Good Evening, A lot of folks decided to pull their money out of less than successful or underperforming hedge funds last week resulting in the large sell off that occurred on Thursday and Friday. In the end, the market gave up all it’s gains from earlier in the week. That’s pretty much been the case this year. By the matter of fact, I would even go as far as calling 2015 the year of whipsaws. That is precisely the reason that so many active fund managers underperformed. I don’t know if this is a short term trend or the way that it is now going to be. With that in mind, I have been developing a new trading style on the street that effectively deals with all the rapid changes caused by the machines and their trading algorithms. Should current market positions persist, I may bring it to TSP in order to improve the performance of our allotment. Some times you have to adapt to the changes and this may be one of those times when things are never going to be the same again. There will always be a way to make money. It’s our job to find it…..

Traders started out the morning hoping to buy a dip that never really materialized. As a result the market drifted throughout the day and closed out with a moderate sized spike in the afternoon. Investors may be attempting to position themselves ahead of what they think will be a run tomorrow. We’ll see what happens.

The days trading left us with the following results: Our TSP allotment was steady in the G Fund. For comparison, the Dow rose +0.72%, the Nasdaq +0.93%, and the S&P 500 +0.78%. The results were good, but it seemed like the enthusiasm that is normally associated with December trading wasn’t present. Possibly, folks just want to get the year over with. It felt like most of the moves were just to position portfolios ahead of next year. Not to make money on a Santa Rally. Time will tell.

Obamacare, tech stocks boost Wall Street

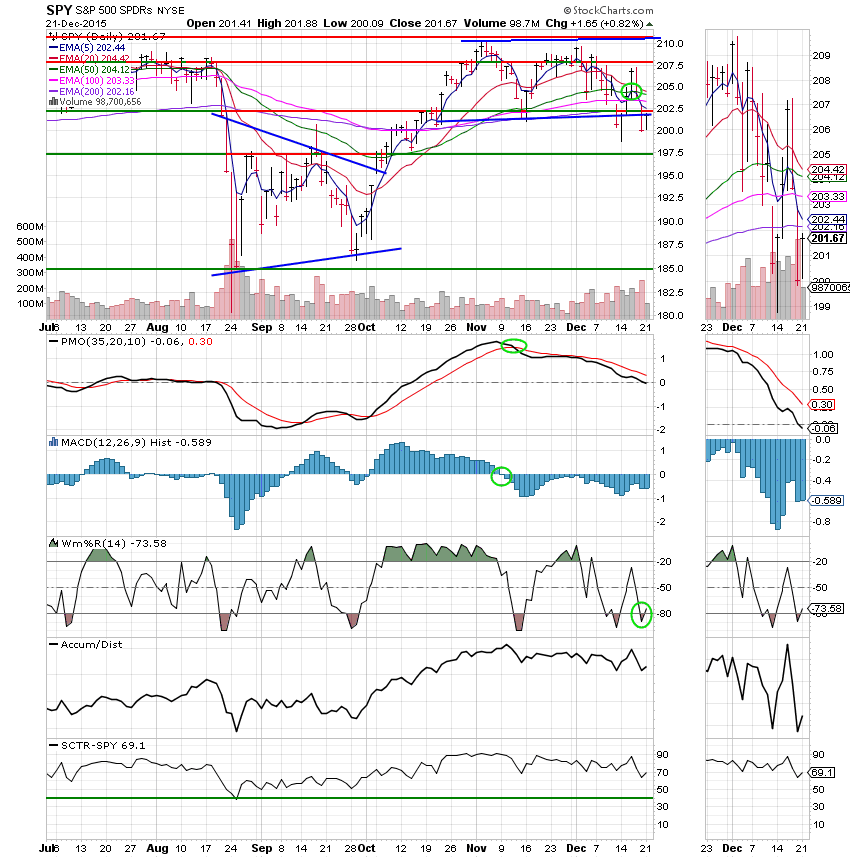

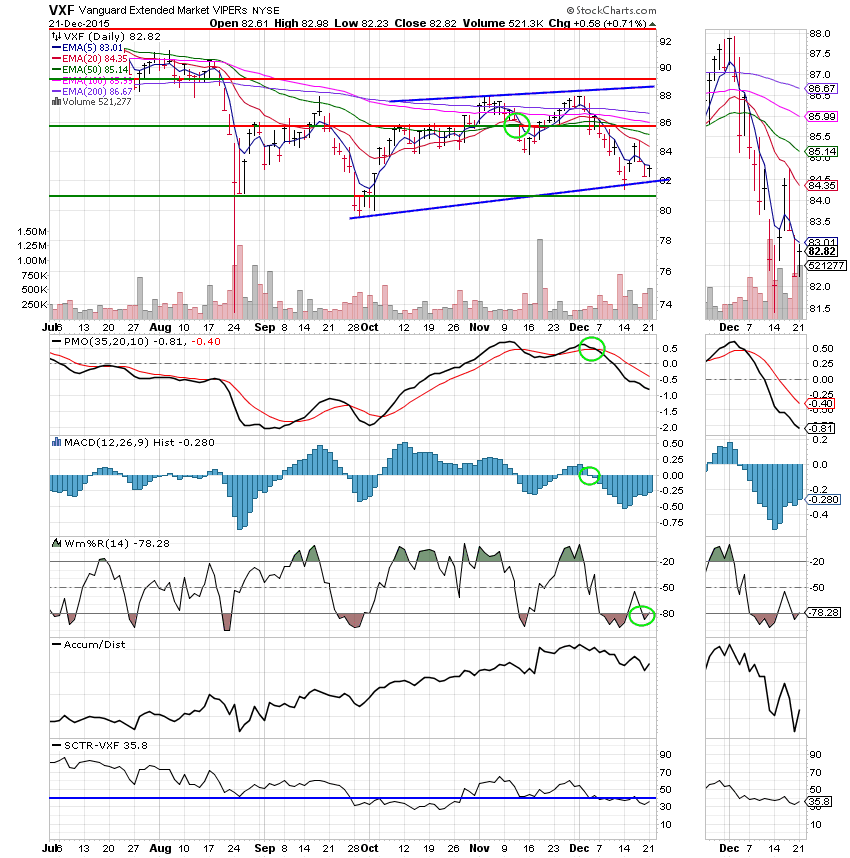

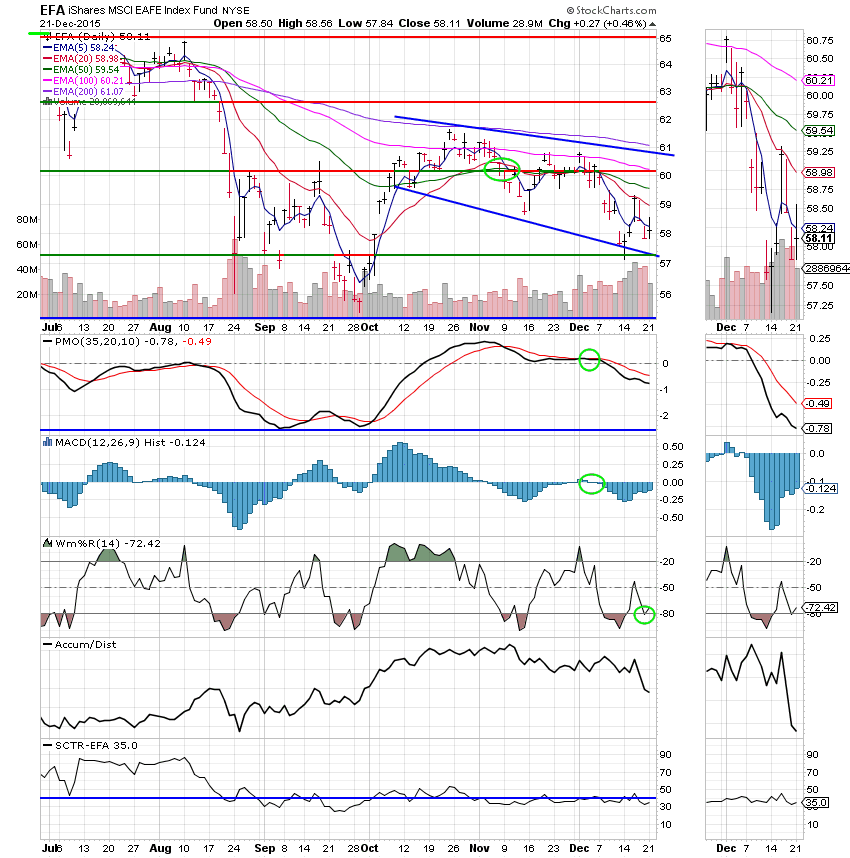

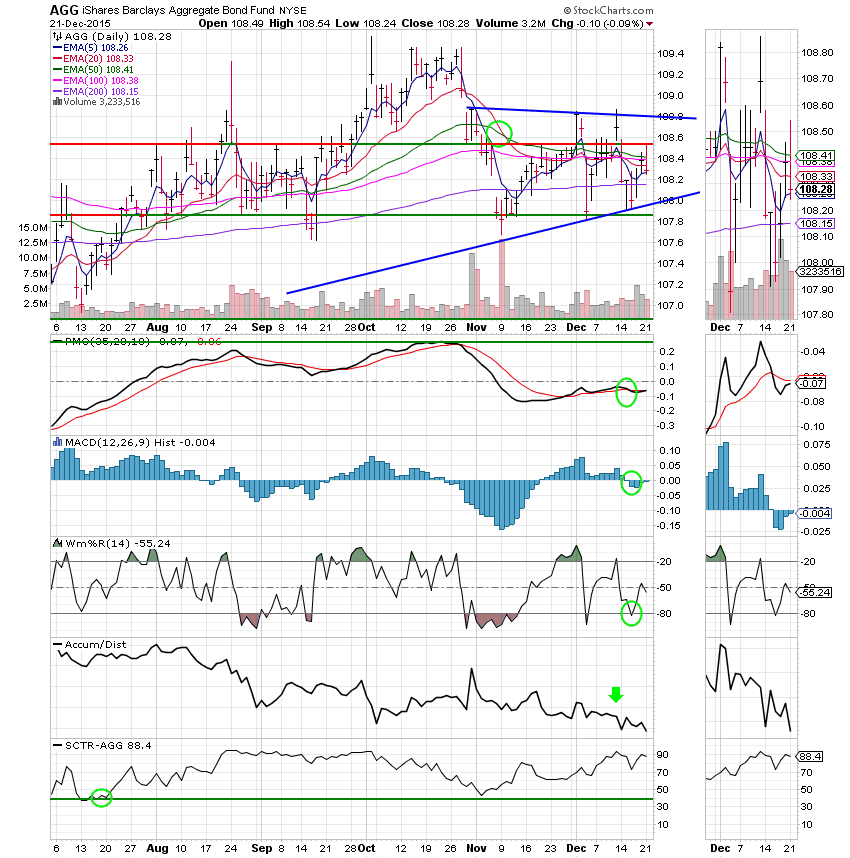

The days action left us with the following signals: C-Sell, S-Sell, I-Sell, F-Sell. We are currently invested at 100/G. Our allocation is now +0.17% on the year not including the day’s results. Here are the latest posted results:

| 12/18/15 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9041 | 16.9983 | 27.0266 | 34.6047 | 23.8359 |

| $ Change | 0.0009 | 0.0232 | -0.4891 | -0.4174 | -0.1818 |

| % Change day | +0.01% | +0.14% | -1.78% | -1.19% | -0.76% |

| % Change week | +0.04% | -0.35% | -0.31% | -0.34% | +0.81% |

| % Change month | +0.11% | -0.04% | -3.48% | -5.63% | -3.08% |

| % Change year | +1.97% | +1.17% | -0.51% | -4.66% | -1.58% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7042 | 23.0143 | 24.79 | 26.2382 | 14.8154 |

| $ Change | -0.0481 | -0.1513 | -0.2178 | -0.2670 | -0.1701 |

| % Change day | -0.27% | -0.65% | -0.87% | -1.01% | -1.14% |

| % Change week | +0.01% | +0.02% | +0.01% | +0.00% | +0.01% |

| % Change month | -0.66% | -1.75% | -2.40% | -2.84% | -3.23% |

| % Change year | +1.45% | +0.50% | -0.07% | -0.53% | -0.96% |