Good Evening, I hate to sound like a broken record, but crude fell today and so did the market. Crude fell after a report indicated an increase held in storage facilities in the US. Also, effecting trading was a lot of last minute tax selling and repositioning. Adding to that was the tendency of many money managers to just raise cash this time of year. They love to start the new year with a clean slate. I never understood why they’d sell a good position to do that. It must be some type of psychological thing…..

The days trading left us with the following results. Our TSP allotment was steady in the G Fund. Conversely, the Dow gave up -0.66%, the Nasdaq -0.82%, and the S&P 500 -0.72%. It’s been a crazy year and I don’t expect any improvements in 2016.

The days selling left us with the following signals: C-Buy, S-Neutral, I-Neutral, F-Sell. We are currently invested at 100/G. Our allocation is now +0.24% for the year not including the days results. Here are the latest posted results:

| 12/29/15 |

|

|

|

Prior Prices |

| Fund |

G Fund |

F Fund |

C Fund |

S Fund |

I Fund |

| Price |

14.9137 |

16.915 |

28.0236 |

35.8047 |

24.4757 |

| $ Change |

0.0009 |

-0.0649 |

0.3006 |

0.3422 |

0.1941 |

| % Change day |

+0.01% |

-0.38% |

+1.08% |

+0.96% |

+0.80% |

| % Change week |

+0.03% |

-0.26% |

+0.87% |

+0.55% |

+0.61% |

| % Change month |

+0.17% |

-0.53% |

+0.08% |

-2.36% |

-0.48% |

| % Change year |

+2.03% |

+0.67% |

+3.16% |

-1.35% |

+1.06% |

| |

L INC |

L 2020 |

L 2030 |

L 2040 |

L 2050 |

| Price |

17.827 |

23.3871 |

25.3226 |

26.8905 |

15.2319 |

| $ Change |

0.0320 |

0.1060 |

0.1535 |

0.1890 |

0.1218 |

| % Change day |

+0.18% |

+0.46% |

+0.61% |

+0.71% |

+0.81% |

| % Change week |

+0.16% |

+0.36% |

+0.47% |

+0.53% |

+0.60% |

| % Change month |

+0.03% |

-0.16% |

-0.30% |

-0.43% |

-0.50% |

| % Change year |

+2.16% |

+2.13% |

+2.08% |

+1.94% |

+1.83% |

Lets take a look at the charts: (All signals annotated with Green Circles)

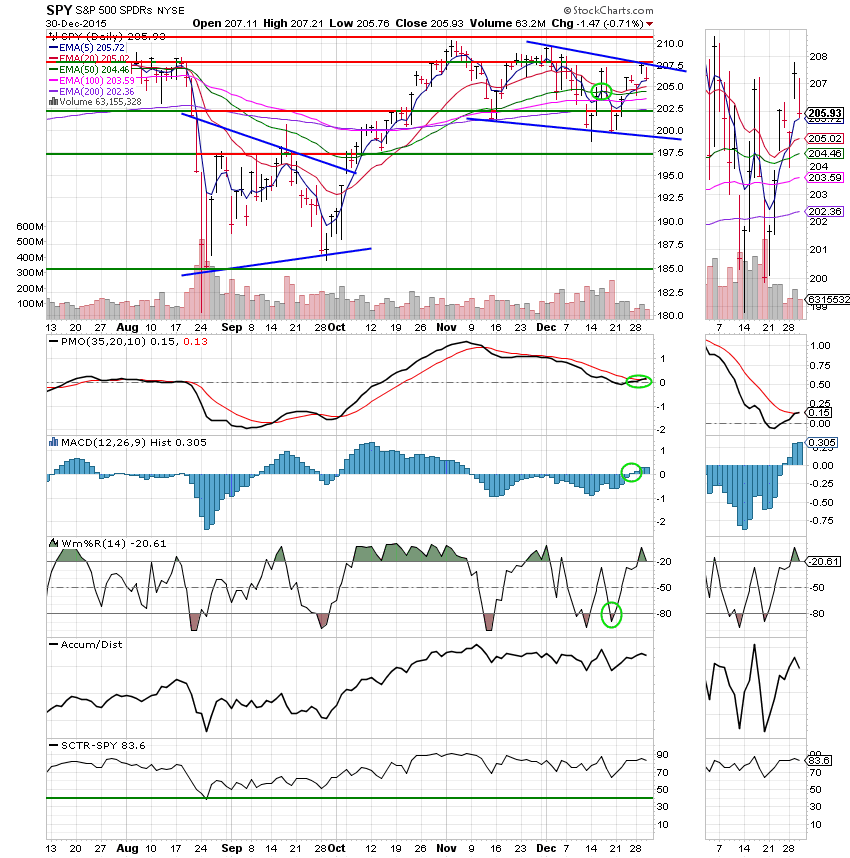

C Fund: This ones still a buy, but price has developed a slight descending channel. The Acc/Dist line indicates that a lot of money is still flowing into stocks and the SCTR remains good at 83.6.

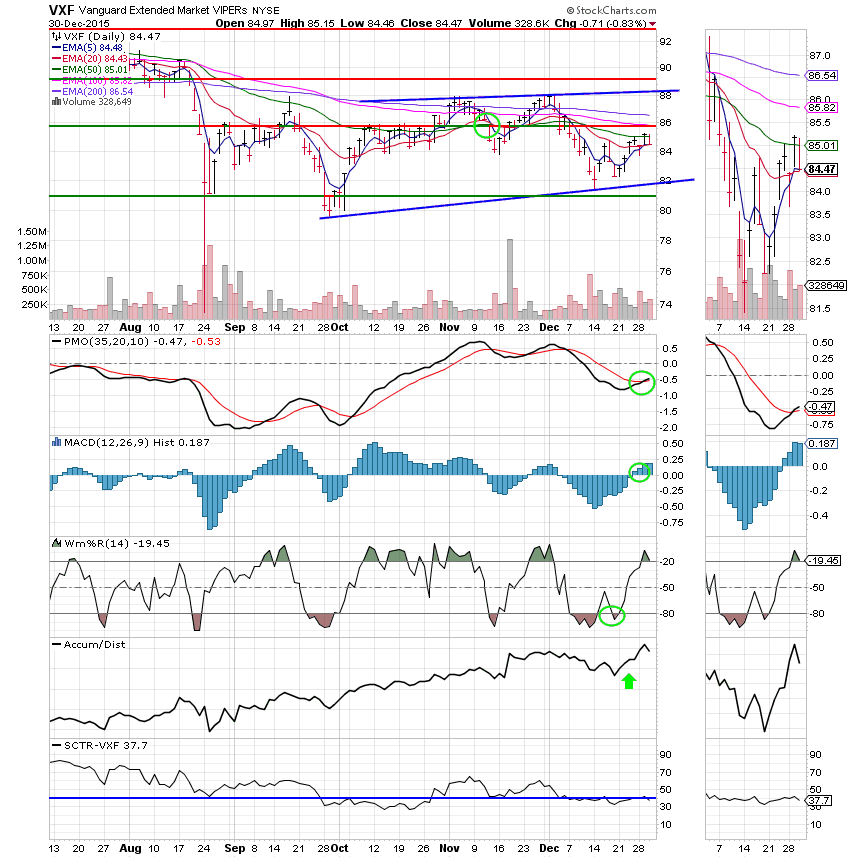

S Fund: This fund still has a lot of money flowing into it as well. As long as that’s the case it’s capable of a run. However, it has a lot of resistance to overcome starting at the 20 EMA.

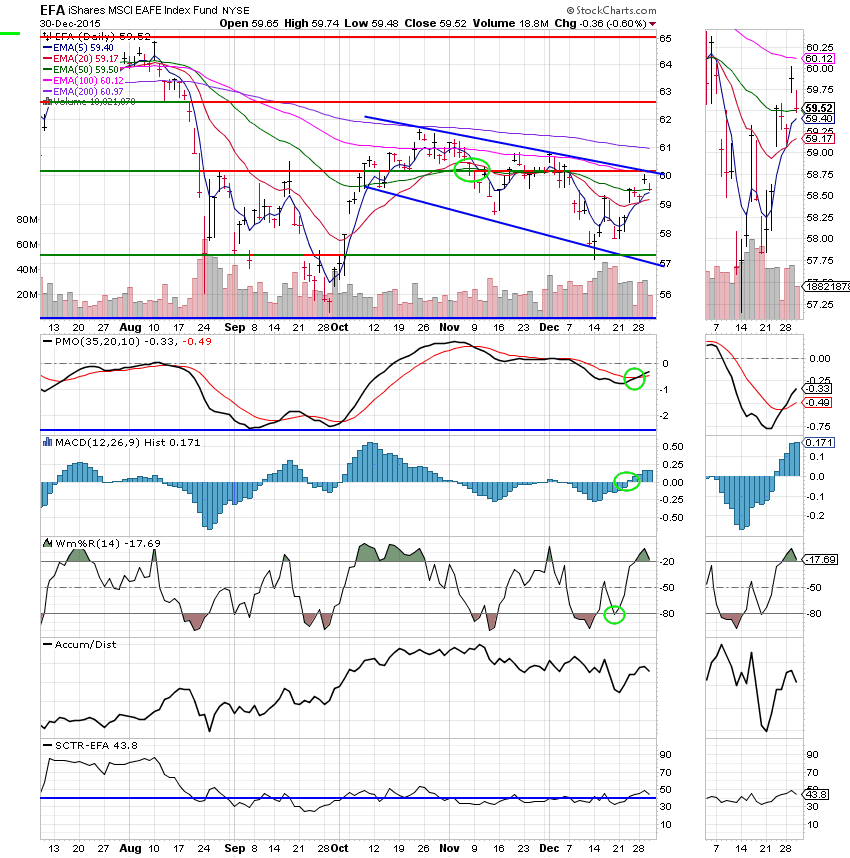

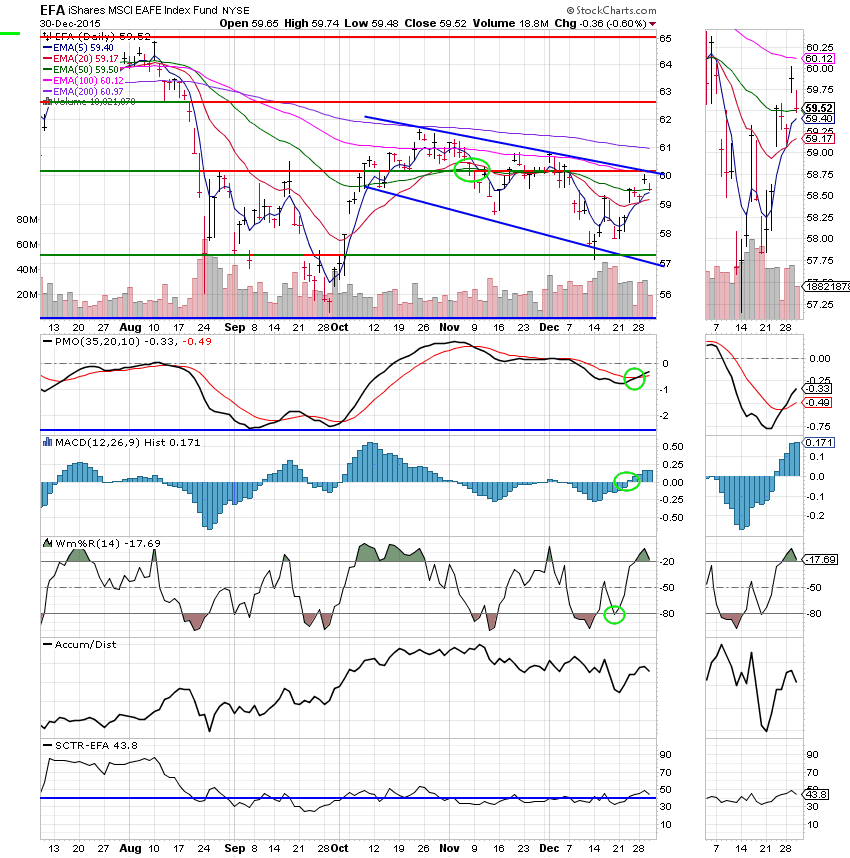

I Fund: This ones entrenched in a descending channel and will have to break the upper trend line before it can go anywhere. The Acc/Dist line is not as convincing as it is on the charts for the C and S Funds. Although, it does indicate that money is still flowing this way.

F Fund: The F Fund is trading in a range from approximately 108.3 to 107.6. It is currently testing the bottom of that range and I expect that it will break out to the down side as the Accum/Dist line indicates heavy selling of this fund. The SCTR remains respectable at 69.4, but that is more a function of how poor the sector is than how well this fund is performing. In other words, you can’t trust it! Still a sell here!

We’re sitting tight in the G Fund for now. There is likely to be more selling before the end of the year so we’ll take our small gain to the door and take a close look at our charts when everyone returns to work. Have a happy and safe new year holiday and may God bless you and yours in 2016!

God bless, Scott

***Just a reminder that you can review the performance of our allocation at the Web Site TSPTALK.com in the autotracker section under the screen name KyFan1.

I produce and publish this blog as both a ministry and for the benefit of any Federal Government Employee. This is done to offer you some guidance as to how to approach your retirement more financially successful. When it is time for you to retire, I recommend you utilize the services of a Professional Money Manager, who works with a reputable investment firm. He understands the guidance you have already received and he can manage your savings assets utilizing a more advanced investment program into the future.

If you would like to receive more information about this introduction, please feel free to contact me at KyFan1@aol.com.