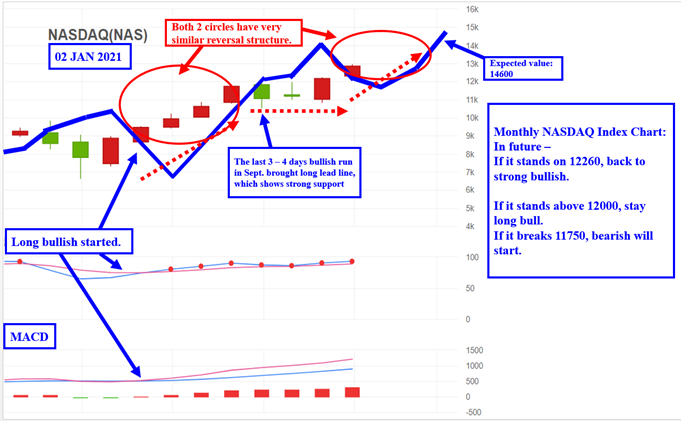

Both 2 red circles have very similar bullish structures.

Above is the Weekly NASDAQ Index Chart:

In future –

If it stands on 12450 + 12025, the trend is very strong.

If it stands on 11460 + 11050, the weekly line is still bullish.

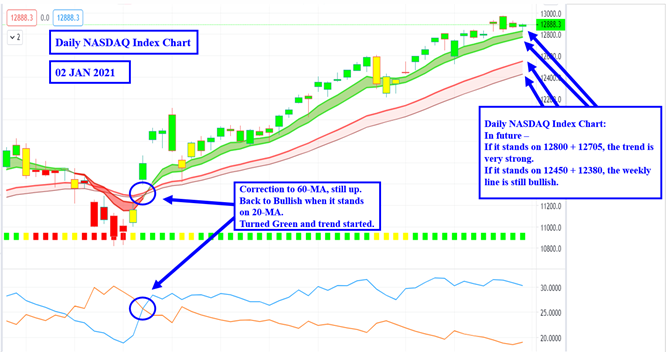

Above is the Daily NASDAQ Index Chart:

In future –

If it stands on 12800 + 12705, the trend is very strong.

If it stands on 12450 + 12380, the weekly line is still bullish.

Have a nice day, Wayne