Good Day. I don’t normally post a blog on a Holiday but last night my 86 year old mother was in the emergency room which precluded me from posting then and I felt that given the current uncertain market conditions that I didn’t want to leave you all hanging. I know the market bounced yesterday, but it was not anything to inspire confidence. The major indices started strong but finished weak. They were well off their highs by the closing bell. It could even be said that they limped into the finish. By the matter of fact the Dow finished the day slightly in the red. Like I said it was hardly anything to inspire confidence. The bottom line is that this is a volatile market and investors don’t want to hold stocks through the weekend. I know that we have a half day of trading on Friday but most investors left their desks for the holiday and won’t be trading again until Monday. Thus they sold. I’ll keep this brief because it’s holiday. The whole 2018 market boils down to the trade negotiations that will occur on the weekend of December 1st between Presidents Trump and Jinping. If they go well the market will move up big. It they don’t there will be punishment. The markets will more than likely drift until then. To be invested at that time is like a crap shoot. The risk/reward ratio is high. Investors will either be highly rewarded or greatly punished and I seriously doubt that there will be anything in between. I’m staying on the sidelines. I feel like I’ve already gambled enough for one year thank you! Right now the Volatility is just too high. I’m still watching my main charts to be sure but I’m placing and even closer scrutiny on the volatility index better known as the VIX. When that is high and I define high as greater than 16 there are more likely to be large bouts of panic selling. When both your charts and the VIX are bad you need to get out of the market until both get better. That is where we find ourselves now. We have up some profits by getting out now. However, we kept the majority of our gains from the past several years. We could have done better but on the flip side we could have done far worse! I thank God for His guidance and trust Him for our future. If we miss a rebound now then so be it. It is better to be safe than to lose a lot of what we worked so hard to make since 2009! Tom Bowley talked about the VIX in his most recent blog here is what He had to say:

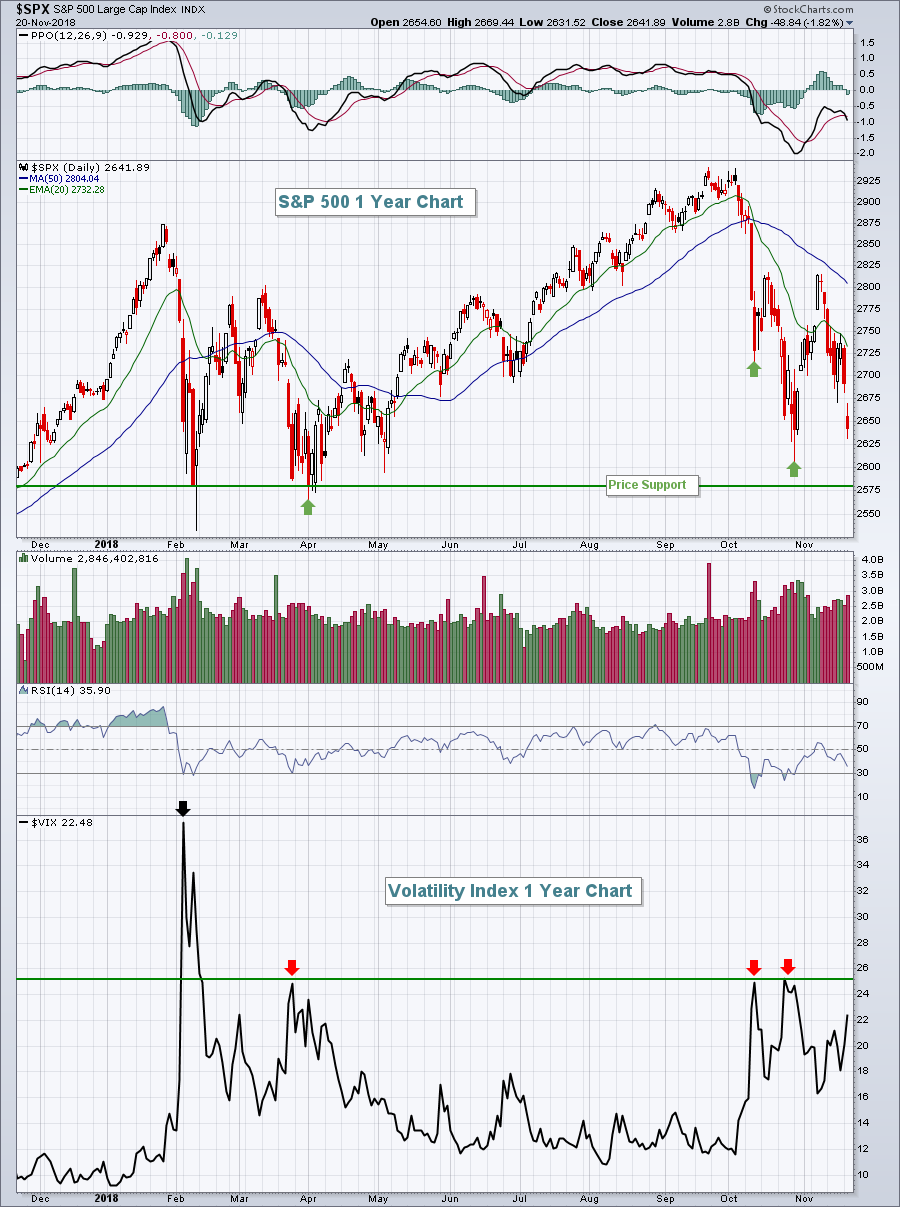

The Volatility Index ($VIX) surged on Tuesday, gaining 11.84% and finishing at 22.48, its highest close in November. A rising VIX means rising expectations of short-term volatility. That’s almost always associated with falling equity prices and increasing fear. And VIX readings in the 20s and higher can lead to periods of impulsive or panicked selling where prices fall extremely rapidly with seemingly few buyers. The good news, however, is that these heightened levels of fear mark very significant market bottoms – bottoms that we don’t want to violate. On the S&P 500, that level is 2582 on a closing basis:

The first thing that really jumps out at me on this chart is the VIX reading from February. Historically, we don’t see many VIX closes near 40. The intraday high reached 50 – again not witnessed very often. So in my view, the S&P 500 low that accompanied that type of panicked selling is critical support. We saw a similar development in 2014, followed up by tests of price support created by that initial bout of panicked selling. We held that support, though, and the bull market lived on. That’s what I’m watching now. Can we hold that February closing support of 2582? I think we’re about to find out.

Folks this is what we need to be focused on now. When volatility is stays between 16 and 29 the you need to be careful. This is one of the indicators that I ignored in favor of strong fundamentals this fall. Like I said in my last blog, Never Again! This market may or may not surge in coming weeks but as long as the market remains at it’s current volatility level it will be very hard to hang onto any gains. It is just not safe to be in the market right now. Technical Analysis helps us manage risk and right now the charts tell us that the risk is too high for retirement money. I have some investments on the street (not in TSP) that I don’t consider crucial to retirement and I don’t even consider this a safe environment for them. So why would you want to risk your retirement money? So what, if Joe Cool at the water cooler says He beat this market and made a bunch of money while you were sitting out. Don’t base your decisions on what others say and don’t say. It’s your retirement and your life. Based on that, your number one priority should be capital preservation!! Remember!!!! It’s not what you make that’s important!! It’s what you keep!!! You made this money and you’ll make more. Trust first in God and second on your charts. Those are the only things that will never lie to you. Your results may suffer when you choose not to listen to them as we did this fall, but the bottom line remains that they will never lever lie! We remain invested at 100/G until all our charts agree that it is safe to return to this market!!!

Let me take this time to wish each and everyone of you a happy Thanksgiving! Don’t forget to thank God for all He has blessed you with not the least of which is your family and friends. Give Him all the praise today!! That’s all for today! God bless you all and I’ll see you on Monday. Remember that Friday is only a half day of trading!