Good Morning, If you don’t like the market today then wait until tomorrow! The only thing that doesn’t change in 2022 is change…. Volatility remains the byword for this market and until we see a lower rate of inflation that will remain the case. For those of you that are keeping score so to speak our trend model has now moved back to a buy signal. At his juncture the market has two things that will determine it’s direction over the short to intermediate term. Those would be todays US midterm elections and Thursdays Consumer Price Index report known as the CPI. Make no mistake about it, today’s elections will have a large impact on the market for he next two years. So when you vote be careful how you vote. It could effect your pocket book in ways you haven’t considered. This election will determine which party controls Congress and thus who controls future spending and taxing. Understand this and understand it well. More spending will increase interest rates and more corporate taxes will will negatively effect stocks. I could get into this a lot deeper, but for now this explanation is sufficient. In very broad and general terms socialism and capitalism don’t mix. A vote for socialism and expecting to make money in capitalism (i.e. the market) is like praying for a drought and expecting an abundant harvest. The more we spend the less we uptrend…….that’s just a fact. If you feel you must vote for left leaning politicians then it is probably best for you to leave your money in the G Fund. At least then you’ll get a little benefit from the higher interest rates. I think the old adage “I’m takin what their givin cause I’m working for a livin” applies here. I understand that many of you have other issues that are more important to you when you vote, but I simply want you to know that everything has a price. Nothing is free. I’ll leave it at that. Now on to CPI. The CPI report will issued on Thursday. It will effect the market in this way. It is both simple and straightforward. If the report comes in lower than expected the market will rally hard. If it comes in as expected then not much will change and finally if the report comes in showing inflation is still hot then the market will sell off hard. The bottom line is that everything is a gamble with market volatility as high as it is. As I have said and said and said, that will not improve until the rate of inflation moves towards two percent. So buckle up, it will continue to be a rough ride.

Today’s trading so far has produced the following results: Our TSP allotment is up by 1.28%. For comparison, the Dow has gained +1.43%, the Nasdaq +1.35%, and the S&P 500 +1.28%. praise God for the green on the screen!

Stocks rise for a third day as investors await midterm election results, Dow jumps 400 points

Recent action has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Hold. We are currently invested at 100/C. Our allocation is now -29.07% not including the days returns. Here are the latest posted results.

| 11/07/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.1335 | 17.5612 | 58.2328 | 62.0588 | 31.3354 |

| $ Change | 0.0061 | -0.0480 | 0.5550 | 0.3837 | 0.1881 |

| % Change day | +0.04% | -0.27% | +0.96% | +0.62% | +0.60% |

| % Change week | +0.04% | -0.27% | +0.96% | +0.62% | +0.60% |

| % Change month | +0.08% | -0.63% | -1.65% | -2.36% | +3.04% |

| % Change year | +2.37% | -15.92% | -19.06% | -25.63% | -20.55% |

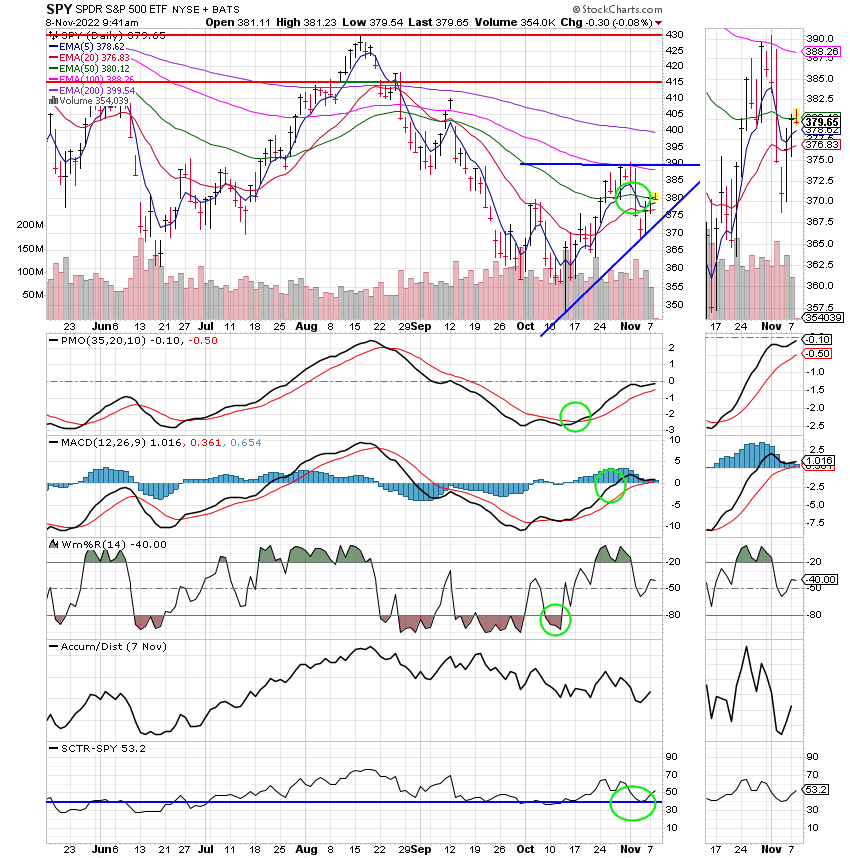

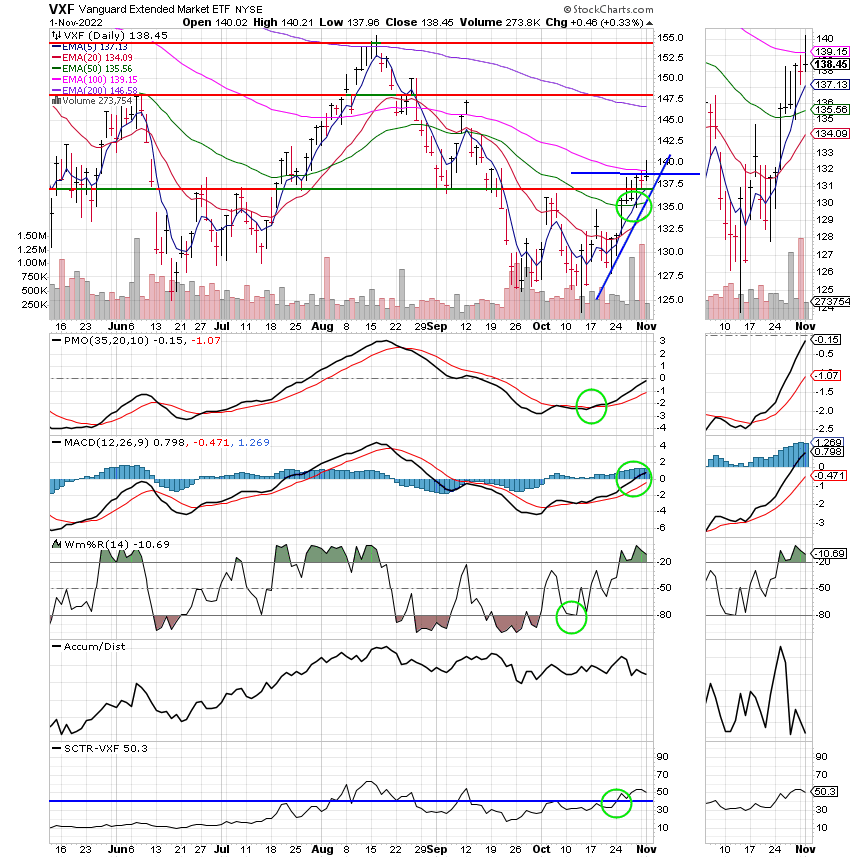

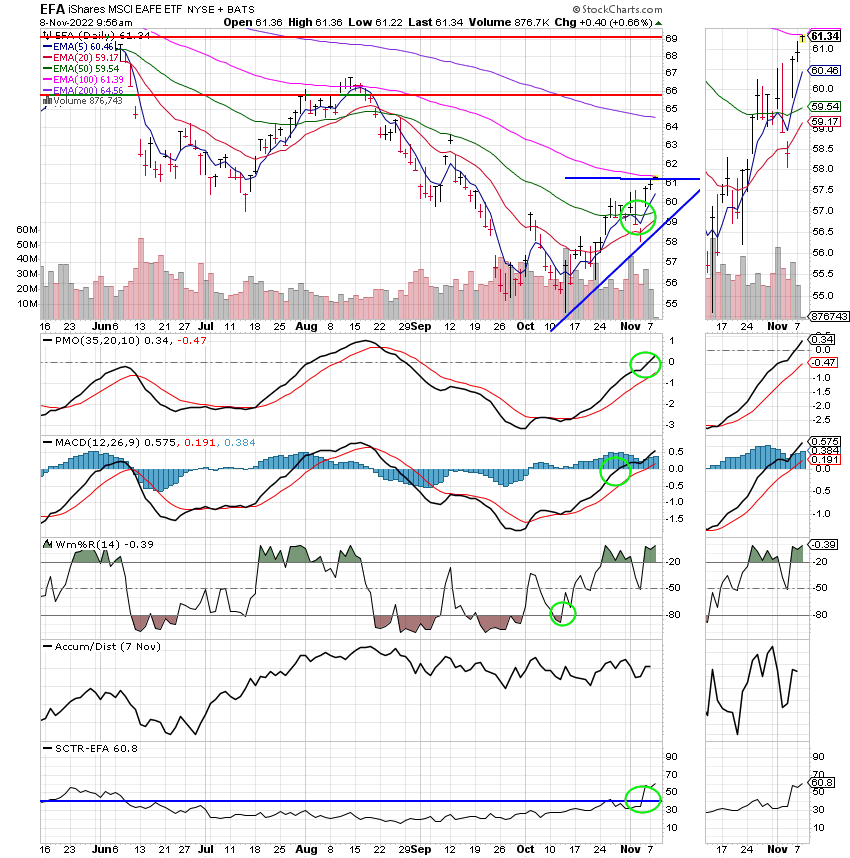

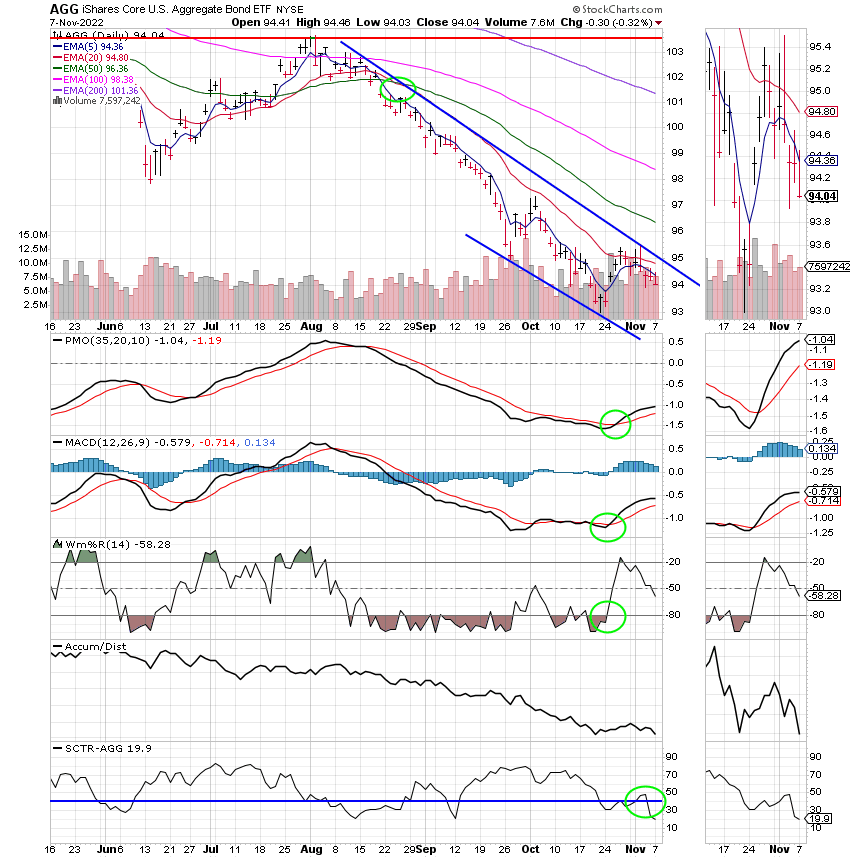

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

One more thing I want to address. I have been watching the I Fund this year and expecting it to pop based on the strength of the dollar and it’s effect on the foreign exchange rate. Earlier this year we moved into the I Fund anticipating those gains. What we ended up getting was a brief three day rally after which the I Fund retreated. The result was that we underperformed. I think one member of our group referred to it as a debacle. In fact it did not go well. Call it what you will. Well…. if you fast forward to today the I Fund has solidly out performed the other TSP Funds over the past week. The performance is not even close. I am again considering a move to the I Fund. However, I find it prudent to wait until Thursday’s CPI report in order to see how if effects interest rates and ultimately the value of the dollar moving forward. If I find conditions favorable for the move at that time then I will move all or part of my allocation to the I Fund. We will see. For now, I am content with the gains we are making in the C Fund and pray that they will continue. I am certainly grateful to God for His guidance! Don’t forget to pray for our nation on this important election day. Pray that God will put the best folks in place to lead us into the future. That’s all for today. Have a nice afternoon and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.