Good Evening, The market sold off this morning as the machines took over. However, oil leveled off in the afternoon and the market headed higher closing out at it’s highs for the day. What is it we’ve been saying recently?? So goes oil so goes the market. That said, I’m not so sure that we’ve found the bottom in either oil or stocks. We will see.

The days trading left us with the following results: Our TSP allotment was steady. For comparison, the Dow gained +0.60%, the Nasdaq +0.38%, and the S&P 500 +0.48%. I expect more volatility ahead of the meeting on Wednesday. The big interest rate announcement will come at 2:00 PM ET that day. I expect the market to take off again into the new year if the rate increase goes as expected. It not, we could get another round of selling. I won’t hold my breath either way. If the rally does continue, we’ll probably jump back in, but it’s better not to take any chances at this time. Of course, all that depends on the price of crude stabilizing as well.

The days action left us with the following signals: C-Sell, S-Sell, I-Sell, F-Neutral. We are currently invested at 100/G. Our allocation is now +0.13% on the year not including the day’s results. Here are the latest posted results:

| 12/11/15 |

|

|

|

|

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

14.8979 |

17.0578 |

27.1097 |

34.7214 |

23.6444 |

| $ Change |

0.0008 |

0.0670 |

-0.5325 |

-0.7012 |

-0.4503 |

| % Change day |

+0.01% |

+0.39% |

-1.93% |

-1.98% |

-1.87% |

| % Change week |

+0.04% |

+0.48% |

-3.74% |

-4.46% |

-4.01% |

| % Change month |

+0.06% |

+0.31% |

-3.19% |

-5.31% |

-3.86% |

| % Change year |

+1.93% |

+1.52% |

-0.21% |

-4.34% |

-2.37% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

17.702 |

23.0087 |

24.7865 |

26.2386 |

14.8141 |

| $ Change |

-0.0633 |

-0.2102 |

-0.3048 |

-0.3754 |

-0.2418 |

| % Change day |

-0.36% |

-0.91% |

-1.21% |

-1.41% |

-1.61% |

| % Change week |

-0.73% |

-1.88% |

-2.53% |

-2.94% |

-3.35% |

| % Change month |

-0.68% |

-1.77% |

-2.41% |

-2.84% |

-3.23% |

| % Change year |

+1.44% |

+0.48% |

-0.08% |

-0.53% |

-0.97% |

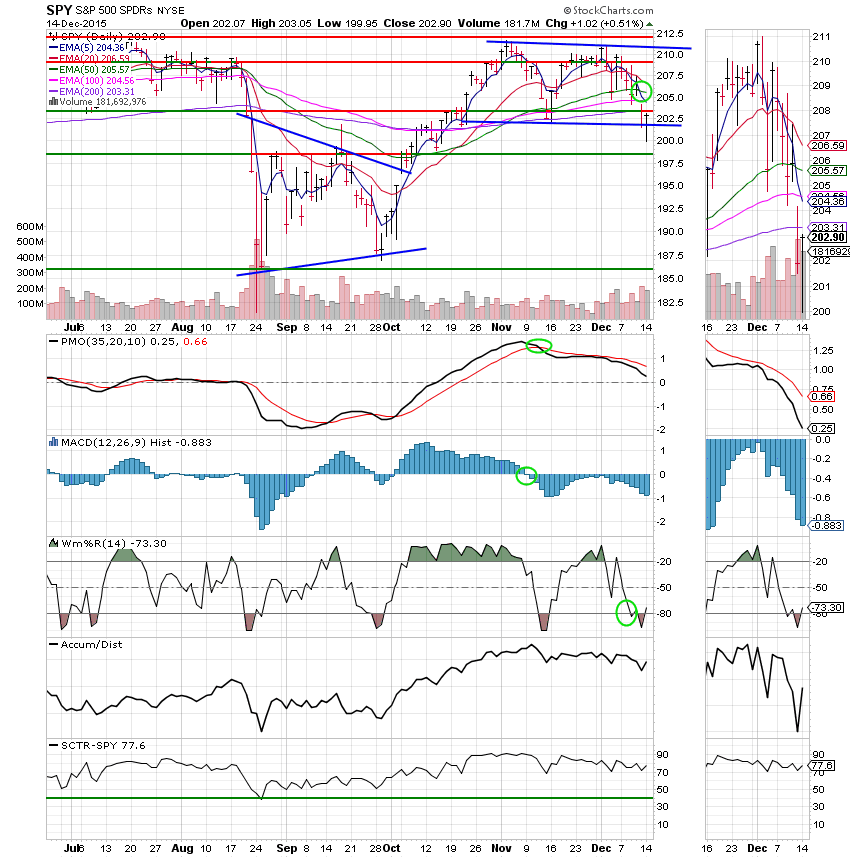

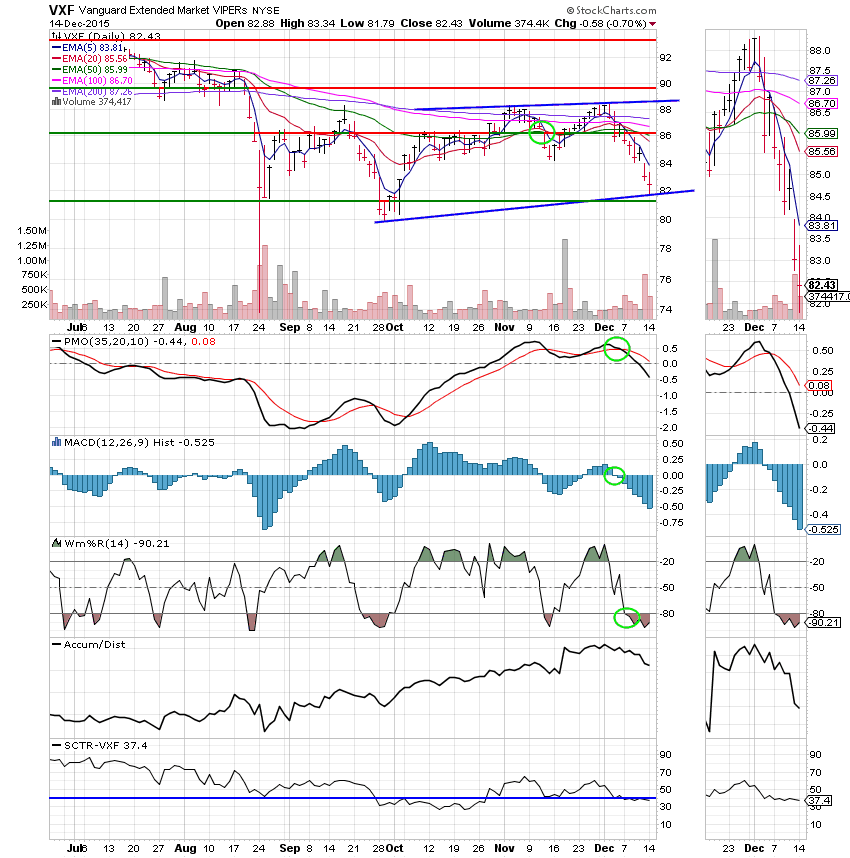

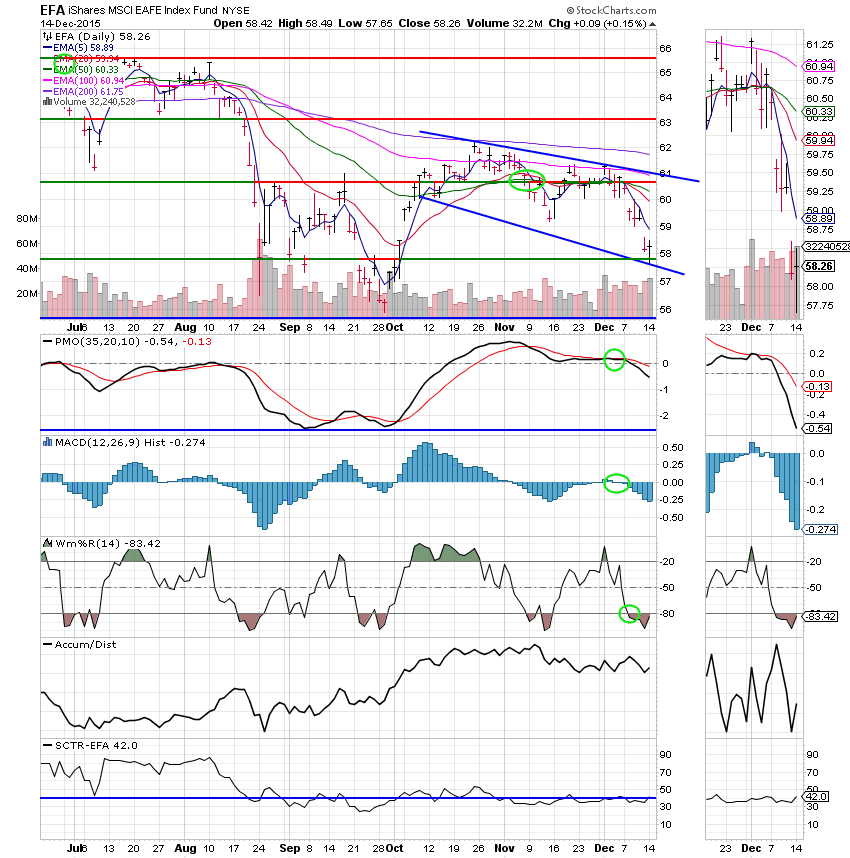

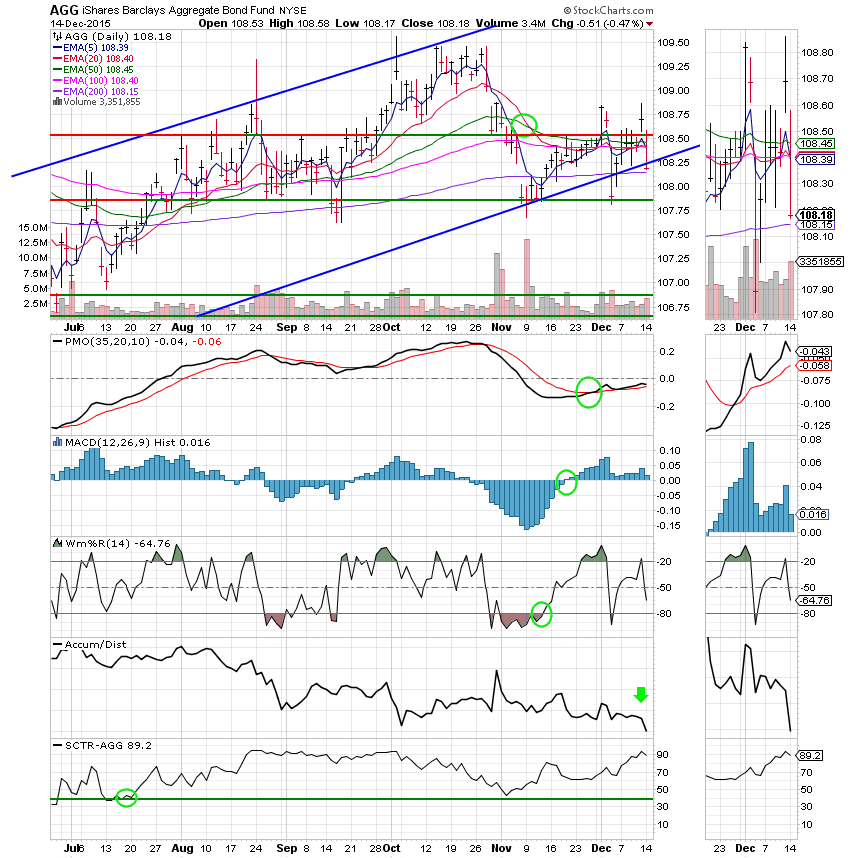

Lets take a look at the charts: (All signals annotated with Green Circles) One thing that I would like to point out is that I have swapped out indicators. Of course as a technical analyst I use several depending on what I am looking for. That said, you will longer find the VTX on our charts. I have replaced it with an Accumulation/ Distribution line. What is that you ask? It is a simple but effective indicator that tells you if money is flowing in or out of the charted stock, fund, or index. In simple terms, Accumulation is buying, Distribution is selling, In most cases it allows you to see money flowing in or out of a stock before it moves. Thus, it can be a very effective at predicting moves before they occur!

C Fund: Still a sell signal here. We will wait and see if it turns back up. Any gains that we miss in such a turn around are the insurance policy that we pay to protect our capital.

S Fund: Small caps sat out today’s rally which tells me that we may not have found the bottom yet. The Williams %R is oversold and the Acc/Dist line is strong. This fund could be priming for a bounce.

I Fund: This fund is still heading down, but the Williams %R is oversold and the Acc/Dist line is strong. This one may be bottoming.

F Fund: This is a good example of how the Acc/Dist line works. If you will notice the line is moving lower indicating that money is flowing out of bonds. That matches our fundamental analysis that bonds will drop if the Fed increases interest rates. This indicates that traders are selling bonds ahead of the Fed meeting on Wednesday. That is the reason that the F fund took such a dive today. -0.47% is a big move for this fund! There simply isn’t enough fuel to keep this one going.

Our job now is to monitor our charts to see what direction the market will head in when the Fed announces their decision. That’s all for tonight! Have a great evening.

God bless, Scott

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.