Good Evening,

The talking heads were at it again today, outlining their predictions for 2015. Some will be right and many will be wrong, but you know what? I don’t really care who’s right and who’s wrong. If you’ll go back and look at my messages from last year, I was dead on, almost to the percent for the S&P 500. I even predicted the choppy performance on the way. And what did it get me? The worst year I’ve ever had. Knowing what it is going to do and reacting to what it does when it happens are two different things and that’s why all today’s predictions are worthless. Entertaining yes, but worthless nonetheless. It really doesn’t matter where a stock or fund ends up at the end of the year if you were able to take advantage of the runs it had in between. It’s painfully obvious to myself and other active money managers that the V shaped bounces that we had in 2014 did not provide the entry points that we needed to get that job done, resulting in almost all of us under-performing. So…do you want to bet half your portfolio that we’ll have five more V shaped corrections in 2015? Not me. The best approach is to realize that the dip buyers and computers will keep doing the same thing as long as it works.You must have a burn limit in mind and stick to it. In other words, you must play the market looser, but remained disciplined while you do it. What do we look at to take cues as to what direction things might be heading as we navigate the troubled waters of 2015? We already talked about oil and interest rates so let me mention a third thing worthy of your attention: international markets. Specifically Europe. We talked about Mario Draghi and the ECB in a few recent letters as they killed our recent play in the I Fund. At the time, I mentioned that Draghi had put off his announcement concerning additional economic stimulus until sometime in January. That date is now January 21st and many analysts believe that it is possible that it may even be moved up from that date given the situation in Greece.

The Greek parliament was unable to elect a president so their constitution requires a flash election. The way I understand it, all the positions in parliament will be up for grabs and that is significant as the anti austerity party (Whatever their name is) may be swept into power and if they are, they will reject the austerity measures required to receive economic assistance from the ECU. If that happens, Greece will default on its debt. As you may remember, that was not very good for world markets, including ours, when it happened before.

Why did I mention that? This will put even more pressure on the Draghi and the ECB to announce more quantitative easing before this possibly destabilizing situation in Greece takes place. What you need to do is watch for that announcement and see how if effects the I fund. If significant additional European stimulus is announced that could create opportunities in international markets, especially emerging international markets. Bottom line, if this happens, we may be able to profit from it in both TSP and AMP.

The numbers for the day are as follows: The market as a whole was flat. The S&P 500 did manage a small gain for another record. TSP held steady again today and AMP was flat finishing at -0.068% on the day. In comparison, the Dow dropped -0.09%, the Nasdaq was dead even, and the S&P gained +0.09%.

Wall Street little changed but S&P hits record

| 12/26/14 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6125 | 16.7285 | 27.5512 | 36.6123 | 24.5964 |

| $ Change | 0.0016 | 0.0127 | 0.0908 | 0.1955 | -0.0030 |

| % Change day | +0.01% | +0.08% | +0.33% | +0.54% | -0.01% |

| % Change week | +0.04% | -0.19% | +0.90% | +1.38% | +0.47% |

| % Change month | +0.15% | -0.23% | +1.17% | +1.87% | -2.63% |

| % Change year | +2.28% | +6.27% | +15.40% | +8.74% | -3.79% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.49 | 23.0501 | 25.0184 | 26.6384 | 15.1277 |

| $ Change | 0.0119 | 0.0328 | 0.0461 | 0.0577 | 0.0360 |

| % Change day | +0.07% | +0.14% | +0.18% | +0.22% | +0.24% |

| % Change week | +0.19% | +0.44% | +0.57% | +0.66% | +0.75% |

| % Change month | +0.18% | +0.15% | +0.18% | +0.22% | +0.18% |

| % Change year | +4.00% | +5.76% | +6.65% | +7.27% | +7.57% |

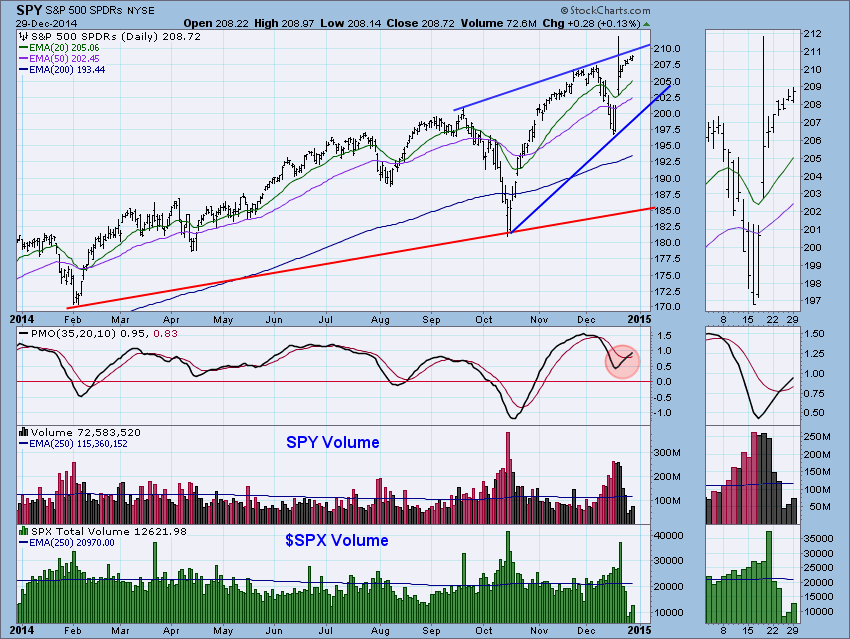

Conclusion: Market action is still characteristic of holiday trading, small movement and even smaller volume numbers. I would expect to see more ‘dull’ and neutral trading through the end of this holiday week. After that, when everyone is back from vacation, we could then see that shorter-term pullback within the intermediate-term rising trend.