Good Evening, As I said last week, this is not your typical December. The market remains under stress. Although, I will say that if given the chance I believe it would rally. Such as it is, for the most part we’ve had a rolling correction with stocks selling in one sector and then the next. Up to this time it has been mostly smaller cap stocks that have been sold but that seemed to shift to some of the large cap names today. Investors have had three things weighing on their minds the past few weeks. The omicron variant of the Covid virus, Inflation, and greatest of all, the question of what the Fed will do in response to inflation. The omicron variant is the gift that keeps giving. While the symptoms are mild the world health organization stated that omicron is spreading more rapidly than all the preceding strains of the virus. Also, it was reported that the first death due to omicron occurred in the UK. It appears that our pandemic conditioned society is taking the threat seriously although my impression has been that it is having only a small effect on the market. In other words it’s already mostly priced in. Now about the issues of greatest concern to the market. A while back I mentioned the word that should remain unmentioned! You remember, the I word….. I said that even the slightest mention of it would have a negative impact on the market. INFLATION!! There I said it again……Inflation has been impossible to ignore with report after report coming in hot. Today’s November reading for the producer price index was no exception showing a year-over-year increase of 9.6%, the fastest pace on record and above the 9.2% expected by economists, according to Dow Jones. The index rose 0.8% month over month, above the 0.5% that was expected. Which brings us to the question that ties everything together. How will the Fed react to this high inflation? We will know tomorrow! The Fed kicked off it’s monthly two day policy meeting today which will conclude with a press conference at 2:00PM tomorrow afternoon. As you know the Fed meetings are usually market moving events but this one has an even greater potential to influence stocks. I hate to use the word guarantee but I can almost guarantee you that the market will make a pretty big move when this policy announcement is made. It is widely expected that the Fed will increase the rate of the taper of their monthly bond buying program ending it in March instead of the previously announced June. It is also expected that the Fed will discuss making an interest rate increase in June. Folks, the rate of inflation is too high and will surely force the Feds hand. Controlling inflation is part of their dual mandate of managing Jobs and Inflation. Increasing interest rates is their biggest tool to slow a hot economy down. INCREASE is another I-word you just don’t want to hear mentioned. Increasing interest rates is something that is normally synonymous with a falling market. Again, we will see. The recovery from the pandemic makes things shall we say less predictable. All I can really say about any of this mess is to keep praying. I certainly will!!

Today’s trading left us with the following results. Our TSP allocation fell back -0.75%. For comparison, the Dow dropped -0.30%, the Nasdaq -1.14%, and the S&P 500 -0.75%. Also, for those of you that are keeping score the S Fund was off -0.96%.

Stocks fall ahead of key Fed decision, Nasdaq drops 1.1% as software names slide

The days action left us with the following signals: C-Buy, S-Sell, I-Hold, F-Hold. We are currently invested at 100/C. Our allocation is now +14.43% not including the days results. Here are the latest posted results:

| 12/13/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.7245 | 20.9467 | 70.4329 | 81.5449 | 38.4514 |

| $ Change | 0.0021 | 0.0715 | -0.6482 | -1.0030 | -0.1889 |

| % Change day | +0.01% | +0.34% | -0.91% | -1.22% | -0.49% |

| % Change week | +0.01% | +0.34% | -0.91% | -1.22% | -0.49% |

| % Change month | +0.05% | -0.03% | +2.28% | -1.70% | +2.46% |

| % Change year | +1.31% | -1.18% | +25.97% | +9.90% | +8.65% |

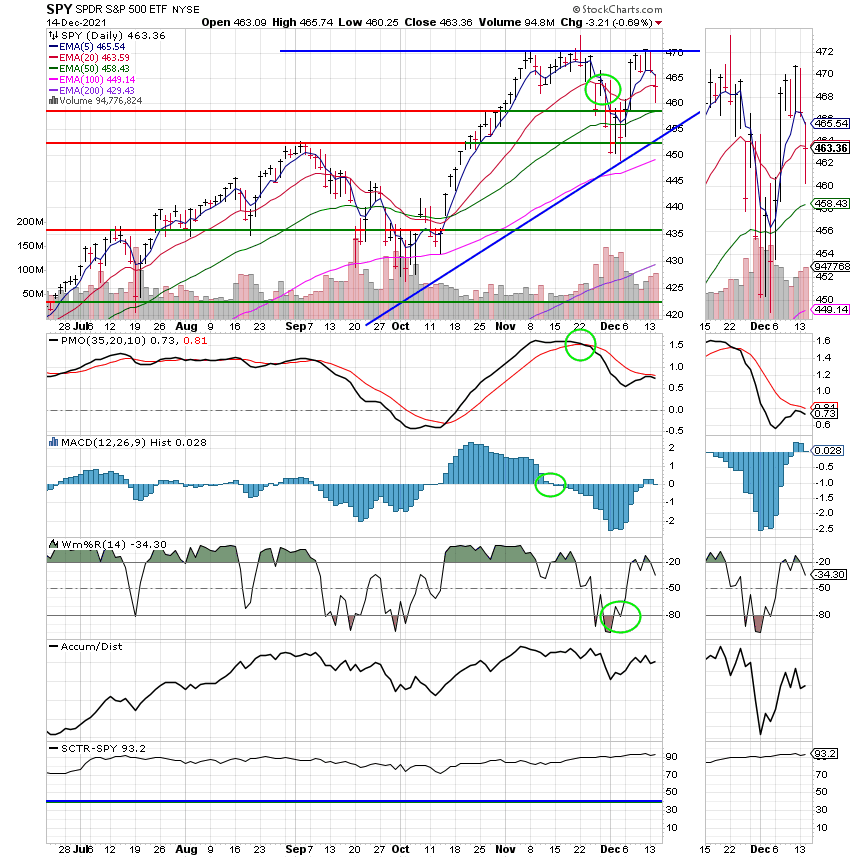

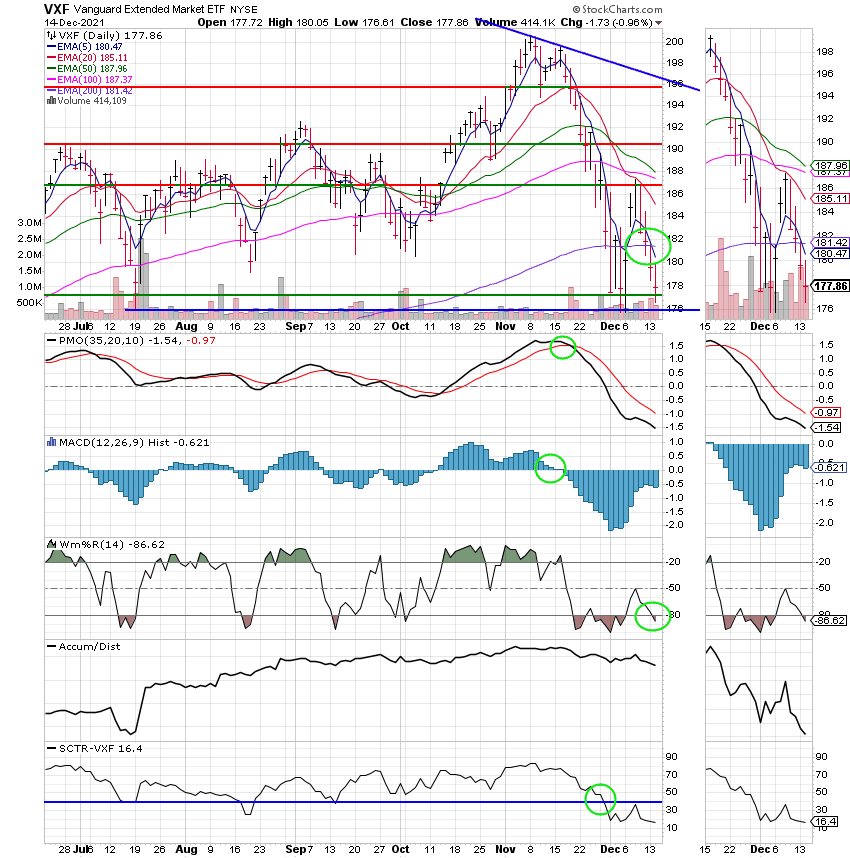

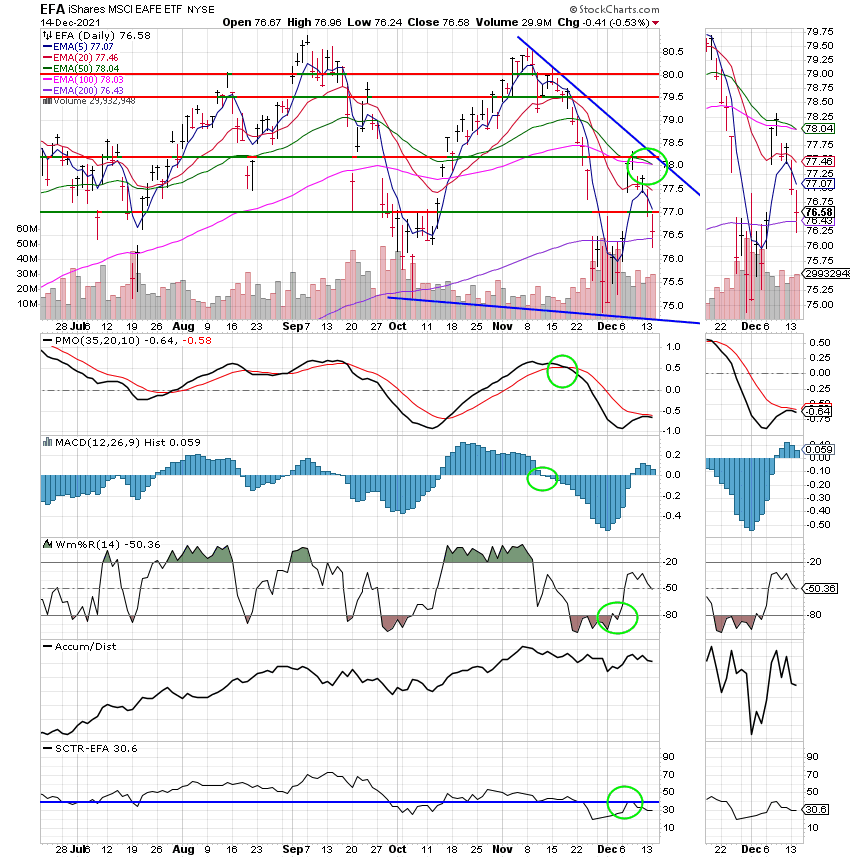

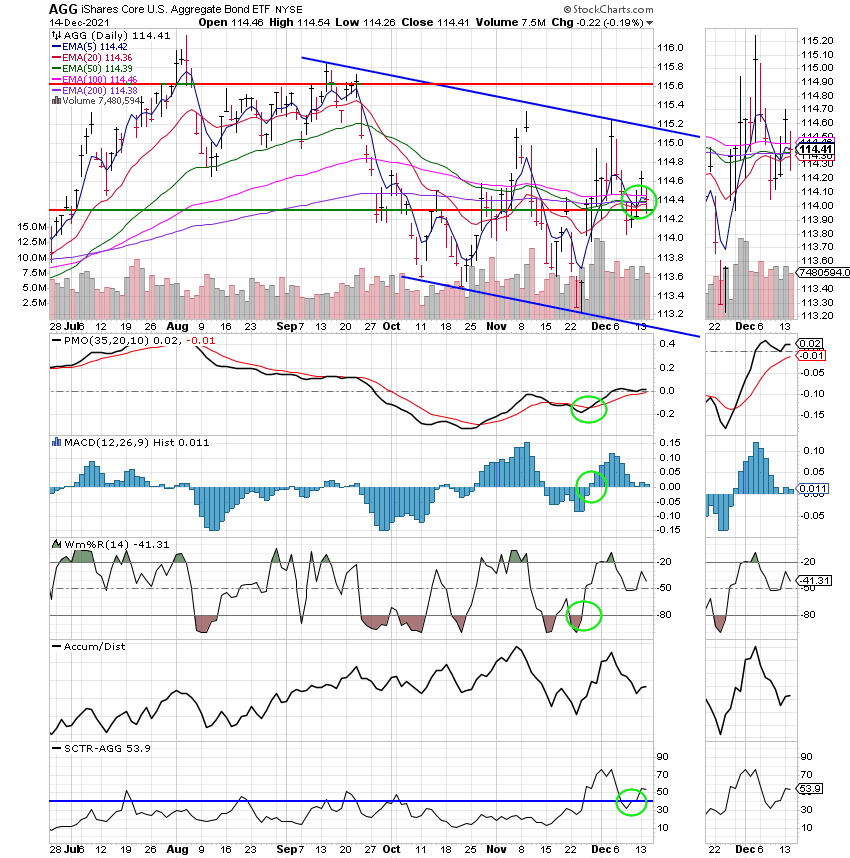

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

Don’t forget to watch the market tomorrow at 2:00 PM Eastern Time. That’s all for tonight! Have a great evening and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.