Good Day, You can read about anything you want to read about the current market. If you have a certain point of view you can find an article to assuage your feelings. It’s nice to feel good, but that kind of feel good doesn’t necessarily make you money. Just because you can find someone who tells you what you want to hear doesn’t make what you are thinking right. Therein lies the weakness in the age of the internet. There is so much information out there that it is extremely difficult to determine what is valid and what is not. Some of these folks will lead you to ruination and make you believe it is the right way to go. You see, it is more important to them to be right. They are more interested in appearing to be right than they are in being accurate. So in the end who are you going to believe? I would suggest you first believe God’s word and second believe your charts. As we say so often here, the math never lies. Sometimes, we interpret it wrong but that’s on us, but it is never wrong. Not ever…… One thing that is particularly troubling about the current market is the way people keep injecting their politics in it. Ya’ll know mine…. I don’t make it any secret. Socialism and capitalism don’t mix. What has that to do with this discussion? Nothing and everything! If you go into your investment with preconceived notions then you will find everything you can on the internet to justify those feelings. A sort of Damn the Torpedoes and Full speed ahead type of thing. Never mind what the market is or isn’t doing. If it isn’t going the way you want then you rationalize that it will change because you are right. It’s them or us! Eventually, you become blind to what the market is actually doing and you start to function and make decisions based on those reconceived notions and not on what is actually taking place. You get to the point where in fact, your not happy. So the very thing you started out doing was in fact your undoing. So Scott…..What are you saying? I’m so glad you asked! When all this stuff is said and done, the market is going to do what the market is going to do. It’s not a matter of if you are going to be wrong but when you are going to be wrong. So ask yourself this question. Are you willing to admit when you are wrong and move in a different direction or………are you so convinced that you are right that your pride will never let you go in another direction. For this I offer you God’s word. Proverbs 16:18 tells us that ” Pride goes before destruction and a haughty spirit before a fall. The bottom line is this. Your attitude and beliefs can most certainly affect your results when investing. Folks, its not about our egos!!!!! For this I offer you another scripture from the book of Proverbs. Proverbs 11:2 tells us that “When pride comes, then comes disgrace, but with humility comes wisdom. I’ll take wisdom every time. Enough said. I’ll take attitude over altitude any day.

So how about today? We continue to have the tariff turbulence. That’s not going away any time soon. It has, however, lessened a bit at the moment and allowed us to focus on some other issues. Namely earnings which is primarily what the market is all about. Today, Bank of America posted better-than-expected earnings for the first quarter, sending shares higher by more than 1% in the premarket. The bank earned 90 cents per share on revenue of $27.51 billion. Analysts had forecast a profit of 82 cents per share on revenue of $26.99 billion. The results were driven by strong revenue from trading and solid interest income. Johnson & Johnson reported quarterly results that beat analyst expectations. The pharmaceutical giant earned $2.77 per share on revenue of $21.89 billion. Analysts polled by LSEG expected a profit of $2.59 per share on revenue of $21.56 billion. Other major reports due this week include United Airlines and Netflix Keep and eye out for those, They are bellwethers for the economy and have the potential to move market. Overall, I’d have to say that the earnings are exceeding expectations and certainly don’t signal an economy that’s in decline. At least not yet. Will the Tariffs change that? I don’t think so, but I reserve the right to be wrong. (Pun Intended)

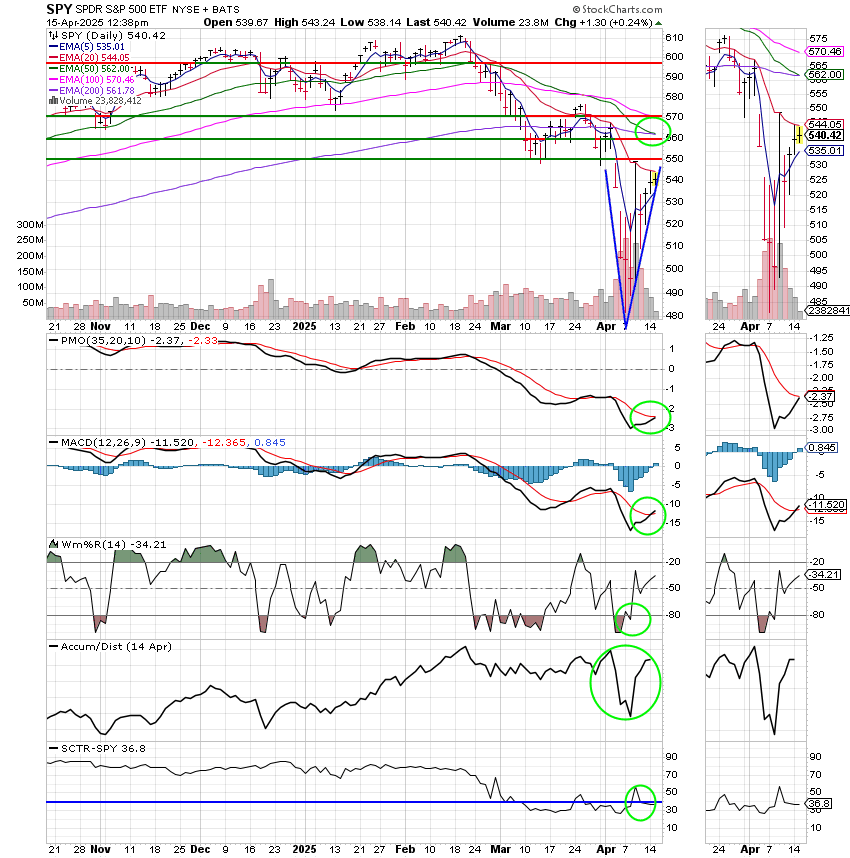

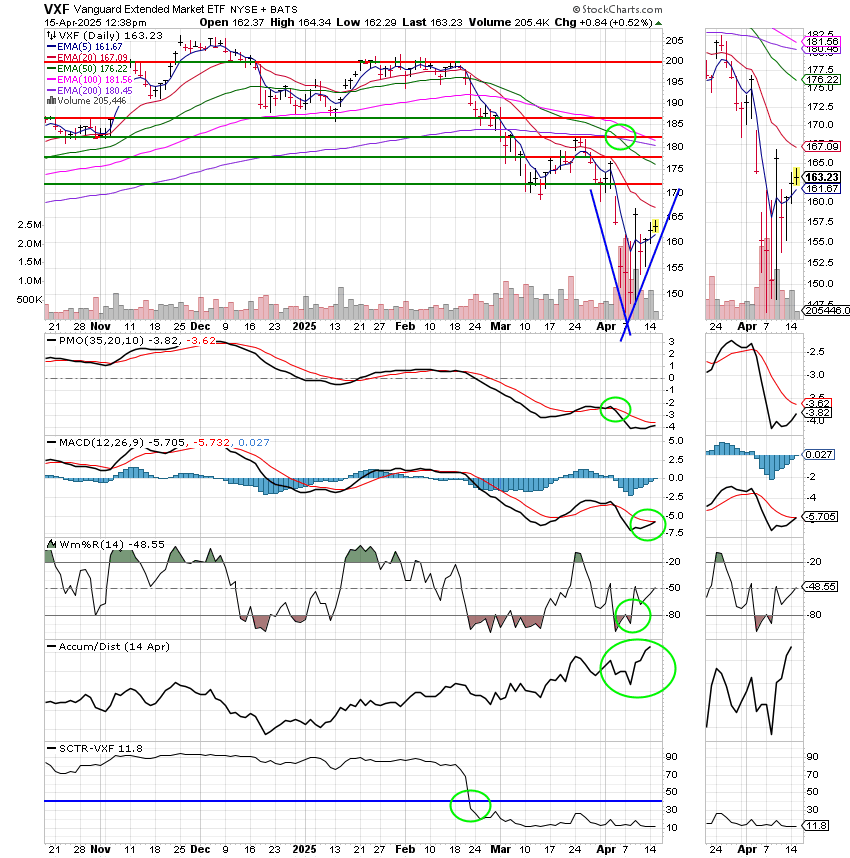

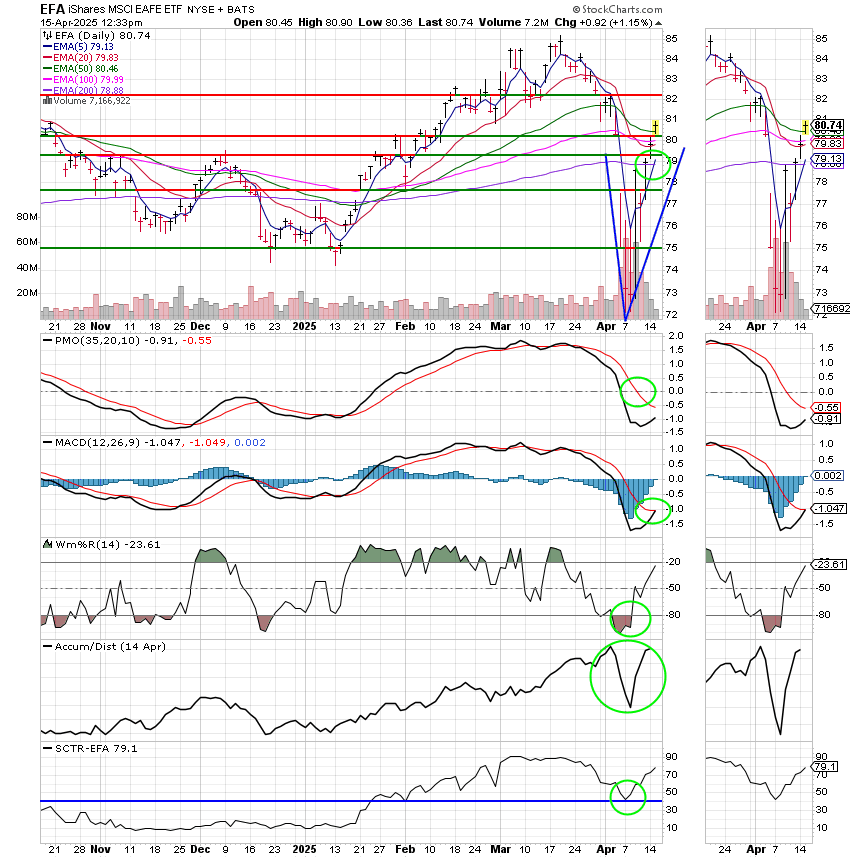

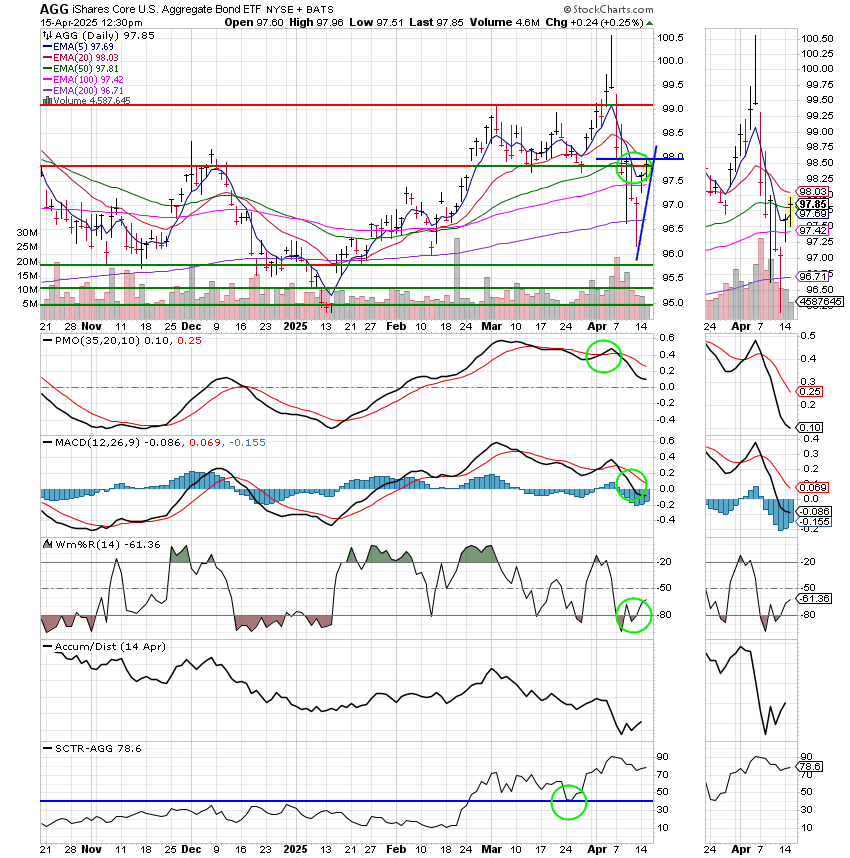

As for today I must say that the majority of the charts that I am looking at show that the market is in the bottoming process. Please note that I used the word process! This could be a week or two, a month, or all summer. Usually, what happens is that the market will trade somewhat sideways during the bottoming process but will not move significantly lower. So my recommendation is that if you are already in the market then be patient and if you are not then buy. I know it’s nice and comforting to sit on the side lines but with the potential for market moving news every day it’s easy to be left behind. You can’t win it if your not in it. Again, my charts show that the market is bottoming…..

The days trading so far has left us with the following results: Our TSP allotment is adding +0.44%. I’ll take it! For comparison, the Dow is trading +0.17% higher, the Nasdaq +0.39%, and the S&P 500 +0.39%. Praise God for another day in the green!

Stocks rise as investors digest latest earnings and tariff volatility eases: Live updates

The most recent action has left us with the following signals: C-Buy, S-Buy, I-Buy, F-Hold. We are currently invested at 100/S. Our allocation is now -5.82% on including the days results: Here are the latest posted results:

| 04/14/25 | Prior Prices | ||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 18.9954 | 19.8061 | 85.7274 | 77.3133 | 43.0704 |

| $ Change | 0.0067 | 0.1217 | 0.6765 | 0.7906 | 0.6715 |

| % Change day | +0.04% | +0.62% | +0.80% | +1.03% | +1.58% |

| % Change week | +0.04% | +0.62% | +0.80% | +1.03% | +1.58% |

| % Change month | +0.16% | -1.06% | -3.62% | -5.82% | -1.76% |

| % Change year | +1.29% | +1.68% | -7.75% | -14.24% | +2.80% |