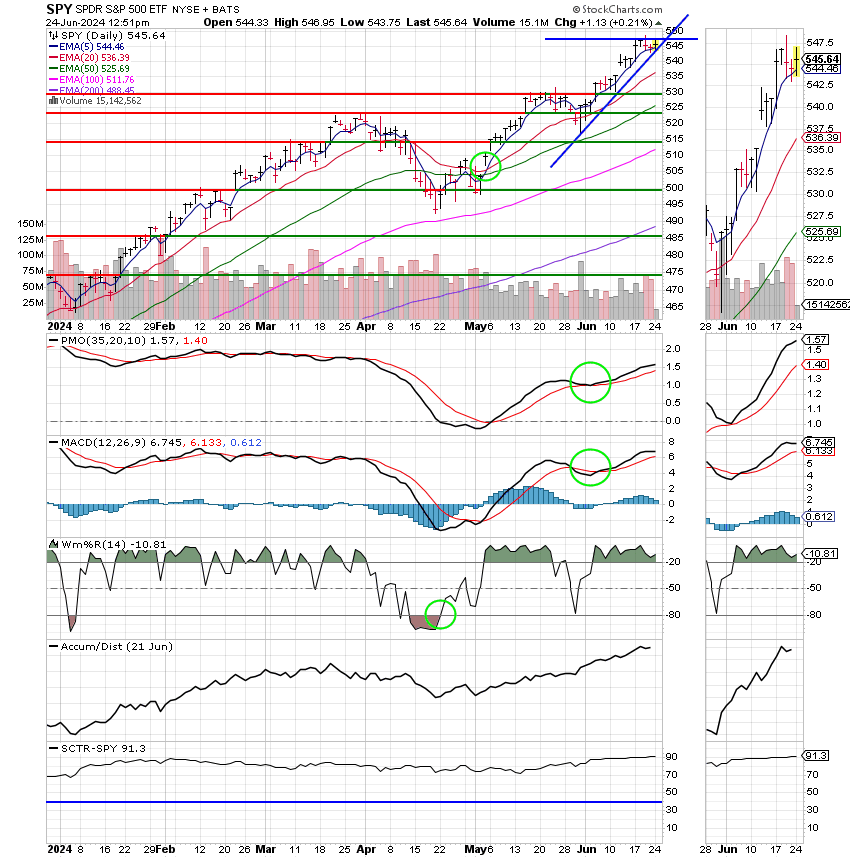

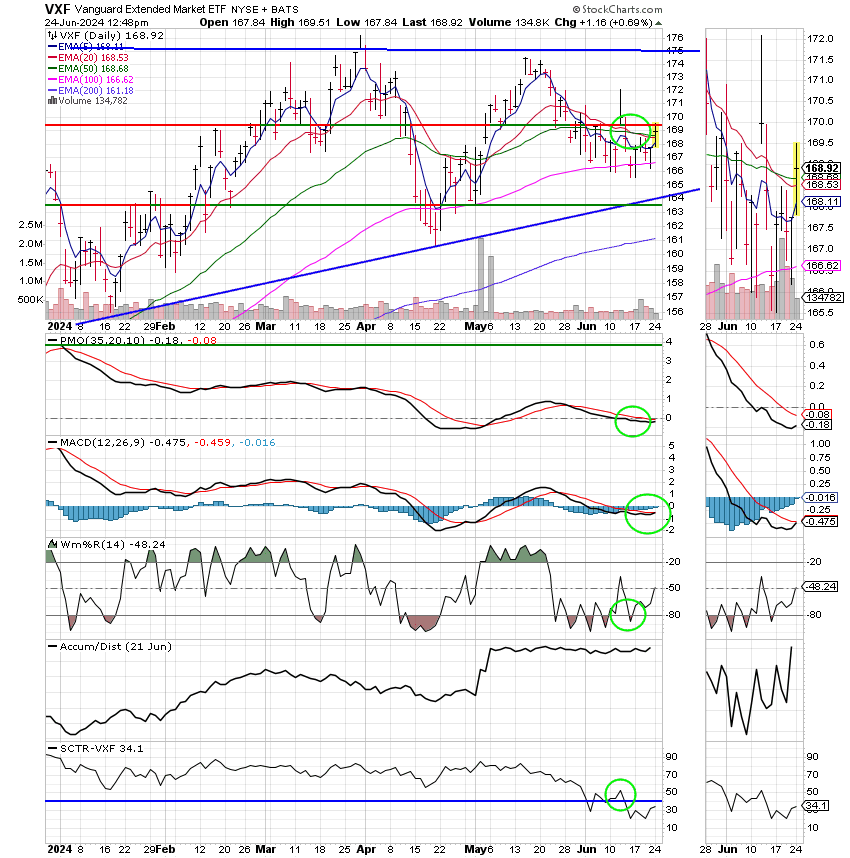

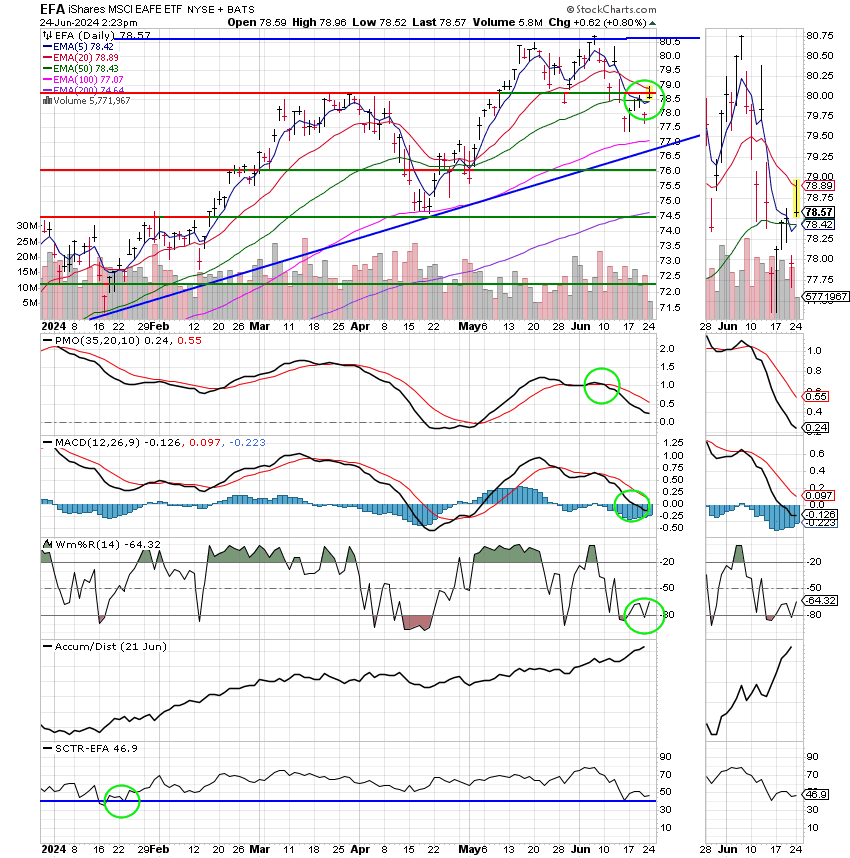

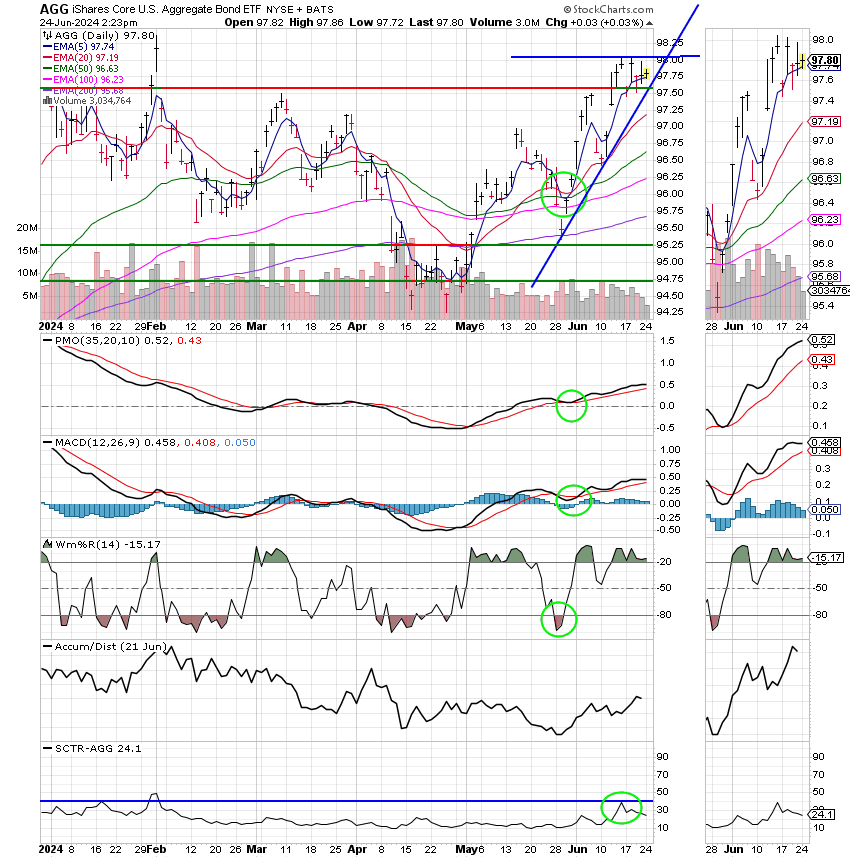

Good Afternoon, We’re now entering the dog days of summer which usually means that nothing big happens with stocks. I’m not sure that’s entirely the case this year as the market grapples with sticky inflation. Everything ultimately comes back to Fed Policy. It’s all about interest rates and how tight the money supply is. We’ve talked about that until we’re blue in the face though. So we’ll say you need to remain aware of it and move on. The move higher in stocks this year has been largely fueled by Artificial intelligence and anything related to it. Stocks like Nvidia, Microsoft, Apple, and Alphabet have pulled the major indices higher as a result. Their extremely large market capitalization has given them a heavy influence 0ver the market as a whole. This week finds those stocks struggling just a little as investors are taking some money out of the sector and deploying into areas that have been struggling in recent months such as banks and industrials. This rotation should be considered healthy as it broadens support for the current uptrend. The question is will the S&P 500 pull back or not? Up to now it has continued to move higher even while the rest of the market struggled with some sectors even falling back. So what will happen now? Looking at the action today as I noted above money appears to be rotating into several recently neglected sectors. This should bring small and mid cap stocks back into play putting a bid under the S Fund and moving it higher. If this buying continues the S Fund should out perform the C Fund over the short term. This will provide us with a good opportunity to get back into equities while they are moving higher. Should the trend continue into the fall we will watch for a rotation back into the AI related mega cap growth areas. If that rotation takes place as we anticipate we will move back into the C Fund at that time. At least that’s the plan. We will also keep a close eye on the I Fund as it is affected by the value of the dollar. We do not anticipate it outperforming the other thrift funds at this time but we could always be wrong. That’s the reason we watch the charts. So that’s our plan and it’s always good to have one even if you don’t always get to follow it.

The days trading so far has left us with the following results: Our TSP allotment is steady in the G Fund. For comparison, the Dow is currently up +0.63%, the Nasdaq is off -0.74%, and the S&P 500 is lower at -0.13%. It appears that the rotation is underway, at least for today anyway.

Dow jumps 300 points as investors rotate out of hot chip stocks like Nvidia: Live updates

Recent trading has generated the following signals: C-Buy, S-Sell, I-Sell, F-Buy. We are currently invested at 100/G. Our allocation is now +5.49% for the year not including the days results. Here are the latest posted results:

| 06/21/24 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.3391 | 19.225 | 85.7734 | 78.8804 | 42.3603 |

| $ Change | 0.0023 | 0.0040 | -0.1302 | 0.1954 | -0.2897 |

| % Change day | +0.01% | +0.02% | -0.15% | +0.25% | -0.68% |

| % Change week | +0.09% | -0.15% | +0.63% | +0.80% | +0.15% |

| % Change month | +0.27% | +1.60% | +3.64% | -1.03% | -2.01% |

| % Change year | +2.09% | +0.01% | +15.34% | +2.32% | +5.42% |