Good Morning, This morning finds us with a new President and a new direction at least as far as business is concerned. Whether, you like President Trump or not is irrelevant. If you are investing, the important thing is what the market thinks of him. I have made more money under some presidents and less under others, but I’ve managed to make at least something under all 0f them. What you have to look at are the changes to policy here and now and how they compare to the last administration. So what is changing this time around? Everything. The last administration was one of the most restrictive that I have seen in all my years of investing. They regulated or attempted to regulate just about everything and business doesn’t like regulation. Their imprint in the market was visible in everything from taxes and energy to the environment and in between. The incoming administration is about relaxing these things. It is about creating a more business friendly environment and that should be no surprise as it is largely driven by businessmen. There is a difference between having an economy and having a free economy. Don’t get me wrong, there are some regulations that are necessary to be sure, but the less they restrict the free movement of business the more money we will all make. So far the market likes what is sees. Today, the focus was on tariffs. Investors are pleased so far that President Trump is taking a measured approach to Tariffs rather than putting them on everything automatically as they had feared initially that he might do. We will see how that goes, but so far so good. The second big elephant in the room right now is energy. So goes energy, so goes the economy and so goes the economy so goes the market. The cost of energy effects everything but most importantly is effects transportation which effects the cost of everything we buy. If the cost of energy goes down, the price of goods goes down, then inflation goes down. It seems simple because it is. There have been many politicians in recent years that have lost sight of this fact. They are so consumed with trying to save the environment that they have lost sight of the big picture (or they just don’t care which is probably closer to the truth). They have lost sight of the forest for looking at the trees. I’m not here to debate climate change. I can, but I won’t for the sake of time. What I will say is that our efforts alone will not change anything. It takes all the nations of the world to do that. It doesn’t do us any good the create clean air here when dirty air drifts in from our neighbors and how much can we change carbon emissions when there are huge industrial nations that power most of their industry with fossil fuels. So we do all that stuff while nobody else does. Meanwhile, they take advantage of lower energy costs and eat our lunch in trade. Yes it’s all about energy!!! Can carbon emissions be decreased. Yes they can. That is…… when everyone reduces them. The United States cannot do it alone and when we attempt to do it alone our energy costs rise and when our energy costs rise inflation rises. Sure, there are other factors that effect this to a small degree but none of them override the cost of energy. The US cannot compete on the world stage when we impose restrictions on our self that the rest of the world does not or will not follow. Folks, the United states is the Saudi Arabia of Oil and Gas and it is the intent of the new administration to unleash this potential through less restrictions on this industry! If they are successful there is nothing but good things ahead for our economy. They absolutely got it right!

Todays trading so far has produced the following results: Our TSP allotment is trading higher at +1.41%. For comparison, the Dow is adding +0.98%, the Nasdaq +0.18%, and the S&P 500 +0.52%. Praise God for another good day!

Dow rises as investors feel Trump’s tone on tariffs is softer than feared: Live updates

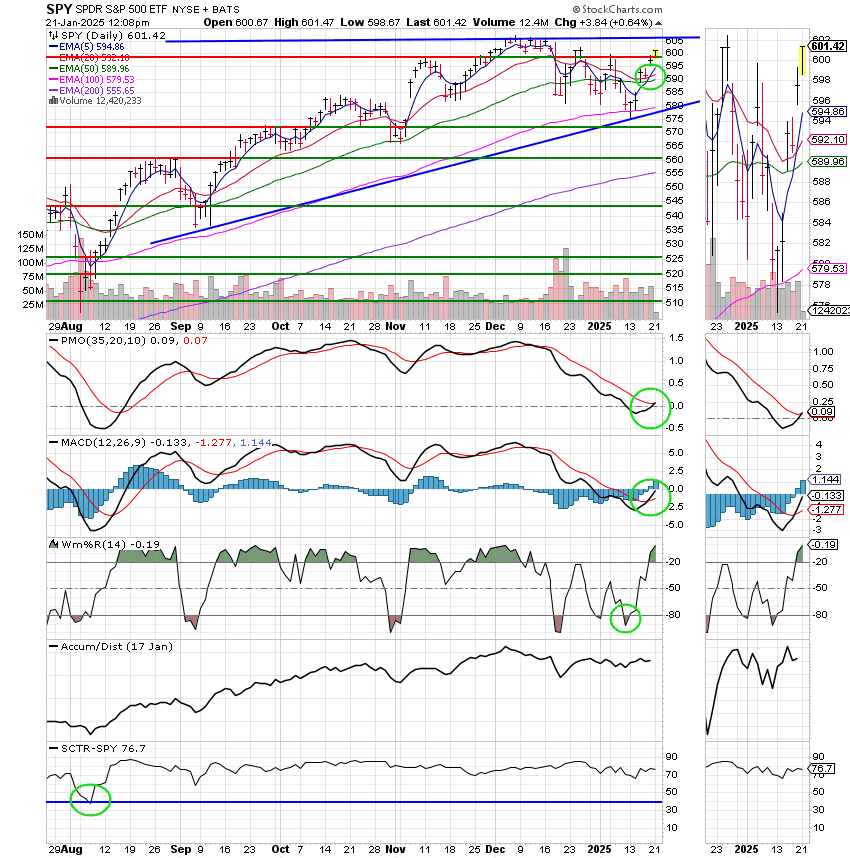

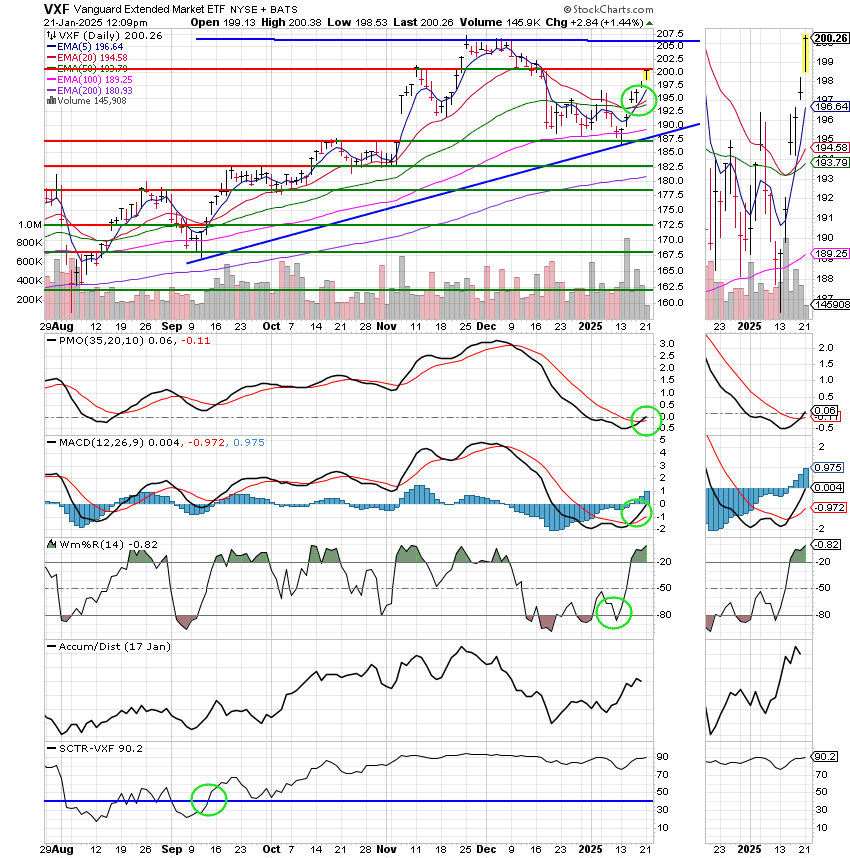

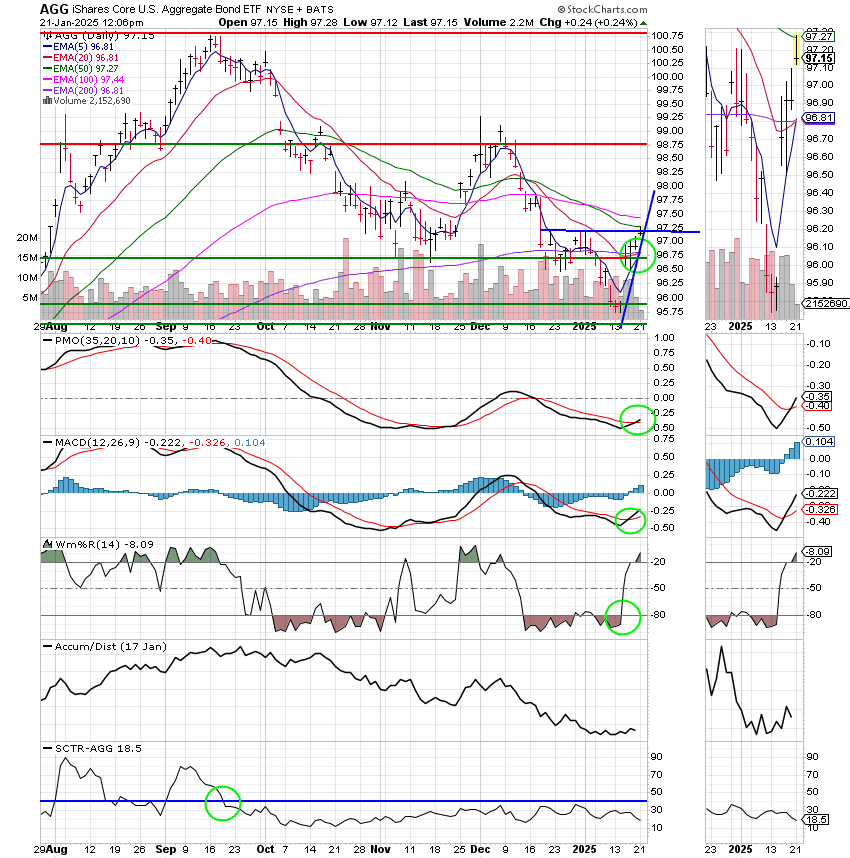

The most recent trading has generated the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 100/S. Lets roll!! Our allocation is currently +4.01% on the year not including the days gains. Here are the latest posted results:

| 01/17/25 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.7945 | 19.4733 | 94.7994 | 93.7672 | 42.4062 |

| $ Change | 0.0024 | -0.0035 | 0.9392 | 0.6222 | 0.1591 |

| % Change day | +0.01% | -0.02% | +1.00% | +0.67% | +0.38% |

| % Change week | +0.09% | +1.00% | +2.92% | +4.56% | +1.87% |

| % Change month | +0.21% | -0.03% | +2.01% | +4.01% | +1.22% |

| % Change year | +0.21% | -0.03% | +2.01% | +4.01% | +1.22% |