Good Morning, It’s Christmas eve eve! We’re close to ending this year and I for one will be glad when it’s over. I know that we’re up on the year but the first half of the year was difficult as we were acclimating to our new system. I am anxious to see what we are able to do with everything fully in place from day one of the new year. Our group has done well in quarters three and four of this year but we spent most of that time making up lost ground. Anyway, I am excited to see what we can do heading into 2025!

Today we’ve got a bit of a post Fed hangover. Last week the Fed did everything exactly as we anticipated. They reduced interest rates by a quarter point and indicated that they would slow the pace of reductions in 2025 and would likely on reduce rates two times during the year instead of the four they had previously penciled in. If you read last weeks blog then you already know that’s exactly what we thought would happen. Well the market pouted and as a result we had pretty big sell off on Wednesday and Thursday. However, the PCE (Personal Consumer Expenditures) report which is the Feds favorite measure of inflation came in less than expected and the market managed to bounce on Friday. Today the market seems to be back to it’s post Fed doldrums. It’s hard for me to figure out why the market sells off on things like this. Sure the Fed slowed the pace of their rate decreases, but honestly, you must look at the reason why. We have an extremely healthy economy. When you put fertilizer on your yard then you expect it to grow more. The Fed has decreased rates by a full point so far. Of course the economy is responding. What do investors expect?? One thing to keep in mind about all this. Unless the Fed is stupid and they are not, they will remain data driven meaning they will respond to whatever is taking place at the time. Just because they expect to cut rates two times in 2025 doesn’t mean they will. They could cut rates more or less depending on what is going on with the economy. Never forget they have a dual mandate to control inflation and employment. They will look at the data and decide what to do and that’s what they always do. So why waste your time trying to decide what they will do 6 months from now? Talk about a waste of time……. but that’s what most market players do.

Of course as you know this is a holiday week and the trading will be on low volume as a lot of the big players will shut down their desks and head home until the new year. That leaves the rest of the investors which will be able to shove things around on low volume more than they usually can. Expect, the trading to be a little more volatile with a slightly positive bias which we usually refer to as a Santa Rally. That is the reason that as a rule you don’t sell in the beginning of December. Most of the gains for the month almost always come in the second half of the month. December is historically the second-best month in a U.S. presidential election year for the Dow Jones Industrial Average and S&P 500, according to the Stock Trader’s Almanac. On average, the two indexes gain 1.3% and 0.8% on the month, respectively, during such years. For the Nasdaq Composite, presidential election year Decembers are usually the fifth-best of the year, with the tech-heavy index rising an average 0.9%.

The bulk of gains in December usually come in the back half of the month, when a Santa Claus rally, and low trading volumes, could give this year’s big run one final push toward the finish line. We will see.

The days trading so far has left us with the following results. Our TSP allotment is off -1.06%. For comparison, the Dow is trading lower at -0.65%, the Nasdaq is higher at flat at +0.01%, and the S&P 500 is off -0.19%.

Recent action has left us with the following signals: C-Sell, S-Sell, I-Sell, F-Sell. We are currently invested at 100/S. Let me address this briefly. No, you didn’t read it wrong. Those are all sells and if you follow them then you won’t be wrong. It’s not often that I ignore sell signals and it is a gamble when you do but a close review of the charts indicate that this will likely not be a deep selloff. So I decided to hold through this one and try to get the gains from a Santa Rally should we have one. It is my concern that if we honored this sell signal that we might not be able to buy back in quick enough to capture the gains from a Santa Rally. I acknowledge that it is a gamble but the reward will be worth it if we indeed get a year end rally. Again, we will see. Given the above sell signals you would not be wrong to sell out a call it a year. It’s a judgement call. My advice would be to pray and go where the Spirit leads. Our allocation is currently +15.35% for the year not including the days results. Here are the latest posted results:

| 12/20/24 |

|

|

|

Prior Prices |

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

18.73 |

19.4807 |

93.6773 |

91.2427 |

41.7878 |

| $ Change |

0.0022 |

0.0449 |

1.0120 |

1.1284 |

-0.0261 |

| % Change day |

+0.01% |

+0.23% |

+1.09% |

+1.25% |

-0.06% |

| % Change week |

+0.08% |

-0.69% |

-1.97% |

-4.01% |

-3.32% |

| % Change month |

+0.23% |

-1.70% |

-1.60% |

-5.92% |

-3.08% |

| % Change year |

+4.27% |

+1.34% |

+25.97% |

+18.35% |

+4.00% |

More Prices & Returns

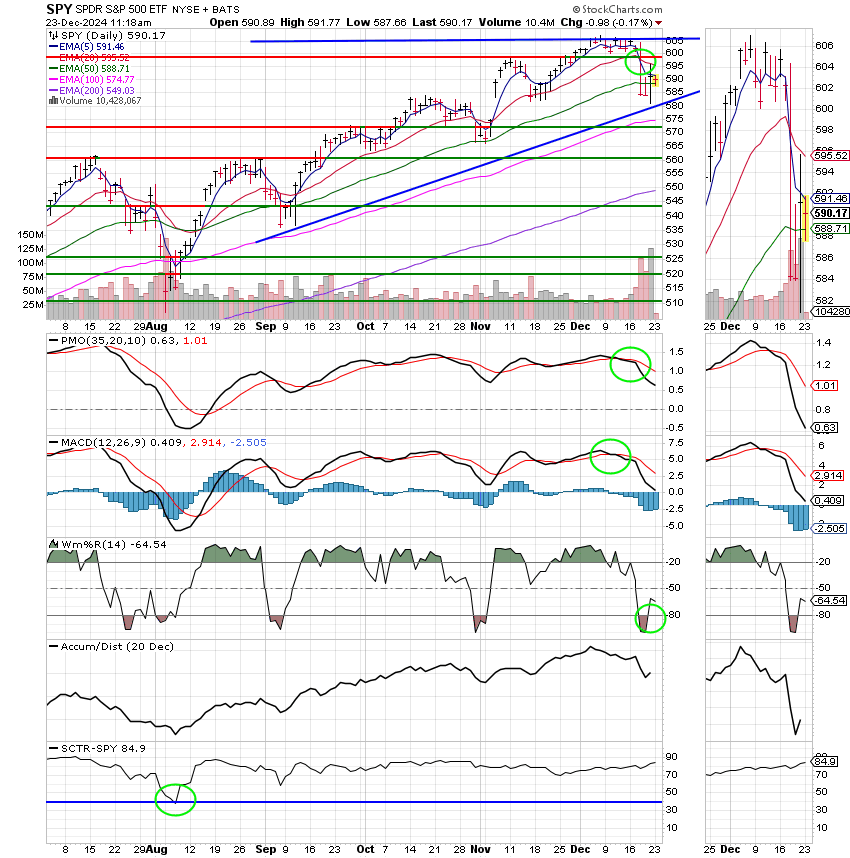

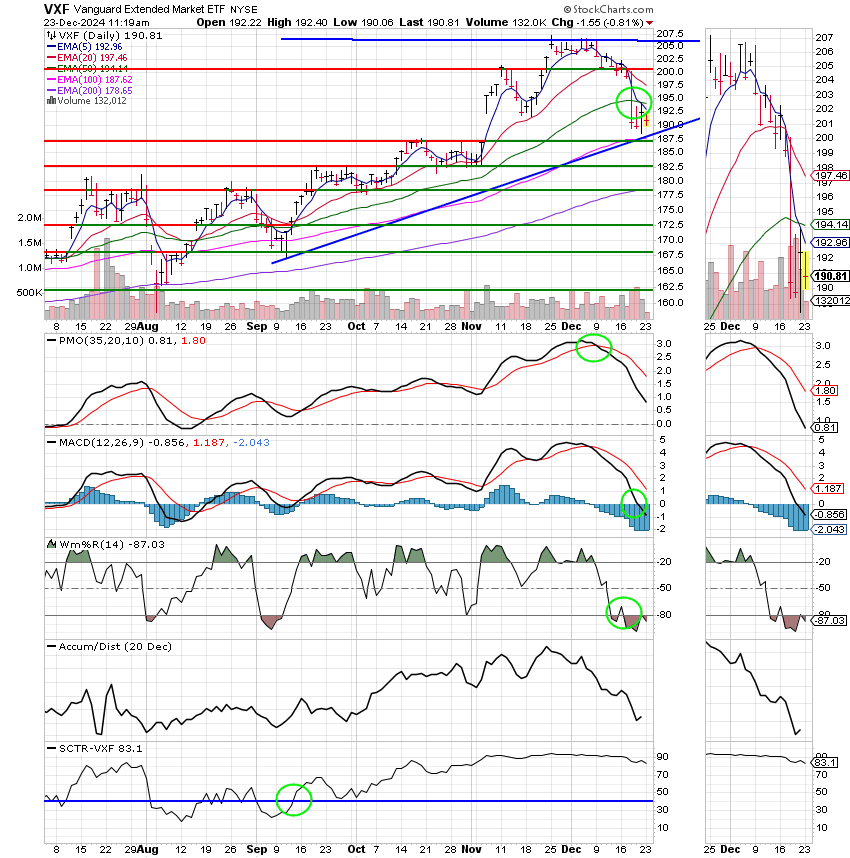

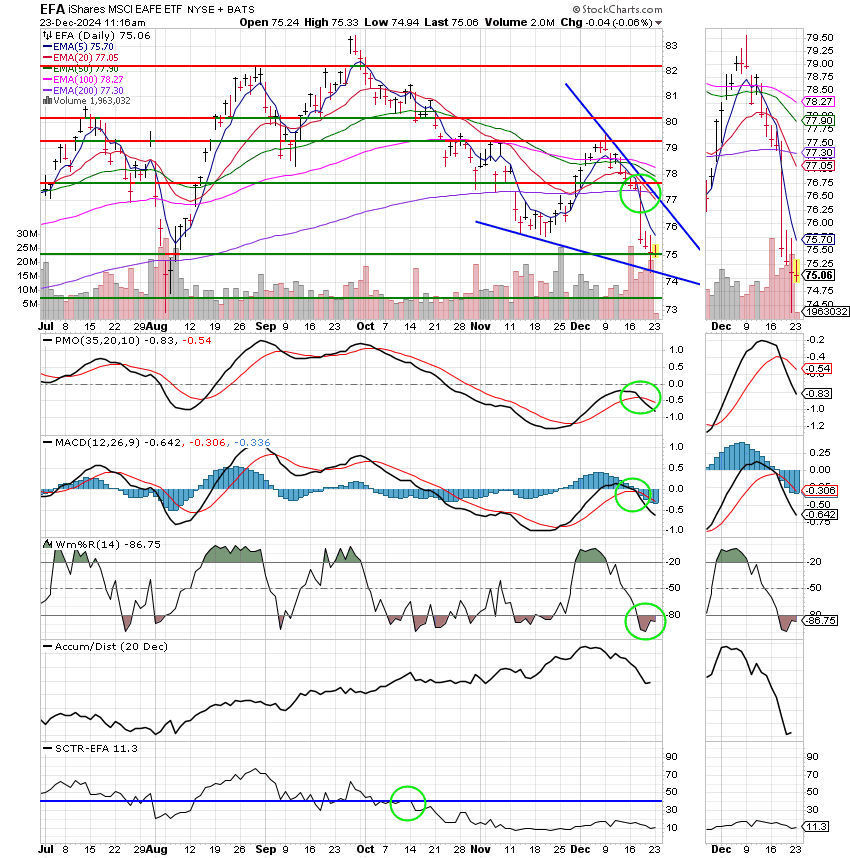

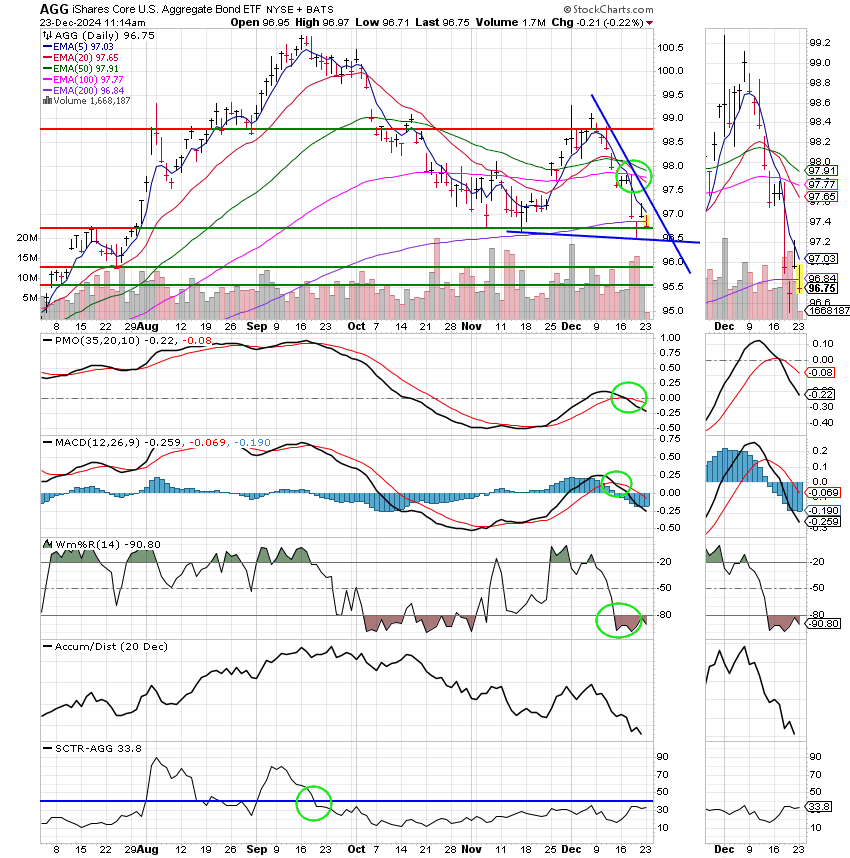

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C fund:

S Fund:

I Fund:

F Fund:

In looking at the charts you will notice that the chart for the C Fund is now slightly better than that of the S Fund. Should this trend continue we will likely make a change to C Fund heading into the new year. However, for today will leave it alone and see how the trading progresses trough Christmas. I still strongly believe that the market will favor small caps moving into the New Year and as a result I am somewhat resistant to making that change until I see for sure where this thing is going. One thing to always keep in mind is that you should never make investment decisions based on thin volume holiday trading. You can never trust that data for making ling term trading decisions. One more time, if you are uncomfortable with this strategy it’s totally okay to sell out and call it a year!

Let me take this time to wish you all a very merry Christmas. It is truly a special time of the year when we celebrate the birth of our Lord and Savior Jesus Christ and the gift of eternal life that He represents. A gift that is freely given and can be freely received with no strings attached. If you don’t know Him and want to establish that eternal relationship’ then all you have to do is follow Romans 10:9 which says that ” if you declare with your mouth, “Jesus is Lord”, and believe in your heart that God raised Him from the dead, you will be saved.” Folks that’s what it’s all about. Yes Jesus is the reason for the season. Those of us that already know Him understand that He can change your life more than all the money in the world. His gift is priceless, It is truly without value. It cannot be purchased or earned. One last thing on this subject. He is a good Father and wants what is best for His children. In that manner, He has always blessed our group and we acknowledge that here. Merry Christmas to you all!!

God bless, Scott

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.