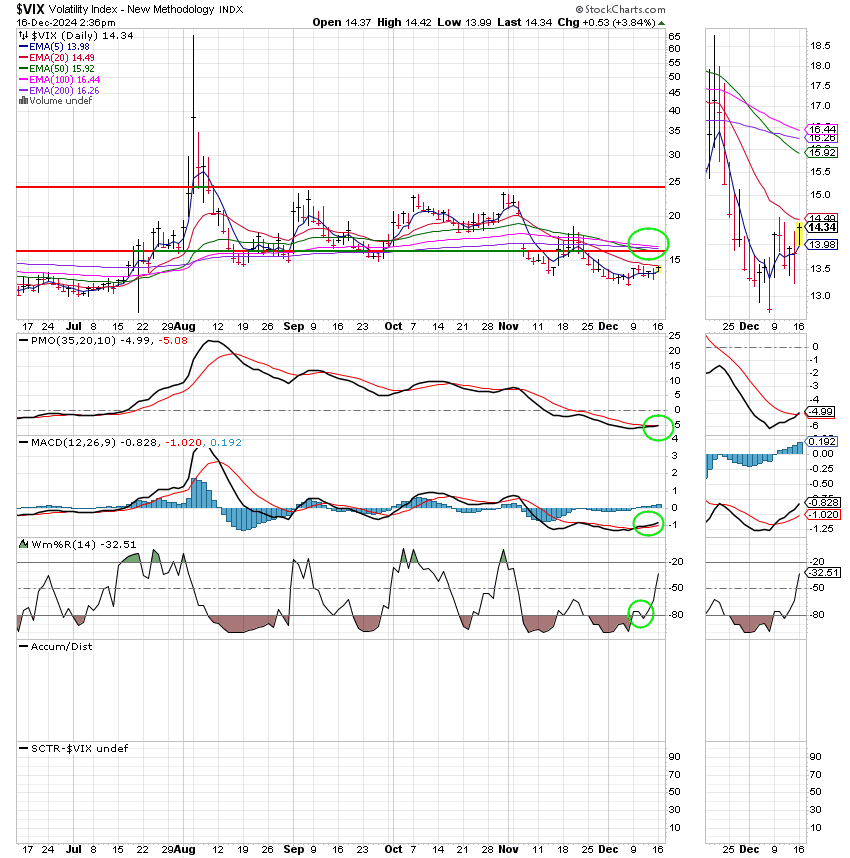

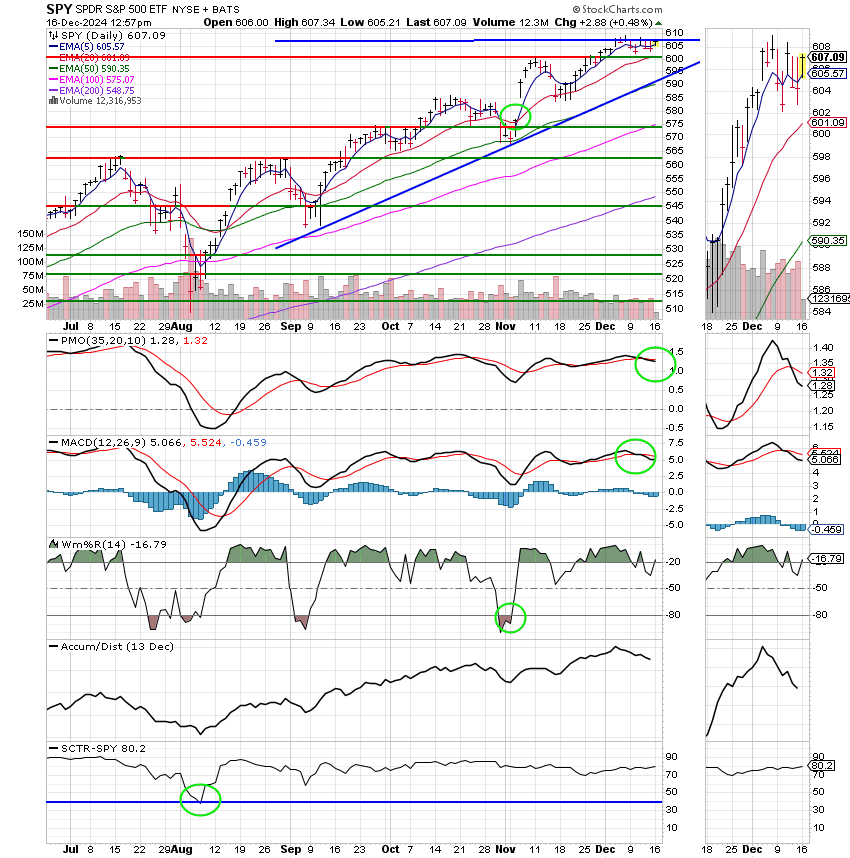

Good Day, How many of you became doubters last week? Better get out before we lose all our gains…..right? There are times when you should get out of stocks and there are times when you should not and smack in the middle of an uptrend during the best season of the year for stocks following the election of a pro-market administration is not one of them. I know, I know we made some nice gains in the beginning of August and lost 90% of them, but remember what I told you at the time??? I told you that losing over seven percent in three days was unprecedented. Very seldom will you see such a thing happen. You might lose seven percent in a month, but not in three days. At the time I felt like we managed it well by getting out of it without any loss of our initial investment. Of course, the market gained a lot of that back a week or so later and we were not in it. Yep, I haven’t forgot that either. So things didn’t work out for us then, but you must understand we were protecting our portfolios from further loss. The charts were really messed up at the time and indicated there would be further losses which eventually came. So what’s the difference now? The season, the charts, and the fundamentals all agree that there will be further gains. When you conditions like we have now it is more of a process for the market trend to reverse than a surprise. You will have time to react. Sure if wed gotten out a couple days earlier in August we’d kept a great deal of our returns and as I said at the time, we made a decision to hold when our charts told us to sell. The charts are much different now and we must take that into consideration. Given the volatility back in August I should have gotten out at the first sign of weakness. However, the VIX is much lower now than it was then clocking in at a bullish 14,66. Folks, as I said in an earlier post where we discussed the VIX, anything below 16 is risk off. Here is what it looks like today: While it is starting to rise a bit it’s still very very bullish and that’s the main reason that we held our position during last weeks decline. Also don’t forget that consolidation occurs in and is a healthy part of any bull market.

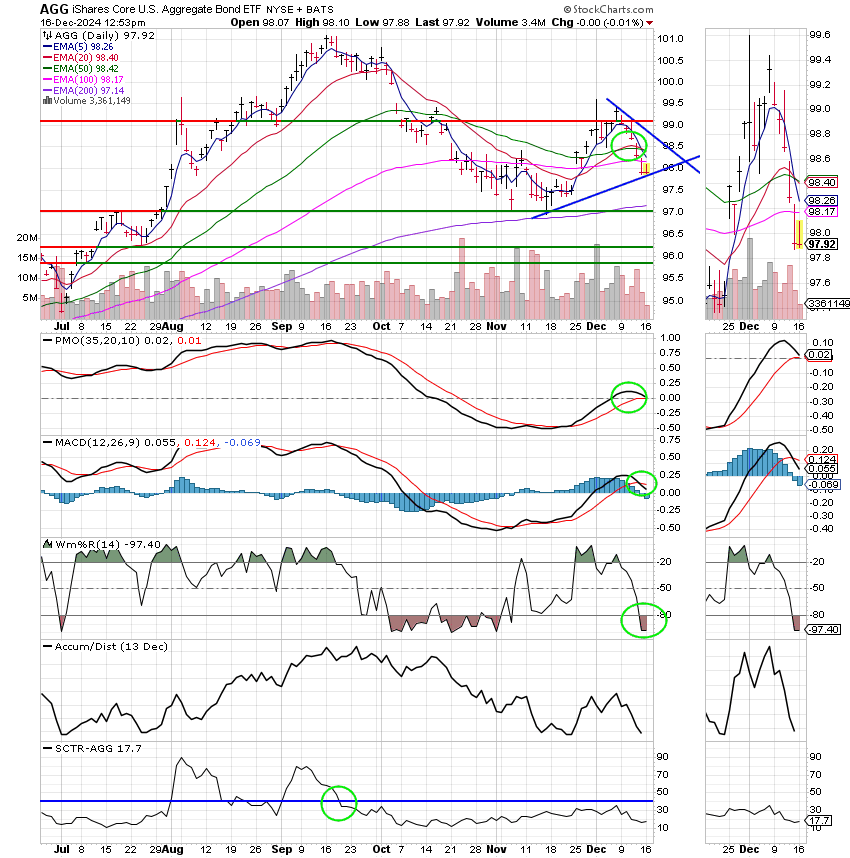

This week we have the Fed meeting which starts tomorrow and ends on Wednesday at 2:00PM EST with the usual press conference. The Fed is widely expected to reduce rates by another quarter point which should provide a catalyst for another move higher. I would expect that will be it for while with regard to any additional rate cuts though. Slightly sticky inflation will cause the Fed to hesitate on cutting rates as we move into into 2025. My expectation is that there will be no more than two rate cuts during the year. We will see, but either way there is no reason to panic. The incoming administrations policy of deregulation will provide enough tail winds to keep the uptrend in tact. Also, remember, inflation is the byproduct of a strong economy albeit a little too strong. Nonetheless, if the Fed takes a measured approach to making cuts there should be no reason to increase rates for the foreseeable future and that ladies and gentlemen is good for stocks!!

The days trading so far has left us with the following results: Our TSP allocation is trading higher at +0.82%. For comparison, the Dow is flat at -0.02%, the Nasdaq is gaining +1.30%, and the S&P 500 is up +0.58%. We’re having another good day. Thank God for guiding our hand for without it we would have no success.

Nasdaq Composite rises 1% to record, led by Broadcom, Alphabet: Live updates

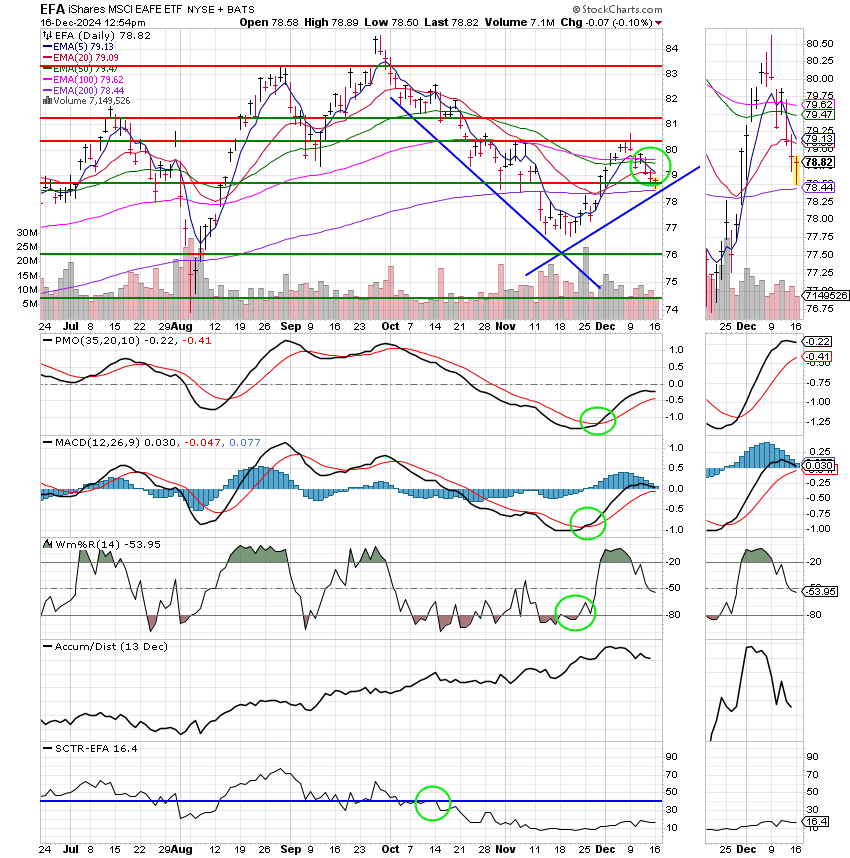

Recent trading has generated the following signals: C-Buy, S-Hold, I-Sell, F-Sell. We are currently invested at 100/S. Our allocation is now +20.17% for the year not including the days results. Here are the latest posted results:

| 12/13/24 | Prior Prices | ||||

| G FundFund | F Fund | C Fund | S Fund | I Fund | |

| Price | 18.7147 | 19.6165 | 95.5558 | 95.0581 | 43.222 |

| $ Change | 0.0022 | -0.0740 | 0.0090 | -0.3956 | -0.1077 |

| % Change day | +0.01% | -0.38% | +0.01% | -0.41% | -0.25% |

| % Change week | +0.08% | -1.38% | -0.62% | -2.55% | -1.23% |

| % Change month | +0.15% | -1.01% | +0.37% | -1.99% | +0.25% |

| % Change year | +4.18% | +2.05% | +28.50% | +23.30% | +7.57% |