Good Morning, The dynamics of this market remain the same as do the knee jerk reactions to them by investors. Lets get this straight. Good news is bad. That’s right, Good news is bad. Last week we got two economic reports that suggested the economy is still strong despite the efforts of the Fed to slow it down. Now normally reports like that would lead to strong rallies, but not in this environment. Everything is viewed through the lens of Good is bad…. Every time the market sees a strong economic report released it automatically focuses on the what it thinks the Fed will do. Good economic reports mean the Fed will keep increasing interest rates until they run the economy into a recession. So they sell. Never mind several other reports that suggest that the economy might be slowing a bit. It’s as if the folks doing this have any memory beyond what they see that day. Perhaps it’s the high speed computer algorithms that have no emotions and are reacting to the latest news. Now there’s a thought! My guess is that it’s a combination of knee jerk reactions by many traders that only started trading since 2008… As I have often said and I will repeat again, they have only known a market fueled by government stimulus that moves straight up and never has down periods of any length or duration. They simply panic each time the market drops. So they sell again and again and again. Then they buy back in thinking things will return to what they view to be normal only to do it all over again. Rinse and repeat! All the while the high speed algo’s feed off their inexperience making more and more money. After all, why should they quit? What you need to know about all this is that this cycle produces volatility which is nice if your average day trader but not so nice when you participate in Thrift and have only two trades month. I’ll be totally honest with you. I choose not to participate in day trading on the street. I simply think there is too much stress and effort involved with it for the reward you get. Yes, I understand there are some folks that make a lot of money at it, but for everyone of them that do there’s two that don’t. So by and large what they do is a waste of time. It’s bad enough to waste time but to waste time and lose money is simply terrible. For that reason, I choose not to focus on the short stuff. I’ll leave what I view as the breadcrumbs to those folks while I pursue the long game and the big money. Which brings me to my main point today. As you know we moved to the I Fund today. You’d think I committed a mortal sin the way some folks reacted. Oh my gosh, you locked in a loss or I lost this much or that much. Folks we didn’t lock in anything! We moved from one equity fund to another. We did not decrease our exposure to equities. When the market flows we will flow with it, which by the way it is doing today. We always endeavor to stay in the best fund and right now the I fund is the best fund. To be totally honest with you it was the best fund when we initially invested in the S Fund. At the time we thought the S Fund would overtake it due to moves in the currency market. However, we were wrong and it did not. We gambled a little bit and we were lost some momentum! It’s normally best to go with best chart even if it has only a slight advantage. In this case that proved once again to be correct. While the S Fund had some good runs, it was the I fund that made the most and then kept the most when the market dropped. So rather than staying invested in what tuned out to be the third best chart out of our TSP equity based funds we chose to correct our mistake and invest in the best chart which is at this time of course the I Fund. Understand one thing about this trade. This is a fluid market and it’s constantly changing with every piece of economic news. Just because the I fund has been the best for the past month does not guarantee that it will remain so. That said, we reserve the right to change our mind. If and when another chart becomes the best we will go with it. We are not concerned with what the market does in a few days or week. We are worried about a months and years. Yes 2022 has been a rough year. The worst we have ever had, but lets look at the big picture for a moment. We are up way over 300 percent since 2010. We’re currently down about 27 percent for the year. So do you call that a loss?? That leaves us up better than 275% over that period of time. I say we are playing with house money. It’s true that if we’d stayed in the G Fund most or all of that time we wouldn’t show a a drop in our balance, but do you think we would be up 275%??? Not by any math I do. The bottom line is you have to be in it to win it. You can play not to lose and that’s exactly what you’ll do. You won’t lose but you won’t win either. Lets put one more thing in perspective also. We’ve been doing this since 1997 and our largest yearly drop to date was -1.86%. This is no normal year. Not for us or for the market. My hats off to those that made a profit but they are few and far between. I told everyone before the year started that it would not be like the last twelve years. Government stimulus is gone!! There will be no quick recoveries. Don’t believe me? Wait until this time next year and lets have this conversation again. In the end you have to decide what your tolerance for volatility is. If it is not pretty high then this is not the market for you. When the market is back we will be back. Our prayer is that will come in 2023 but it may not come until 2024. We will just have to wait and see. Which brings us to today. We got another light inflation report this morning and the market is rallying once again.

- The consumer price index rose just 0.1% from the previous month, and increased 7.1% from a year ago, compared with respective estimates of 0.3% and 7.3%.

- Core CPI rose 0.2% on the month and 6% on an annual basis, compared with respective estimates of 0.3% and 6.1%.

Surprise, surprise! Please detect my note of sarcasm…. So now we look to the conclusion of the current Fed meeting tomorrow afternoon at 2:00PM EST. The market is currently pricing in a half point increase in the Fed rate. Surprise surprise again…. I think (and I am not alone) that if we indeed get the half pint increase that the market will follow though with a nice Santa Cause rally. That is the reason we remain with 100% invested in equities. We believe that the market for the most part bottomed in October and are making every effort to remain positioned for a subsequent recovery. Which leads us to the fly in the ointment. Volatility will continue until inflation moderates. We said this well over a year ago. So no one should be surprised. Inexperienced traders will continue to react to this volatility and high speed algorithms will continue to make money at their expense. My advice is that you don’t even take anything into consideration less than a 50 day moving average with regard to your investment decisions. Moving into the new year the market will be all about the the rate of inflation, the interest rate in response to that inflation, and where the economy with regard to a possible recession. You can watch all of the above or if you so choose you can keep your eye on one thing (other than your charts of course) and that is the rate of inflation. Right now the rate of inflation is in the 7% range. While the economy is slowing down we should be under no illusion that the Fed will not keep increasing rates albeit with smaller increases until the rate of inflation slows to the Fed target of two percent. Okay, assuming the rate of inflation decreases as slowly as it has in previous months it will be a while before all this volatility is gone. We believe that will take most of 2023 and may actually go into 2024 before things are back to normal. That is the market we have to deal with. In the end you can stay invested and put up with the volatility or you if you can’t stomach that then you can move to the G Fund until the rate of inflation approaches two percent. Just know that if you do that you might be there a while. One more thing, the more volatility the more moves we may have to make. This market remains fluid……

The days trading has generated the following result so far: Our TSP allotment is currently up nicely at +1.37%. For comparison, the Dow is slightly higher at +0.05%, the Nasdaq is +0.61%, and the S&P 500 is +0.41%. Praise God we have them covered today.

Dow rises for a second day on hopes inflation is peaking

Recent action has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 100/I. Our allocation is now -27.34% for the year not including today’s results. Here are the latest posted results:

| 12/12/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.2016 | 18.488 | 61.173 | 63.7892 | 34.3886 |

| $ Change | 0.0055 | -0.0006 | 0.8620 | 0.9285 | 0.0507 |

| % Change day | +0.03% | +0.00% | +1.43% | +1.48% | +0.15% |

| % Change week | +0.03% | +0.00% | +1.43% | +1.48% | +0.15% |

| % Change month | +0.13% | +0.88% | -2.15% | -3.12% | -0.56% |

| % Change year | +2.78% | -11.48% | -14.97% | -23.55% | -12.81% |

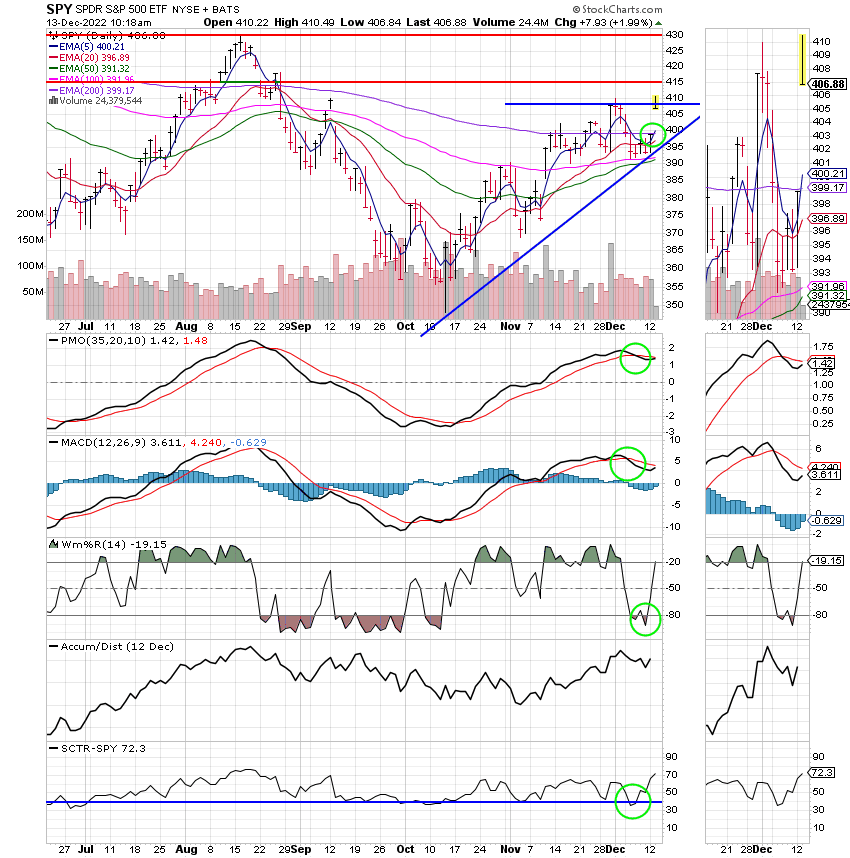

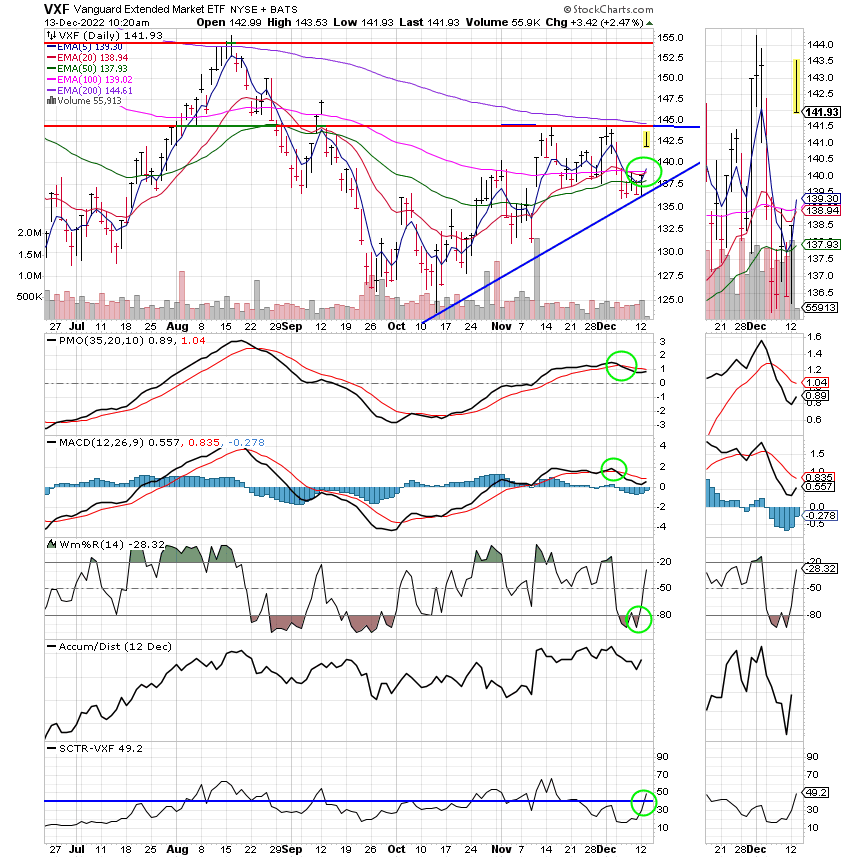

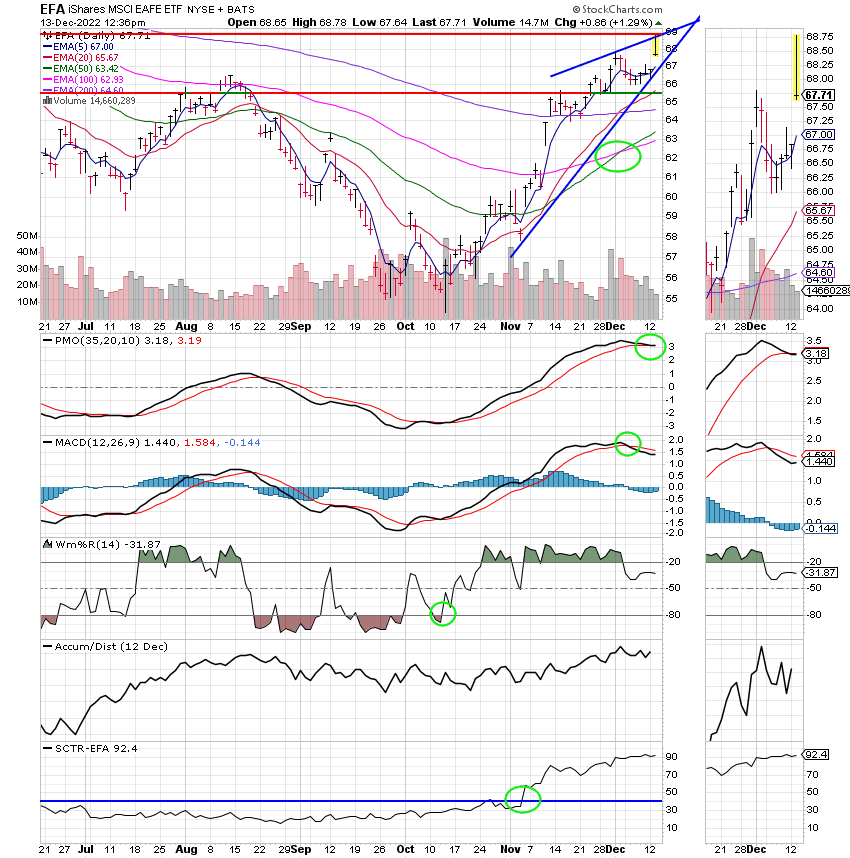

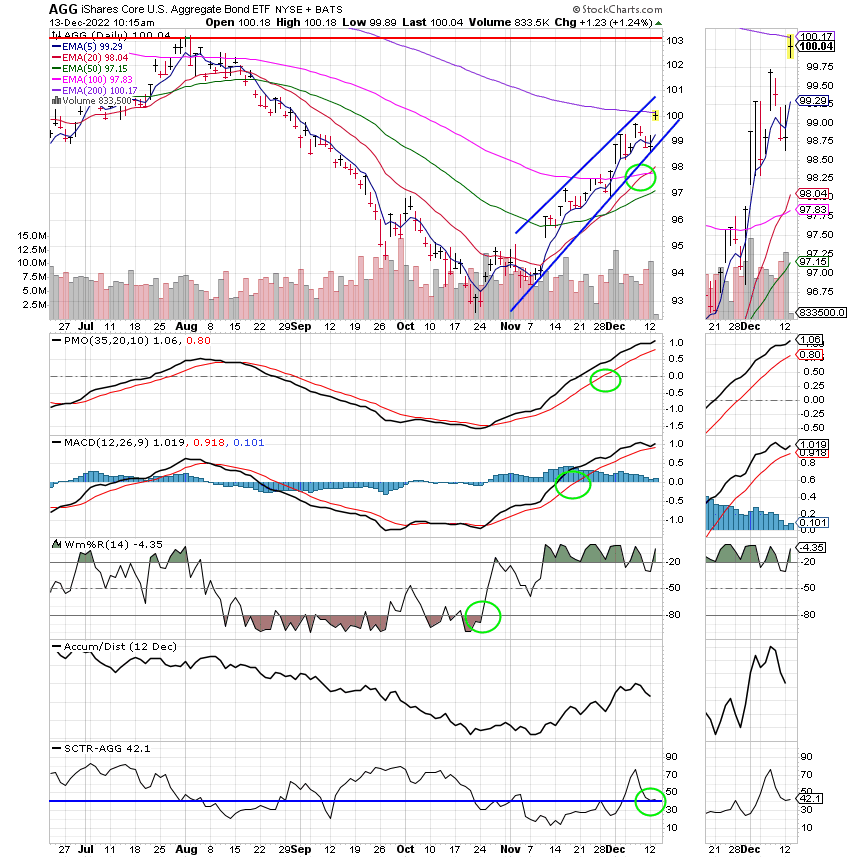

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

I wrote a book up above. So I’ll leave it at that. Have a nice afternoon and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.