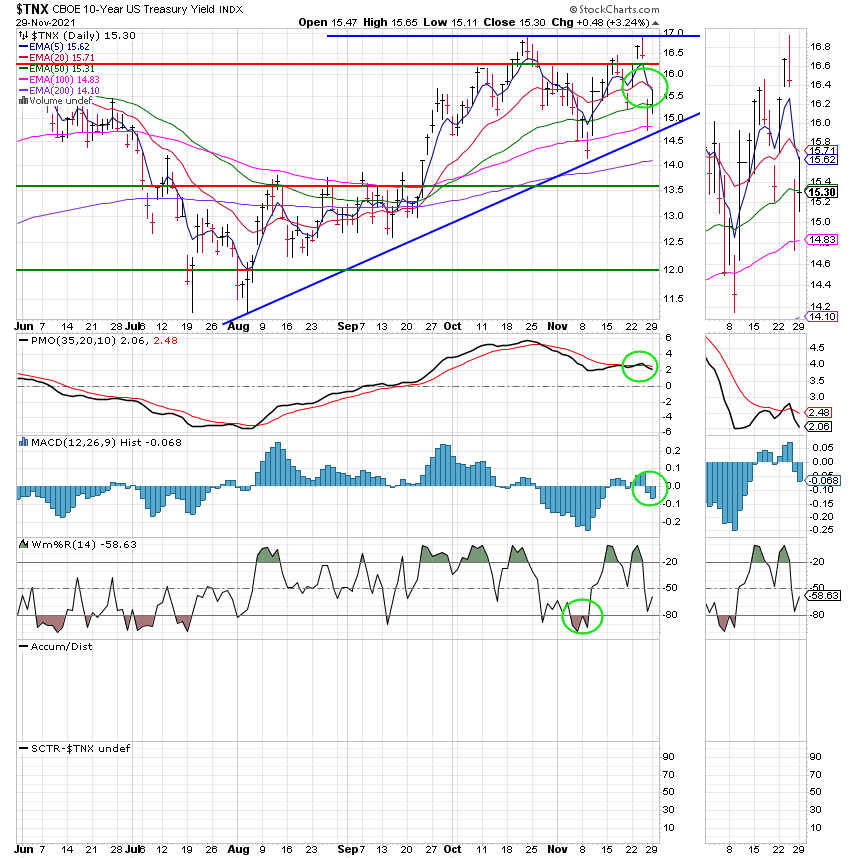

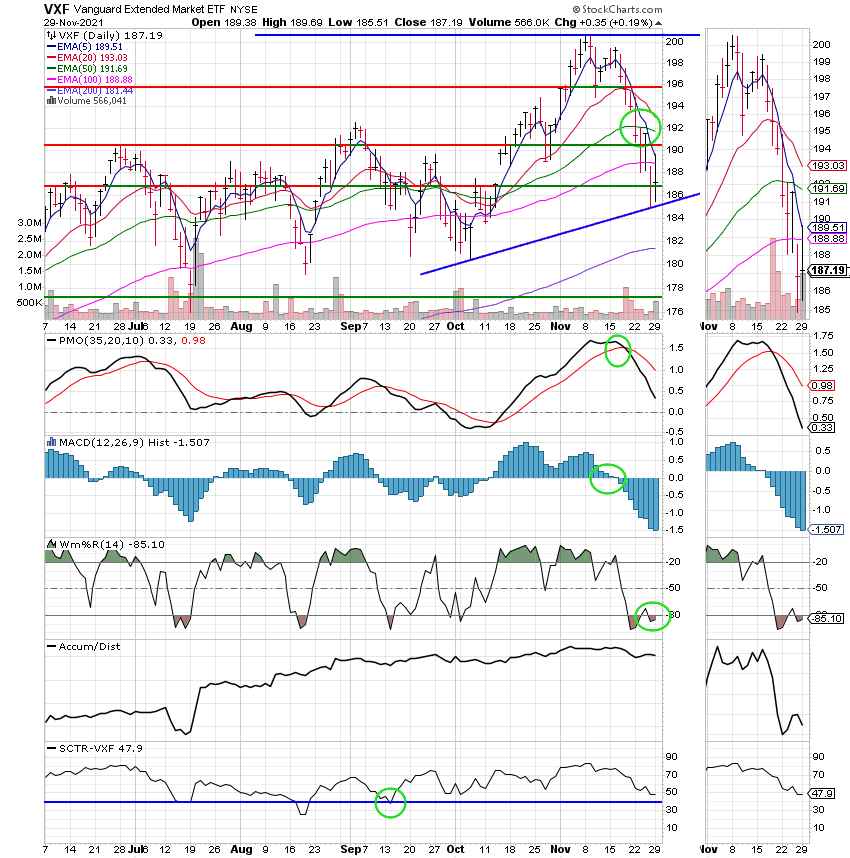

Good Evening, Usually the holiday season is a good time to simply watch your portfolios rise. It’s kind of like playing darts with a blindfold on. Your definitely going to hit something. However, in our case just hitting something is not enough, we’re aiming for the bullseye! This continues to be a profitable but volatile year. Just when you think you’ve got things nailed down for a nice long run something changes and that was the case with our trade to the S Fund. We moved to the S Fund earlier this month as the chart for the S Fund overtook the chart for the C Fund as our best TSP chart. So we reacted and moved our money into the S. The chart for the S Fund stayed on top for the day we put in the interfund transfer and one more. Then it returned to second place and the gap between it and the C Fund has widened ever since and as you already noticed so did the gap in performance between the two. So why did this take place? Treasury yields started to rise once again. You probably remember the same thing happened to us back in August when we were forced to move from the S to the C Fund. The whole treasury yield thing has just become unpredictable in the short run. As bond yield rates rise (most folks watch the 10 year treasury) interest rates rise as well. That’s the reason that bank stocks rally when bond yields go up. They make more money on their loans! At any rate, the Fed which sets the short term interest rates that banks charge one another has stated that there will be no reason to raise interest rates in response to the current rate of inflation (which remains above their target of two percent) as the inflation is transitory. As I have mentioned before they say that current inflation rates are a result of the pandemic and won’t stay high for long. I agree with that, but the bond market does not and is putting upward pressure on interest rates. Why does this effect the S Fund? The S Fund is a small cap/ midcap blend and smaller stocks are more economically sensitive. They do better when they have cheap money to fuel their growth. One can look no further than the Russell 2000 small cap index which actually fell 0.2% today to 2,241.98. This on a day when the S&P 500 made up of large cap stocks rose 1.3%!! Thus, as a result the S Fund underperformed again! Normally small caps prosper in November and December. You can bet on it during a normal year, but 2021 has been anything but a normal year. I tried my best not to chase the C Fund as I felt that the chart for the S Fund would turn around and overtake the C once again. That however, has not been the case. Bond yields have simply been a stone around the neck of the S Fund making it doubly hard for it to rally. The S Fund may indeed turn around but the difference in the charts has become too great to ignore. Due to that coupled with the fact that the chart for the 10 year treasury yield is in a bullish wedge pattern (Chart below) I have decided to move back to the C Fund until treasury yields make a sustained move lower. That said, I entered an interfund transfer request for 100% C Fund to be effective at the close of business tomorrow. This trade didn’t work so it’s on to the next one. No emotion, just business. May God continue to bless our hand! Also, I would be amiss not to mention the new Omicron mutation of Covid 19. Does anyone call it corona virus anymore? Just wondered. It caused the market to sell off and sell off hard on Friday. The media was out in droves saying the sky was falling once again. The politicians were out as well telling us how bad this is going to be! After all they want us to think we need them….. Should we be cautious? Yes, but should we run and hide once again? I think not!! Do we run and hide during flue season every year? Do we jump in the bunker when we hear there is a new virus making it’s rounds at school or work? No we do not! So what’s different about this? Folks, the doctor that first treated patients with the Omicron mutation in South Africa said the symptoms she observed were mild. I can understand why we are investigating this. We should, but to sell all your stocks over what looks up to this point to be a glorified cold? I don’t think so. Not until we know more….. you know what I have to say about that??? Nice bounce today wasn’t it?

The days trading left us with the following results: Our TSP allotment posted a gain of +0.19%. For comparison, the Dow was up +0.68%, the Nasdaq +1.88%, and the S&P 500 +1.32%. Praise God for a day in the green.

S&P 500 bounces 1.3% from Friday’s rout after Biden says there’s no need for Covid omicron lockdowns

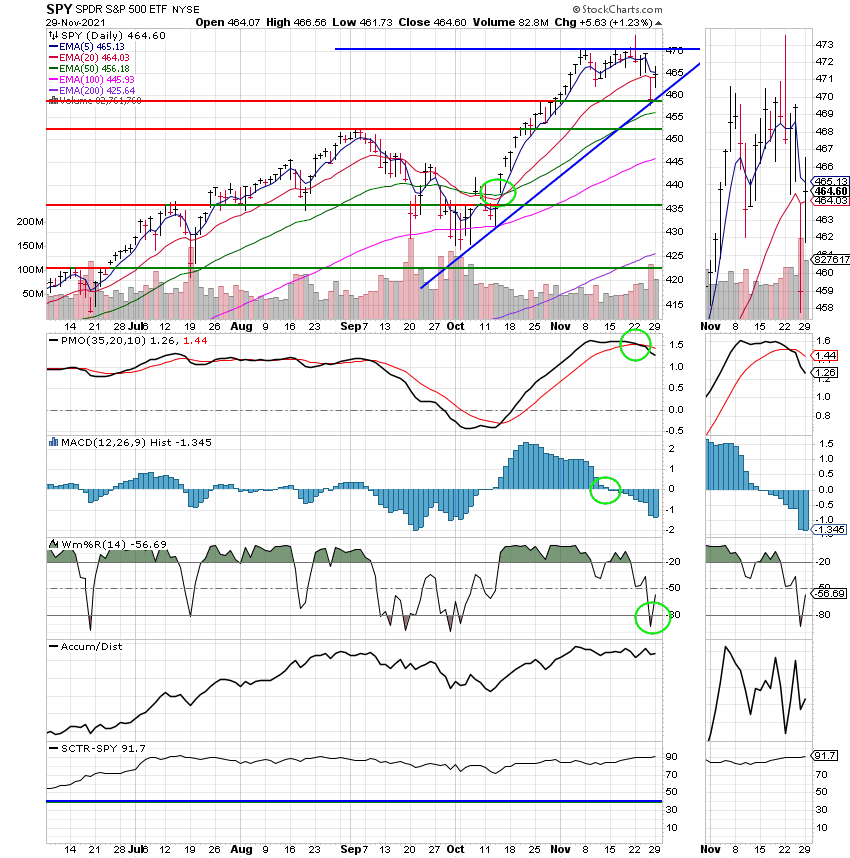

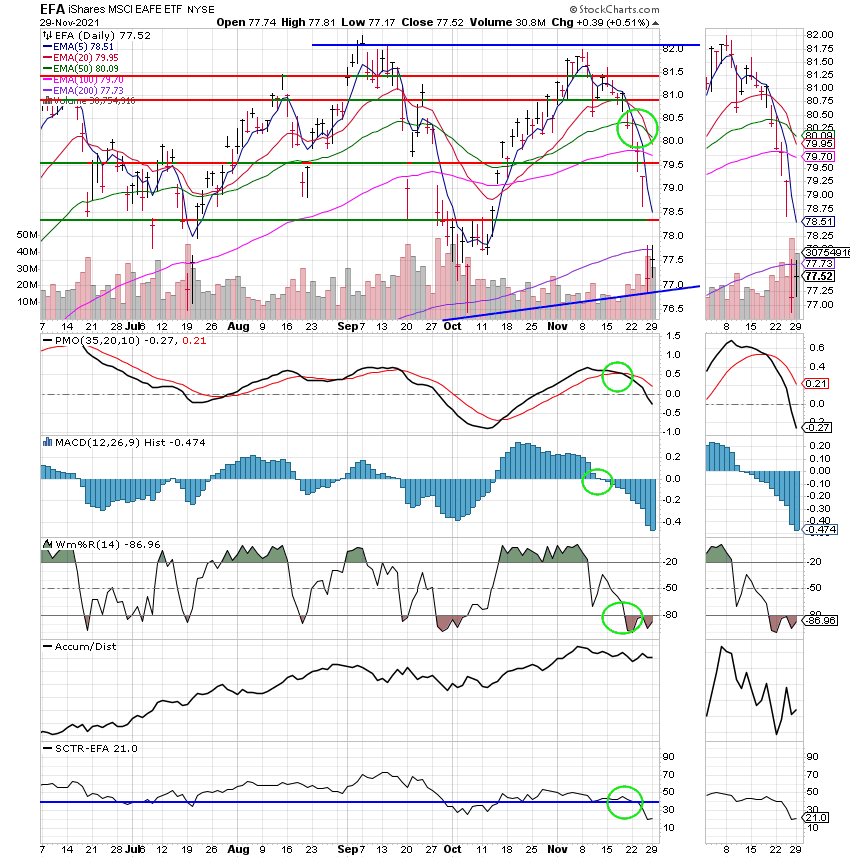

The days action left us with the following signals: C-Buy, S-Hold, I-Sell, F-Hold. We are currently invested at 100/S but will be moving to 100/C at the close of business tomorrow. Our allocation is now +14.43% on the year not including the days results.

| 11/26/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.7127 | 20.922 | 69.264 | 84.8572 | 37.8901 |

| $ Change | 0.0015 | 0.1624 | -1.6088 | -2.1223 | -0.8469 |

| % Change day | +0.01% | +0.78% | -2.27% | -2.44% | -2.19% |

| % Change week | +0.03% | +0.16% | -2.18% | -3.72% | -4.21% |

| % Change month | +0.11% | +0.15% | -0.11% | -2.86% | -3.74% |

| % Change year | +1.24% | -1.29% | +23.88% | +14.36% | +7.07% |

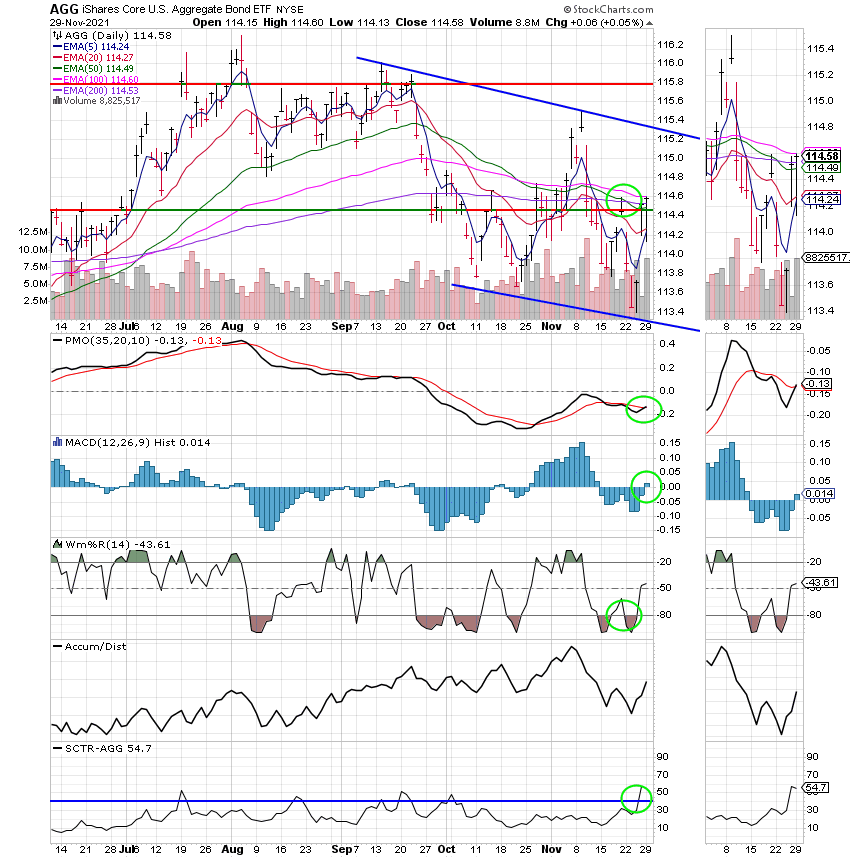

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

10 Year Treasury Bond Yield:

C Fund:

S Fund:

I Fund:

F Fund:

Lets pray that Omicron will stay mild! That’s all for tonight. Have a nice evening and may God continue to bless your trades.

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.