Good Afternoon, Hopefully, you all had a blessed Thanksgiving. I know that some of you had to work. I had to do that many times myself, but that makes me appreciate all the more the time that I am able to spend with family and friends now. The market continued to move higher last week although it was obvious that it was beginning to slow down from the torrid pace of the prior three weeks. For the most part the market continued higher based on softer economic data and the Fed holding rates steady at their November meeting. It all continues to be about interest rates and inflation. If you really want to know what the market is going to do from day to day then watch the 10 Year Treasury Yield. It closely correlates with interest rates. When treasury rates move higher the market will sell off and when they move lower, traders will buy. The majority consensus of investors at this time is that the interest rate increases put in place by the Fed have started to take effect and slow the economy down. Based on that observati0n it is widely thought that the Fed is done increasing rates but will not decrease rates until sometime late in 2024. As long as conditions meet market expectations everything will go reasonably smooth. If they do not then volatility will increase. That said, we should always remain aware that there will continue to be a somewhat elevated level of volatility as long as the rate of inflation remains above 2 percent. Of course that volatility will continue to increase as we get closer to each Fed meeting and anytime economic reports come in hotter with regard to inflation. As long as those conditions persist, the runs both higher and lower in this market will remain relatively short in duration which means that you will have to move your money a little more than usual to outperform the market. That is just the cost of doing business. So why not buy and hold some of you ask?? Let me get this straight, there is nothing wrong with trying to hold the best funds. That is a viable system. With that strategy you will make what the market makes or a little more. However, if you want to significantly outperform the market you are going to have to buy the dips and sell the rips so to speak. Now the buy and hold crowd will tell you that can’t be done. That it is a fools errand. Well maybe so….but we outperformed the market some 380% for the 10 year period through the pandemic and had it not been for the pandemic we would have out performed it by over 400%. Just ask the folks that were with us during that time! God blessed us and we did well even when adding in the dip during 2021 and 2022. The market maker/ algorithm boys took advantage of quantitative easing and the subsequent quantitative tightening. We had a difficult time reacting to what they were doing and I will add we were not the only ones. There were, however, a few systems that were not greatly effected and they were mostly buy and hold systems. Why?? Were they actually superior to us as they claimed… You talk about getting trashed…. It was crazy some of the stuff they said about us. So back to my question, were their systems superior to what we did? They were not and never have been and never will be. Are they a good system to make money? Of course, they are a viable way to make money. You will never hear me trash them as they tried to do to us. Although, I must add, they are starting to get quiet again….wonder why????? To answer our question above. Nothing changed for the buy and hold folks during and after the pandemic. They just kept doing that they had been doing. They took what the market gave them. Add that to what they made the past ten or twenty years and they made a little money. Again, they didn’t have to make any adjustments. What they did took very little skill. The 28% that we lost during that period of time was unprecedented for us. However, we own it and never denied or ran away from it. No….what we did was learn from it and get better. The algorithm folks had our number for 12 months and then for another 6 while we adapted to our new system. All this while, the buy and hold folks did the same thing they had been doing and made the same thing they had been making and then told everyone that would listen that they were right and had always been right. They stood up on their podium and sold their snake oil. One shot cures all!!! As if their one year of outperformance made up for their last 20 years mediocre performance. They beat their drum and proclaimed how much better they were doing than us. Perhaps because they had never done it before. I just don’t know. So where am I going with all this? I actually wanted to make a point although I must freely admit that at the time I was somewhat offended by their baseless claims. I guess they just had to kick us while we were down. I forgave them as God would have me to do and moved on. Why bring it up then??? So you will know the difference in what they do and what we do. So you will utilize the system that you are most comfortable with. So you will have the best retirement that you can have. As I have often said, there is no one system that fits all. You must find and use the one that is best for you. The one that best fits your needs. That noted, lets get back to the difference. In their system they take what the market gives because they truly believe the Wallstreet line that that is the best that an investor can do. They drank the Wallstreet Kool Aid. Once again, they truly believe this. On the other hand, our goal is to significantly outperform the market not just match it. As far as we’re concerned investing in the L Funds is just as effective as what they do and that is what we recommend that folks do if they don’t want to put in the extra effort that’s required to outperform the market. Folks, it’s simply more work. You have to pay attention to things and move your money. We already know that it’s worth it. I know there are some folks who have only been with us since the pandemic and either don’t understand or don’t believe what I am saying. I got that! All I can say to them is ask anyone that’s actively managed there money for 10, 15, or 20 years and see what they made and if it was worth it. As I said on our face book page, We have made the adjustment. We are good to go now. The algorithm folks will not fake us out again…..now we have their number. God be praised!!

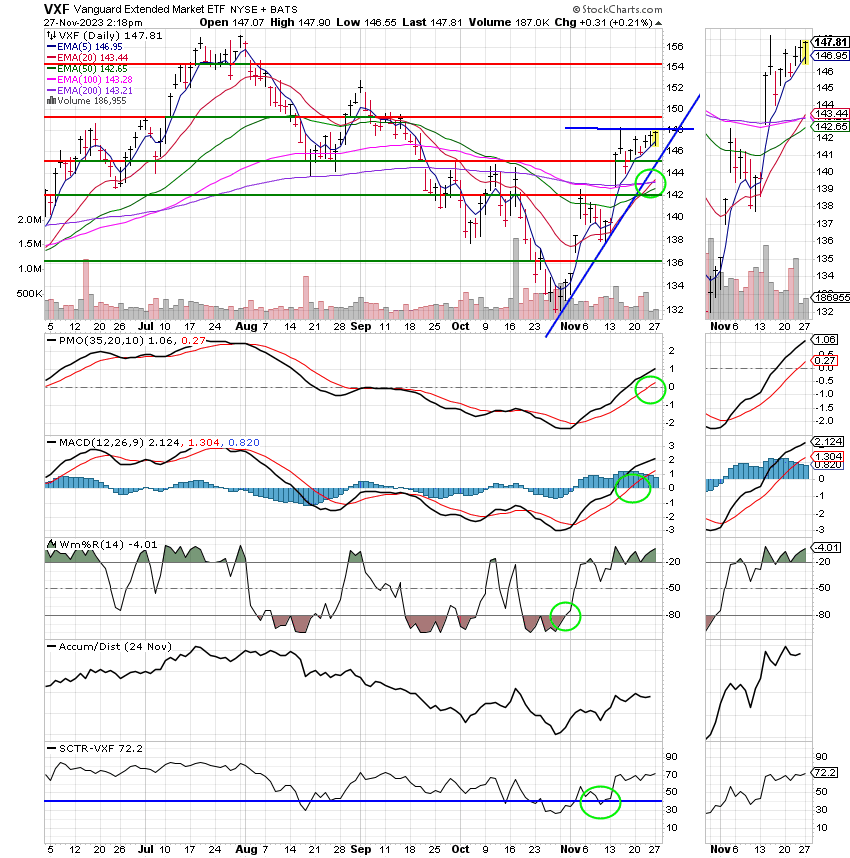

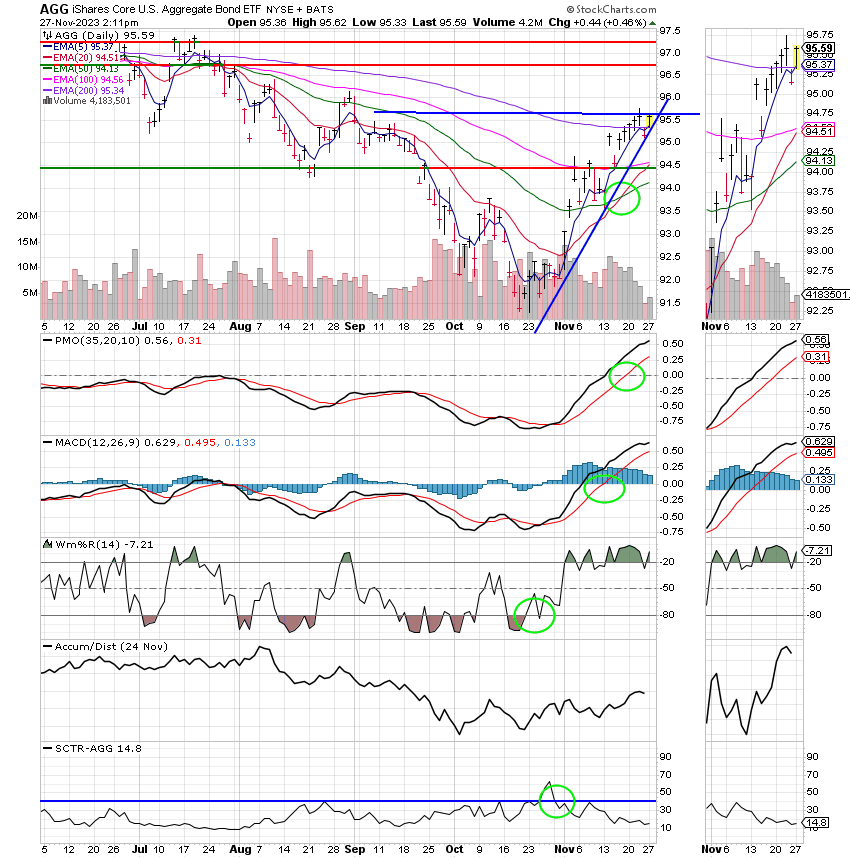

Okay, last week we moved to the G fund. Our indicators showed that the market was becoming extended and due for a rest. A rest could mean a dip or could merely mean some sideways movement. We moved our money because the risk for a selloff either small or large is highest at this time. My point is that we are not timing the market. No, if that is what you think then you don’t understand what we do. What we are doing is managing risk. We are stepping to the side when the market is likely to move lower. Okay, so you ask, didn’t we miss out on some gains last week? Not as many as you might think. The media tends to sensationalize things every time they get a chance. Actually, the S&P 500 (C Fund) only rose one percent. It will be very hard to hang onto that one percent if you stay invested and the market takes a dip. At best you’ll break even and in the event you do we will too. However, if the market moves lower, say even two to three percent lower, then we will actually hang onto more of our profit than someone who stayed invested during that same period of time. Getting out within one percent of the top is pretty darn good in my book. I’m happy and I’ll gladly take that profit. Right now our indicators show that the market will move sideways to slightly lower. As of the close of market today, the C Fund dropped -0.18%. That’s -0.18% of that 1.00% that the C fund gained last week. As you see the gap is already closing…. I simply look at that one percent as an insurance policy. I’ll give up a little to protect a lot. Although, most of the time when my indicators read like they do right now we will get a decent sized dip. If I had to guess I’d say this one will be in the three percent range when all is said and done. If so, we will make money. Praise God for that! He is good to us every day!!

The days trading left us with the following results: our TSP allotment was steady in the G Fund. For comparison, the Dow fell -0.16%, the Nasdaq -0.07%, and the S&P 500 -0.18%. Thank God for guiding us to another good day!

Dow closes lower Monday as four-week rally takes a break: Live updates

The days action left us with the following signals: C-Hold, S-Hold, I-Hold, F-Hold. We are currently invested at 100/G. Our allocation is now -1.11% for the year and +7.87% for the month. Here are the latest posted results:

| 11/24/23 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.8792 | 18.3319 | 70.9698 | 69.0654 | 38.1526 |

| $ Change | 0.0049 | -0.0604 | 0.0436 | 0.3937 | 0.2888 |

| % Change day | +0.03% | -0.33% | +0.06% | +0.57% | +0.76% |

| % Change week | +0.10% | -0.02% | +1.02% | +1.17% | +1.01% |

| % Change month | +0.33% | +3.38% | +8.87% | +10.01% | +8.61% |

| % Change year | +3.74% | +0.68% | +20.48% | +12.25% | +12.40% |