Good Evening, I’ve had a few questions asking if this is the end of the December rally. I don’t know and I won’t even venture a guess. The thing you must understand about the last trading week of the year is that you can’t take anything from it. Why?? For three reasons. First, the trading is on low volume. Many traders have shut down their desks for the year. Second: There is a lot of selling for tax purposes and Third: There is a lot of positioning and repositioning for the upcoming year. So you can’t make any decisions based on the action during the last week. Any data you may take from it can be misleading. I would also remind everyone that the success we’ve had here is a attributable to #1 Gods blessing and #2 The fact that we refuse to engage in short term trading. Make no mistake about the latter. We used to trade almost exclusively short term but that was when we had unlimited trades in Thrift and before the advent of high speed computer algorithm trading. Those two things plus a few more issues made it nearly impossible for us to trade short term. So we adapted and retooled our charts for the medium to long term game. We don’t worry about the days or weeks anymore. Only months and years.

In all my years of trading this has been one of the most difficult that I have experienced. It has been bifurcated and volatile. We spent the first part of the year in in the S Fund when small caps and tech were out performing the market. Then folks started returning to work and investors started selling stay at home stocks such as Zoom and tech reversed. So recovery stocks such as Hotels and Cruise Lines took over the leadership. You can also add energy to that as people started gassing up their vehicles once again. This led to a surge in the S&P 500 (C Fund) and a drop in the VXF or S Fund. That ladies and gentlemen was the last time that small caps and large caps moved together. The market has been bifurcated in one way or the other since that time. It’s been led by either small caps or large caps, Tech or value, OR stay at home or recovery stocks. With these dynamics going we found ourselves chasing different sectors most of the year when we were not in fact running from the latest Covid outbreak. While we have survived we didn’t exactly thrive. However, I do want to take time to thank God for another profitable year! He has been so good to our group with only three losing years since 1997 and those added together were less than two percent. Give Him all the praise!!

So……. We end the year hanging on in Large Caps at 100/C. Where do we go from here? You all know I don’t prognosticate, but I do plan! Based on past experience small cap stocks are the canary on the coal mine. They are the first to fall and the first to rally. The first to find the bottom in a bear market and many many small cap stocks are indeed in bear market territory defined as a decline of 20% or more at this time. There is nothing written in stone but my experience has been that large caps stocks will eventually follow the small caps. The large gap that now exists between the two sectors will not be there forever. You can pretty well bank on that. Where one goes so will the other. Usually they will move in the same direction but one will outperform the other. With that noted, if I were forced to guess I would say that there will be at the least a correction (a drop of 10% or more) in the large cap indices sometime in the next quarter or so. With that in mind my contingency plan is to ride the large caps as far as they can go and then sell and move to the G Fund when the charts give the signal. At that time I’ll watch the small caps to see when they form a bottom and get back in and do all over it again. Once again, this is only a plan! Things could move in totally different direction in which case our plan will change. In other words we will react to the action we see before us on our charts whatever that might be and wherever that might take us……..

The days trading left us with the following results: Our TSP allotment slipped slightly at -0.10%. For comparison, the Dow gained +0.26%, the Nasdaq dropped -0.56%, and the S&P 500 fell slightly at -0.10%. I thank God that we held onto most of yesterdays gains!

Dow notches 5-day winning streak, S&P 500 dips from record as investors weigh omicron

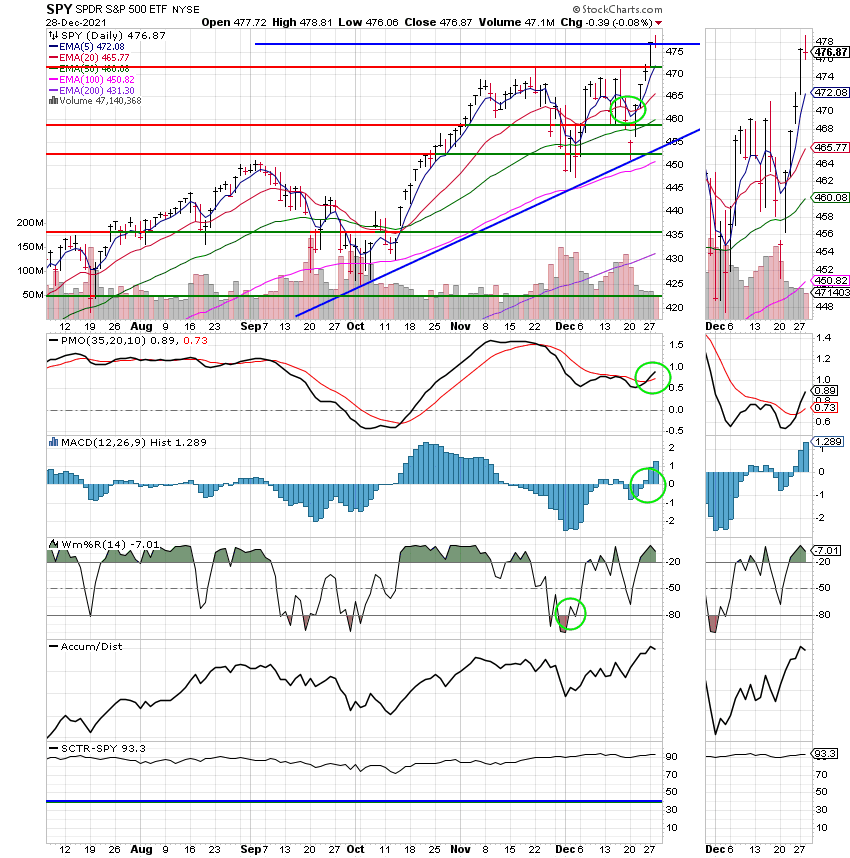

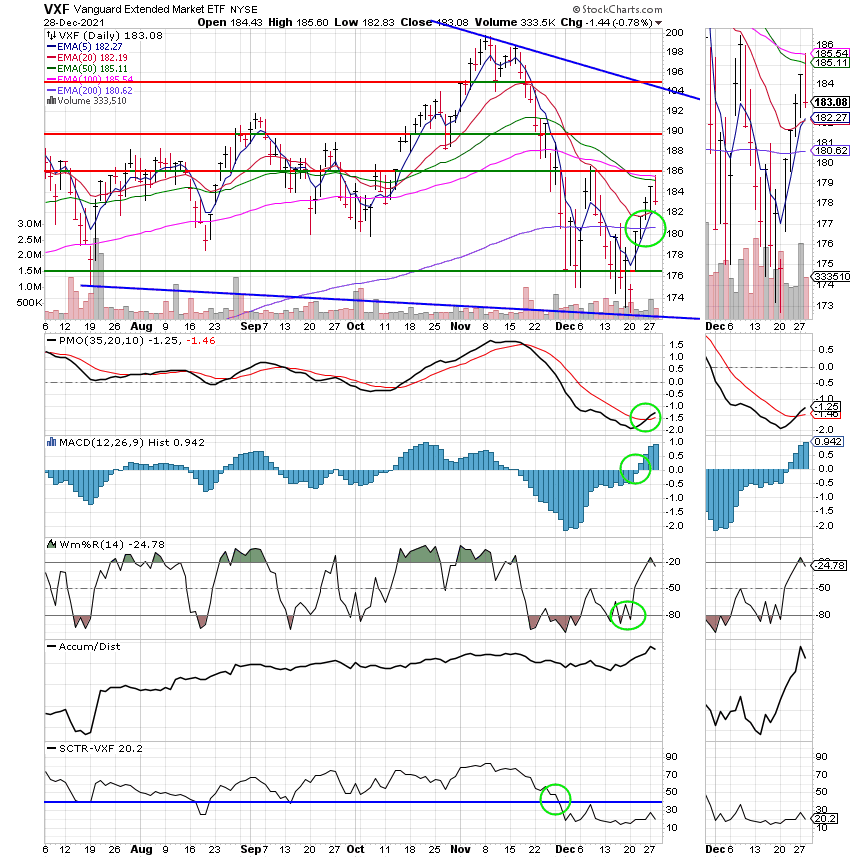

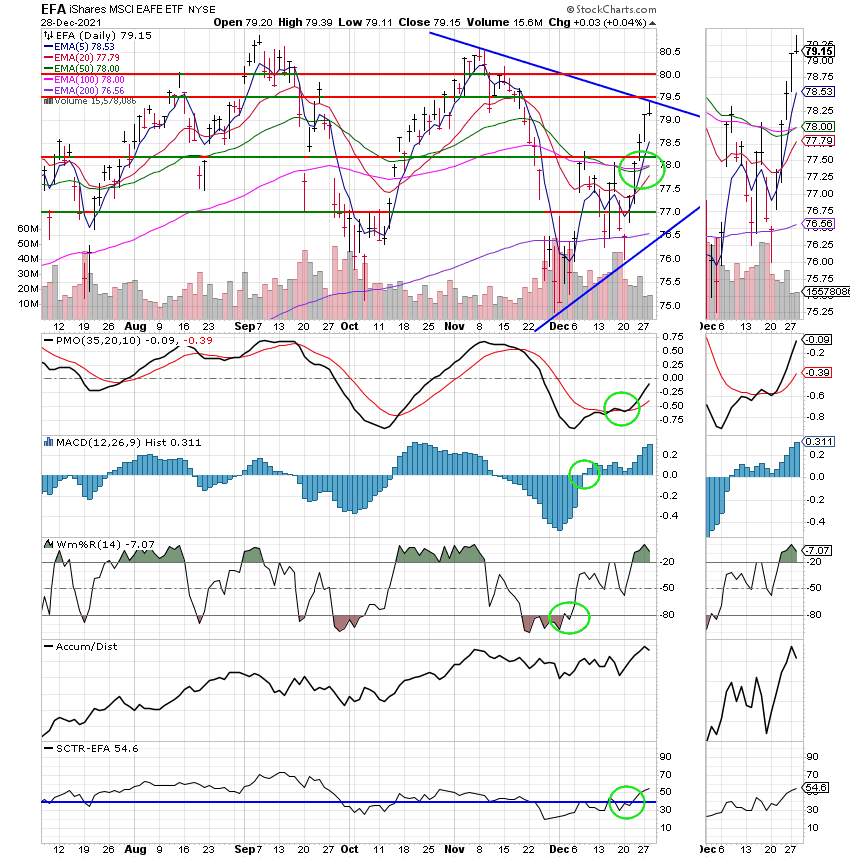

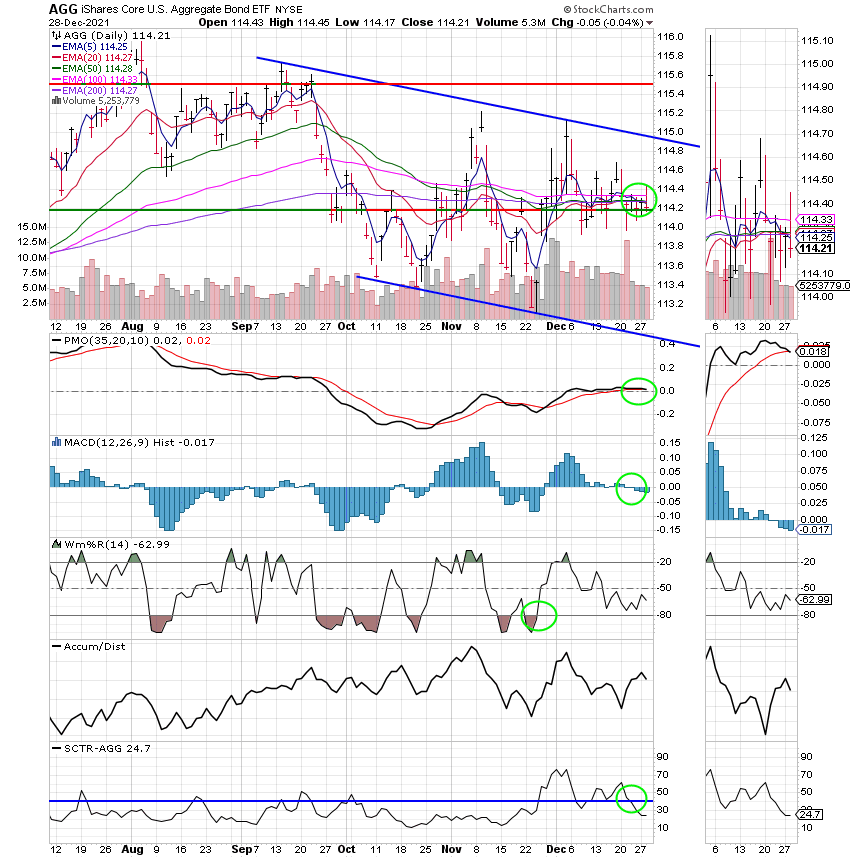

The days action left us with the following signals: C-Buy, S-Hold, I-Buy, F-Sell. We are currently invested at 100/C. Our allocation is now +17.48% on the year not including the days results. Here are the latest posted results:

| 12/27/21 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 16.7339 | 20.8928 | 72.3143 | 84.135 | 39.3482 |

| $ Change | 0.0028 | 0.0248 | 0.9904 | 0.6233 | 0.2782 |

| % Change day | +0.02% | +0.12% | +1.39% | +0.75% | +0.71% |

| % Change week | +0.02% | +0.12% | +1.39% | +0.75% | +0.71% |

| % Change month | +0.11% | -0.29% | +5.02% | +1.42% | +4.85% |

| % Change year | +1.37% | -1.43% | +29.34% | +13.39% | +11.19% |

Now lets take a look at the charts. All signals are annotated with green circles. If you click on the charts they will become larger. If you want to learn more about technical analysis check out the website StockCharts.com.

C Fund:

S Fund:

I Fund:

F Fund:

I want to take this time to wish each and every one of you a Happy New Year! May God bless your families and keep them safe in 2022. That’s all for 2021. I’ll see you next year!!! Have a great rest of your year and may God continue to bless your trades!

God bless, Scott ![]()

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.