Good Afternoon,

The market ended its half day session flat today. The Dow moved up by the tiny increment of .003%, but that was a record. Shoot the fireworks and bring out the band (detect a note of sarcasm). 2014 has been marked by the bull market that everyone loves to hate. That is mostly because the action just doesn’t seem natural. That’s because it’s not. It has been a year of FED manipulation and algorithmic trading. Maybe I’m just complaining because it’s the worst year that I’ve ever had, but if it is the worst one that I ever have, then I will thank God for that. Not that it’s all that bad, but it’s the idea that we under-performed. I am accustomed to out-performing every year, as are most of the folks in my trading circle. With the exception of a precious few, they are in the same boat. So what can we learn from 2014? The buy-and-hold trading philosophy is now king? I don’t think so! I’m sure that we will talk about 2014 for years to come. After all is said and done, I know how to trade this market, but what I don’t know is if and how long the current market conditions will last. We head into 2015 with an extended market badly in need of a real correction. Sound familiar? It should because it’s the same thing we were saying last year. So how do we deal with it? Do we wait for a pullback? Do we chase extended stocks? Do we risk investing in bonds with an improving labor market that will most likely key interest rate increases? Just when you thought it was all over, it begins anew.

I’m not going to waste your time on Christmas Eve. However, I will mention a few things worth looking at in 2015. The dollar– will it continue to rise and put pressure on commodities? We are betting here that it will, but it is our position that both oil and precious metals will find a bottom in 2015. Our strategy is to to take advantage of those trends. The FED– will they increase interest rates? The last two labor reports have improved significantly and the GDP in the third quarter of 2014 came in at a vastly improved 5%. We are betting here that the FED will have no choice but to increase interest rates to battle inflation. Inflation has not been an issue up to now, as the slow world economy has kept it in check, but if it improves it will add even more pressure for the FED to act.

Our position is that the FED will increase rates sometime in the summer of 2015, which will have a detrimental effect on stocks and especially on bonds. Our choices in TSP are limited. Obviously, if both stocks and bonds drop at the same time, we will have no place to go but the G Fund. One bright spot could be the I Fund. If the foreign markets improve it could out perform. We will keep a close eye on our charts for trends in that Fund. As for AMP, we are already positioning our allocation to take advantage of these trends as we have nibbled in a few of the aforementioned areas. We will are prepared to increase those positions if the market trends in that direction. As far as TSP goes, we will stay involved in the US equity market as long as we can, using an even softer set of indicators. We feel that the dip buyers and algorithmic traders will keep doing what they are doing until they fail. The price of following them into this eventual downturn will be to give up an even larger portion of our gains when and if we are forced to sell. As I said, the main to factors to watch will be the FED and oil. When one or both of these change,you should be ready to react.

Day’s results: TSP held steady and AMP posted very small loss on the day.

Wall St. ends flat in short session, Dow ekes out record close

The day’s action left us with the following signals: C-Buy, S-Buy, I-Neutral, F-Neutral. We are currently invested at 100/G. Our allocation is now -3.31% on the year not including today’s results. Here are the latest posted results:

| 12/23/14 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6101 | 16.7109 | 27.4631 | 36.3221 | 24.5162 |

| $ Change | 0.0008 | -0.0646 | 0.0496 | 0.0655 | -0.0708 |

| % Change day | +0.01% | -0.39% | +0.18% | +0.18% | -0.29% |

| % Change week | +0.02% | -0.29% | +0.58% | +0.58% | +0.14% |

| % Change month | +0.14% | -0.34% | +0.85% | +1.06% | -2.95% |

| % Change year | +2.26% | +6.16% | +15.03% | +7.87% | -4.10% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.473 | 23.0001 | 24.9482 | 26.5507 | 15.0721 |

| $ Change | -0.0011 | 0.0007 | 0.0023 | 0.0046 | 0.0034 |

| % Change day | -0.01% | +0.00% | +0.01% | +0.02% | +0.02% |

| % Change week | +0.09% | +0.22% | +0.29% | +0.33% | +0.38% |

| % Change month | +0.09% | -0.06% | -0.10% | -0.11% | -0.19% |

| % Change year | +3.90% | +5.53% | +6.35% | +6.91% | +7.17% |

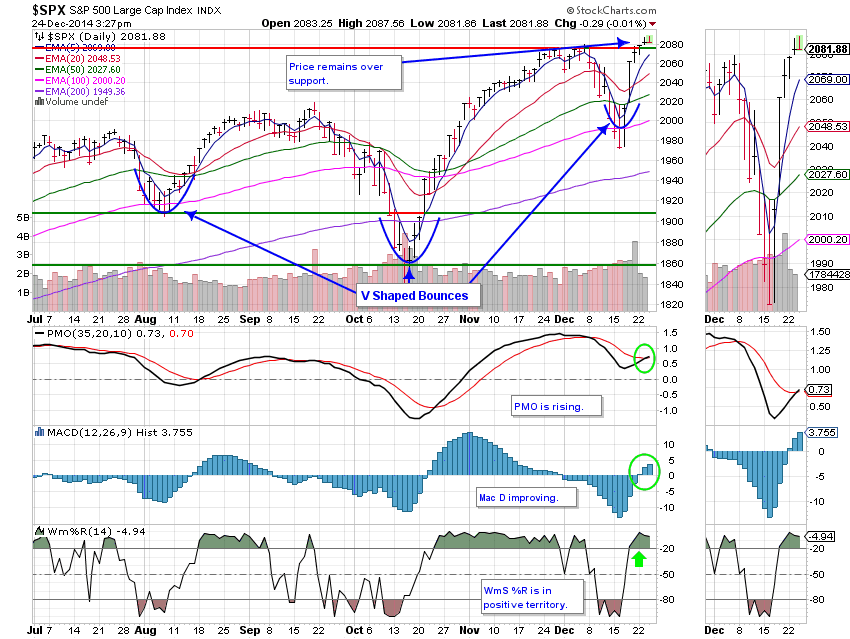

Here’s what the C Fund looked like today. (Chart Courtesy of Stockcharts.com)

I keep these charts annotated so I won’t make any additional comments tonight.