Good Evening, The overall dynamics of this market remain the same as focus continues to be on the same issues. The market moved higher today with the S&P 500 posting another new record at 3702.25 buoyed by the initial rollout of the Covid 19 vaccine by Pfizer in the United Kingdom. More positive news on the vaccine front was an announcement by the Food and Drug administration that the vaccine provides some protection after the first dose and that no safety issues had be noted. Also lending support to the market was news that Democrats and Republicans are inching toward a stimulus package. There is increased pressure to get a deal done before the new year. It is a consensus among investors that the economy needs additional stimulus to weather this second surge of Covid 19. Cases reached an all time high with More than 15 million coronavirus cases having been confirmed in the U.S., according to data from Johns Hopkins University. The country’s daily infection rate, as a seven-day average, is also at an all-time high. I am convinced that the market would be in full bull mode if not for this second surge of Covid. The bottom line is that in order to remain positive the market will likely need for a new stimulus package to be passed by congress before the end of the year. If we get that it should be smooth sailing over the short to intermediate term.

The days trading left us with the following results: Our TSP allotment posted a gain of +0.95%. For comparison, the Dow added +0.35%, the Nasdaq +0.50%, and the S&P 500 +0.28%. Praise God for another great day!

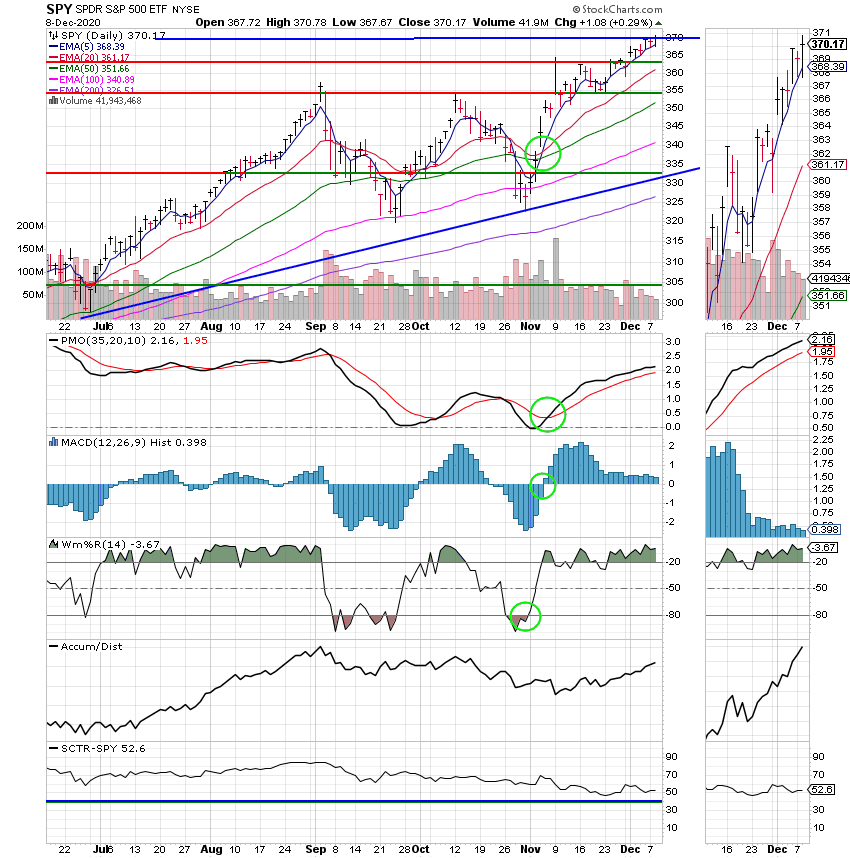

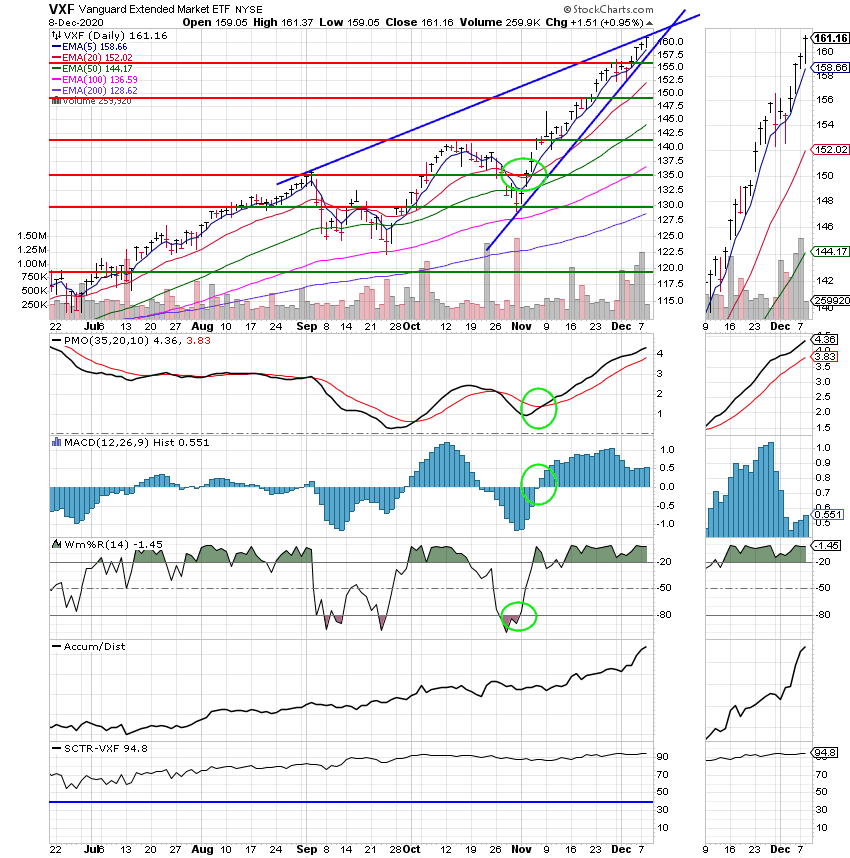

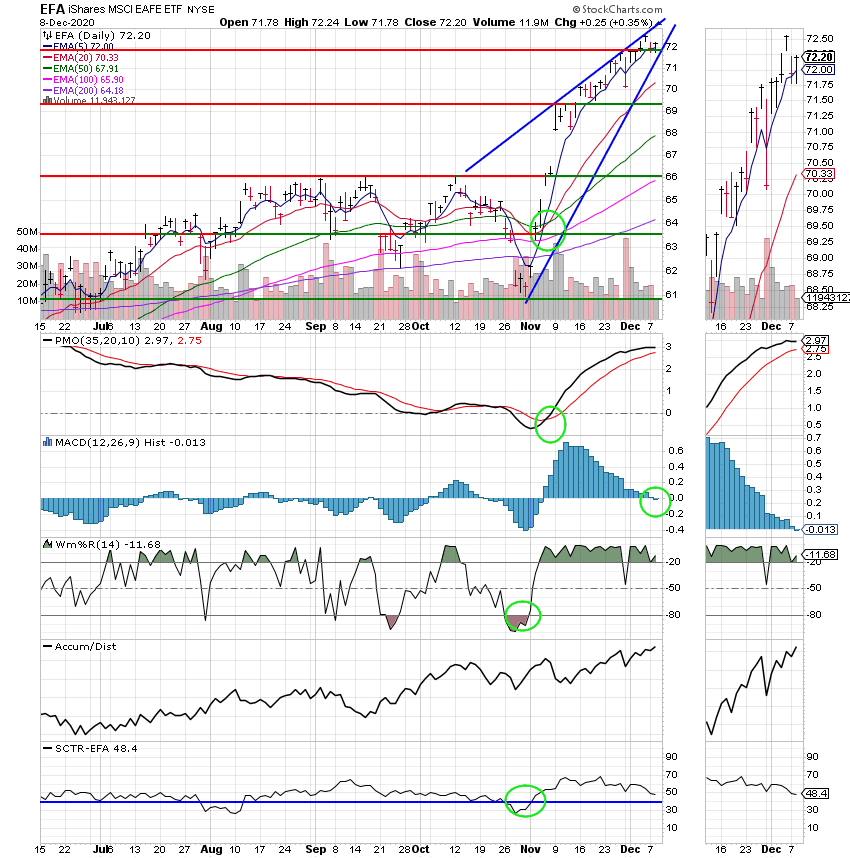

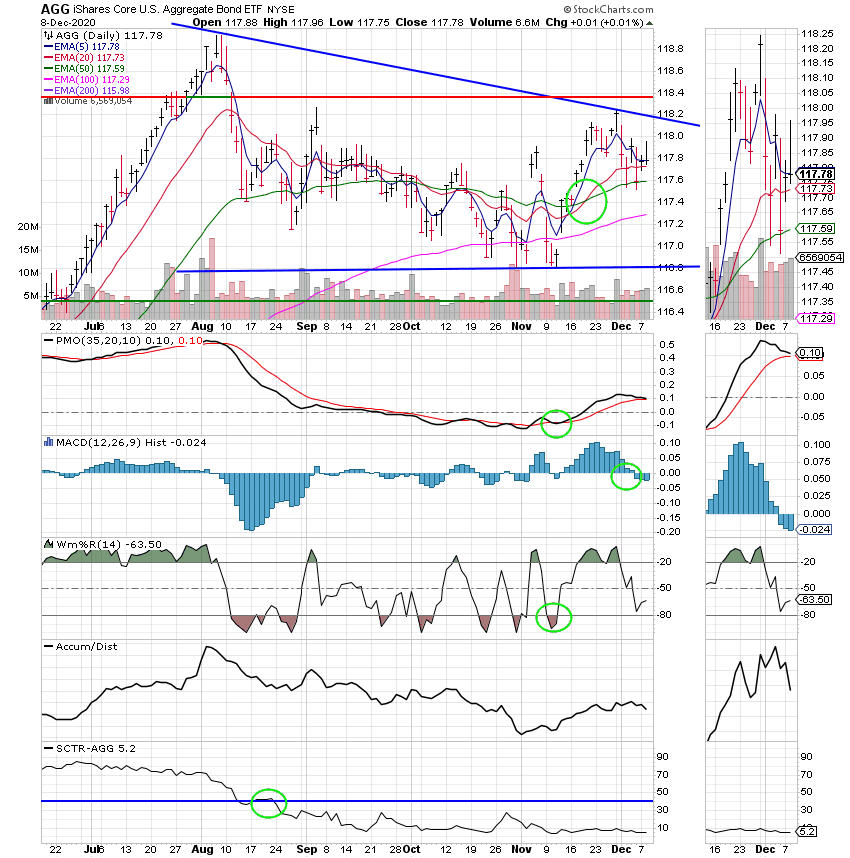

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Neutral. We are currently invested at 100/S. Our allocation is now +42.79% on the year not including the days results. Does anyone not see the hand of God in this? Give Him all the praise!! Here are the latest posted results:

| 12/07/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.4991 | 21.1089 | 54.9085 | 71.6364 | 34.4812 |

| $ Change | 0.0012 | 0.0426 | -0.1068 | 0.2567 | -0.1228 |

| % Change day | +0.01% | +0.20% | -0.19% | +0.36% | -0.35% |

| % Change week | +0.01% | +0.20% | -0.19% | +0.36% | -0.35% |

| % Change month | +0.02% | -0.27% | +1.98% | +3.53% | +1.96% |

| % Change year | +0.91% | +7.06% | +16.18% | +27.30% | +5.39% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 22.1476 | 11.0267 | 38.2143 | 11.3854 | 42.7386 |

| $ Change | -0.0051 | -0.0077 | -0.0335 | -0.0108 | -0.0443 |

| % Change day | -0.02% | -0.07% | -0.09% | -0.09% | -0.10% |

| % Change week | -0.02% | -0.07% | -0.09% | -0.09% | -0.10% |

| % Change month | +0.48% | +1.05% | +1.30% | +1.43% | +1.56% |

| % Change year | +4.54% | +10.27% | +9.64% | +13.85% | +11.21% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 11.6294 | 25.3016 | 12.1234 | 12.1235 | 12.1236 |

| $ Change | -0.0126 | -0.0295 | -0.0194 | -0.0193 | -0.0194 |

| % Change day | -0.11% | -0.12% | -0.16% | -0.16% | -0.16% |

| % Change week | -0.11% | -0.12% | -0.16% | -0.16% | -0.16% |

| % Change month | +1.67% | +1.79% | +2.20% | +2.20% | +2.20% |

| % Change year | +16.29% | +12.54% | +21.23% | +21.24% | +21.24% |