Good Evening, The post election market continues to be shaped by the same issues that we’ve been discussing since March. First and foremost are the infection rate of Covid 19 and the development of a Vaccine. Somewhat in the rearview mirror but not entirely gone is the uncertainty created by the Presidential election. The big drag on the market now is absolutely the surge of Covid 19 cases in the US and abroad forcing new restrictions which threaten the world economy. New restrictions in European Countries such France and the UK are of great concern to investors who see Europe as being several weeks ahead of the US with regard to Corona Virus and an indicator of things to come here. Balancing out this negativity was a report released this week which stated that Pfizer’s Covid 19 vaccine was 90 percent effective in phase III trails. Although actual widespread distribution of the vaccine may be months away it’s success as viewed as a light at the end of the tunnel. In all actuality it will likely be late spring before the benefits of the the vaccine will significantly improve the pandemic. So this issue will probably continue to be a headwind to the market until that time. As far as the Election effect of the market, it is fairly clear that Joe Biden will be our next President. At this time the market seems to be shrugging off the challenge that President Trump is making to the results. However, it still bears watching as we never know for sure what surprises could come from the litigation, but so far it’s been a non issue. All that said, the market is assuming that we will be moving forward with a Biden administration. As I mentioned before the election, there are different issues with either candidate winning the election. With the Biden administration the markets concern is that there will be increased corporate regulation, higher corporate taxes, and higher personal income taxes. Should these concerns concerns turn into reality they will definitely put downward pressure on the market. The market hates increased taxes and regulations regardless of who puts them in place. It doesn’t care what party is in power. All it cares about is the profitability of the companies listed on the stock exchange. Anything that effects profit is bad for business. And just for the record. Any comments I make are in regard to the market. It is a reality that politics effects the market. No matter how careful you are when you comment on them you are bound to step on someone’s toes. I have never shared my personal political views in this blog. Let me clarify one thing though. I am pro capitalist and pro democracy and I don’t apologize for either one. Beyond that I endeavor to remain neutral for the purposes of this blog. I made these these comments because I have recently receive messages accusing me of supporting both sides! Oh well…it is what it is. So continuing…. The market has so far shrugged off these concerns due to the fact that the Republicans have thus far retained control of the Senate. The markets view is that a divided government will keep taxes and regulations in check. If the balance of power changes in the Senate with two upcoming runoff elections in the state of Georgia in January the market will likely frown on that development. On the other side of this issue is the fact that the size of any badly needed economic stimulus package will be less generous with the Republicans controlling the Senate which is also seen as a negative. With that in mind, keep a close eye on those senate runoff elections in January. But be advised that the only reason I mention any of this stuff is so you will know what to look for on the charts. Any investment decisions that you make should be based on the charts and nothing else. Knowing what’s going on will sometimes let you know what to look for on the charts, but never make a change until you actually see it on the charts. The moral of the story is that the fundamentals sometimes lie but the charts are seldom misleading. We have an old saying here….Think with your chart and not your heart. Remember, nobody has a crystal ball and emotions will get you killed in this business……

The days trading left us with the following results: Our TSP allotment posted a gain of +0.81%. For comparison, the Dow slipped -0.08%, the Nasdaq rallied +2.01%, and the S&P 500 added +0.77%. Praise God for another good day!

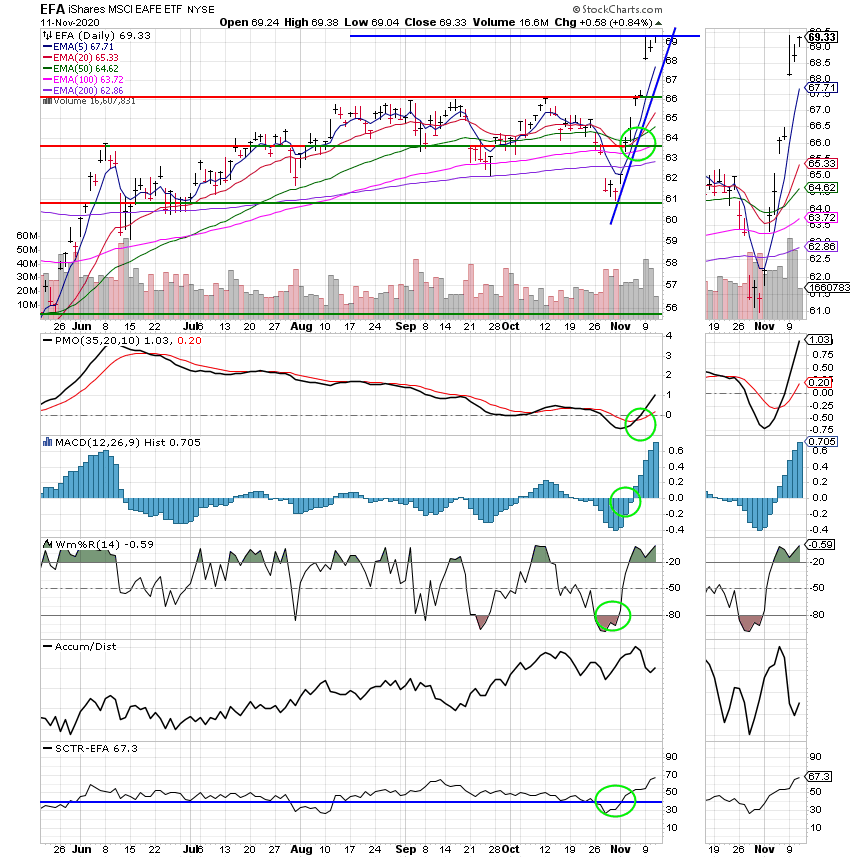

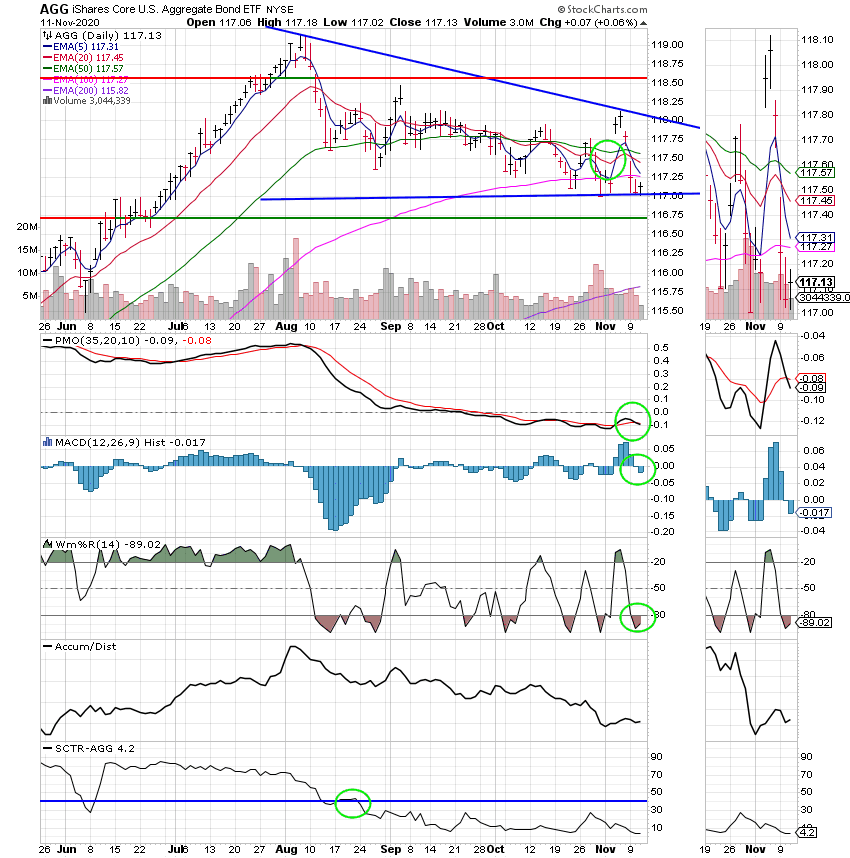

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Sell. We are currently invested at 100/S. Our allocation is now +27.45% on the year not including the days results. Here are the latest posted results:

| 11/11/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4888 | 20.9453 | 52.6519 | 63.9375 | 32.7468 |

| $ Change | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| % Change day | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change week | +0.01% | -0.55% | +1.06% | +0.99% | +3.49% |

| % Change month | +0.02% | -0.07% | +8.49% | +9.28% | +11.88% |

| % Change year | +0.85% | +6.23% | +11.41% | +13.61% | +0.09% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 21.8582 | 10.7237 | 36.928 | 10.9648 | 41.0203 |

| $ Change | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| % Change day | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change week | +0.40% | +0.90% | +1.11% | +1.21% | +1.32% |

| % Change month | +2.14% | +4.72% | +5.82% | +6.40% | +6.97% |

| % Change year | +3.17% | +7.24% | +5.95% | +9.65% | +6.74% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 11.127 | 24.1373 | 11.4605 | 11.4605 | 11.4605 |

| $ Change | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| % Change day | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change week | +1.41% | +1.51% | +1.88% | +1.88% | +1.88% |

| % Change month | +7.47% | +7.97% | +9.70% | +9.70% | +9.70% |

| % Change year | +11.27% | +7.36% | +14.61% | +14.61% | +14.61% |