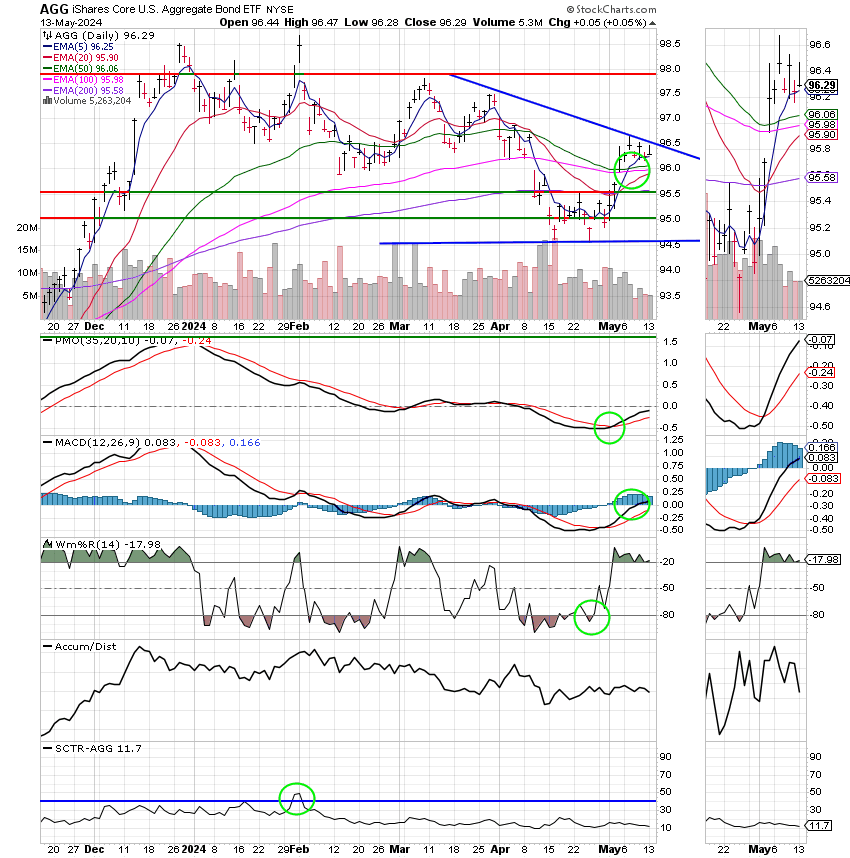

Good Afternoon, The theme we’ve been discussing in our recent blogs has been pretty spot on. Sticky inflation and speculation over what the Fed will do about it has kept the market trading mostly sideways. There really hasn’t been a lot to gain unless you are a short term trader and if you are you better be on your toes because there is definitely a lot of short term give and take in the current market. It should also be noted that we are entering a slower season for stocks. While I don’t make investment decisions based on seasonality, I do take note of where we are on the calendar with consideration to my expectations. As I said in a recent blog, I do not think there is a lot of money to be made right now. Nonetheless, as long as the trend is higher even if it’s just a little higher, I’m all in. I’ll take what the market gives me as long as the risk is not too high. Looking at the rest of the week, we have the CPI (Consumer Price Index and the PPI (Producer Price Index) coming up. The CPI is due out on Wednesday and the PPI will be released tomorrow. Both reports are watched closely by the Fed and as a result are market movers. We should expect some selling if the reports come in hot. Investors are clearly concerned with the sticky inflation. Two weeks ago or at least I think if was two weeks ago we discussed stagflation. Right now the market has clear expectations of a soft landing for the economy as the Fed fights inflation. However, the longer that inflation sticks around the more that goldilocks scenario is threatened and the odds of a less favorable recession or stagflation increase. My contention has and continues to be that the economy is too strong for a recession and there is virtually no chance of one taking place, but on the other hand, the chances of us experiencing some stagflation are much higher. A lot of folks scoffed at the idea of stagflation when I mentioned it the first time. By the matter of fact there were a lot of folks back in the 60’s that said one couldn’t even take place. That it was impossible. That was until the 1970’s and 1980’s which saw extended bouts of of stagflation. Stagflation is a combination of high inflation and a slowing economy. It makes it hard for the Fed to control inflation by raising interest rates because of the slowing economy and it can have devastating effects. I’m going to date myself now. When I graduated from college back in the stone ages (1980) unemployment was well over 14% and interest rates where close to 20%. That’s right 20%! That’s not a typo. The high interest rates where a result of the Fed increasing rates to control inflation. Here’s how it took place, A spike in oil prices from the Arab oil embargo in the US and other countries that supported Israel in the 1973 Yom Kippur War raised the cost of living dramatically. But when the Federal Reserve tried to ease inflation by raising interest rates, the economy fell into recession. With the exception of a few months , the unemployment rate stayed above above 6% from 1974 to 198 7, peaking at 14,5% in April 1980. Over the same time frame, inflation stayed above 5% peaking in 1980 at 14.6% and to think they are complaining about 3% inflation and 5% interest rates now. Give me a break. At the time I didn’t know much about economics and couldn’t figure out why I couldn’t just go out and get a job with a college degree. How naive we were. So why am I talking about this again? Last weeks hot unemployment report saw unemployment rise significantly. While unemployment is still low by the aforementioned standards it did increase and inflation is still around. So what is it the new generation says when they offer a controversial opinion……. ah yes I remember………Just saying! Works for me. I don’t know about you but I’m going to keep praying that inflation will go down. Don’t ever forget, the Fed is data dependent and if the data forces them to move in a certain direction then they really have no choice because when your dealing with stagflation you have to pick your poison and whatever you do is going to hurt. Yep, keep praying!!

The days trading left us with the following results: Our TSP allotment posted a gain of +0.12%. For comparison, the Dow slipped -0.18%, the Nasdaq gained +0.29%, and the S&P 500 was flat at +0.01%.

Dow slips for first losing day in nine as consumers’ expectations for inflation rise: Live updates

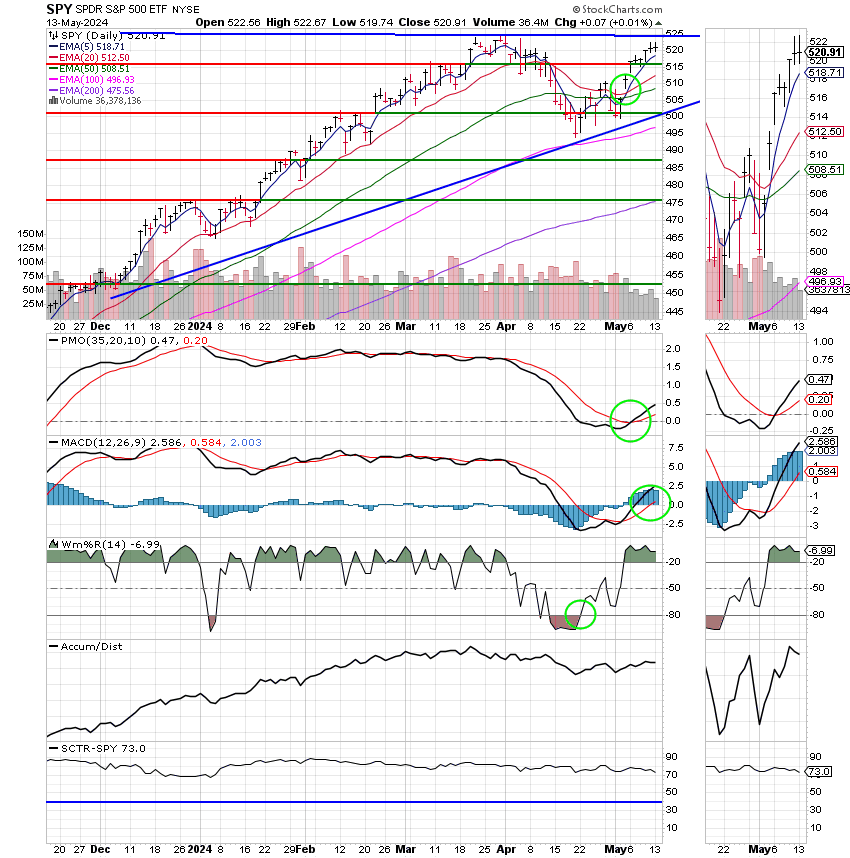

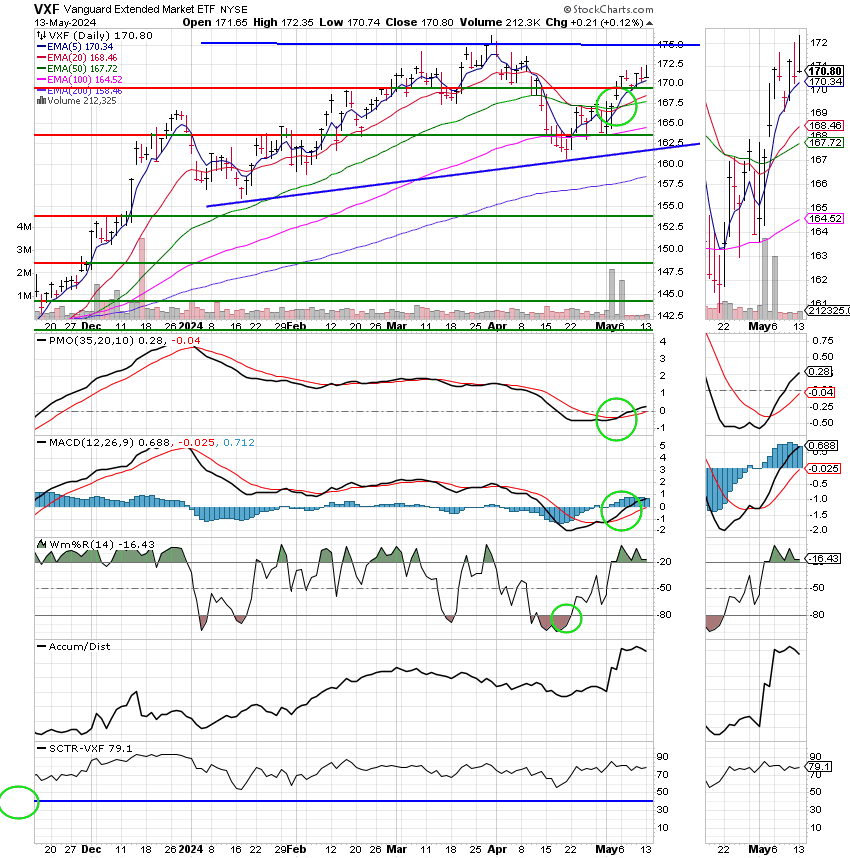

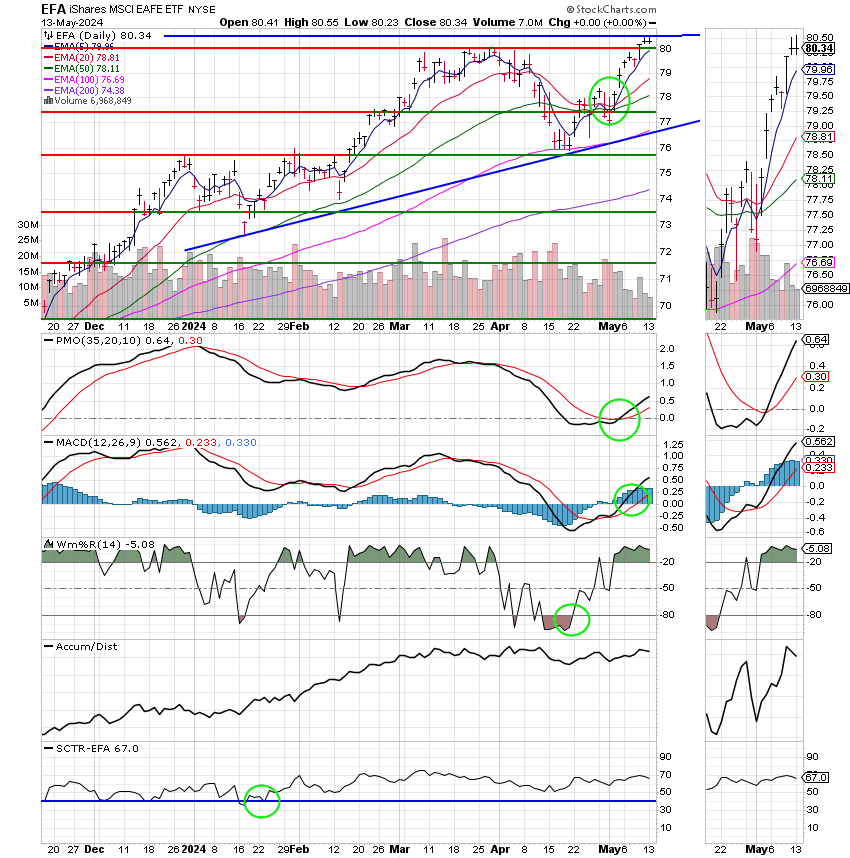

The days action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are invested at 100/S. Our allocation is +5.42% not including the days results. Here are the latest posted results:

| 05/10/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.2396 | 18.8621 | 81.8181 | 80.2546 | 42.7851 |

| $ Change | 0.0024 | -0.0424 | 0.1471 | -0.2589 | 0.1341 |

| % Change day | +0.01% | -0.22% | +0.18% | -0.32% | +0.31% |

| % Change week | +0.09% | +0.10% | +1.89% | +1.32% | +1.58% |

| % Change month | +0.13% | +1.36% | +3.76% | +4.08% | +3.79% |

| % Change year | +1.54% | -1.88% | +10.02% | +4.10% | +6.48% |