Good Morning, All I can say about this market right now is that it’s fluid. While corporate earnings are a constant with over 70% of the reports beating estimates, the tariff situation is anything but. The Trump administration continues to discuss and enact Tariffs on foreign trade partners (and I use the term partner loosely). This leaves the market wondering if the tariffs being discussed will be enacted or if they are only threats to accomplish policy goals and if that is the case will the targeted countries give up concessions that will make them go away. This creates confusion which we all know presents headwinds for the market. I do not think the uptrend is in jeopardy at this time, but I do expect things to be choppy moving forward as the market considers various outcomes of these tariffs. Other than that market players will be focusing on incoming economic data in regard to how it might effect the personal consumption expenditures price index. The PCE is released each month and reflects the changes in the prices of goods and services purchased by consumers in the United States. It’s next release will be on February 28th. It is without a doubt the Feds favorite gauge of inflation and will greatly influence their decision on future rate cuts. The higher the PCE, the less likely it is that the Fed will reduce interest rates and while the market is happy for the most part with what the Fed has done up to this point it clearly wants and expects more. It loves cheap money and it doesn’t consider current rates to be cheap. Although, it has been placated with the rate reductions that the Fed has made heretofore. The bottom line here has not changed. Anything that indicates that inflation is rising will result in selling. Plain and simple! So you can view all news releases through this lens and be fairly confident in the direction that the market will go.

The market is closed for Washingtons birthday today. Here are the results from Friday. Our TSP allotment posted a modest gain of +0.16%. For comparison, the Dow dropped -0.33%, the Nasdaq added +0.41%, and the S&P 500 was flat -0.01%.

S&P 500 closes little changed on Friday, but Wall Street notches weekly gains: Live updates

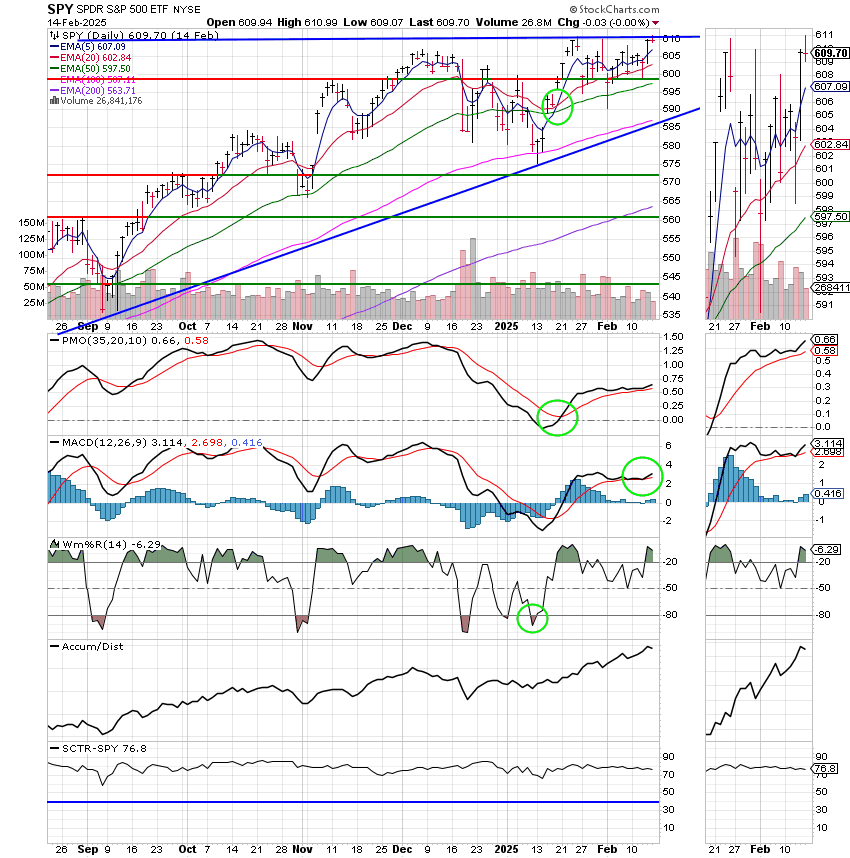

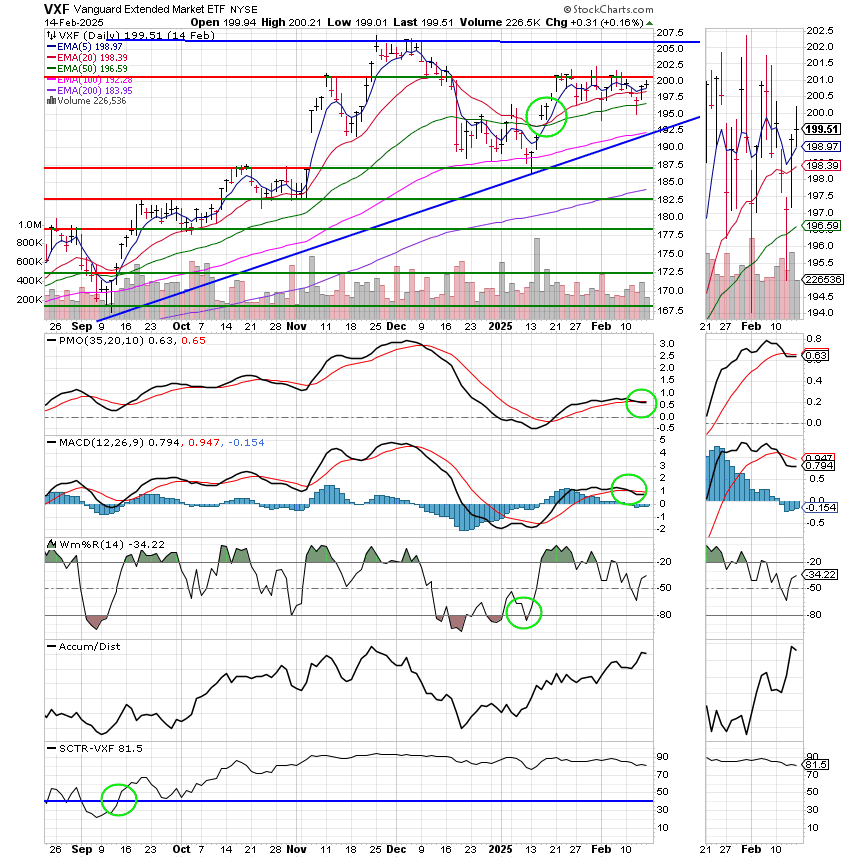

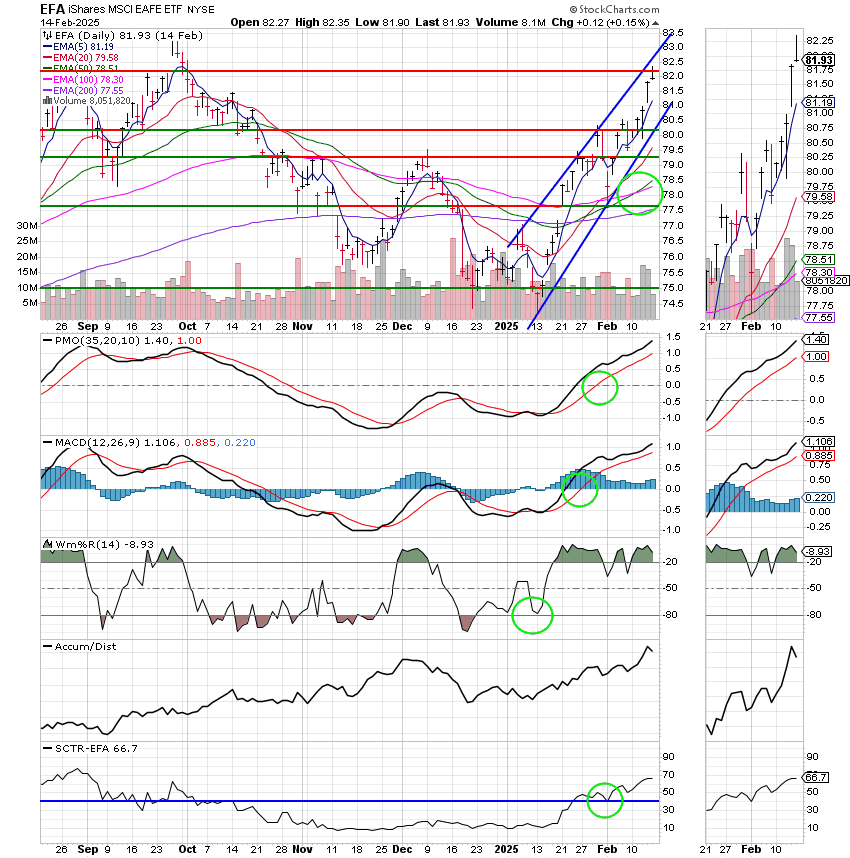

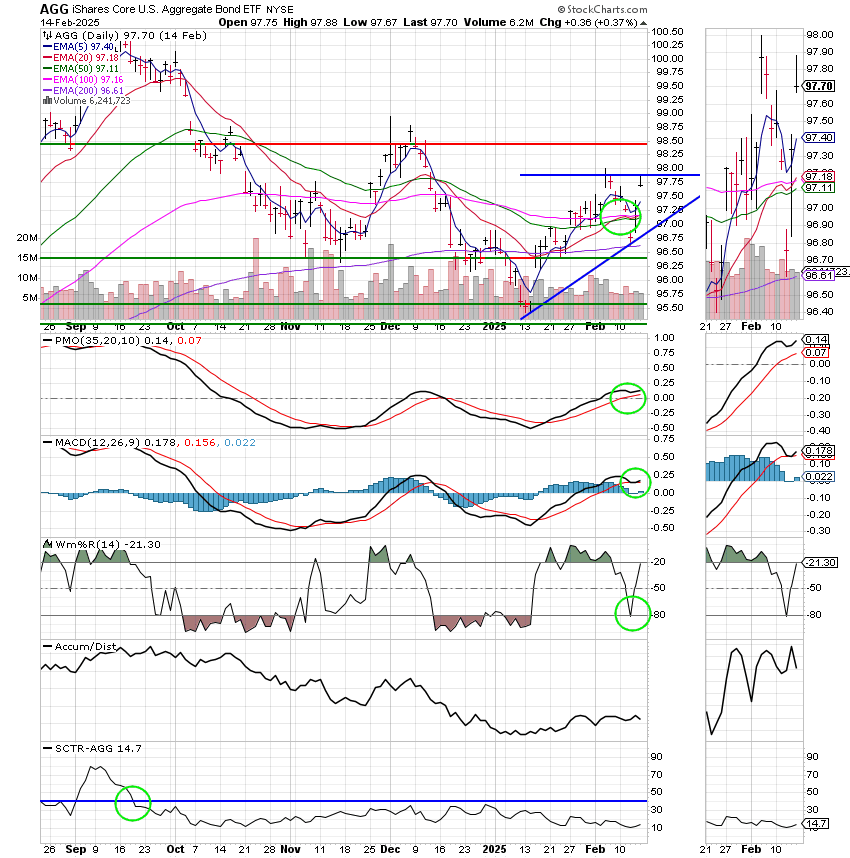

The most recent action has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy, We are currently invested at 100/S. Our allocation is now +5.08% for the year. Here are the latest posted results:

| 02/14/25 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.8616 | 19.6933 | 96.7502 | 94.7317 | 44.4727 |

| $ Change | 0.0024 | 0.0624 | 0.0154 | 0.1199 | -0.0594 |

| % Change day | +0.01% | +0.32% | +0.02% | +0.13% | -0.13% |

| % Change week | +0.09% | +0.19% | +1.52% | +0.35% | +1.74% |

| % Change month | +0.18% | +0.59% | +1.30% | +0.08% | +2.38% |

| % Change year | +0.57% | +1.10% | +4.11% | +5.08% | +6.15% |