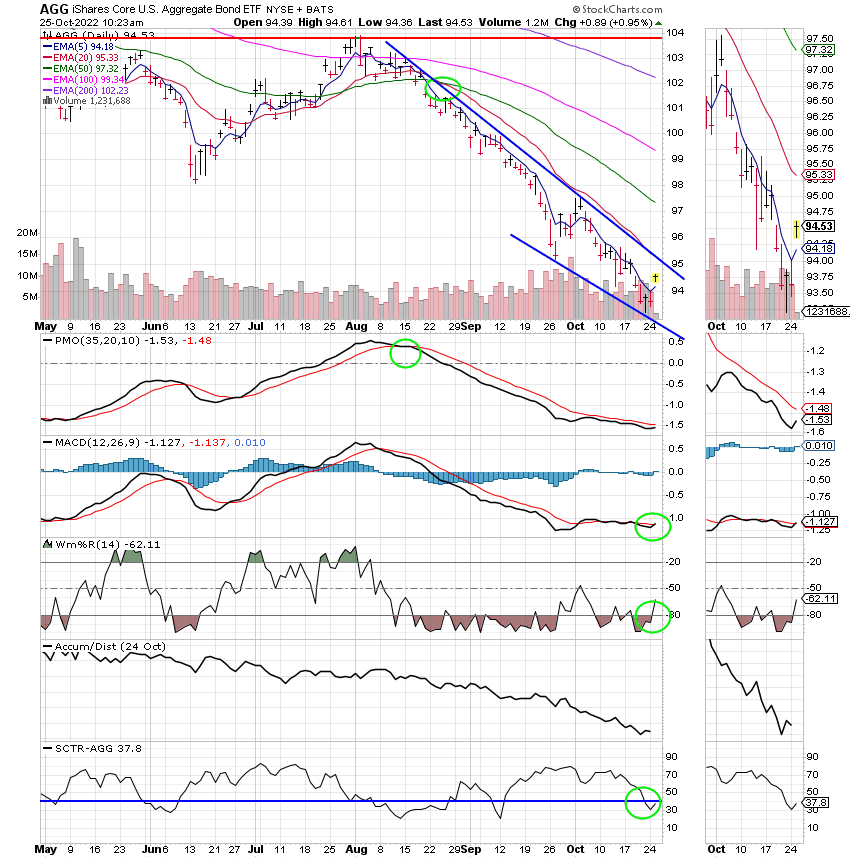

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Lets talk fundamental just a minute. What has changed. Inflation is still running over eight percent, The FED still insists they are going to continue to increase rates until it comes down, treasury rates are still rising (yes I know their down some today but that’s today), energy prices are still rising (and we’re facing winter), the War in the Ukraine is still raging, parts of Europe are already in a recession which will only be made worse by the energy crisis from the war in the Ukraine…. Yes earnings reports for US corporations are still good, employment is strong, the dollar is soaring. So what has changed??? Tell me what has changed???? Is there any reason for the Fed to stop raising rates?? Has the rate of inflation moved significantly lower?? Am I missing something here? What has changed that the market should reverse course and move to new highs? The bottom line is that I can clearly see why the indicators we follow are sluggish and not rushing headlong into the market. Sure we could have an overall buy signals in a day or so but I got to be honest with you. Right here and now I’m glad that we don’t have a buy signal. I just don’t trust this market. Not in the least…. If I get a buy signal I’ll deal with it when it comes. That’s all for today. Have a great afternoon and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.