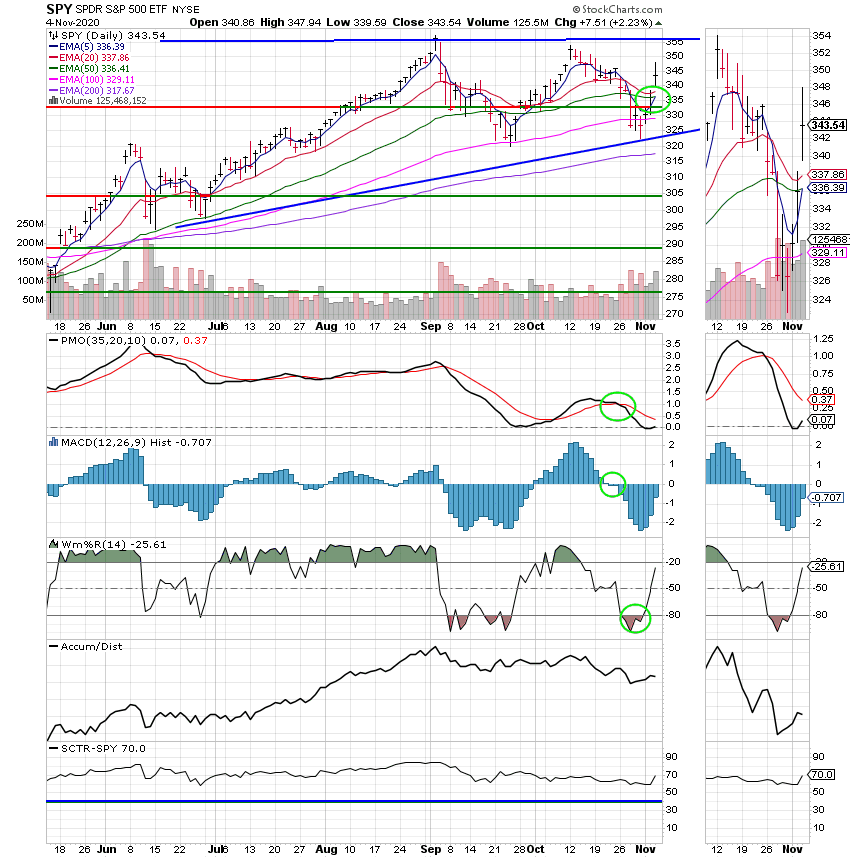

Good Evening. Surprise Surprise! We now have a contested election. I don’t care which party you support. This high volume of mail in ballets is a bad thing. They increase the margin for error and invite corruption. Thanks to them neither party or it’s voters will accept the results of this election. Hopefully, we can can get through this somehow. Keep praying for our nation! Today was a good example of why you trust your chart and not your heart. Is there anybody that didn’t at least think about selling prior to or the day of the election? Stocks unexpectantly surged today as if to say they are done with this election. Actually investors were relieved that Republicans retained control of the Senate. The way they see it, corporate taxes and regulations would have increased and constricted the market had the Democrats controlled both Presidency and Senate in addition to the House of Representatives. I have to say….I agree. Such as it is they see it as a Goldilocks ‘not to Hot or Not to Cold’ situation. We will see what happens, but either way I will continue to make my investment decisions based on my charts not on what I think or what someone else thinks. Those type of market decisions normally don’t go well for me! My expectation now is that the market will continue to rise in the next three months due to additional economic stimulus and continued accommodative Fed policies and I might add that is regardless of who wins the Whitehouse. After that…well it depends on the administrations policies. We will see who wins and what they do.

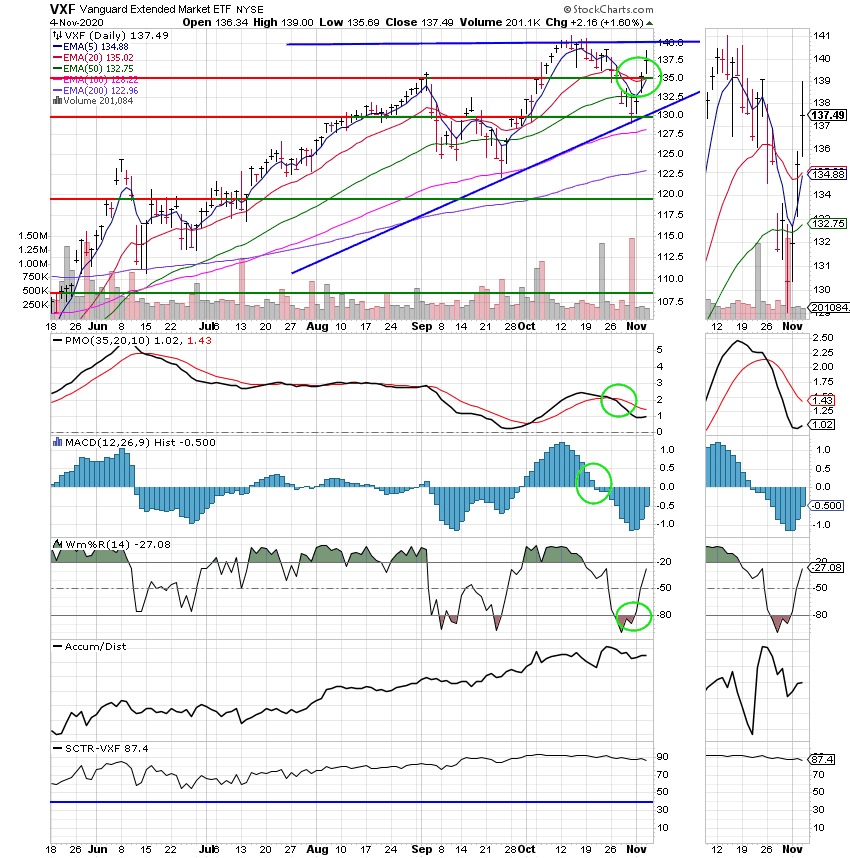

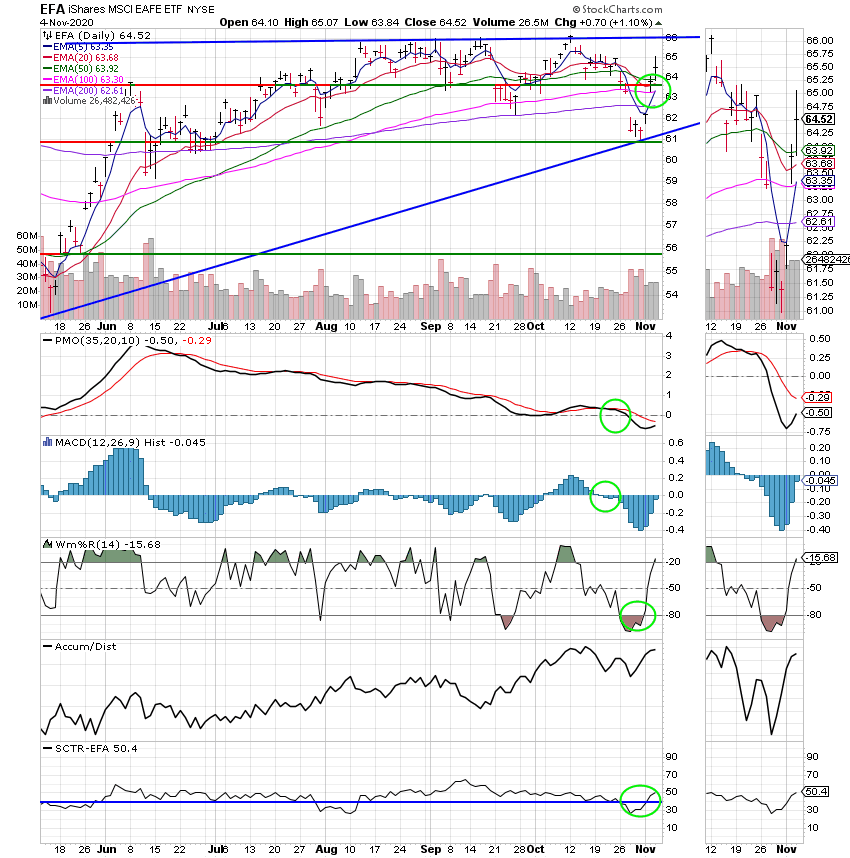

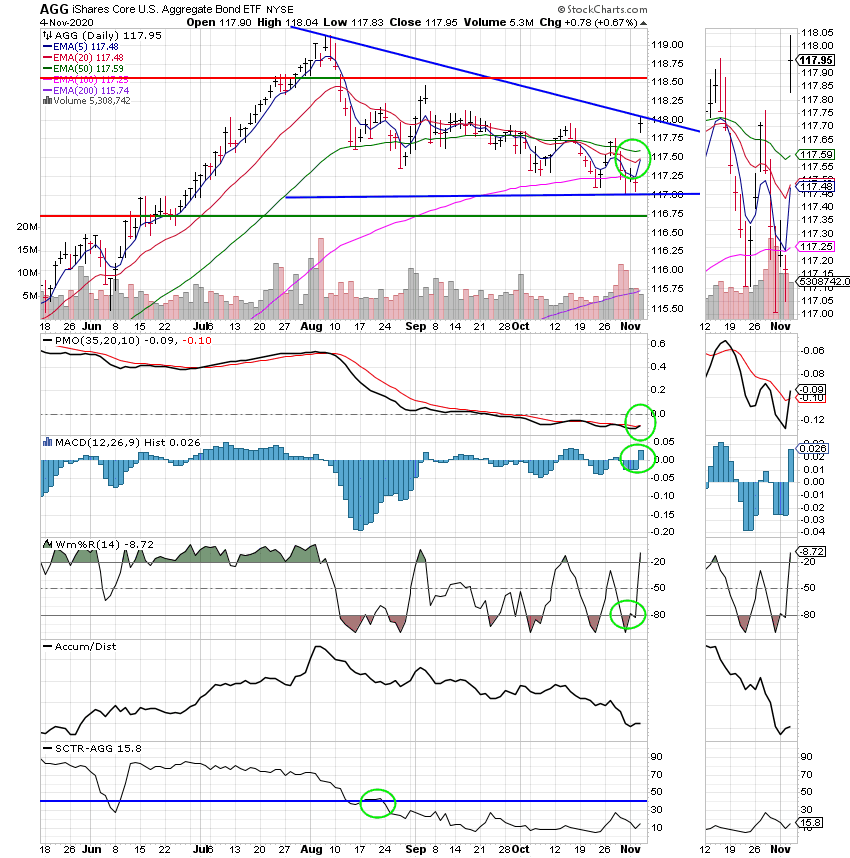

The days trading left us with the following results: Our TSP allotment gained +1.60%. For comparison, the Dow was up +1.34%, the Nasdaq +3.85%, and the S&P 500 +2.23%. Praise God for a couple nice days!

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Neutral. We are currently invested at 100/S. Our allocation is now +21.22% on the year not including the days results. Here are the latest posted results:

| 11/03/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4861 | 20.9572 | 50.0028 | 60.8118 | 30.5556 |

| $ Change | 0.0003 | -0.0197 | 0.8751 | 1.5158 | 0.8631 |

| % Change day | +0.00% | -0.09% | +1.78% | +2.56% | +2.91% |

| % Change week | +0.01% | -0.01% | +3.04% | +3.94% | +4.39% |

| % Change month | +0.01% | -0.01% | +3.04% | +3.94% | +4.39% |

| % Change year | +0.83% | +6.29% | +5.80% | +8.06% | -6.61% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 21.5728 | 10.4222 | 35.6586 | 10.5529 | 39.3488 |

| $ Change | 0.1090 | 0.1152 | 0.4836 | 0.1568 | 0.6357 |

| % Change day | +0.51% | +1.12% | +1.37% | +1.51% | +1.64% |

| % Change week | +0.81% | +1.77% | +2.18% | +2.40% | +2.61% |

| % Change month | +0.81% | +1.77% | +2.18% | +2.40% | +2.61% |

| % Change year | +1.83% | +4.22% | +2.31% | +5.53% | +2.39% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 10.6435 | 23.0231 | 10.8248 | 10.8249 | 10.8249 |

| $ Change | 0.1840 | 0.4237 | 0.2407 | 0.2408 | 0.2407 |

| % Change day | +1.76% | +1.87% | +2.27% | +2.28% | +2.27% |

| % Change week | +2.80% | +2.98% | +3.62% | +3.62% | +3.62% |

| % Change month | +2.80% | +2.98% | +3.62% | +3.62% | +3.62% |

| % Change year | +6.44% | +2.40% | +8.25% | +8.25% | +8.25% |