Good Evening, Janet Yellen and gang raised rates as expected today and the market rallied. The amount of the raise was 25 basis points or .25%. Of course this is the rate that banks are charged overnight for borrowing. One could say that the reaction was totally anticipated, but I say that a sell the news reaction was a possibility and could still take place on a delayed basis. For now at least, those that held firm were rewarded and those that adhered to traditional old school tactics were punished just as they have been since the great recession. I’m afraid this is the new norm as the machines seek to manipulate and take advantage of human emotions. Something that the skilled trader used to be able to use to his advantage. Now, for the most part it’s buy and hold and Katie bar the door when you don’t. That said, there have always been bear markets and I still believe that there will always be bear markets. I don’t intend to change. I will remain defensive by nature. Why? Holding blindly, may lead to greater profits now. However, one has to ask, with the machines propping the market up for so long will the next bear market be even more severe and if that’s the case will the out performance now be worth it??? I still say no. Better to be safe than sorry!

The days rally left us with the following results: Our TSP allotment was steady in the G Fund. For comparison the Dow gained +1.28%, the Nasdaq +1.52%, and the S&P 500 +1.45%.

Stocks Rally as Fed Lifts Months of Uncertainty

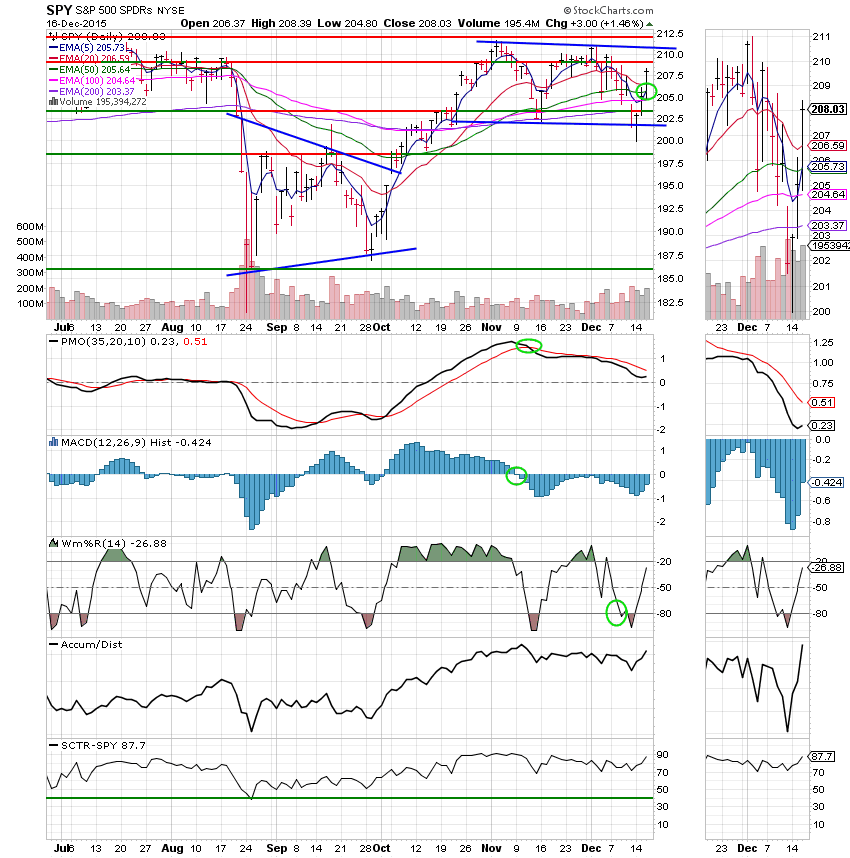

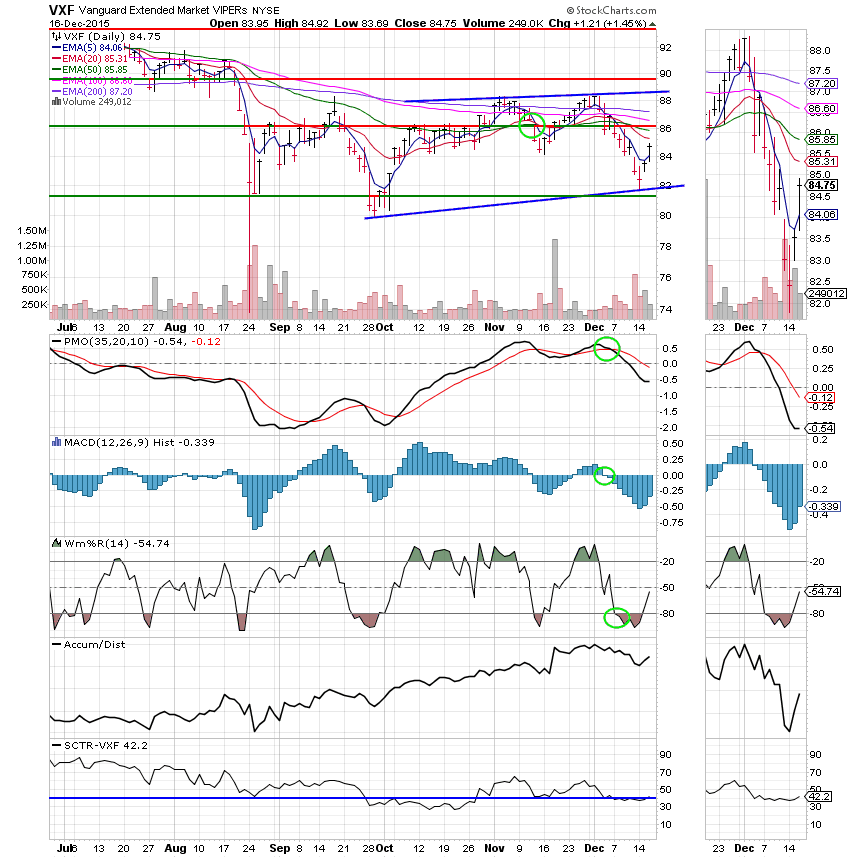

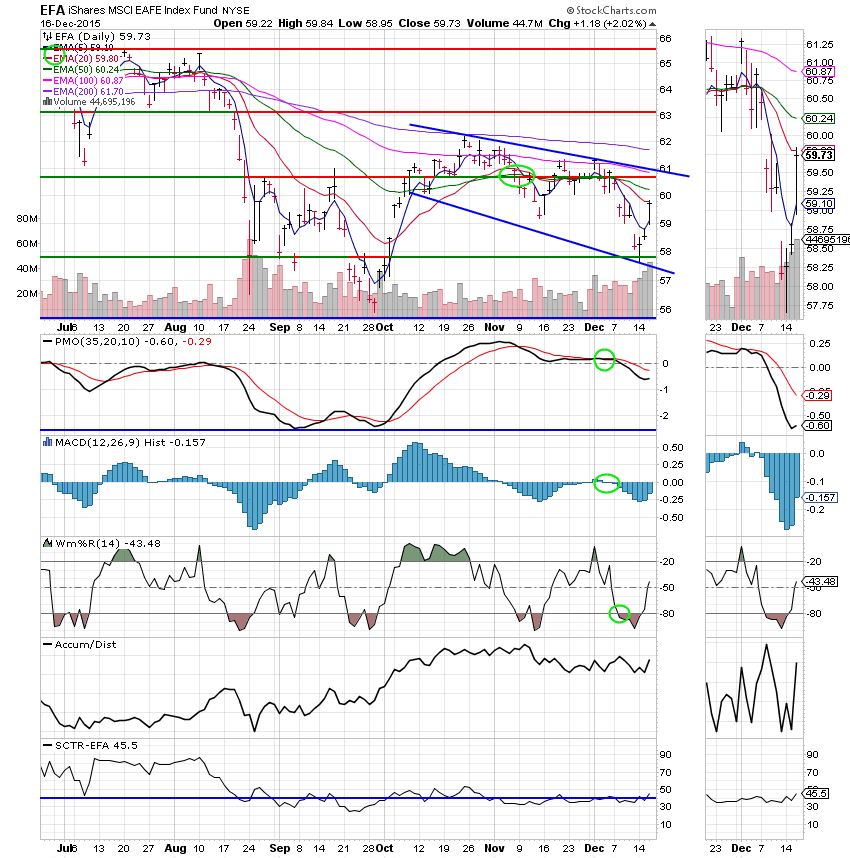

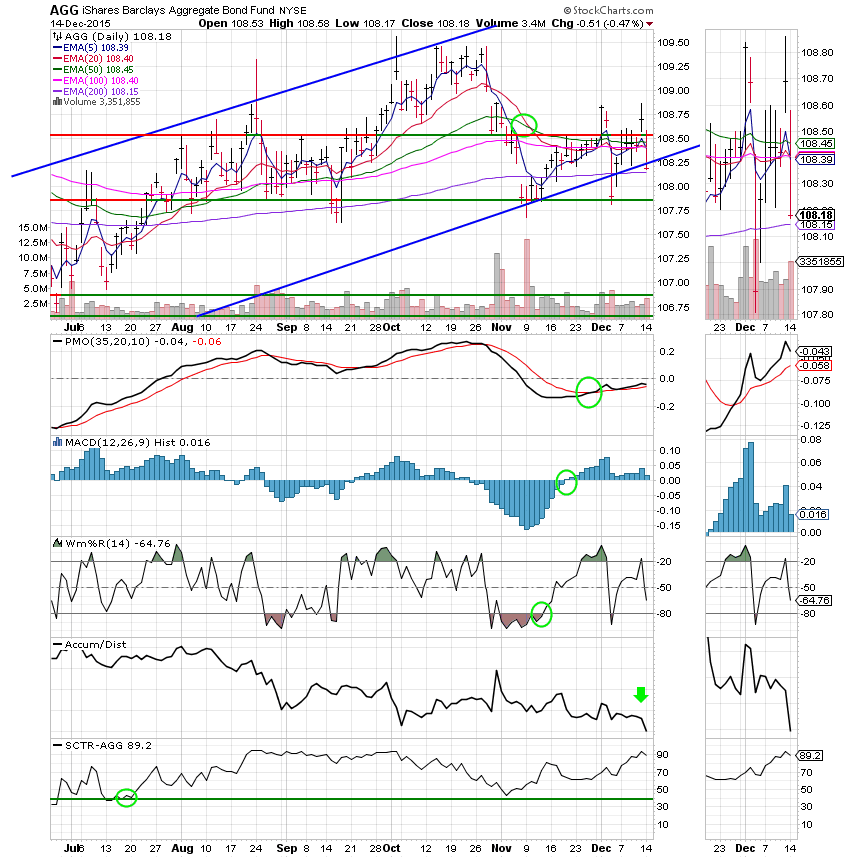

The days action left us with the following signals: C-Neutral, S-Sell, I-Sell, F-Sell. We are currently invested at 100/G. Our allocation is now +0.16% on the year not including the days results. Here are the latest posted results:

| 12/15/15 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9015 | 16.9483 | 27.531 | 34.9541 | 23.6595 |

| $ Change | 0.0009 | -0.0292 | 0.2907 | 0.4508 | 0.1273 |

| % Change day | +0.01% | -0.17% | +1.07% | +1.31% | +0.54% |

| % Change week | +0.02% | -0.64% | +1.55% | +0.67% | +0.06% |

| % Change month | +0.09% | -0.34% | -1.68% | -4.68% | -3.80% |

| % Change year | +1.95% | +0.87% | +1.35% | -3.70% | -2.31% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7354 | 23.1105 | 24.9313 | 26.4149 | 14.9258 |

| $ Change | 0.0334 | 0.1042 | 0.1512 | 0.1879 | 0.1197 |

| % Change day | +0.19% | +0.45% | +0.61% | +0.72% | +0.81% |

| % Change week | +0.19% | +0.44% | +0.58% | +0.67% | +0.75% |

| % Change month | -0.49% | -1.34% | -1.84% | -2.19% | -2.50% |

| % Change year | +1.63% | +0.92% | +0.50% | +0.14% | -0.22% |