Good Day, The market is trading lower today after Moody’s investors service downgraded the outlook on US credit from stable to negative and that’s all about the elephant in the room which are the ongoing budget negotiations in the US congress. As you already know they agreed to a stopgap temporary funding deal known as a continuing resolution which funded the government through the end of this week. The idea with a continuing resolution is that the government will stay funded until a permanent budget is negotiated for fiscal year 2024. The problem as Moody’s sees it as that the budget process has become so partisan that it is basically nonfunctional. in other words Moody’s sees congress as a dysfunctional family. Moody’s did maintain the US credit rating at AAA but will surely reduce it if there is no budget agreement by the end of the week. Earlier this year Fitches credit agency downgraded their US credit rating to AA+ citing the same reasons. I believe they’ll end up pushing through another Continuing Resolution at the last minute, but that does very little for the confidence of the US financial markets. If you look closely at the negotiations it’s hard to see how they will ever come to an agreement. You have one side of the isle that insists on increasing border security but does not necessarily want to fund the war in the Ukraine and the other side that doesn’t give a flip about border security but is all in for funding the war in Ukraine. Then you add in all the other issues such as abortion and green energy and the budget process is held hostage to the desires of both parties. What ever happened to passing a budget on what we can agree on and negotiating the other issues individually??? Why hold the entire country hostage over something like abortion or green energy or whatever. Couldn’t some of this be solved by letting each state do what they want to do? After all, aren’t we supposed to be a republic?? If you don’t like what one states doing then move to another one that’s more to your liking, but quit trying to force your preferences off on someone else. That’s never a good thing and that’s got an awful lot to do with the budget impasse. I’m pretty sure that fits under the template of socialism and the last time I checked our founding fathers made this a democracy!! I look at this budget process and wonder if there are really any adults in the room…. What does this have to do with the market you ask?? Everything!!! It has everything to do with it! Absolutely!!!! Capitalism and socialism don’t mix. You can trace it to almost every problem we have. So there you go. We’ll keep our eyes on congress and that should tell us what to look for on our charts. Our strategy remains the same. We are currently remain invested at 100/C. However, our charts indicate that the buy signal is starting to get long in the tooth. Given the current conditions we are looking to our charts with a defensive mind. Should we get a sell signal we will sell quickly and wait for the next run. Also, the threat of a recession is quite real. While a soft landing is possible and would be nice we must continue to hope for the best but prepare for the worst. Nobody ever got hurt taking a profit and we definitely have some gains to protect after the recent run. So make no mistake, we are strongly of the the mindset to protect our gains….

The days trading is generating the following returns. Our TSP allotment is currently trading slightly higher at +0.05%. For comparison, the Dow is up +0.28%, the Nasdaq is off -0.15%, and the S&P 500 is in the green +0.05%. We thank God for the nice run that we’ve been experiencing!

S&P 500 falls to start the week after Moody’s cuts U.S. outlook: Live updates

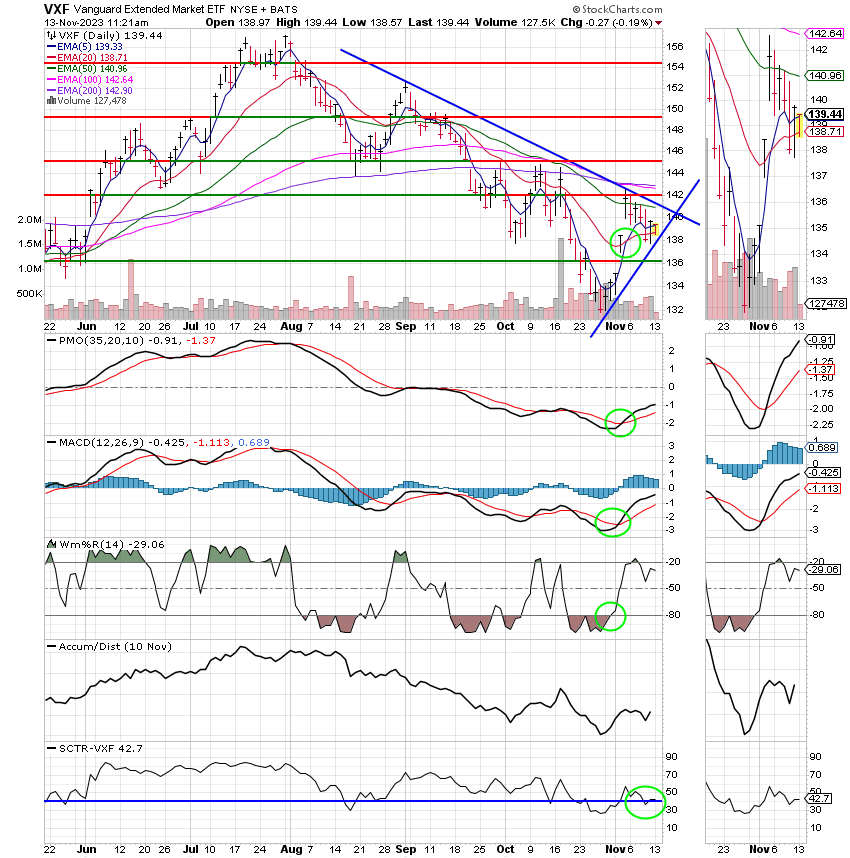

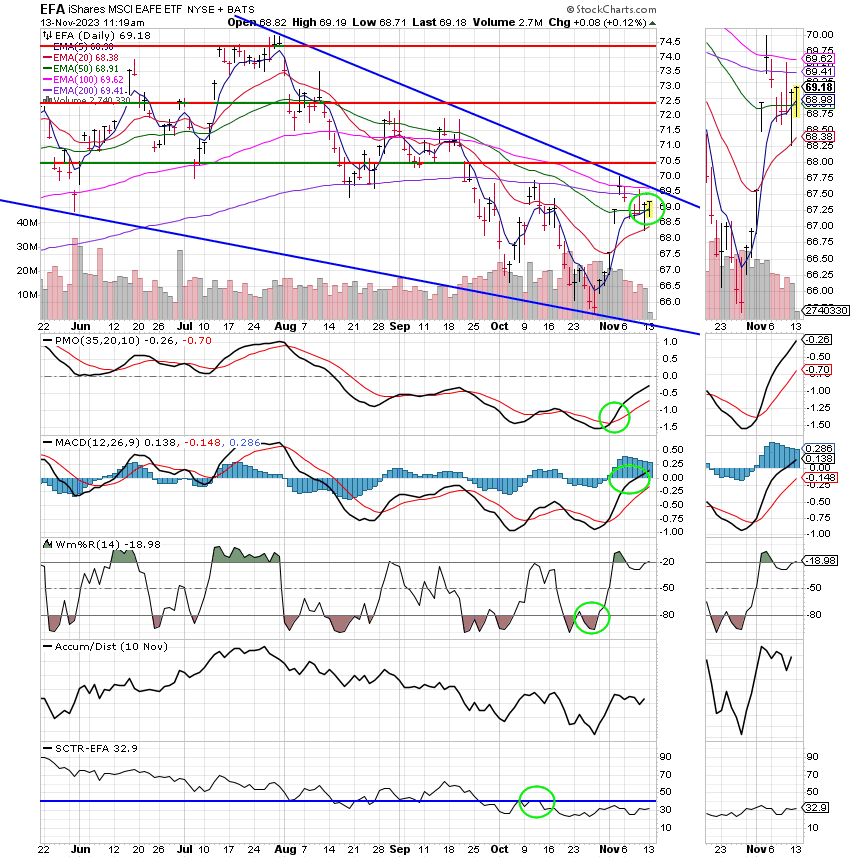

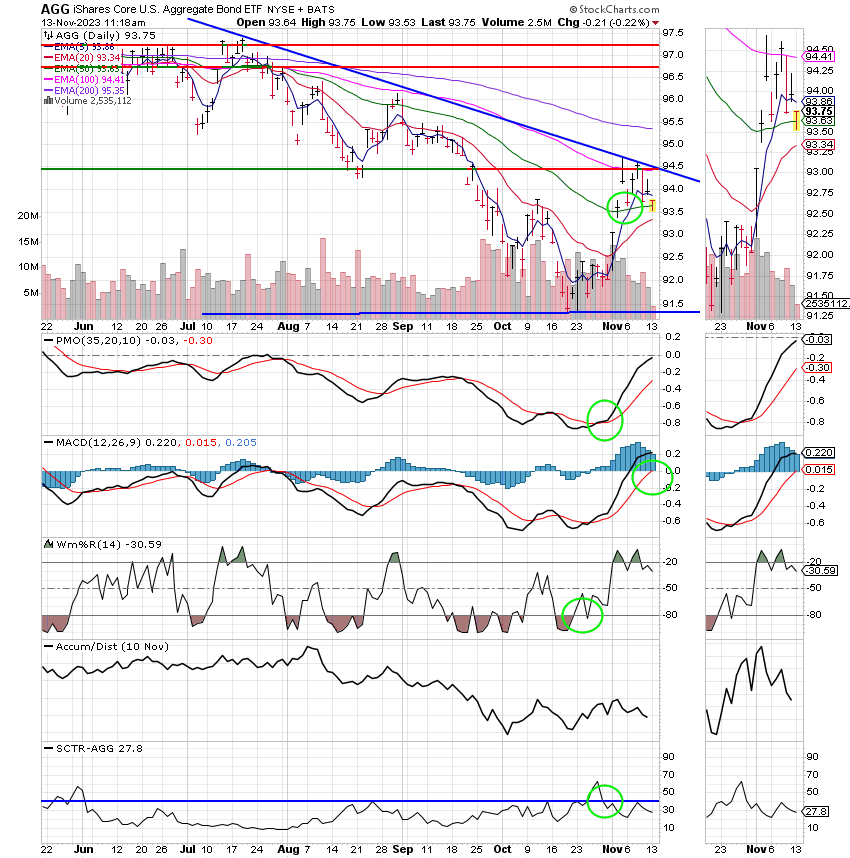

Recent action has left us with the following signals: C-Buy, S-Hold, I-Hold, F-Hold. We are currently invested at 100/C. Our allocation is now -3.37% for the year and +5.26% for the month not including today’s results. Here are the latest posted results:

| 11/09/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.8425 | 18.0669 | 67.6016 | 64.4925 | 36.2846 |

| $ Change | 0.0024 | -0.1408 | -0.5382 | -0.8796 | 0.0824 |

| % Change day | +0.01% | -0.77% | -0.79% | -1.35% | +0.23% |

| % Change week | +0.08% | -0.40% | -0.22% | -2.65% | -0.81% |

| % Change month | +0.12% | +1.88% | +3.70% | +2.73% | +3.29% |

| % Change year | +3.52% | -0.77% | +14.77% | +4.81% | +6.90% |