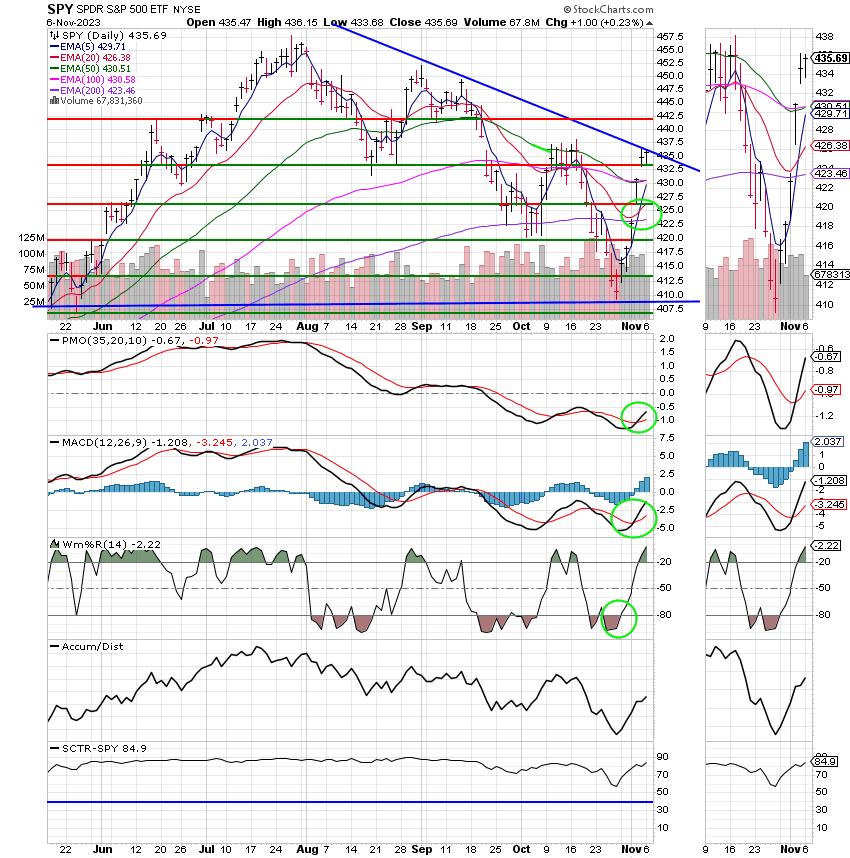

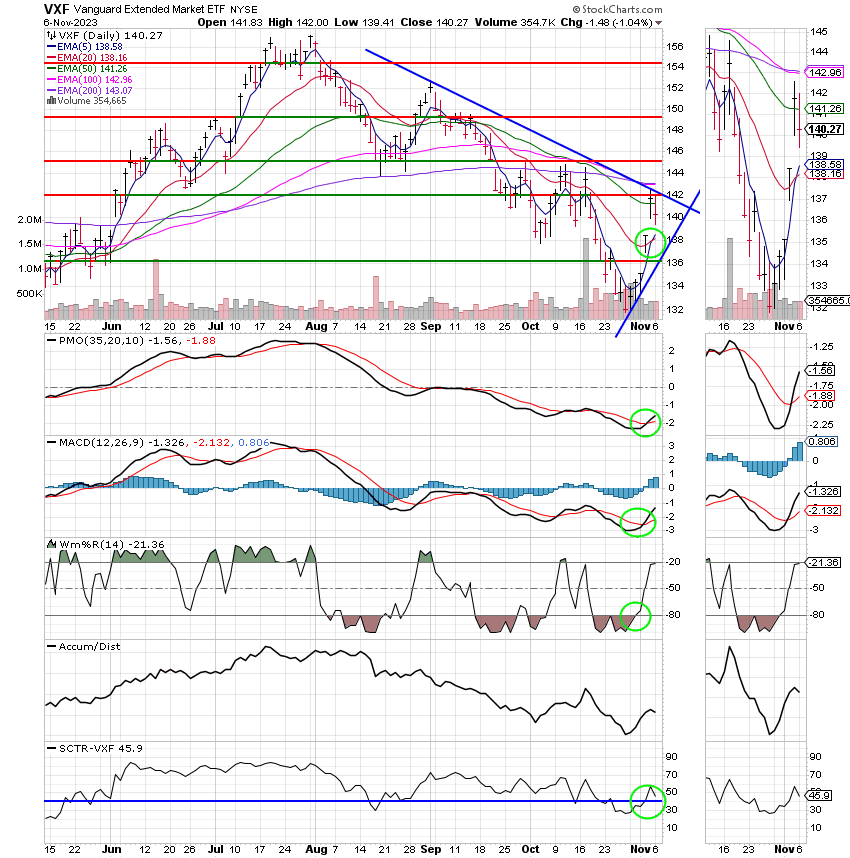

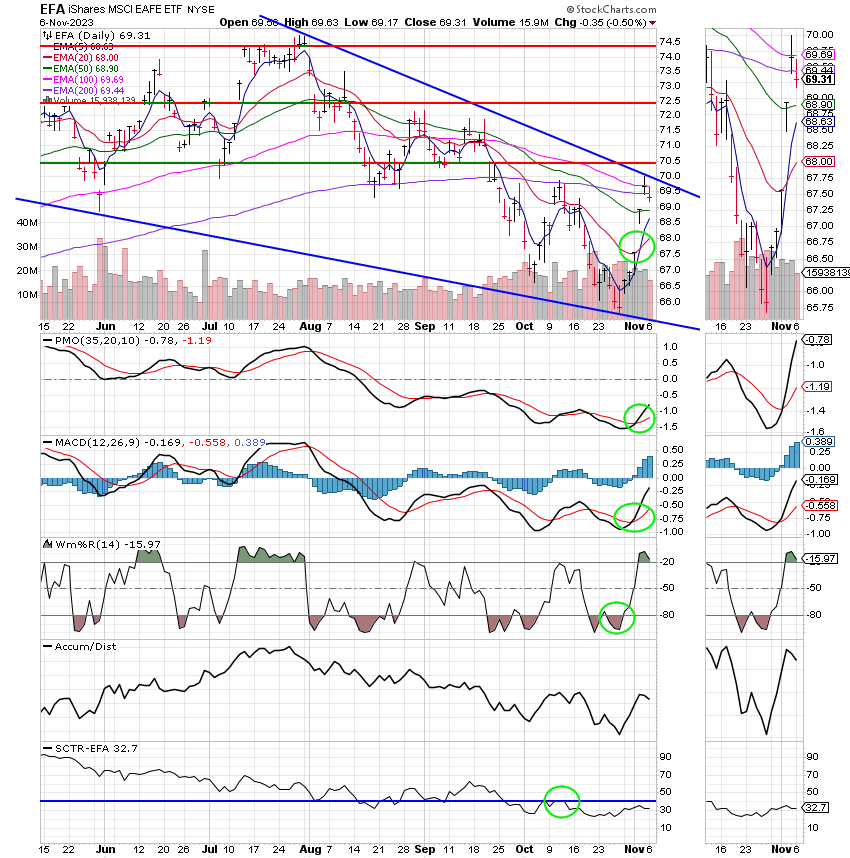

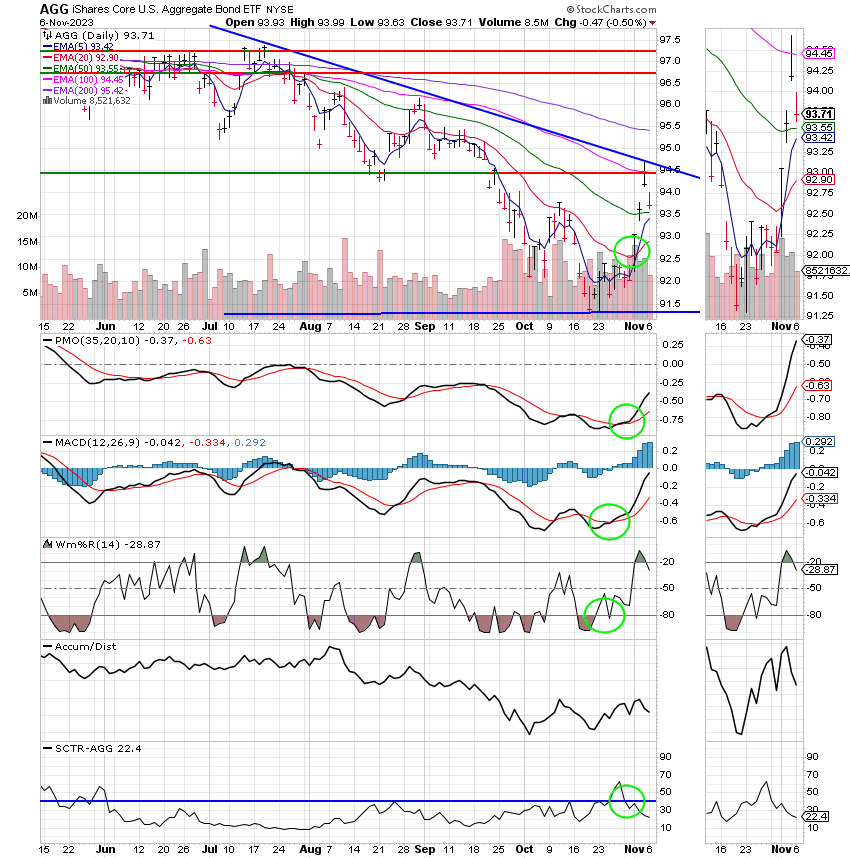

Good Morning, We finally got the run that our indictors were predicting. Our analysis was spot on with last week being the best week for stocks in 2023. The main catalyst was the Fed holding rates steady at their November meeting as a result of a weak jobs report this past Friday. It is now widely thought that the Fed rate increases have peeked and are over for the year. We will see. Investors will be watching speeches by three Fed Officials this week paying particular attention to Fed Chairman Jerome Powell’s two scheduled speeches. Other than that, the schedule is pretty light on economic news. Currently my our indictors are showing that this rally still has some room to run. Our plan is to ride it out until we get a sell signal and to sell at that time. Then we’ll watch our charts closely for the next move. However, we will do so with a defensive mindset as we feel that it is highly likely that we will experience a recession sometime in the beginning to middle of 2024. For now though, it appears that this rally has more room to run. That’s pretty much it in a nutshell. Somedays there’s a lot to talk about and somedays it’s just best to keep it simple. It is easy to overanalyze and cause paralysis through analysis. The bottom line is that our new post pandemic indicators are working well. We can see clearly once again so there’s no use to overcomplicate things. All we need to do is run our system.

Monday’s trading left us with the following results: Our TSP allotment posted a gain of +0.18%. For comparison, the Dow added +0.13%, The Nasdaq +0.30%, and the S&P 500 +0.18%. Praise God for the nice run. We needed it!!

Stock futures slip after Nasdaq registers 7-day win streak: Live updates

Recent action has left us with the following signals: C-Hold, S-Hold, I-Hold, F-Hold. We are currently invested at 100/C. our allocation is now -4.55% for the year and +4,12% on the month. Here are the latest posted results:

| 11/06/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.8353 | 18.0589 | 67.8745 | 65.4909 | 36.5044 |

| $ Change | 0.0074 | -0.0809 | 0.1210 | -0.7560 | -0.0772 |

| % Change day | +0.04% | -0.45% | +0.18% | -1.14% | -0.21% |

| % Change week | +0.04% | -0.45% | +0.18% | -1.14% | -0.21% |

| % Change month | +0.08% | +1.84% | +4.12% | +4.32% | +3.92% |

| % Change year | +3.48% | -0.82% | +15.23% | +6.44% | +7.55% |