Good Evening,

The Dow and the S&P set new records today. I guess everyone should be rejoicing, but they are not. There are a lot of under invested bulls and squeezed bears out there who would just like to see a decent correction so they could have a chance to make some real money. The way they see it, things just won’t be normal until that happens. I agree with them. As I have oft repeated, this has been a difficult year for the active trader. RevShark made a few comments about trading the current market. Here’s what he had to say:

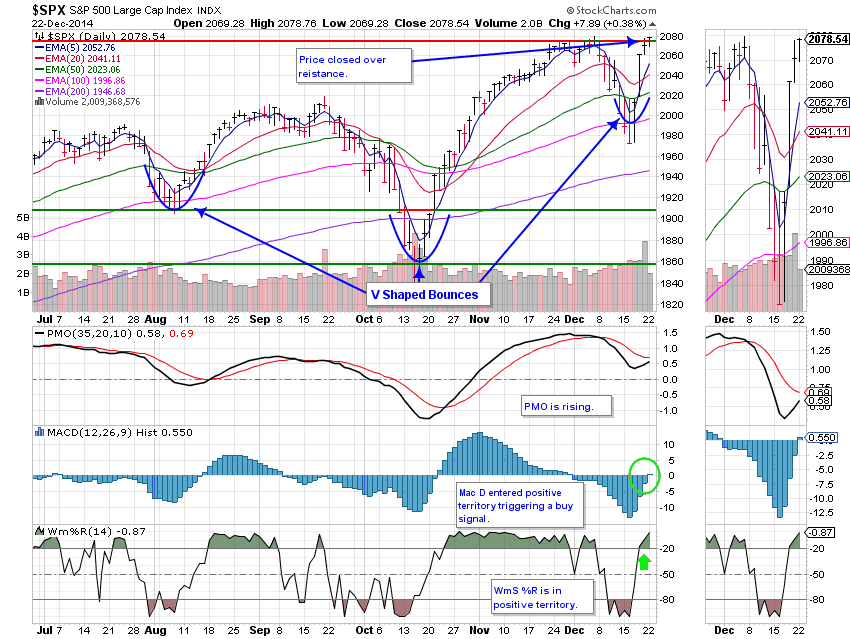

“The difficulty in navigating this market is exhibited well by the fact that active fund managers are having one of their worse years of underperformance in a while. Managers have not done well in recent years but this year has been particularly difficult because of the consistent V-shaped bounces.

The way most active managers beat the markets isn’t by outperforming in uptrends. The big advantage they typically have is that they outperform during pullbacks and breakdowns. By limited losses a bit market they produce outperformance with just average returns in an uptrend.

This market has made that style of trading exceedingly difficult. When a fund manager does finally catch a pullback or downtrend, the V-shaped bounce is so quick that they never have a chance to reload. Most managers just don’t think it is possible for the market to keep coming back in this manner. The action last week was particularly surprising to the market players that keep thinking that market conditions are changing.”

His website is Sharkinvesting.com for anyone who is interested in his service.

Our TSP allotment held steady today at 100/G. AMP dropped -0.38%, managing to hold onto a little over half of yesterday’s gains. AMP is invested a little differently so it won’t stay in step with the Dow. It will have its good days independent of the major indices, as it did yesterday.

Dow, S&P end at records in fourth straight day of gains for Wall Street

The day’s action left us with the following signals: C-Buy, S-Buy, I-Sell, F-Buy. We are currently invested at 100/G. Our allocation is now -3.32% on the year, not including the day’s results. Here are the latest posted results:

| 12/19/14 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6069 | 16.7603 | 27.3058 | 36.1134 | 24.4808 |

| $ Change | 0.0008 | 0.0221 | 0.1242 | 0.1676 | -0.0274 |

| % Change day | +0.01% | +0.13% | +0.46% | +0.47% | -0.11% |

| % Change week | +0.04% | -0.26% | +3.44% | +3.53% | +1.57% |

| % Change month | +0.12% | -0.04% | +0.27% | +0.48% | -3.09% |

| % Change year | +2.24% | +6.47% | +14.37% | +7.26% | -4.24% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.4568 | 22.9489 | 24.8769 | 26.4625 | 15.0155 |

| $ Change | 0.0133 | 0.0362 | 0.0503 | 0.0621 | 0.0382 |

| % Change day | +0.08% | +0.16% | +0.20% | +0.24% | +0.26% |

| % Change week | +0.62% | +1.50% | +1.92% | +2.22% | +2.49% |

| % Change month | -0.01% | -0.29% | -0.39% | -0.44% | -0.56% |

| % Change year | +3.81% | +5.29% | +6.04% | +6.56% | +6.77% |