Good Morning, The market dropped a few days and now a lot of folks are using that other strategy which is really not a strategy at all. PANIC. My inbox is full of messages. “I’m losing all the gains I made last week. Shouldn’t I put some in the G Fund ?” So you want to be partially right on partially wrong? I’m not going to tell you not to do it. In the end you must invest according to your risk tolerance and if you must have at least some of your funds in the right place all the time then by all means that is what you need to do. After all it is the prevailing strategy and it is viable. Just look at the L Funds. Set it and forget it. Go live your life. Spend your time elsewhere. If your not willing to put in the time (and it does take some time) to check your portfolio at minimum on a daily basis then the L Funds are for you. What we do here is not for everyone. We want more than the average market return and we are willing to work for it. Over time we have achieved our goal but in the past couple years not so much although we have done quit well over the past quarter. My view of things is a little different than the average L Fund investor. I can’t bear the thought of intentionally having part of my funds invested in the wrong place so they will be in the right place later when the market shifts. I’ve never though of myself as a glass half empty type of person but maybe in this case I am. While I understand that it is impossible to be in the right place 100% of the time, my goal is to simply be there 80 – 90% of the time. When I do that I can handily outperform the market and when I don’t, I at least have the satisfaction of knowing that I tried. I know it worked for my retirement and I believe it will still work for yours to or I wouldn’t be wasting my time doing this in the first place.

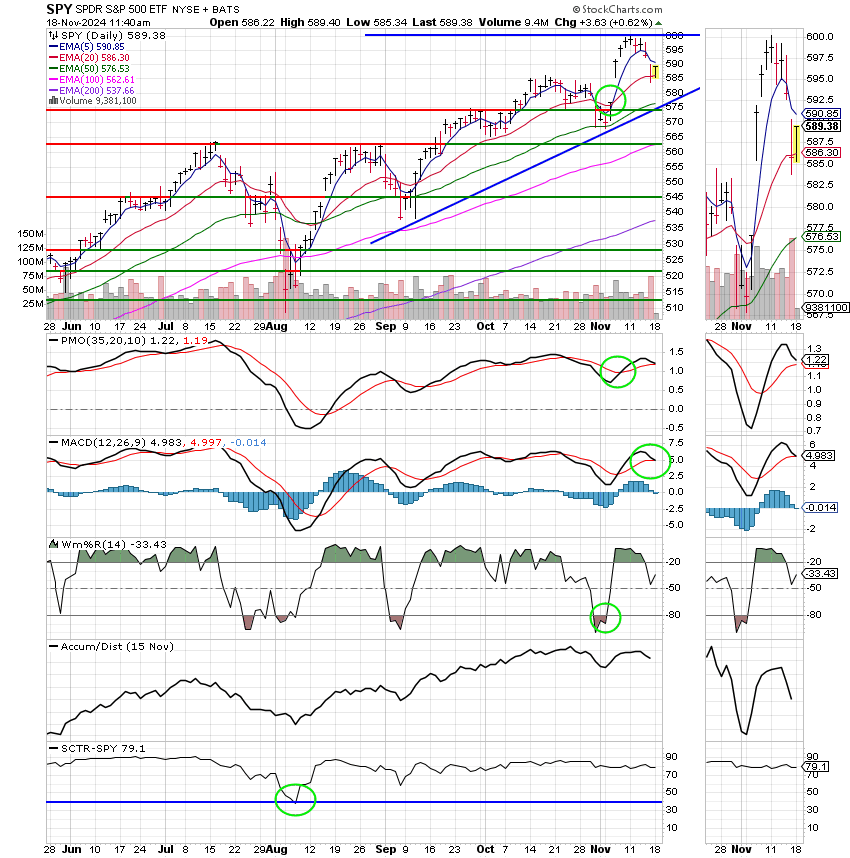

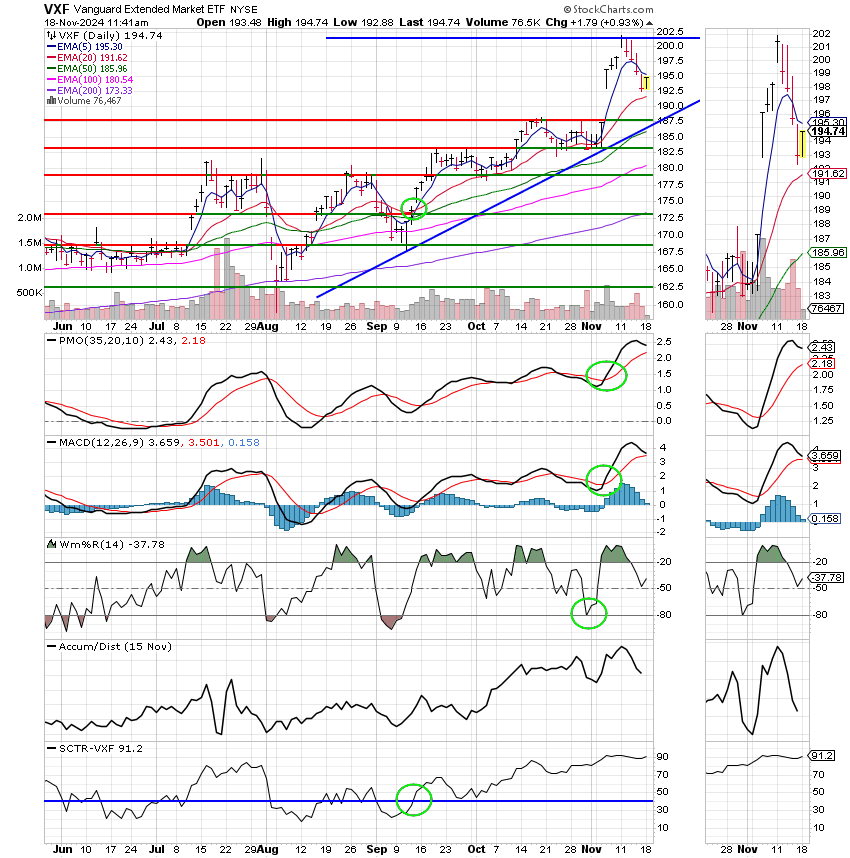

Last week the market got a boost off the Trump election. The boost was based on what the market anticipates to come. A business friendly environment created by deregulation that will allow companies and especially small companies to flourish while being supported by a falling interest rates. All in all, perfect for business and in the end when all is said and done, business must make money in order for the market to prosper, in order for us to make money. However, this is what you must understand, this is all anticipation until January when the new administration takes office. So the market will continue to ebb and flow based on whatever news is out there. On top of that you have a Fed that is now not in a hurry to drop rates. The optimistic outlook created by the election has put given a strong economy even more support resulting in somewhat stick inflation. It’s kind of like putting fertilizer on your lawn. If you do what’s best for it then it grows and the result of that is that you have to cut it more. Healthy grass grows and so does a healthy economy. Just think of inflation as the growing grass that you have to mow a few more times. Why is this such a big deal? Well….its not to me but it most certainly is to the market because the market is completely and utterly addicted to cheap money. So….the longer the rate of inflation stays above 2%, the longer the Fed will leave rates at an elevated level which on turn results in a greater expense to business. This especially means small business which is highly leveraged and make no mistake. There are two factors that effect the ec0nomy in a huge way. Those are small business and the consumer. Anything that effects one or both of those effects the market and your portfolio. So where am I going with all this? The market is all about anticipation. It always puts the cart before the horse. With anticipation comes uncertainty and as we say on almost a weekly basis the market hates uncertainty. Uncertainty breeds volatility and that’s where we’re at. Which brings me to my point. At this point and time investing in the market is about being positioned for what is to come. Charts permitting, you need to be ready for the aforementioned deregulation to take place. If you wait until it actually starts then the train will have already left the station. That means that you have to ride a roller coaster now. As long as your charts show that the trend is moving higher you must stay buckled in and endure the rough ride. The long game is all about the first quarter of 2025. Also not to be overlooked, the current season is the best season of the year to be invested. Again, charts permitting, you want to remain invested it at all possible in November and December. Given all these factors we remain invested at 100/S and will not sell unless we are forced by our charts to do so!

The days trading so far has left us with the following results: Our TSP allotment is currently trading higher at +0.93%. For comparison, the Dow is up +0.11%, the Nasdaq +0.86%, and the S&P 500 +0.58%. Praise God for a nice day!

Nasdaq rises slightly to start the week, led by Tesla shares: Live updates

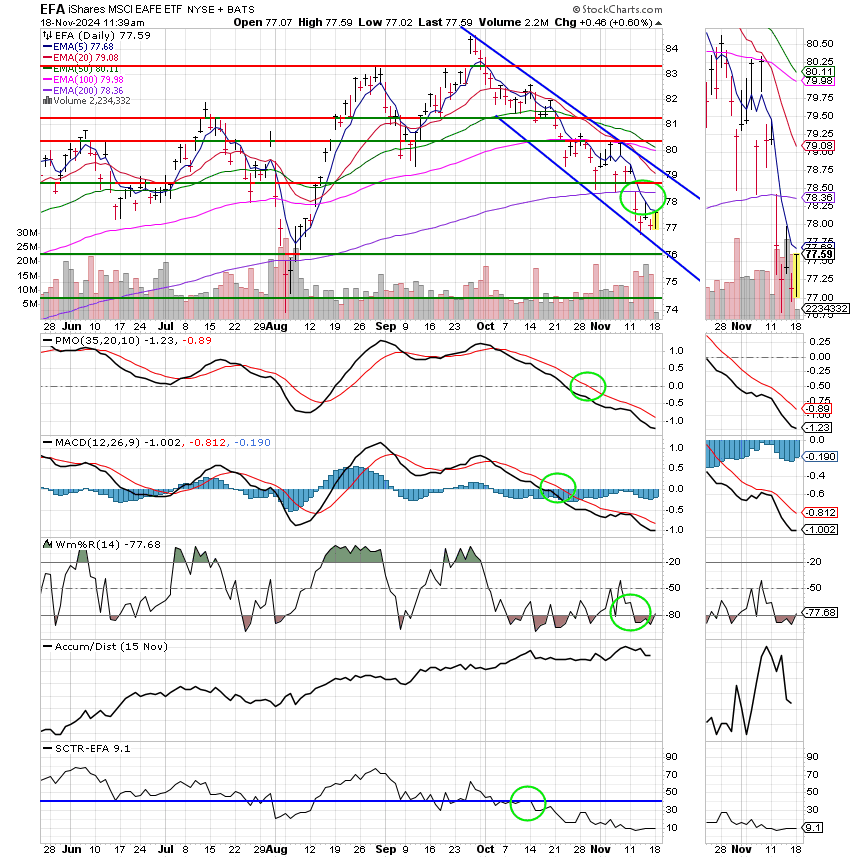

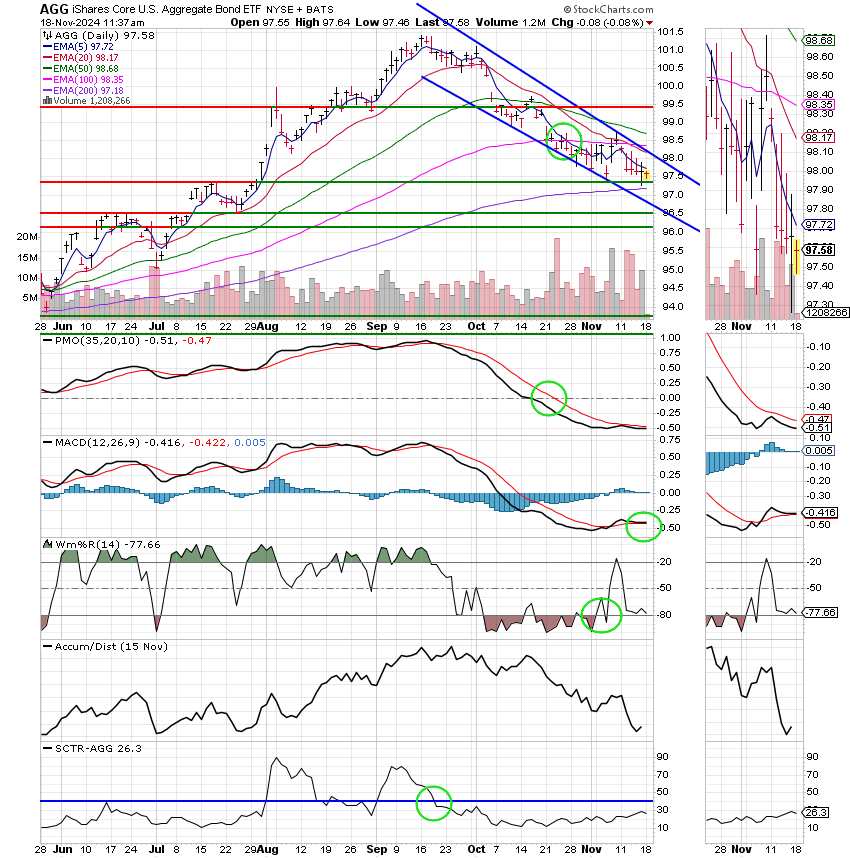

The recent action has left us with the following signals: C-Hold, S-Hold, I-Sell, F-Sell. We are currently invested at 100/S. Our allocation is now +15.48% for the year not including the days results. Here are the latest posted results:

| 11/15/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.6523 | 19.4934 | 92.5928 | 91.3423 | 42.1863 |

| $ Change | 0.0022 | -0.0047 | -1.2273 | -1.1970 | -0.2432 |

| % Change day | +0.01% | -0.02% | -1.31% | -1.29% | -0.57% |

| % Change week | +0.08% | -0.84% | -2.05% | -2.57% | -2.90% |

| % Change month | +0.18% | -0.51% | +2.96% | +5.46% | -2.17% |

| % Change year | +3.84% | +1.41% | +24.51% | +18.48% | +4.99% |