Good Morning, Well we’re one day out from the first Tuesday in November and unless you’ve been hiding under a rock somewhere you know what that means. Election day and not just any election day. We will elect a new president and determine who will control the senate. The winners of these highly contested elections will definitely have an effect on your thrift accounts. The outcome of these elections will most certainly determine how you invest. Dare I get into this subject? I think they threatened to burn me at the stake the last time I commented on it…. Peace be with you all. This is a geo-political event that cannot be ignored and I would argue that this particular election has the potential to have even a more profound effect on the market than usual. I really don’t want to write a book here although I could. So let me break it down in general terms and pray that the angry villagers will let me live. LOL There are three possible outcomes to this election. The right wins the house and senate, the left wins the house and senate, or the two contests are split between the two parties. Also you must consider how much of a majority the Republicans will retain in the House of Representatives. I guess you could consider those results as giving us a fourth outcome. In the event that the the Republicans or the Democrats control the house and the senate the market will have to consider big changes in taxes and spending. I’m not going to get into all the individual plans put forth by the various candidates. As I said above, it is not my intention to write a book. Also, I am not discussing the non-economic implications of this election and they are enormous. For purposes of this discussion we will stick with the market moving issues. As far as he other stuff is concerned my recommendation is to seek God’s will through his word and prayer. In my case, if a candidate willingly goes against God’s word, I strike them from consideration, period. One more thing on this issue and I promise I’ll leave it alone. If you are seeking the perfect man or women to receive your vote then quit looking because you will never find them. Romans 3:23 says that all have sinned and fallen short of the glory of God. The only thing you can do is look at what their doing and what their trying to do. Did they do something bad because it is their intent or did they make mistake and learn from it? Are they saying one thing and doing another? If so that’s the same thing as telling a lie and we all know who they father of lies is. Jesus said it well when He said you will know them by their fruits. Enough said. Should either party gain control of the White house and Senate while the margin in the House remains thin then the market will have to consider big changes in the tax structure and the economy. That will determine how market players invest. For instance do they invest in solar panels and electric vehicles or will they invest in energy. Will they invest in health care and insurance or will they sell it. The same could be said of banks and most other financials. Then how about housing? How will the tax structure effect the consumer and retail and don’t forget inflation. These policies could well determine whether we see renewed inflation or not. Those type of considerations go on and on. In the end how will those policies effect the broader economy? Here’s my take for what it’s worth. I have said it a hundred times, so now I’ll make it 101…..Socialism and Capitalism don’t mix. They never have and they never will. Not today, tomorrow or ever. A vote in the direction of socialism is a vote against capitalism and a vote against capitalism is a vote against the market and for that matter the American dream. The market is a game changer and the largest vehicle of wealth creation in our country. So what’s good for the market is good for the country. Every time that corporate taxes are increased it decreases corporate profits. As earnings and profits decrease then so does the market. Another considerati0n are regulations. The more regulations the less the profit which also results in well….. a decline in the market. You also must consider what happens when companies leave the US to avoid these taxes and regulations. Less jobs…….that is never good. Then….there is energy. You have one party that is totally against fossil fuels and one that is for it. This is probably the biggest elephant in the room as it increases the cost of everything. Energy is the largest contributor to inflation that there is. Think not??? Just look at the results of the Arab oil embargo of the 70’s that resulted in 21% interest rates and 14,5% unemployment. These policies result in dramatic increases to energy cost across the board and drowning the consumer in higher costs on everything from gas and home energy to groceries. You think it’s expensive now, then just wait. Anytime you try to regulate industry (or should I say over regulate industry as some regulations are needed) it results in higher costs and lower profitability for corporations. If allowed to let supply and demand determine when such things as the advent of electric cars and renewable energy occur then it will benefit the economy, not restrict it! That’s how a free market economy works. Things take place when they are beneficial to the consumer and the ec0nomy. Trust me again when I tell you I can write a book on this….. Lets consider one more example of what I am talking about and this is a central tenant of socialism. Price control. These folks want to control the price of everything from pharmaceuticals to groceries. Again, in a free market economy supply and demand controls these things, not the government. What happens when a socialist government controls these things. The former Soviet Union and Venezuela come to mind… How did that work for them? Show me even one government in history that enacted price controls and survived. You can’t because it never occurred. Enough of that. If y0u don’t understand now then you never will. So to sum it up there will be one of three outcomes. The the left will control the government in which case there will be increased taxes, regulation, and social programs. The right will control the government in which there will be lower taxes and fewer government regulations and programs. Or…. there will be gridlock. I must tell you that the market prefers gridlock more than it does the other outcomes. It will react to whichever of these scenarios that take place. So plan accordingly. As you vote, some of you will prioritize social issuers over the economy. I actually saw one women being interviewed on television that said she didn’t care what the price of gas was. She just wanted someone who was positive and nice to be president…… Okay, alright…… but I want someone who could effectively run a major corporation and believes in a free market economy……and if they are nice then all the better. Oh yeah, and yes, I definitely care about the price of gas!

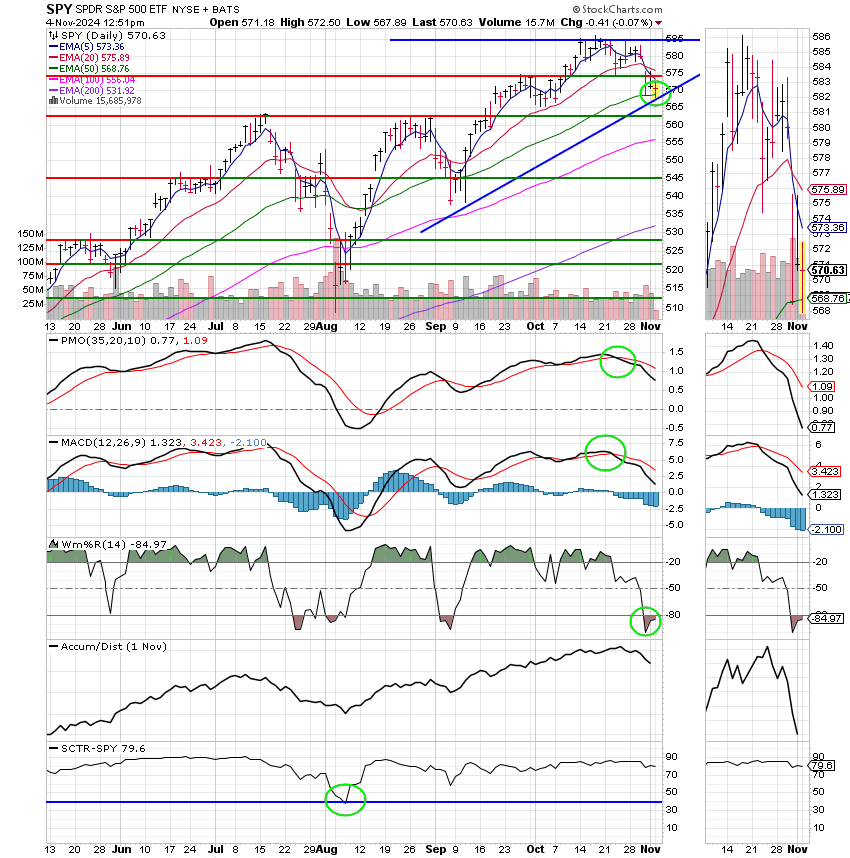

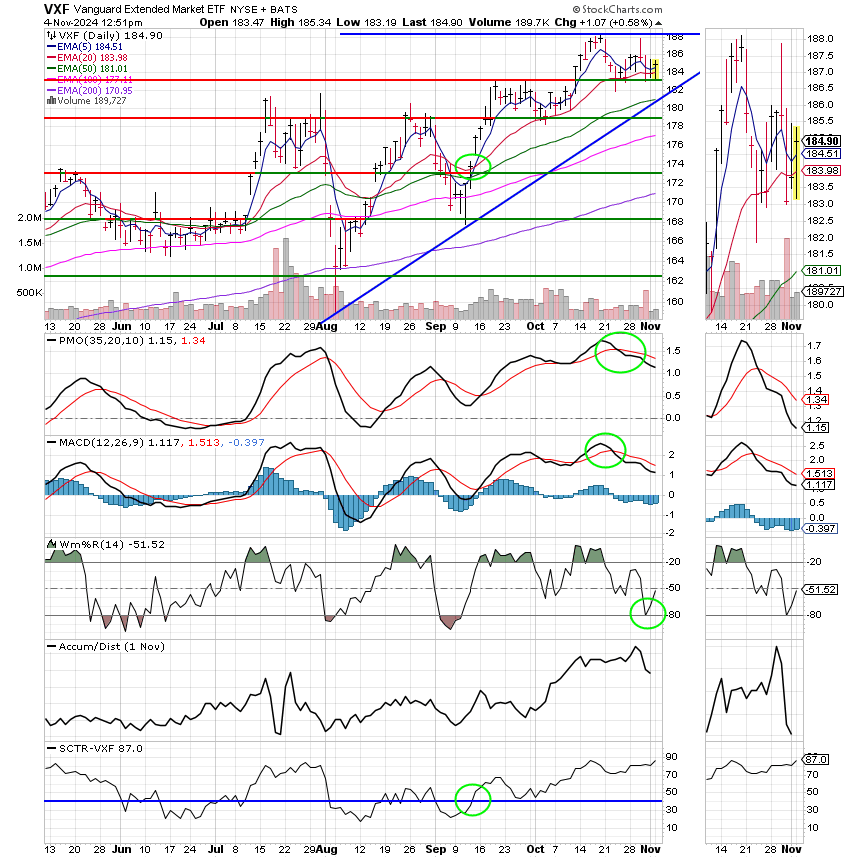

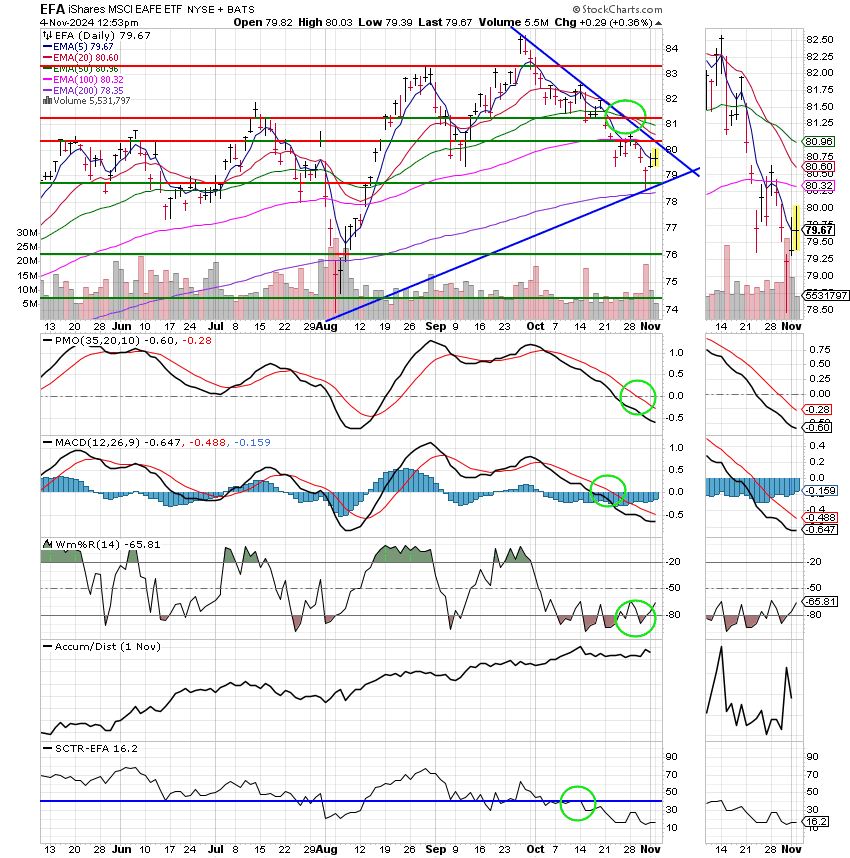

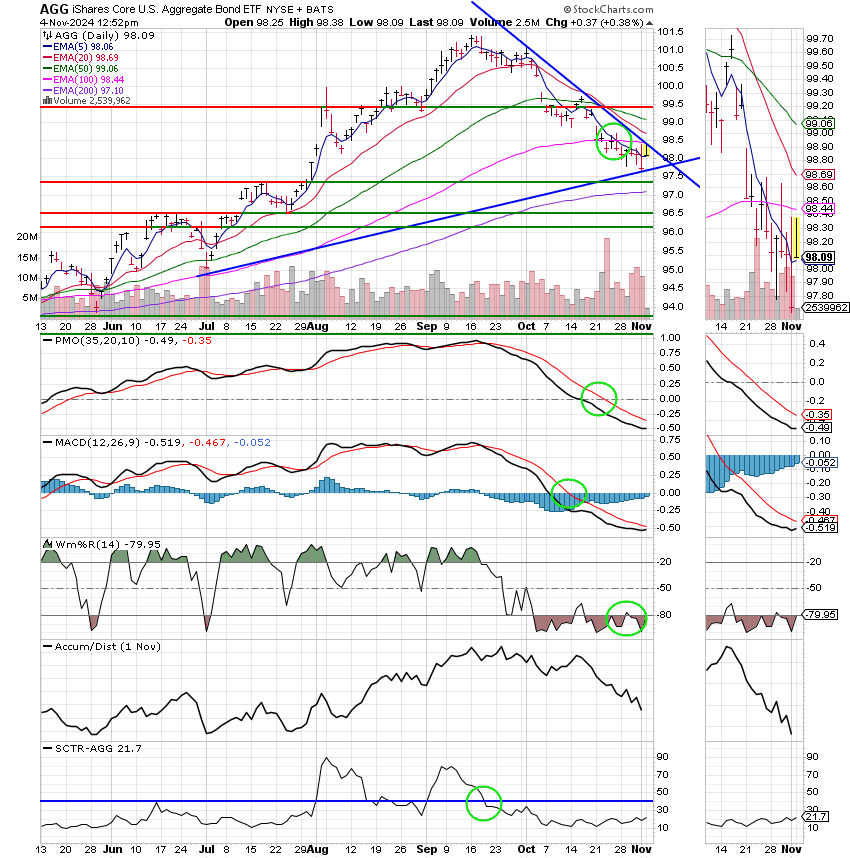

Now quickly on the charts. I had someone some one comment that I had not talked about the S fund in the last blog. Well, I did in fact mention it. I said that it’s chart was improving and that if it caught or surpassed the C Fund I would make a change. Well it happened and I did….change to the S Fund that is. In glancing at the charts today the first thing I noticed is that the S Fund is currently up +0.13% and the C Fund is down -0.44%. The proof is in the pudding as they say…. Looking closer at the charts I see that the SCTR for the S Fund is now 83.8 and the SCTR for the C fund has now dropped to 76.9. This is the primary reason I made the change and todays results reflect it. Delving further into the two charts, I rate the chart for the S Fund as a hold. It’s price remains above support at 183 and it’s 20 EMA is positioned firmly in a bullish wedge pattern. This is the most bullish pattern that I know of. I will add it is my favorite pattern for that reason. The reason that I rate it as a hold and not as a buy is that it’s PMO and MACD are both in negative configurations in that their EMA’s have passed down through their signal line. Although, both indicators remain above their zero axis which is technically bullish. Conversely the C Fund, has broken support at 574 and is now trading below its 50 EMA. It is a sell. In addition, it’s PMO, MACD, and Williams %R are all in negative configurations. I do expect the C Fund to recover as both of these indicators remain above their zero axis. The I and the F Funds have both generated sell signals. If you will observe their charts I have annotated the signals with green circles. I will talk more about them next week but I’m out of time for now…;You can view the annotated charts below

The days trading has so far generated the following results: Our TSP allotment is trading higher at +0.52%. For comparison, the Dow is down -0.46%, the Nasdaq -0.28%, and the S&P is off -0.16%. So far it looks like we made a good move. Praise God for that!

Dow falls more than 200 points as stocks slip ahead of presidential election: Live updates

The most recent action has left us with the following signals: C-Sell, S- Hold, I-Sell, F-Sell, We are currently invested at 100/S. Our allocation is now +9.94% on the year not including the days results. Here are the latest posted results:

| 11/01/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.6208 | 19.5051 | 90.2991 | 86.9634 | 43.3151 |

| $ Change | 0.0019 | -0.0881 | 0.3714 | 0.3501 | 0.1944 |

| % Change day | +0.01% | -0.45% | +0.41% | +0.40% | +0.45% |

| % Change week | +0.07% | -0.62% | -1.35% | +0.26% | -0.76% |

| % Change month | +0.01% | -0.45% | +0.41% | +0.40% | +0.45% |

| % Change year | +3.66% | +1.47% | +21.43% | +12.80% | +7.80% |