Good Evening, If you will remember back when we reentered equities in early October I said we’d need the patience of Job to get through this trade and today’s action was exactly what I was talking about. As I feared then and know now a second surge of Corona Virus and political instability resulting from the US elections to be held in a matter of days have put downward pressure on stocks. At the time we made that trade we were being left behind by the upward momentum of stocks. Since that time the pendulum has swung in both directions with volatility being high as we suspected it would be. The Volatility index better known as the VIX exceeded 40 again today reflecting this current action. So the question is did we make a mistake be getting back in??? I don’t think so but things will have to play out before any of us know for sure. Both COVID 19 and the US elections are transitory conditions. In other words they will eventually pass us by and when they do there will be a nice relief rally. However, there are several factors that will effect the timing and scope of this action. Could we have timed it? Possibly, we will see. Either way we are in it now so we must manage this situation. So what are those factor?. The economic stimulus plan, had congress passed it already this current selling would be a non issue or at least not as bad as we have experienced. Secondly, the multiple Covid 19 Vaccines currently in phase three testing. When one of those is finally released you can expect a big spike in stocks. Thirdly, we have the elections. If we get a clear winner you can expect a relief rally regardless of which party wins the elections. If we have a contested election, you can look for the selling to continue. That is the short term view. In the event that politicians are elected that increase tax and regulations on US Companies you will see a long term drag develop that will eventually bring stocks down. However, as far as the current situation goes the market will be relieved to have a clear winner and get his election behind it. Those are the issues that are effecting the market now. Covid 19 and the Election. Once all is said and done and we get a stimulus bill which I feel is a certainty the market will turn it’s attention once again to the things that most matter to it. Earnings and the economy. Earnings during this earnings season continue to surprise to the upside. When companies make money their value increases. And the economy has been resilient and is clearly getting stronger each time it is given a chance to do so. Only a second lockdown can derail that train. I will add that the rate of the economic recovery is clearly linked to the passage of a stimulus bill. MInus stimulus, the recovery in both the economy and stocks will be tepid. With the passage of a decent sized stimulus bill it will be robust. It’s all as clear as mud right????? If I knew the answers to all the above questions I could tell you exactly where stocks will go, but I don’t have a crystal ball and neither does anyone else regardless of the image they might be trying to project. I have always said that if someone tells you they know what is going to happen with the market. That you should invest this way or that…..then run away from that person as fast as you can because they are dangerous! What we do know right now is that we still have charts that point higher for the intermediate to long term, we have corporations that are making money and an economy that will recover if we will just let it do so. Get these other issues out of the way and it will be rally on! All we have to do is be just a lot more patient than we normally would. Given no unexpected bad news the market will likely continue to trade sideways until the above noted factors are resolved. One more thing. I never thought I would say this publicly but it is getting really hard to trust our mainstream media. It seems that they are biased both politically and otherwise. They make it extremely difficult to make fundamental market decisions based on their reports. If I ever put any creed in making decisions based on the 5 o’clock news it is long gone now. When I hear them say one thing and see another on a daily basis it becomes impossible to take them seriously as a source of decision making data. That is the reason it is even more important now than it has ever been to understand at least the basics of technical analysis. The media may change what they report but the math that supports the charts never does. Here’s the bottom line. Glean what you can from the media, but do so knowing that they are corrupt and have an agenda. Trust only God and your charts. They are always true if you just take the time and know how to listen to them!!

The days trading left us with the following results: Our TSP allotment fell -2.80%. For comparison, the Dow dropped a whopping -3.43%, the Nasdaq -3.73%, and the S&P 500 -3.53%. Dare I say we carried the day?? There’s no covering it up. It was ugly but hopefully it is behind us……;..

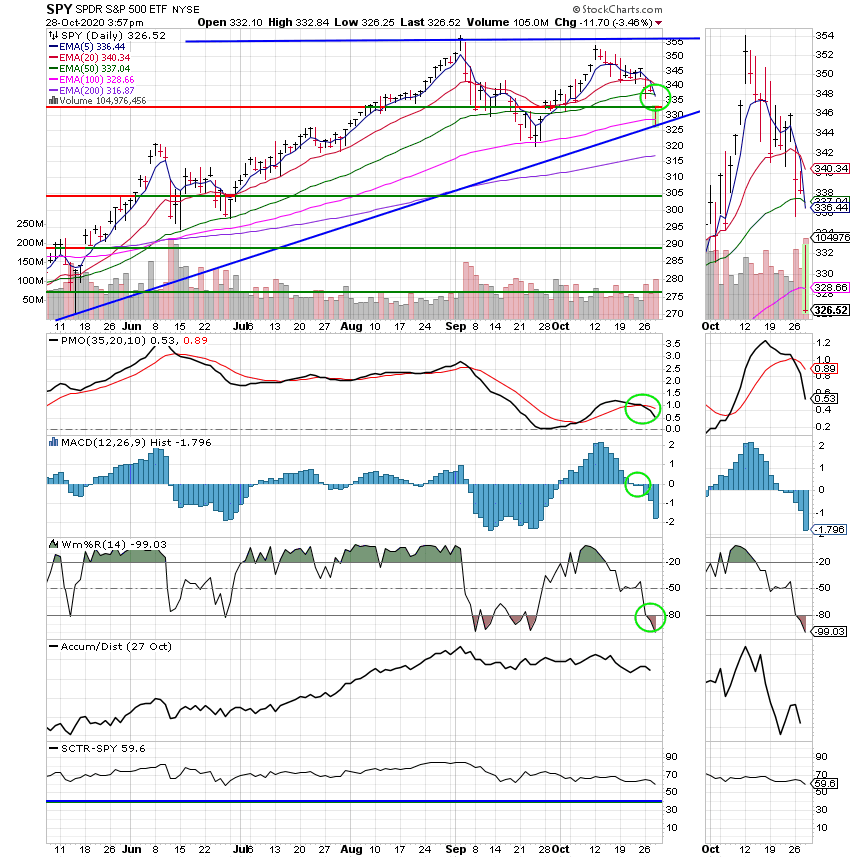

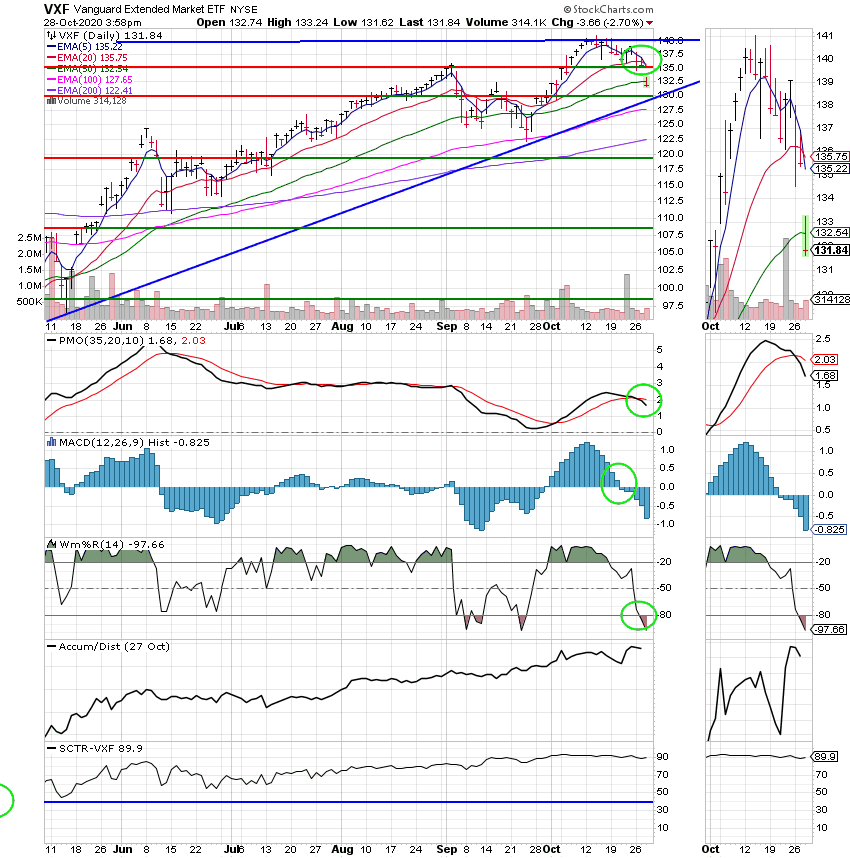

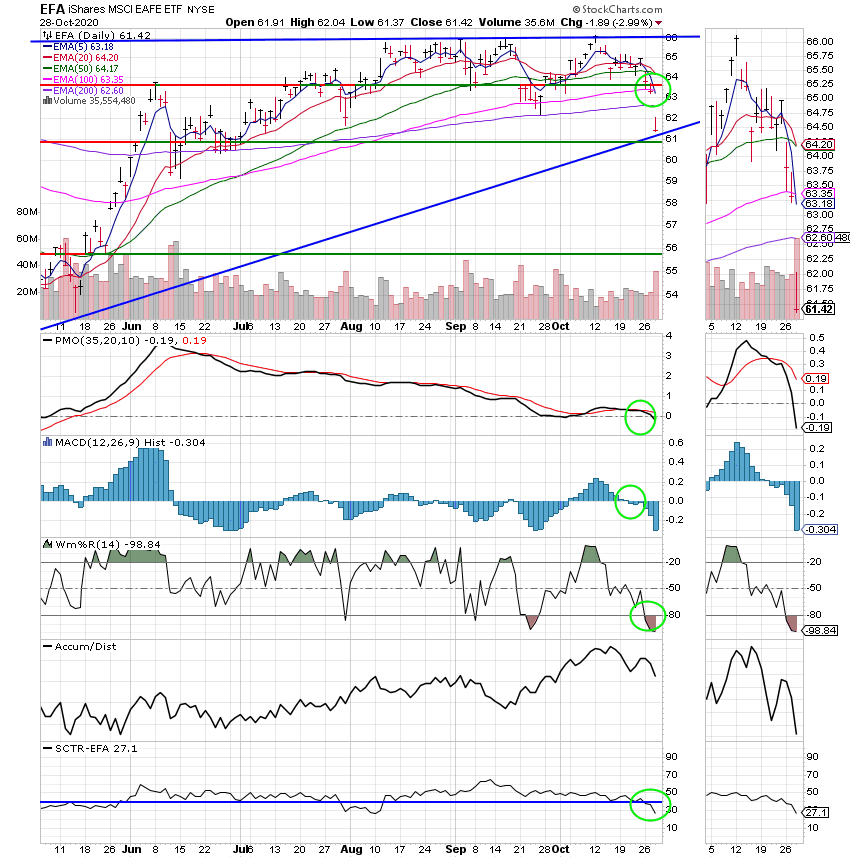

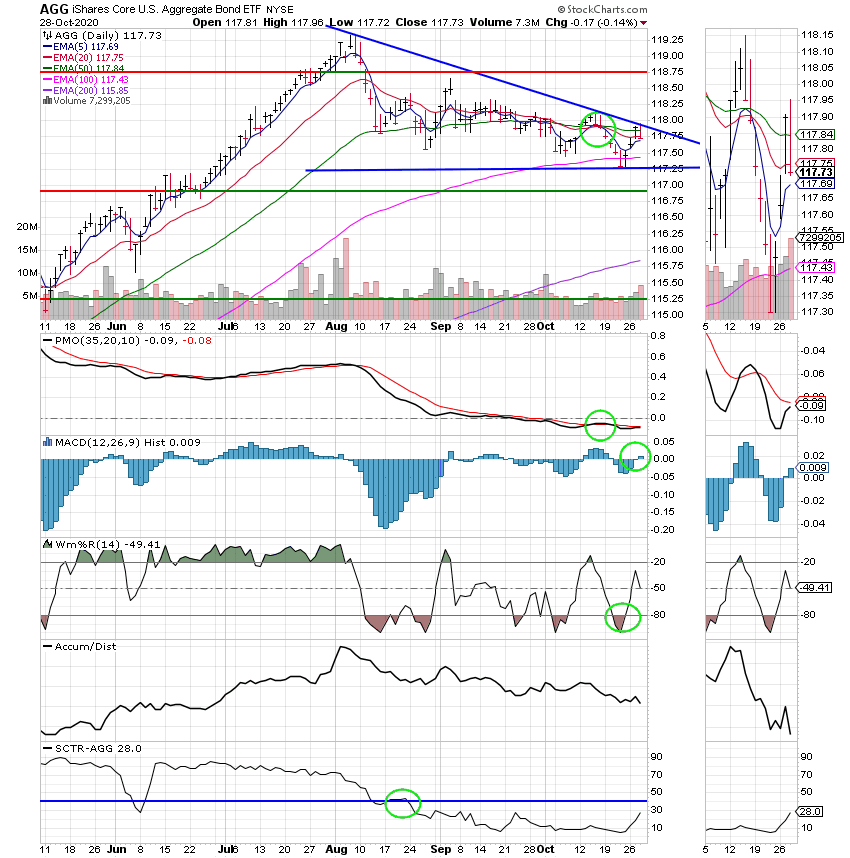

The days action left us with the following signals: C-Neutral, S-Neutral, I-Sell, F-Neutral. We are currently invested at 100/S. Our allocation is now +21.26% on the year not including the days results. Here are the latest posted results.

| 10/27/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4838 | 21.038 | 50.312 | 60.8345 | 30.4015 |

| $ Change | 0.0003 | 0.0291 | -0.1519 | -0.3256 | -0.1783 |

| % Change day | +0.00% | +0.14% | -0.30% | -0.53% | -0.58% |

| % Change week | +0.01% | +0.34% | -2.15% | -2.51% | -1.85% |

| % Change month | +0.05% | -0.05% | +0.91% | +4.49% | -0.26% |

| % Change year | +0.82% | +6.70% | +6.46% | +8.10% | -7.08% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 21.5789 | 10.4287 | 35.6882 | 10.5629 | 39.3902 |

| $ Change | -0.0183 | -0.0209 | -0.0887 | -0.0289 | -0.1180 |

| % Change day | -0.08% | -0.20% | -0.25% | -0.27% | -0.30% |

| % Change week | -0.44% | -1.00% | -1.24% | -1.36% | -1.48% |

| % Change month | +0.26% | +0.51% | +0.63% | +0.69% | +0.75% |

| % Change year | +1.85% | +4.29% | +2.40% | +5.63% | +2.50% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 10.6557 | 23.0513 | 10.8389 | 10.839 | 10.8391 |

| $ Change | -0.0343 | -0.0795 | -0.0470 | -0.0469 | -0.0469 |

| % Change day | -0.32% | -0.34% | -0.43% | -0.43% | -0.43% |

| % Change week | -1.58% | -1.69% | -2.08% | -2.08% | -2.08% |

| % Change month | +0.82% | +0.87% | +1.06% | +1.06% | +1.06% |

| % Change year | +6.56% | +2.53% | +8.39% | +8.39% | +8.39% |