Good Evening, Our recent theme of so goes oil, so goes the market was accurate again today. Oil lost and so did stocks. Also adding to the downward pressure was more China weakness with the Chinese market dropping 2.6%.

The days trading left us with the following results. Our TSP allotment was steady in the G fund. For comparison, the Dow dropped -0.14%, the Nasdaq -0.15%, and the S&P 500 -0.22%. The S&P 500 turned negative on the year again today. Whether it will end the year that way is anybody’s guess…

Wall Street cedes ground as oil decline deepens

The days action left us with the following signals: C-Neutral, S-Neutral, I-Neutral, F-Sell. We are currently invested at 100/G. Our allocation is now +0.21% on the year not including the days results. Here are the latest posted results:

| 12/25/15 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.9093 | 16.9596 | 27.7831 | 35.6084 | 24.3272 |

| $ Change | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| % Change day | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change week | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change month | +0.14% | -0.27% | -0.78% | -2.89% | -1.08% |

| % Change year | +2.00% | +0.94% | +2.27% | -1.90% | +0.45% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.7991 | 23.3039 | 25.2052 | 26.7481 | 15.1407 |

| $ Change | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| % Change day | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change week | +0.00% | +0.00% | +0.00% | +0.00% | +0.00% |

| % Change month | -0.13% | -0.51% | -0.76% | -0.95% | -1.10% |

| % Change year | +2.00% | +1.77% | +1.61% | +1.40% | +1.22% |

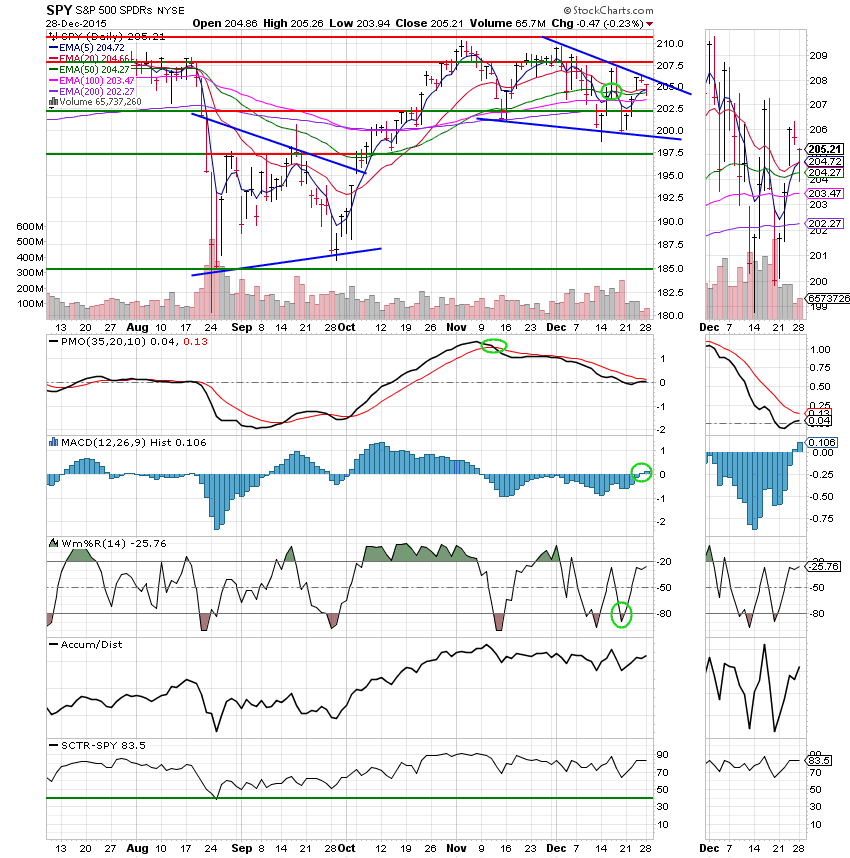

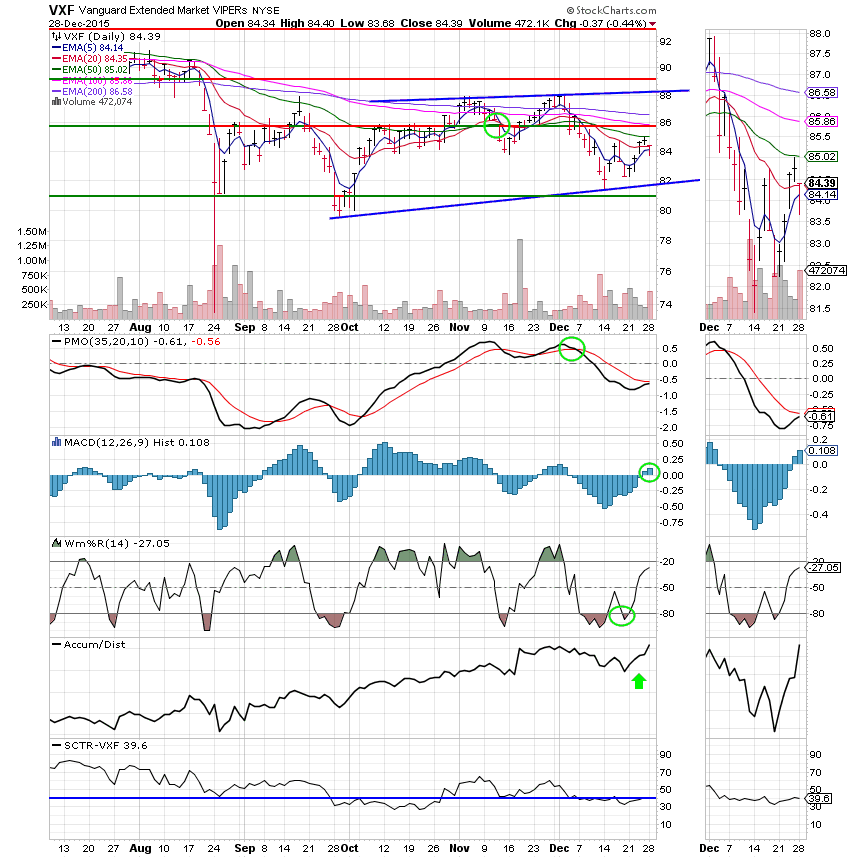

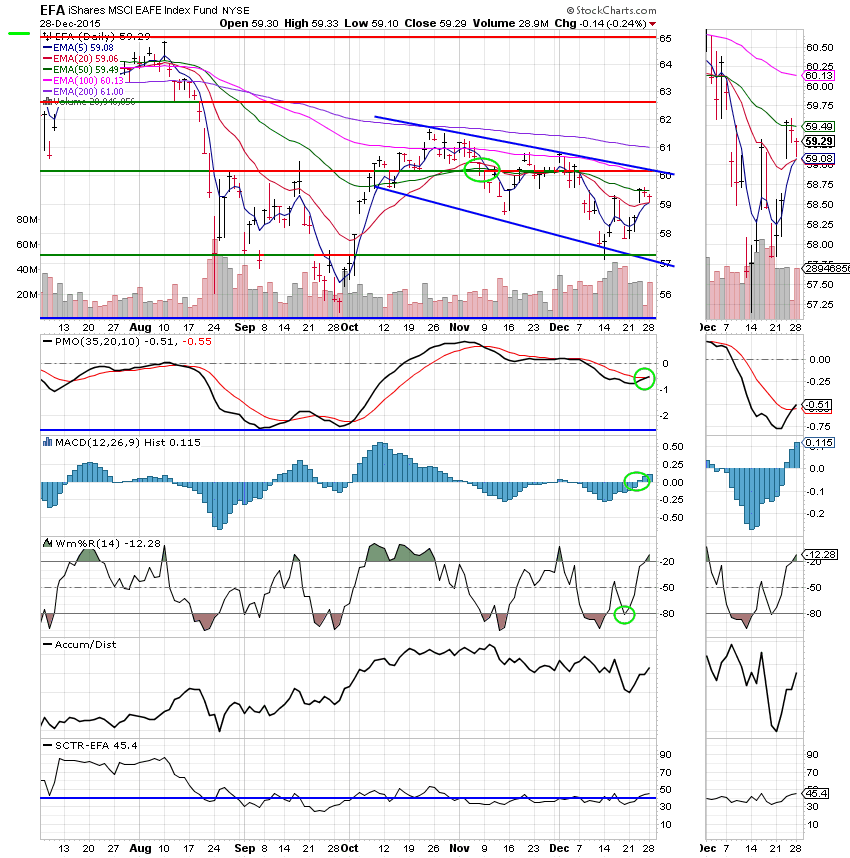

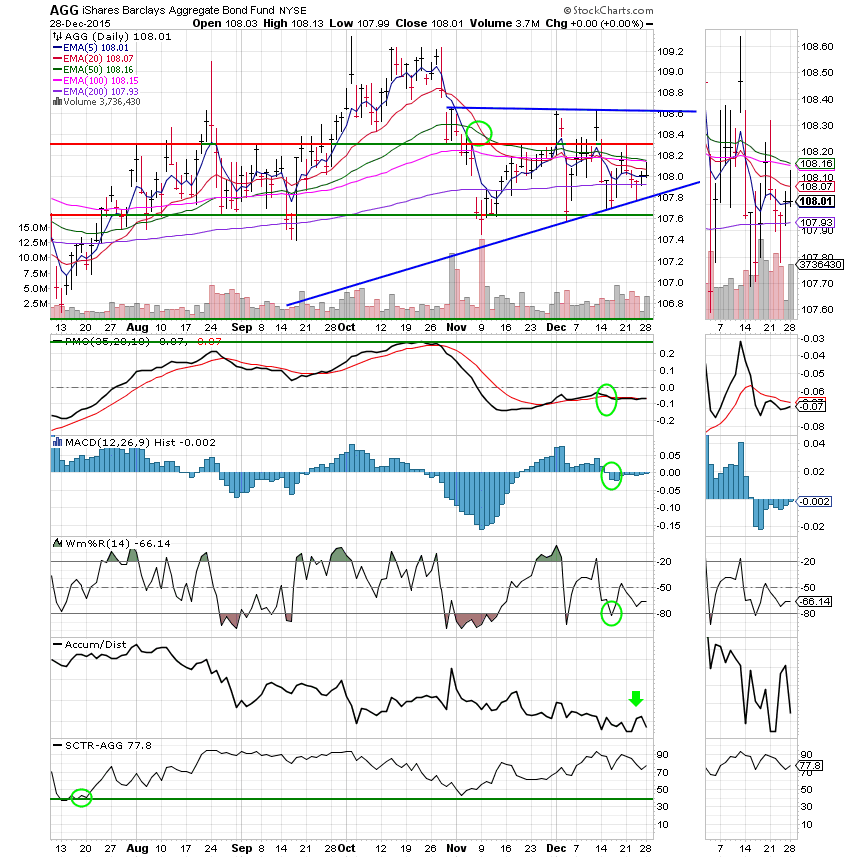

Lets take a look at the charts: (All signals annotated with Green Circles)

C Fund: The Accumulation/ Distribution line indicates that money is flowing back into the C Fund. A strong SCTR of 83.5 supports this case. However, low volume tells us to take any results with a grain of salt. That’s the reason we watch the charts. We’ll see!

S Fund: The S Fund moved to neutral with the MACD moving into a positive configuration. The ACC/Dist line tells us that money is flowing into the S Fund and that it may be getting primed for a run.

I Fund: The I Fund has also moved to neutral with the PMO and MACD moving into positive configurations. The Acc/Dist line tells us the money is moving here as well. A run could be in the cards as fuel builds up!

F Fund: The F Fund continues to trade sideways. However, the Accum/Dist line indicates that money is flowing out of this bond fund. So one has to ask how much longer can price maintain it’s position?

We are sitting on a very small return for the year, but that’s better than a loss. It has yet to be determined exactly where we finish in the pack. However, I’m inclined to take the gain for the year considering the recent volatility. Nevertheless, as usual we’ll pray and consult the charts for the final decision. That’s all for tonight. May God continue to bless your trades! Have a nice evening.