Good Morning, I decided to go ahead and get this blog out of the way because there is so much turmoil in the market this morning. Wow, what a week it was. It seems like a month passed by. It was just a little over a week ago when the market was flying high and our charts generated sell signals to get out. I issued the alert and then made the move myself. At the time I had more than few folks make negative comments about me doing so. It was our first real test of the new “post pandemic” system and I have to admit after the past two years that I was beginning to doubt if we’d ever get it right again, but I know that doubt does not come from God so I kept the faith. I just needed to see the system perform the way it had in back testing. I know our strategy of buying and selling the trends is solid as I’ve used it for almost my entire career. All we needed was a system to identify the trends as our old system had done in the past. You see there are two things you need to be successful in this business. A strategy and a system to execute that strategy. Our strategy is one of shorting the negative trend and riding the positive trends higher. The combination of both in our experience has given us the highest returns. Again, I will make one brief statement. There are many strategies that will make money. For example as much as I dislike it, buy and hold is a strategy that will make you money. However, in the long run it will never make as much as investing with the trend. There are many different systems of buying and holding. Some are based on fundamentals and some are based on technical analysis. For the most part they stay in the market at all times and adjust their allocations to match current market conditions mostly based on fundamentals but occasionally based in technical analysis. I have two reasons for saying this, actually three. First, you should never say the other folks don’t make money because most of them do. Second, you should do what you are most comfortable with. You should select your strategy and system to best match your time, temperament (risk tolerance/patience), and ability. Each of these characteristics are what make your approach to investing different and unique. This is because most of them are based on your individual needs. So the bottom line is there is no one system that fits all. You must determine what is best for you in your situation and ultimately, you are the only one that can determine that.

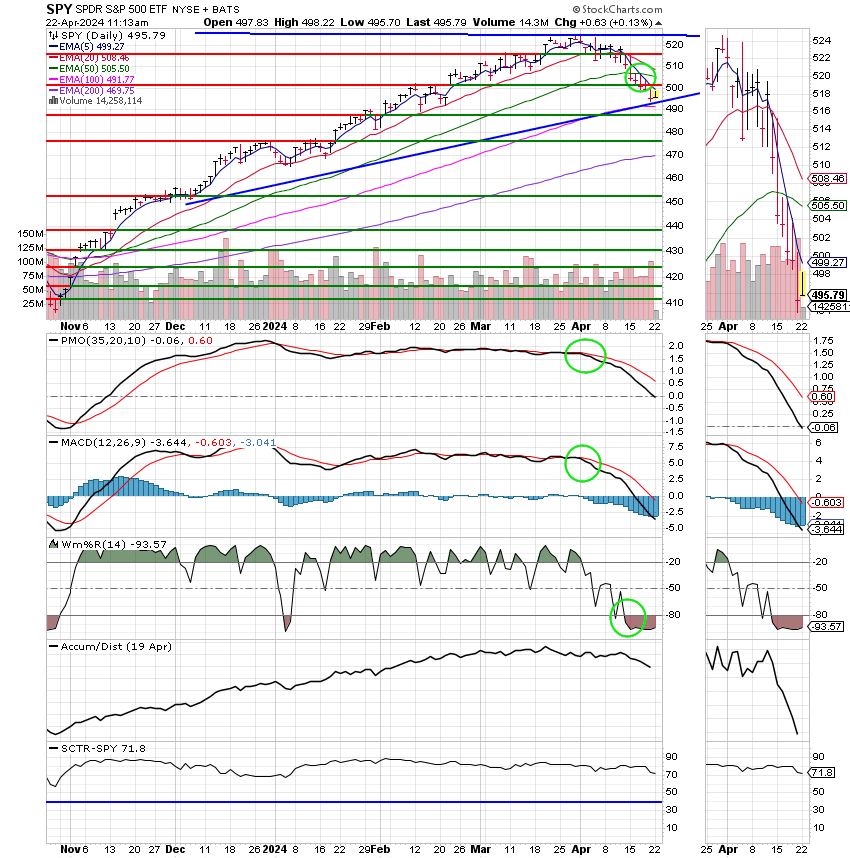

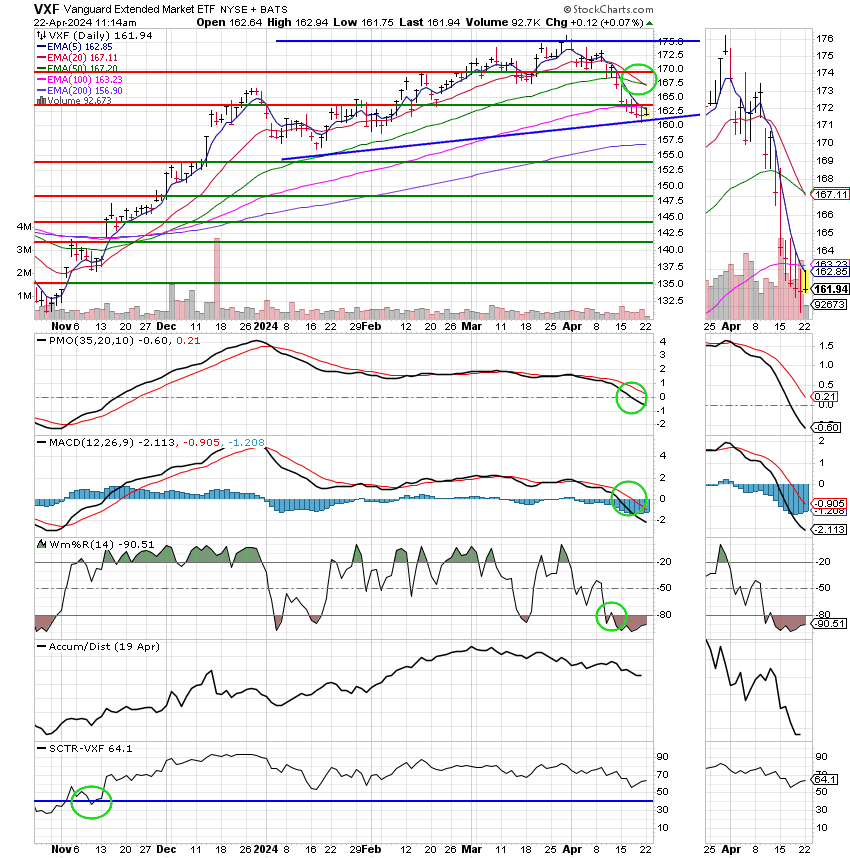

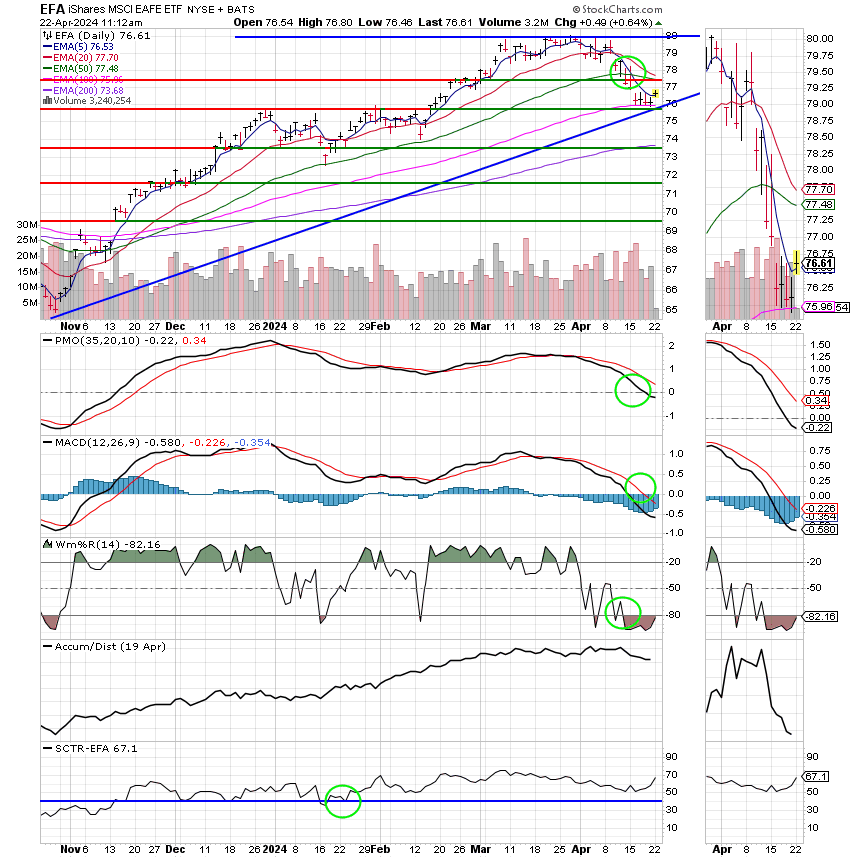

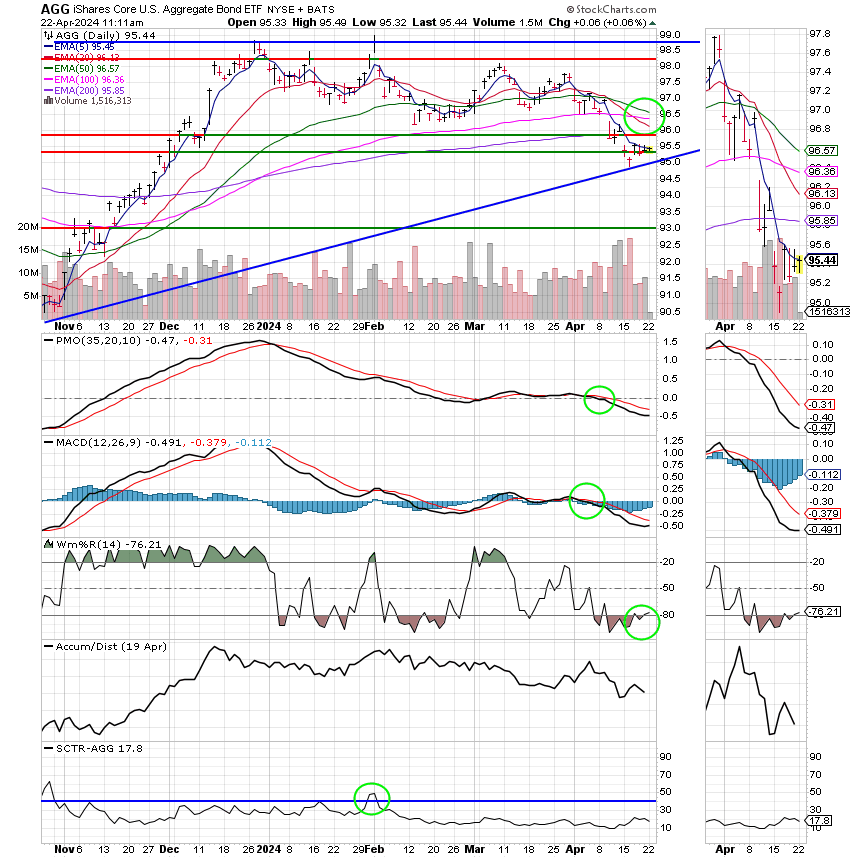

So getting back to to this morning. We find the market bouncing and a lot investors asking questions. Of course the big one always is “Is this the bottom”. My answer is always the same. Every bottom starts with a bounce. You need to watch the charts to see if it’s the real deal or not. Until you see a confirmed up trend you must assume that it’s a dead cat bounce and going nowhere. Right now the trend is moving lower and the rule is that we can’t trust any bounces until we see the major indices set some higher highs and higher lows. As is our custom, we will look to the major market altering events and watch our charts closely before, during, and after each one to determine how they effect the trend. Right now we have four things going on. We have continued earnings reports, we have the GDP report on Thursday, we have the PCE report in Friday and the big bombshell which is the Fed meeting next week. My expectation is that these events will continue to put up headwinds for the market and that it will continue in it’s current trading range with a slightly negative bias. Looking forward the next really major market moving event beyond those will the June Fed meeting. It is my expectation that the Fed will not decrease interest rates at that time due to persistent inflation. Even though a lot of market pundits are saying this is priced in, I do not believe that is the case and it is my expectation that the market will be disappointed and sell off. That’s my best guess at this time, but you just never know for sure. That is the reason my friends that we have charts…..

The days trading so far has generated the following results. Our TSP allotment is steady in the G Fund. For comparison, the Dow is trading higher at +0.14%, the Nasdaq +0.25%, and the S&P 500 +0,19%. The market had been trading higher at the beginning of the session. My bet is that is stays positive on the day.

S&P 500 rises to start the week, tries to snap 6-day decline: Live updates

Recent action has left us with the following signals: C-Sell, S-Sell, I-Sell, F-Sell. That only leaves one place to be which is where we are. We are currently invested at 100/G. Our allocation is now +3.88% for the year. Here are the latest posted results:

| 04/19/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.1925 | 18.642 | 77.7675 | 76.0678 | 40.5384 |

| $ Change | 0.0021 | 0.0235 | -0.6835 | -0.0474 | -0.1313 |

| % Change day | +0.01% | +0.13% | -0.87% | -0.06% | -0.32% |

| % Change week | +0.08% | -0.61% | -3.04% | -3.19% | -1.74% |

| % Change month | +0.22% | -2.30% | -5.40% | -7.72% | -4.78% |

| % Change year | +1.28% | -3.02% | +4.58% | -1.33% | +0.89% |