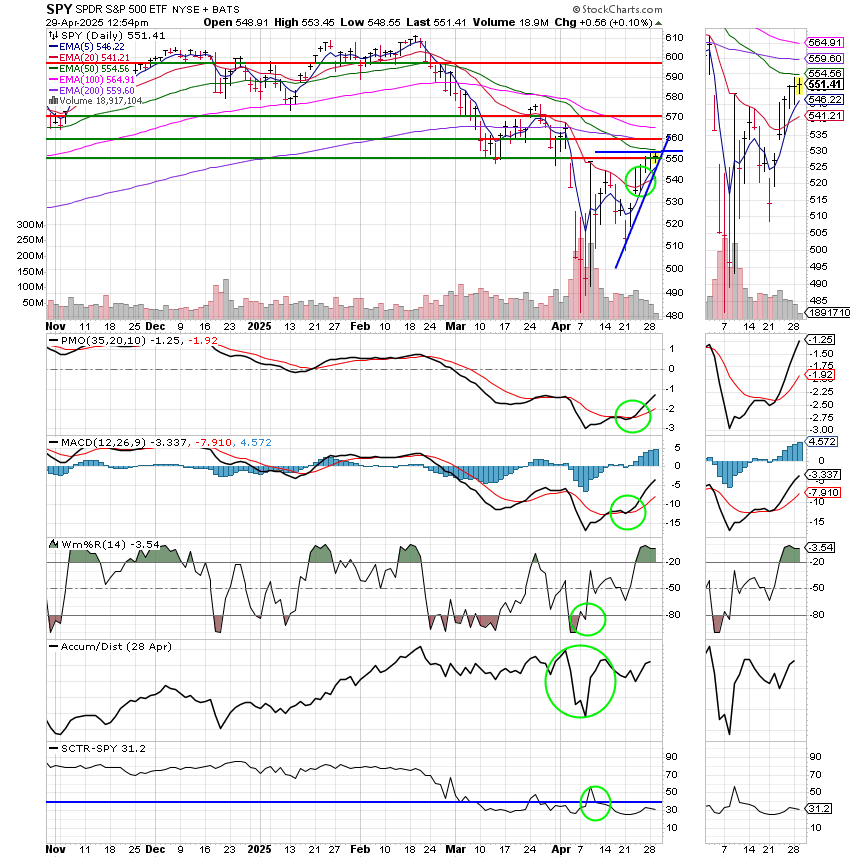

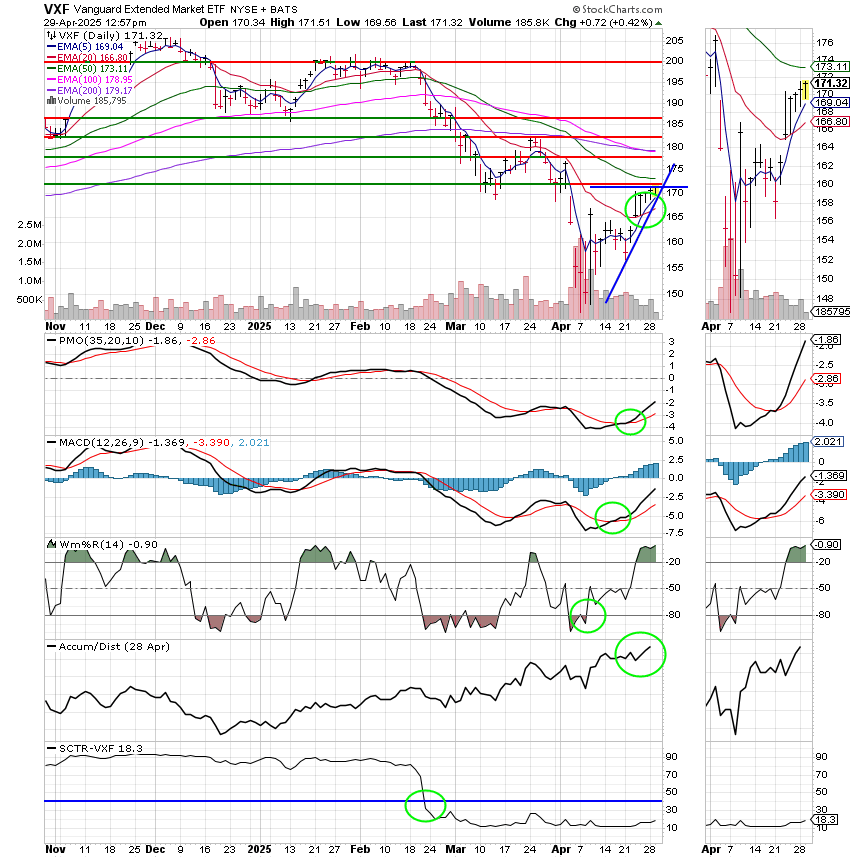

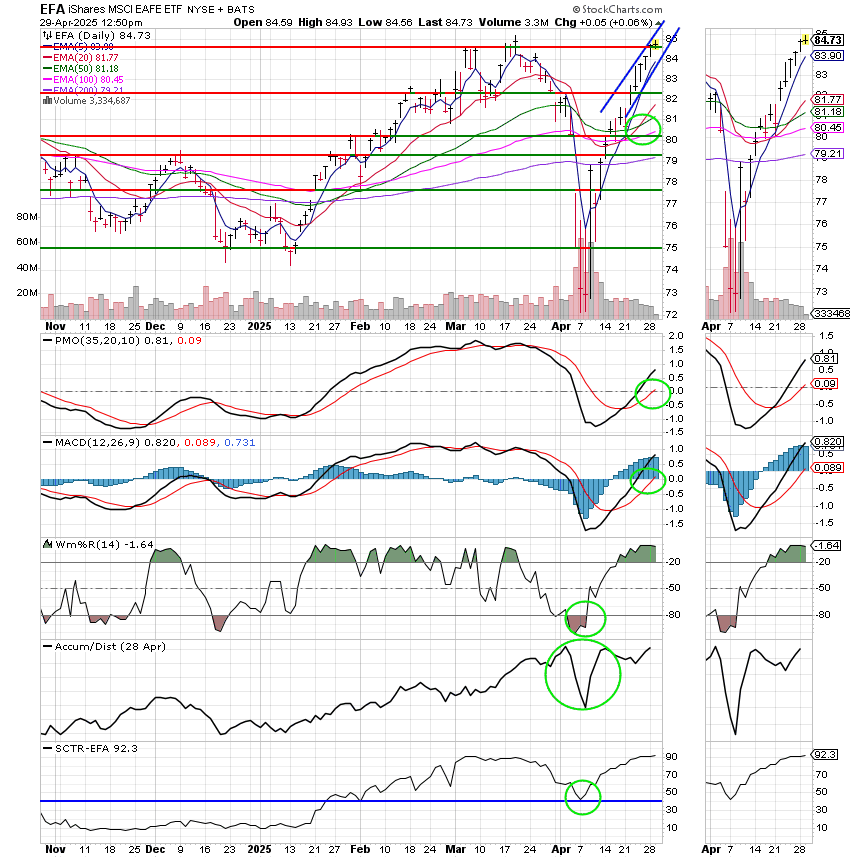

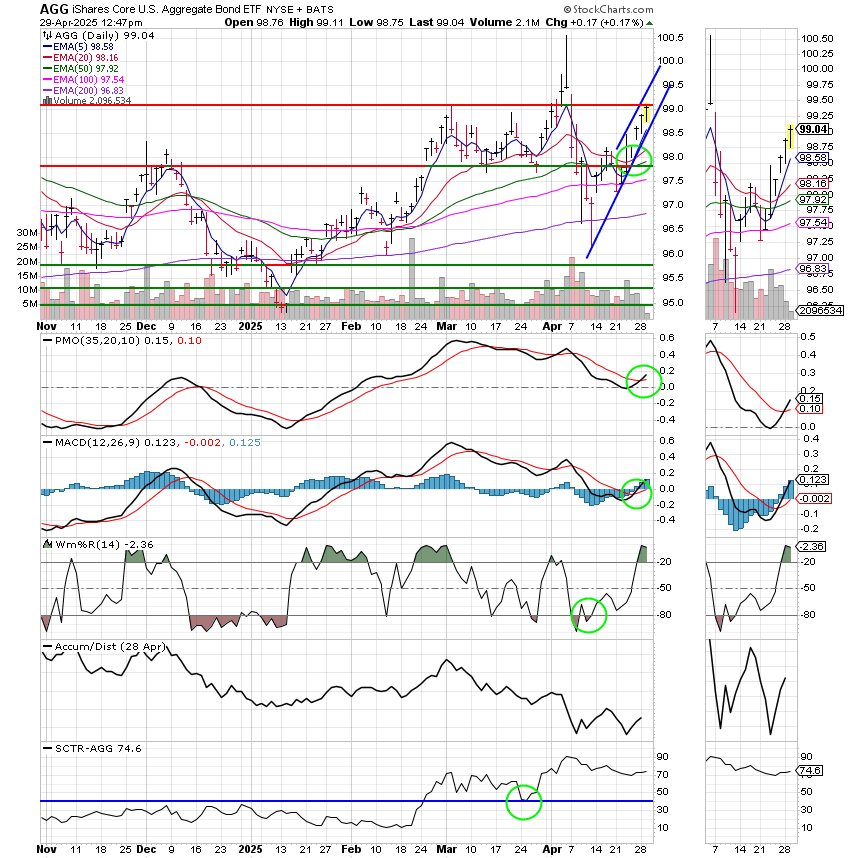

Good Afternoon, This was a Fed Driven market. It was all about when the Fed would be reducing interest rates based on inflation and that’s still the case to a certain degree, but in all actuality everything is waiting on the outcome of the tariff situation. So given that fact I’m going to say that it’s really all about the tariffs. The market continues to trade in a range as it is held hostage by the tariff situation with the S&P 500 staying between 5100 and 5700. Usually when the market is in a range it means that it is unclear on something that needs to be resolved before it decides to move lower or move higher. In this particular case my charts are pretty clear that the bottom is in. However, the market will not move higher until it receives some clarity on the Tariffs. Right now there is simply a lot of indecision. Investors want to move the market higher but they will not commit to risk on trading until they see some light at the end of the tariff tunnel and currently the data is not showing it. Nothing makes that more evident than corporate earnings reports. As you all know the market is driven by earnings. They determine the current and future prices of stocks. While the current earnings have been stellar, there is a question about how future earnings will look because of the tariffs. As a result of this fact many companies that are reporting are reflecting this in their earnings reports. Some are even pulling their future guidance based on this lack of clarity. Just today, General Motors said it is reassessing future guidance and suspending more share buybacks as it awaits clarity on the impact from the levies. Shares had risen earlier on reports that Trump was willing to make concessions on foreign-made parts used in domestic production, but now everything is in limbo. GM’s decision follows a number of other companies that have announced they’re reconsidering their full-year forecasts in the wake of rising global trade tensions. Last week, American Airlines and Skechers withdrew their 2025 outlooks, with both companies citing economic uncertainty . Ladies and gentlemen that is exactly why the market is trading in a range…… Being invested now is all about being positioned for the future. The fundamentals will simply drive you crazy. It is impossible the forecast on outcome to this event if you are a fundamental investor. So…what about us? Right now our charts are telling us that the bottom is in. Given that fact we are buying in order to be positioned for the uptrend that we believe will take place once the market finally does receive some clarity regarding tariffs. During this time we are patiently waiting for this outcome just like everyone else. We will continue to monitor our charts for any unexpected selling as a result of a surprise event but other than that it is pretty cut and dried. We are in it for the duration. So keep praying that God will guide our hand! For now we will remain invested at 100/S.

Todays trading is generating the following results. Our TSP allotment is trading higher at +0.53%. It has been strong as of late. For comparison, the Dow is adding +0.73%, the Nasdaq +0.15%, and the S&P 500 +0.28%. So far it’s been a decent day. We praise God for that!

S&P 500 ticks higher as investors await trade deal progress: Live updates

Recent action has generated the following signals: C-Buy, S-Buy, I-Buy, F-Buy. We are currently invested at 100/S. Our allocation is now -2.90% for the year not including the days results. Here are the latest posted results:

| Prior Prices | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 19.0266 | 20.0564 | 87.6983 | 81.3156 | 45.4041 |

| $ Change | 0.0067 | 0.0573 | 0.0575 | 0.3463 | 0.3280 |

| % Change day | +0.04% | +0.29% | +0.07% | +0.43% | +0.73% |

| % Change week | +0.04% | +0.29% | +0.07% | +0.43% | +0.73% |

| % Change month | +0.33% | +0.19% | -1.41% | -0.95% | +3.56% |

| % Change year | +1.45% | +2.97% | -5.63% | -9.80% | +8.37% |