Good Afternoon, Neither Six Flags or Universal Studios have a roller coaster that rivals the ride we have taken in the 2022. High inflation along with the unwinding of Federal Stimulus has created unprecedented volatility. I know I’ve used that word (unprecedented) a lot this year, but to me that’s what it is. I have been trading since 1987 and doing one form or the other of this blog since 1998 and I have never experienced anything like it. I will add that in my studies of the history of the market I have not found anything like it. So unprecedented is how I describe it. Heretofore, it has resulted (as I have repeatedly said) in the worst year our group has experienced. Actually, the damage was done during the first six months of the year when we like everyone else were adjusting to quantitative tightening. During that time we reworked our indicators for the new (or should I say old) conditions. Since then, We have been holding our own as we always did in the past. However, it has been impossible to overcome the deficit that we incurred during the beginning of 2022 that has let us with a pretty good black eye moving into 2023. We simply haven’t had the market to do it. The good news is that our indicators are performing well and it is only a matter of time until we are back on the top of the page as they say. So looking on from here we are dealing with the same issues that have caused all the volatility in 2022. High inflation, the threat of recession, and higher interest rates. I won’t go over all those things yet again as it would be akin to beating a dead horse to death. For any of you that or new or just want to review our previous discussions on this subject all you have to do is look under the blog tab on our website and you have access to every blog that we have published. I might also add that it is a good place to check our past analysis to see how good it was! One slight nuance with regard to the market moving forward will be a greater emphasis on quarterly earnings reports. As the market focuses on the effect of the Fed rate increases on the economy it is a given that Corporate earnings will slow down. The market will be watching corporate earnings closely to determine how much effect the Fed rate increases are having and to make sure that they have not overdone the rate increases and hurt corporate earnings too much. Investors will also continue to focus on whether or not there will be a recession. They are obsessed with it. I guess they are looking for Goldilocks warm when it comes to inflation coming under control vs the economy and corporate earnings slowing down. The bottom line is that the Fed rate increases are made to slow the economy down. That is to be expected while at the same time it is to expected that the Corporate earnings will decrease. After all, that is what the Fed is trying to do, isn’t it? In their eyes that will decrease demand which will decrease inflation. So you get the picture. Given that the bond yield has been inverted for a really long time why would we not expect at least a mild recession? It seems like market players expect it to be a perfect world and will pout if it’s anything less. In other words they want inflation to end with little or no recession. A so called soft landing. I have one thing to say about that. I wish them luck with their unrealistic expectations. They sell every time there is good news about that economy and they buy every time there is bad news (I explained that in the last blog). It’s like my mom used to say when I was a kid with regard to running in and out of the house. Either stay in or out!!! As long as they continue to do this we will continue to experience the type of volatility that we’ve had for the past twelve months. Which brings me to where we are at now and what we’re trying to do. We remain invested at 100% I Fund. That is because the I Fund has the best chart and is out performing the other TSP funds almost on a daily basis. This is largely to do with the strong dollar creating a favorable exchange rate between US and foreign currencies. We said this would happen in the fall, but we were too early with our first foray into the I Fund receiving a healthy dose of criticism for the move at the time. At any rate , we could just wait in the G Fund and avoid all of this stress but to do so would not allow us to be positioned for the recovery when it comes. While we believe the market will not recover until the spring of 2023 at the earliest, we don’t have a crystal ball and will continue to remain invested in equities as long as we have a chart that will allow us to do so and right now that continues to be the I Fund. Again, why not the G Fund?? We believe that for the most part the market bottom was reached in October. So we think that market downside is limited moving forward into 2023. Of course, I reserve the right to change my mind. Remember, I’m not the one that claims to have a crystal ball. If things do not go as we think the will we will sell. Never ever forget, Sell is not a dirty word around here!!! It is a tool and we will not hesitate to use it if we get a sell signal for the I fund chart. Right now though, it’s hanging in there nicely and we are pleased with the way that it has allowed us to remain positioned in equities.

The days trading has produced the following results: Our TSP allotment is currently in the green at +0.55%. For comparison, The Dow is up +0.27%, the Nasdaq is off slightly at -0.04%, and the S&P is showing a gain of +0.17%. Praise God! It looks like we have them covered again today.

S&P 500 turns slightly higher as it attempts to snap 4-day losing streak

Recent trading has left us with the following signals: C-Sell, S-Sell, I-Hold, F-Hold. We are currently invested at 100/I. Our allocation is now -29.02% on the year not including the days results. Here are the latest posted results:

| 12/19/22 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 17.2139 | 18.5246 | 58.5453 | 60.761 | 33.596 |

| $ Change | 0.0054 | -0.1108 | -0.5285 | -0.9777 | -0.0945 |

| % Change day | +0.03% | -0.59% | -0.89% | -1.58% | -0.28% |

| % Change week | +0.03% | -0.59% | -0.89% | -1.58% | -0.28% |

| % Change month | +0.20% | +1.08% | -6.35% | -7.72% | -2.85% |

| % Change year | +2.85% | -11.31% | -18.63% | -27.18% | -14.82% |

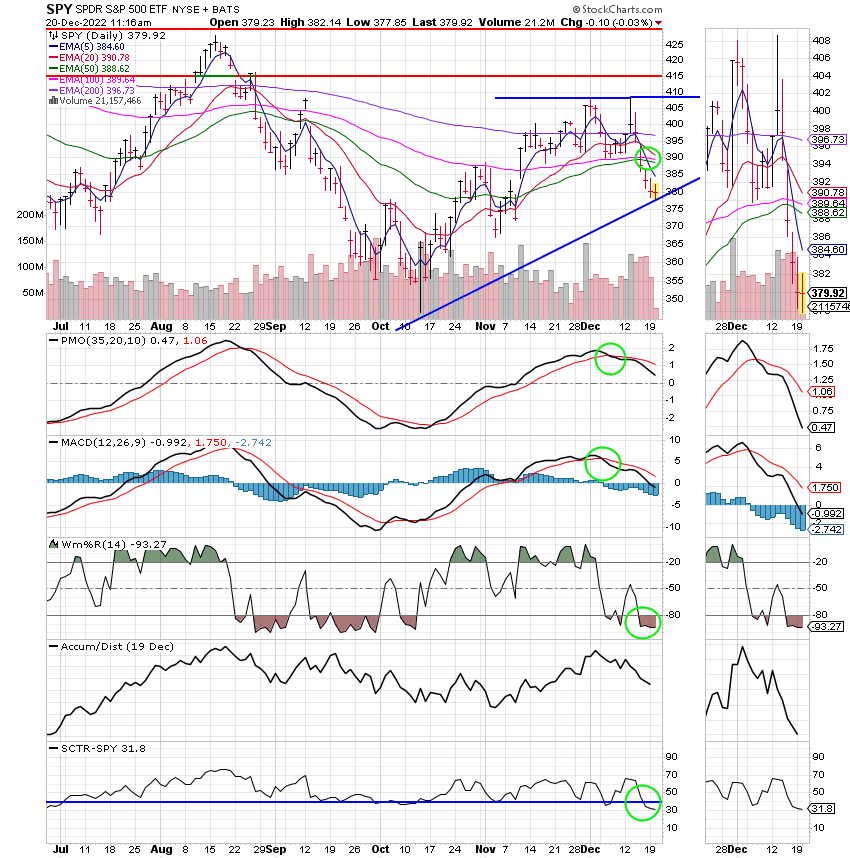

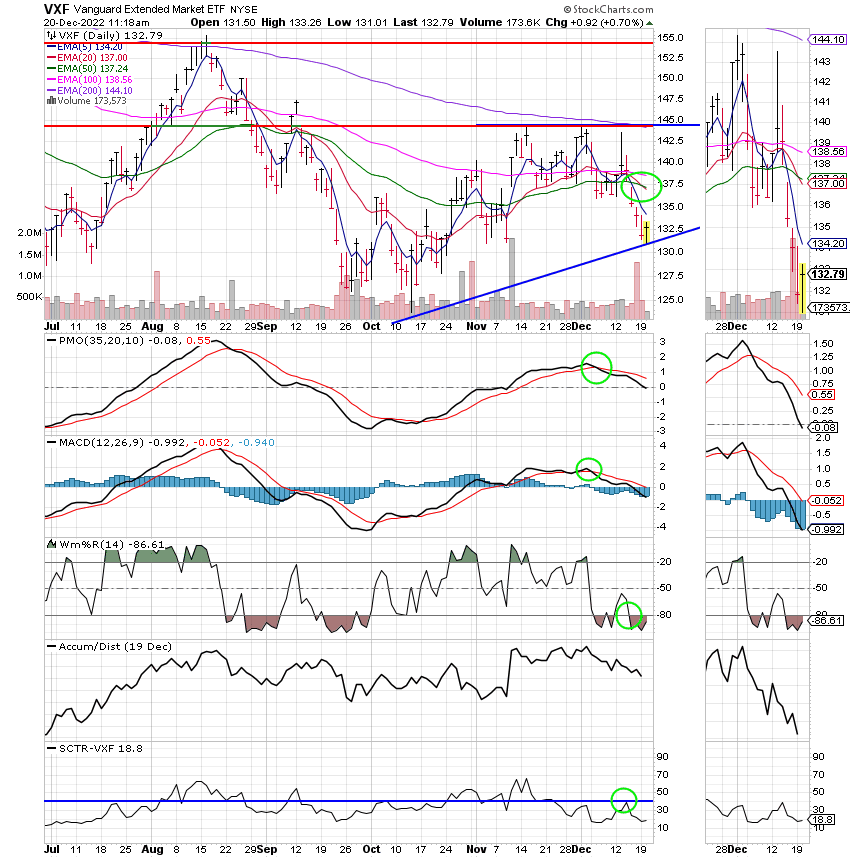

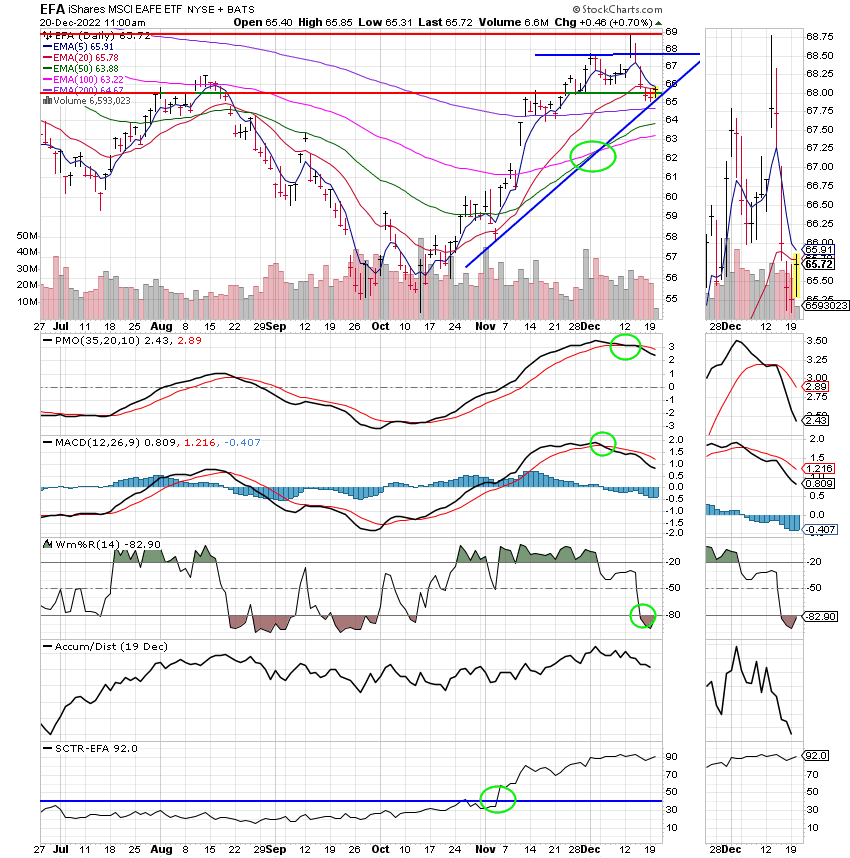

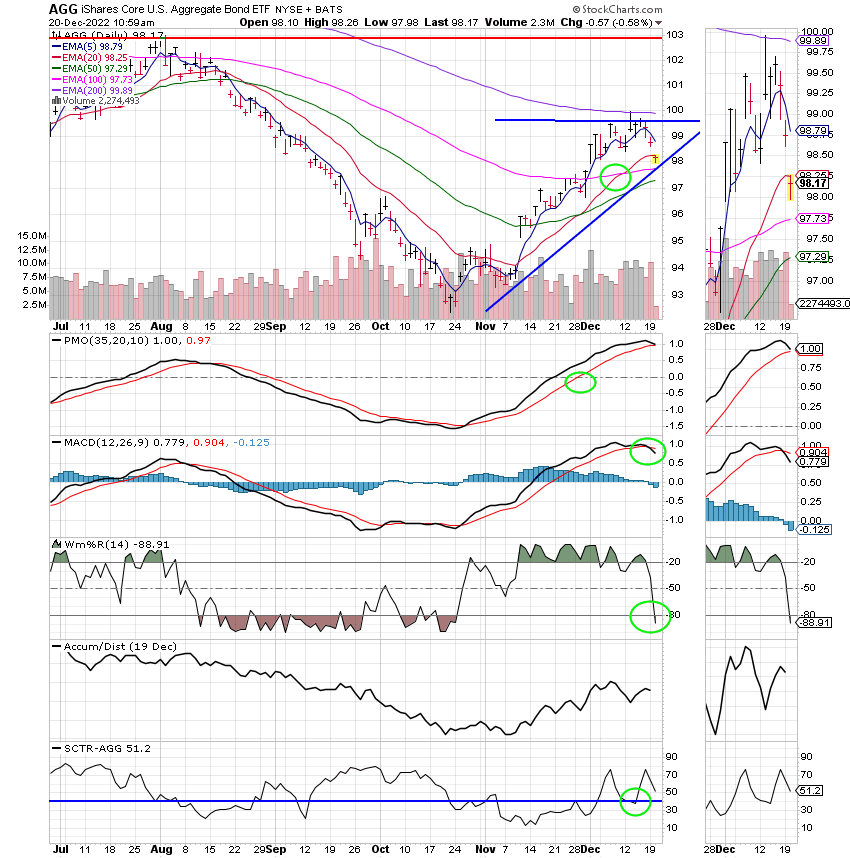

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

It’s been a rough year, but it can’t go on forever. There are very few investors that are up on the year. Personally speaking I only have one account that is up for the year and it’s invested in of all things corporate bonds. Who would have guessed. Please understand me when I say that I’m not crying or complaining. God has been so good to us over the years. I definitely am playing with house money and experience tells me that we will eventually get back in the green and then some. All this give and take reminds me that this money is only a tool we use. It’s a result of God’s blessing, but we should never forget that the love of it is the root of all evil. So it is a tool and only one of the blessings that come with the Life Abundant that Christ promised and so graciously provides for us. Ultimately it is really nothing in the big scheme of things. In fact scripture tells us that one day it will all burn. The good news is that we will no longer have need of it. It will be worthless. In this Christmas season it is important not to forget the other blessings that God has provided for His children. Family, friends, food and a roof over our heads. For many of us peace and with that in mind we must never forget to say a prayer for our Ukrainian brothers and sisters that have suffered so many hardships, but yet have kept their faith through it all. Thinking of them makes us aware just how insignificant that money is. For many of us our health is a blessing. So many have suffered from and lost the battle to COVID. Those of us that have overcome it are truly blessed. To be able to gather with our families and celebrate the birth of our savior in this wonderful country, in peace and health with no pandemic is a blessing beyond measure. There are so many blessings that I could write a book and never mention money, but ya’ll know where I’m going with this. I do every year. In this Christmas season I want to proclaim the greatest blessing of all. The greatest gift of God. The birth of is His son and our savior Jesus Christ. Through Him come all good things but most importantly eternal life to those who know Him. Do you know Him???? If you are troubled, if you are distressed, if your life seems to be without direction, He provides all the answers. I know this because he did it for me. I won’t preach a sermon here. That’s not what I do. It’s just that this season reminds me of all the gifts He has provided for me and of the greatest gift He provided for me. I just want to share it. When I have joy in this life, this is why I have it. It was a free gift. All I had to do was accept it and I am so glad I did. So back to my question. Do you know Him? If you don’t and you want to. Romans 10:9 gives us the simple instructions to receiving this gift. It says “If you declare with your mouth “Jesus is Lord”, and believe in your heart that God raised Him from the dead, you will be saved”. It’s simple, pray and receive Him into your heart. It will change you forever. It doesn’t matter if you are hard core. I was…military, dept of Justice all that. There was a day when I would have laughed at this post. He changed my heart. He made life worth living and He will do it for you. All you have to do is accept it. So do this thing and go enjoy your family and friends for Christmas as you have never enjoyed them before. For Jesus said, “you will know them by their love for one another”. I leave you with this. I know it’s an old worn our cliché but it is so true. Jesus is the reason for the season. God bless you all. Merry Christmas and may God truly bless everything you do in the remainder of 2022 and in 2023.

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.