Good Evening, As we move toward the end of the year the market continues to rally and sell off based on Covid 19 and it’s effect on the economy. On one hand you have a market and economy that are ready and willing to surge, a vaccine in the early stages of distribution, and a congress that understands the need for fiscal stimulus to get the economy over this virus induced hump. On the other hand you have a record surge in cases of the virus even as a vaccine is being distributed and continued partisan haggling over the details of the stimulus bill. Sorry to bore you but it’s the same old song and dance. When we get a good news on the stimulus bill the market rallies. We get bad news about the increasing cases of Corona virus and the market sells. We get good news about distribution of Covid 19 vaccine and the market surges again. We get bad news that the Democrats and Republicans and disagreeing on some minute detail of the stimulus bill and the market starts selling all over again. The fact that we have had such a good fourth quarter is testament to the resilience of this market. Folks if we ever get the above noted problems solved we should make some really good money over the next six months or so! Right now its a race between the virus and the vaccine and between congress passing a stimulus bill and the end of the year. The greatest threat to the market at this moment is a stimulus bill not being passed before the end of the year. It says here that you can expect a sizeable sell off it one is not passed before new years. I honestly don’t believe the politicians will let that happen but given recent history you never know…. We will put it all in God’s hands and see……His will be done.

The days trading left us with the following results: Our TSP allocation posted another nice gain of +1.72%. Praise God for His guidance! For comparison, the Dow was up +1.13%, the Nasdaq +1.25% and the S&P 500 +1.29%.

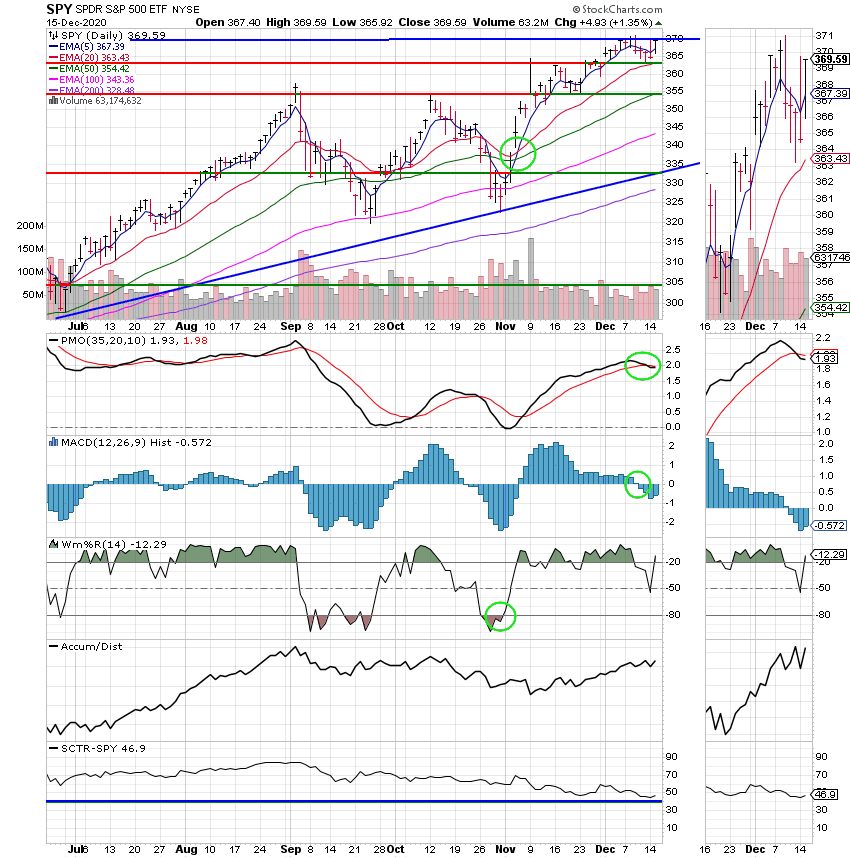

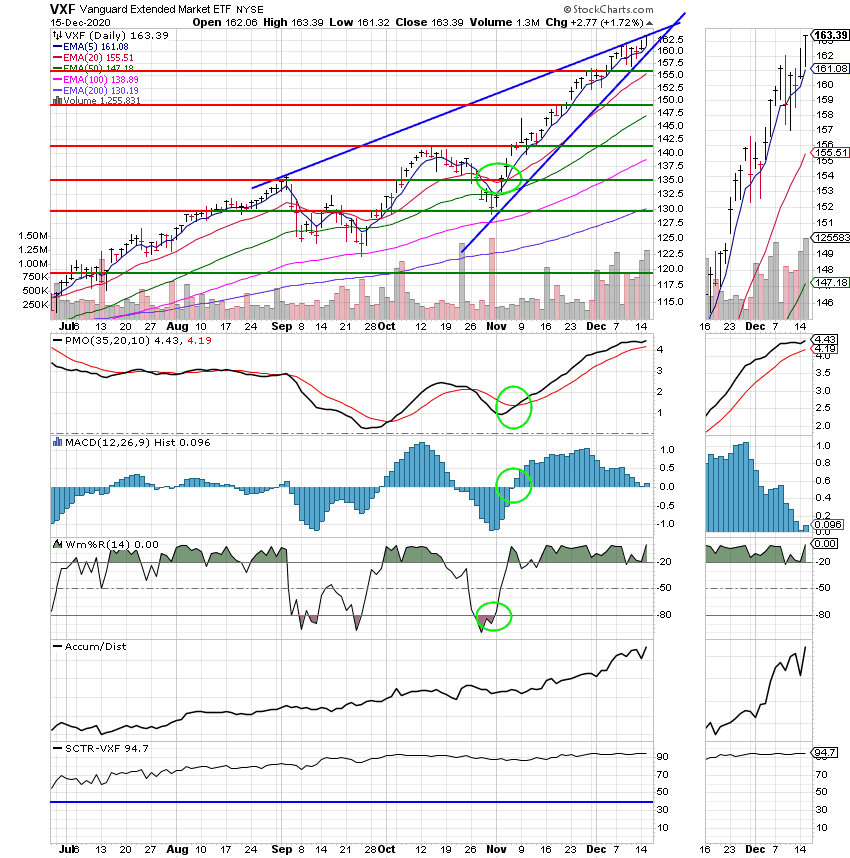

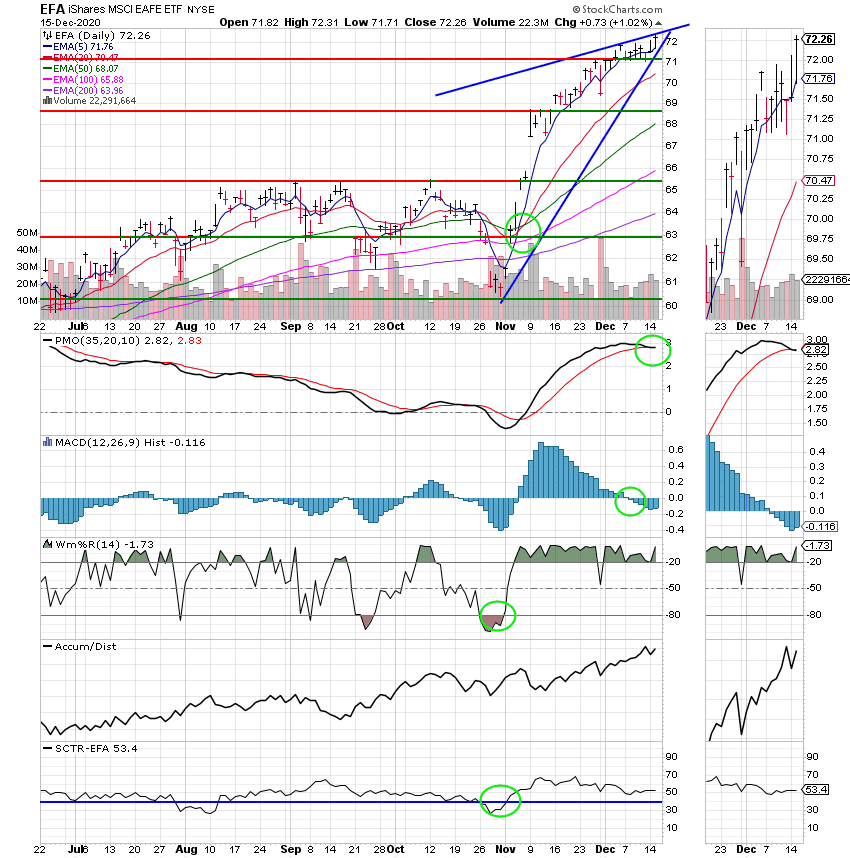

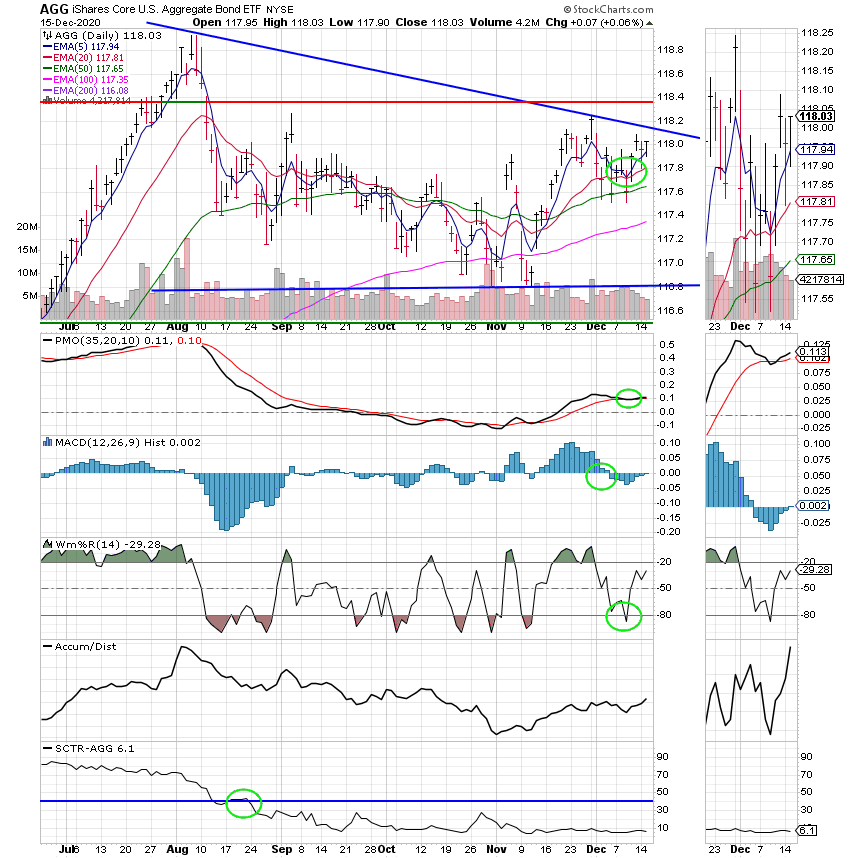

The days action left us with the following signals: C-Buy, S-Buy, I-Neutral, F-Neutral. We are currently invested at 100/S. Our allocation is now +43.68% on the year not including the days results. Here are the latest posted results:

| 12/14/20 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.5018 | 21.1453 | 54.2663 | 72.0817 | 34.5787 |

| $ Change | 0.0012 | 0.0068 | -0.2275 | 0.2047 | 0.1549 |

| % Change day | +0.01% | +0.03% | -0.42% | +0.28% | +0.45% |

| % Change week | +0.01% | +0.03% | -0.42% | +0.28% | +0.45% |

| % Change month | +0.03% | -0.10% | +0.79% | +4.18% | +2.25% |

| % Change year | +0.93% | +7.24% | +14.82% | +28.09% | +5.69% |

| Fund | L INC | L 2025 | L 2030 | L 2035 | L 2040 |

| Price | 22.131 | 11.0061 | 38.126 | 11.3568 | 42.623 |

| $ Change | 0.0003 | -0.0004 | -0.0020 | -0.0006 | -0.0017 |

| % Change day | +0.00% | +0.00% | -0.01% | -0.01% | +0.00% |

| % Change week | +0.00% | +0.00% | -0.01% | -0.01% | +0.00% |

| % Change month | +0.40% | +0.86% | +1.07% | +1.17% | +1.28% |

| % Change year | +4.46% | +10.06% | +9.39% | +13.57% | +10.91% |

| Fund | L 2045 | L 2050 | L 2055 | L 2060 | L 2065 |

| Price | 11.5965 | 25.2262 | 12.0777 | 12.0778 | 12.078 |

| $ Change | -0.0002 | -0.0001 | -0.0005 | -0.0005 | -0.0004 |

| % Change day | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change week | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change month | +1.39% | +1.49% | +1.81% | +1.81% | +1.81% |

| % Change year | +15.97% | +12.20% | +20.78% | +20.78% | +20.78 |