Good Day, Don’t you love China? Please detect a note of Sarcasm. I don’t have a problem with the people there, but that government…… Even though I refuse to own China stocks on the street I still manage to get burned by their market practices from time to time. By the matter of fact, we all did today. NVDA (Nvidia), the largest company in the world by market cap is being investigated in China for possible antimonopoly violations. Really?? Antimonopoly violations? So China expects a capitalist company to act like it’s communist? What are they being accused of ? Perhaps being too successful? True, they are cleaning the clock of every other chip producer out there. Chinese companies cant compete…… or perhaps Nvidia hasn’t shared enough corporate secrets with the Chinese government. After all they are the world leader in the production of chips utilized for Artificial Intelligence. At any rate NVDA is sliding today as a result of this so called investigation and the major indices are sliding as well. On a personal basis every time I bought a stock from China I ended up losing money due to some underhanded trick or market manipulation. So I swore off of them and do not recommend that you buy or sell stocks from China or ones with heavy exposure there. However, sometimes it just can’t be avoided with a behemoth the size of Nvidia.

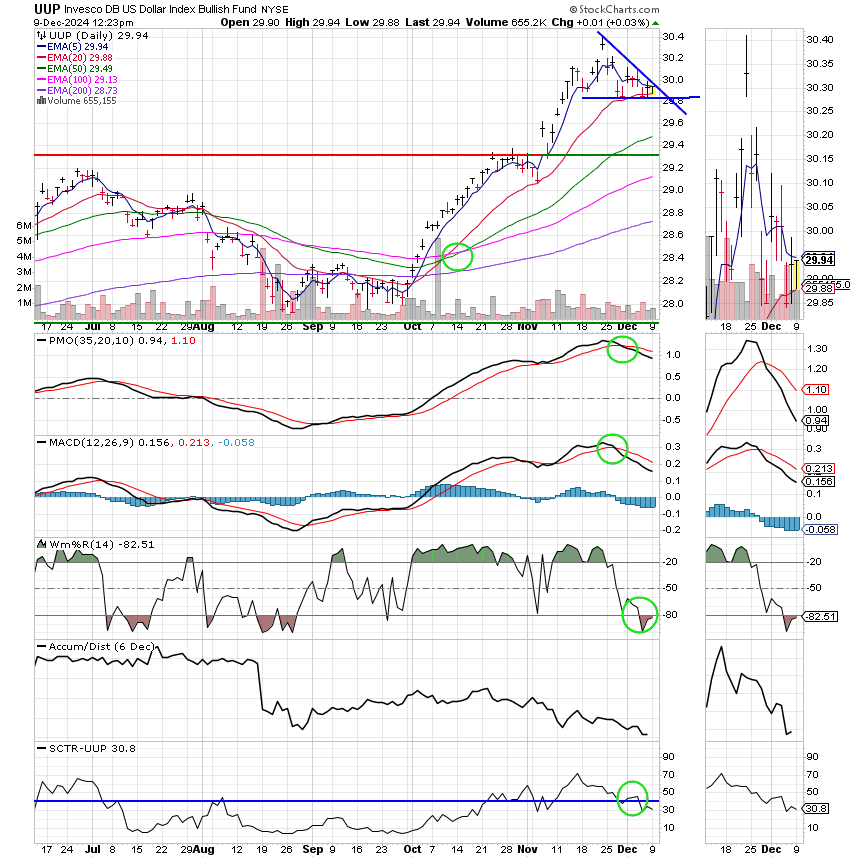

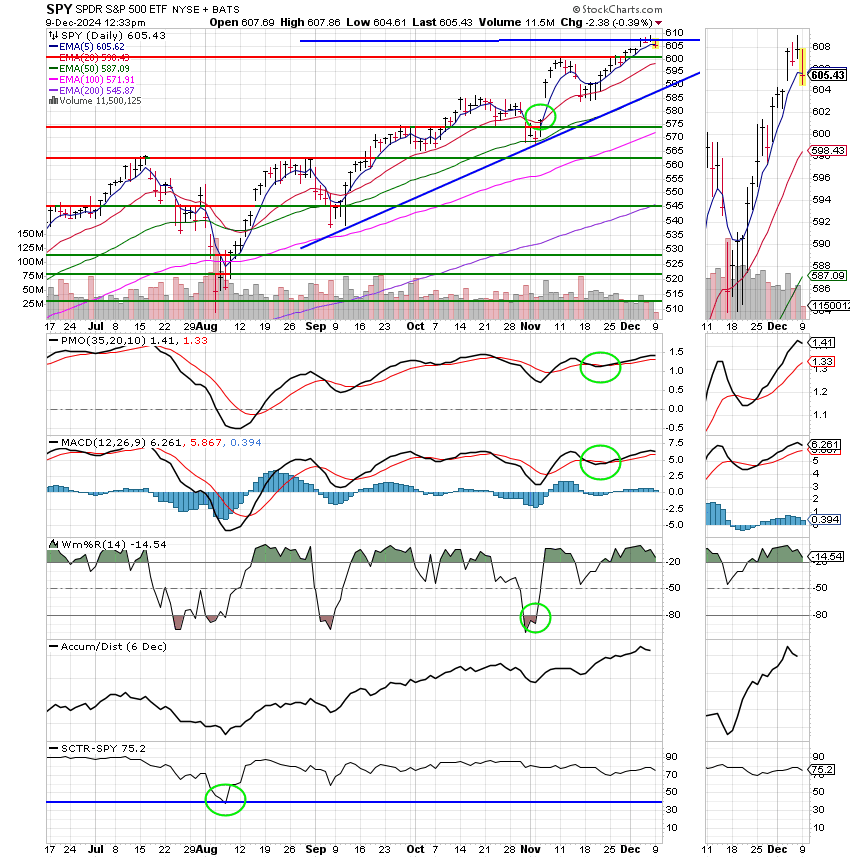

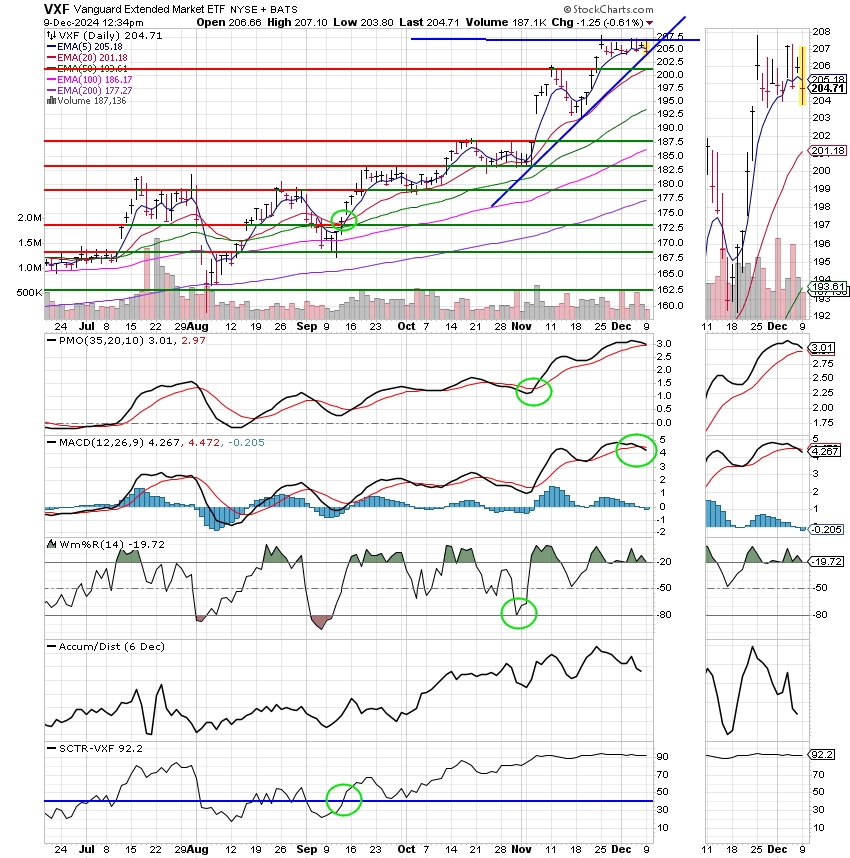

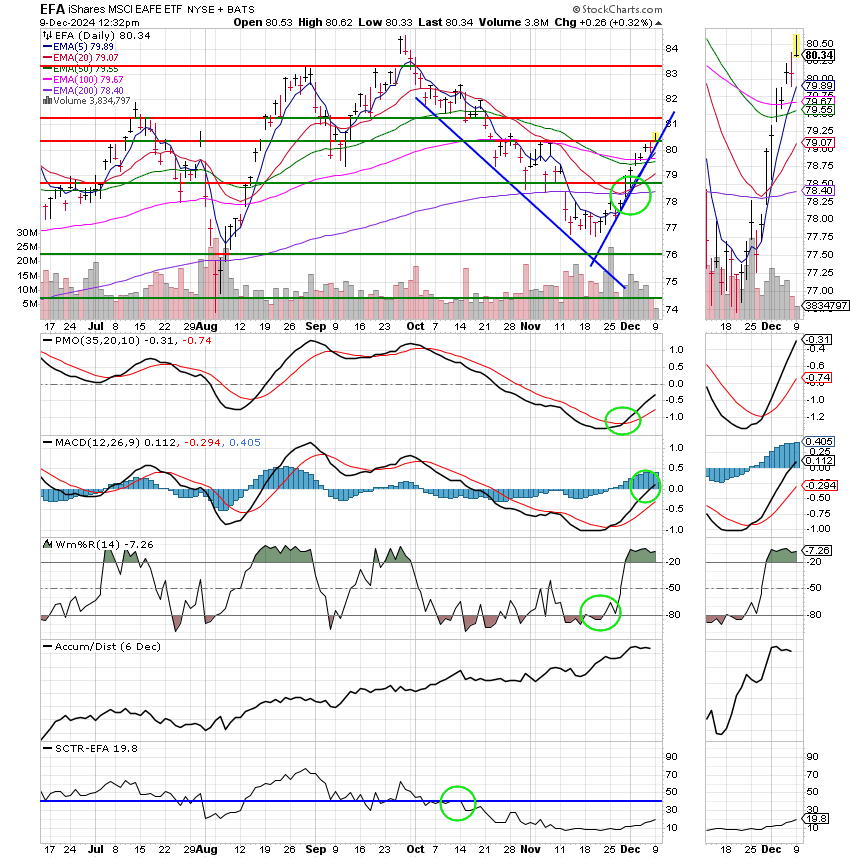

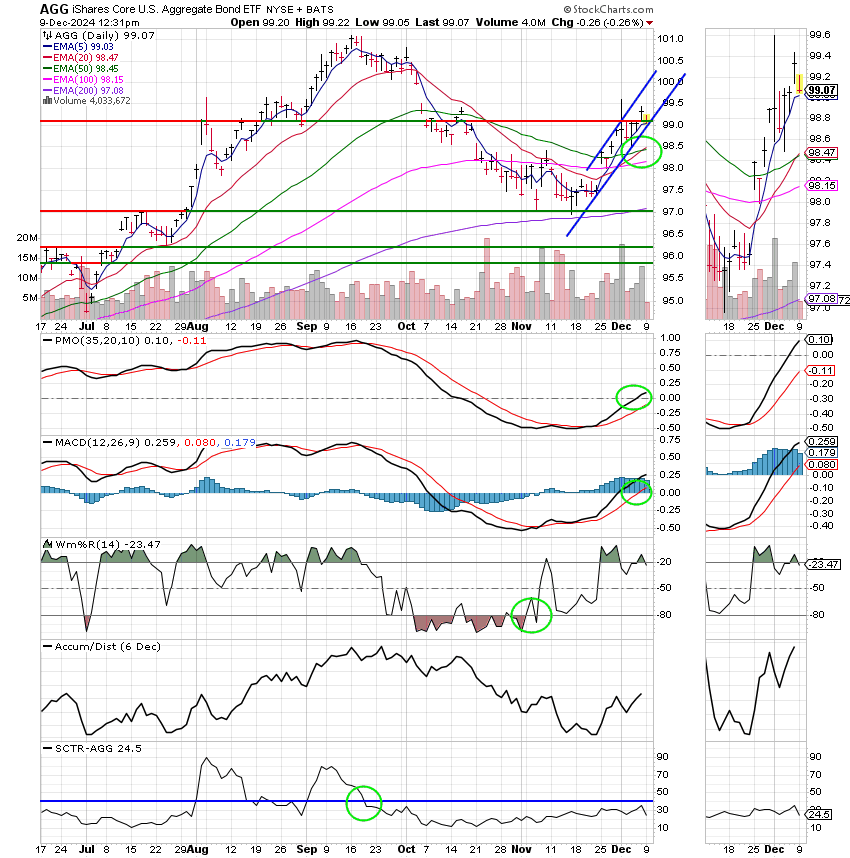

Nevertheless, the trend is still moving higher. This Nvidia investigation and last weeks slightly hot jobs report are only speed bumps in the road. I full expect stocks to rally through the end of year and beyond. Issues like this are more of an annoyance than a roadblock. Speaking of Fridays jobs report, while it showed more growth than was anticipated it was not enough in my opinion to derail a decrease in interest rates by the Fed next week. That noted, I will say this concerning the Feds decreasing of rates. As we move into 2025 we will probably not see as many rate decreases as we first thought. My guess is there will be no more than two or three quarter point decreases at the most which will not please the market. However, you have to understand this is due to a healthy economy which in the end is a good thing. I am optimistic that the incoming administrations deregulation and tax policies will create a successful environment for business in the US that will keep the current uptrend in tact. Given those facts and decent charts we will continue to maintain our current allocation at 100/S. One thing to keep an eye on. The current rate of currency exchange is starting to provide a boost for the I Fund. I have included a chart for the dollar below so you can see it’s recent weakness. We will keep a close eye on this development to see if an opportunity presents itself there. For now though, we will will remain invested in the S Fund in a market that is obviously small cap friendly.

The days trading so far has left us with the following results: Our TSP allotment is trading lower at -0.48%. For comparison, the Dow is flat at -0.05%, the Nasdaq is off -0.44%, and the S&P 500 is down -0.33%. Given the recent run, I’m not too concerned. Conditions are ripe for a nice Santa Rally and we definitely want to be invested for that.

S&P 500, Nasdaq retreat from records as Nvidia shares slide: Live updates

Recent action has generated the following results: C-Buy, S-Hold, I-Buy, F-Buy. We are currently invested at 100/S. Our allocation is now +23.31% for the year not including the days results. Here are the latest posted results:

| 12/06/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.6993 | 19.8907 | 96.1474 | 97.5419 | 43.7593 |

| $ Change | 0.0022 | 0.0438 | 0.2497 | 0.6100 | -0.0738 |

| % Change day | +0.01% | +0.22% | +0.26% | +0.63% | -0.17% |

| % Change week | +0.07% | +0.37% | +0.99% | +0.57% | +1.50% |

| % Change month | +0.07% | +0.37% | +0.99% | +0.57% | +1.50% |

| % Change year | +4.10% | +3.48% | +29.29% | +26.52% | +8.90% |