Good Evening, Well we got the bounce that we anticipated today. However, it was a weak bounce with a poor close that hardly inspires confidence in putting money to work. Oil slipped lower today which likely has a lot to do with the lack of enthusiasm for this bounce. Another factor that is complicating the low oil prices is a strong dollar that is becoming even stronger on the probability that the FED will raise rates next week. Which leaves me to wonder how the strong dollar will effect the market as a whole moving forward. Will we be selling soon???? We’ll have to keep an eye on our charts to see.

The days trading left us with the following results: Our TSP allotment added +0.23%. For comparison the Dow gained +0.47%, the Nasdaq +0.44%, and the S&P 500 +0.23%. The lack of strength in this bounce concerns me…..

Stocks Bounce Back After Three Days of Losses

The days action left us with the following signals: C-Neutral, S-Sell, I-Sell, F-Neutral. We are currently invested at 100/C. Our allotment is now +1.86% on the year not including the day’s results. Here are the latest posted results:

| 12/09/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.8962 | 17.0194 | 27.5768 | 35.3009 | 24.2056 |

| $ Change | 0.0009 | 0.0215 | -0.2133 | -0.3679 | 0.0519 |

| % Change day | +0.01% | +0.13% | -0.77% | -1.03% | +0.21% |

| % Change week | +0.03% | +0.26% | -2.08% | -2.87% | -1.73% |

| % Change month | +0.05% | +0.08% | -1.52% | -3.73% | -1.58% |

| % Change year | +1.91% | +1.30% | +1.51% | -2.74% | -0.05% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7636 | 23.2155 | 25.0851 | 26.6039 | 15.0503 |

| $ Change | -0.0178 | -0.0559 | -0.0836 | -0.1072 | -0.0676 |

| % Change day | -0.10% | -0.24% | -0.33% | -0.40% | -0.45% |

| % Change week | -0.39% | -1.00% | -1.35% | -1.59% | -1.81% |

| % Change month | -0.33% | -0.89% | -1.24% | -1.49% | -1.69% |

| % Change year | +1.79% | +1.38% | +1.12% | +0.85% | +0.61% |

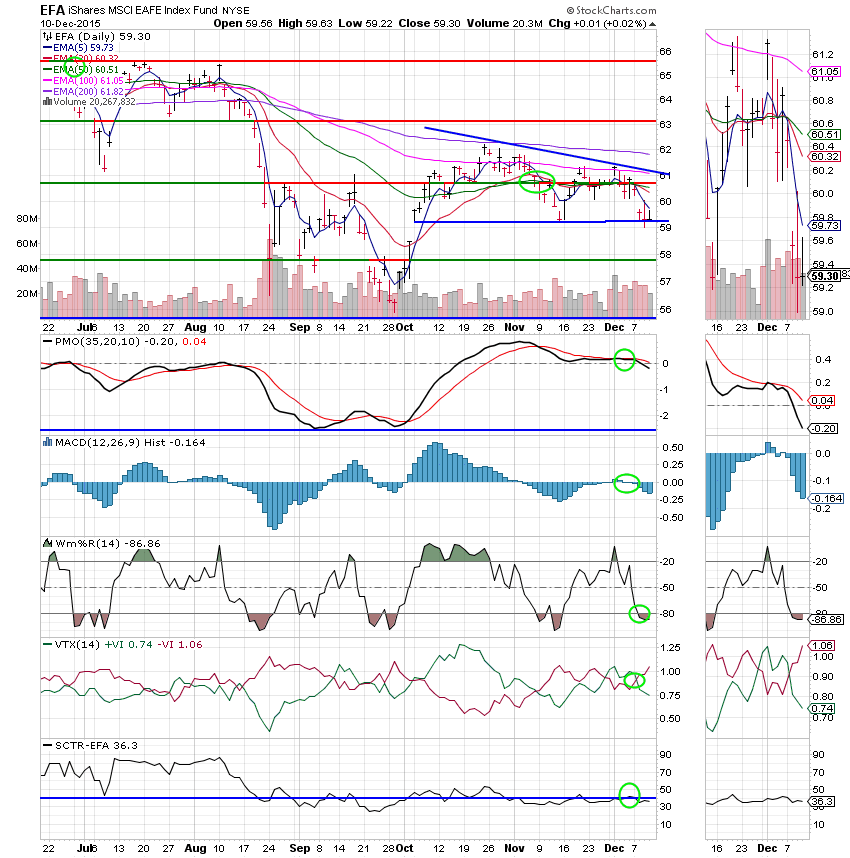

Lets take a look at the charts: (All signals annotated with Green Circles)

C Fund: Price closed right on it’s 50 EMA. The thing to watch here is the 5 EMA. If it continues to move down and crosses the 50 EMA it will generate a sell signal in price using our current set of indictors. Of course, all the other indicators would have to remain in negative configurations for that to take place. The Williams %R did move into a positive configuration today which may signal some more short term upside. The SCTR is hanging in there at 79.7.

S Fund: Still a sell.

I Fund: Still a sell.

F Fund: This ones neutral and has a strong SCTR of 86.6. Folks, I just don’t have a lot of faith here with a pending interest rate increase. Higher interest rates will have a negative impact on bonds.

Keep a close watch on your charts. It is possible that a sell signal could be generated in the C Fund if things don’t improve. Of course, I’ll put out an Alert if that’s the case. That’s all for tonight. Have a nice evening and may God continue to bless your trades!

God bless, Scott ![]()