Good Evening,

The action today was driven by end of the year tax selling and end of the quarter window dressing. Tomorrow, it likely will be as well. There’s something about taking profits and getting rid of losers that helps traders feel like they are making a fresh start in the new year. Expect more selling tomorrow. Our TSP allotment held its ground today and AMP made a slight gain of +.031%. Both were good enough to beat the big three. The Dow dropped -0.31%, the S&P stepped back -0.49%, and the Nasdaq lost -0.61%. It’s not what you make, it’s what you keep that counts!

The RevShark made some comments this morning on the 2014/2015 markets. I have included a few of them here as it’s pretty much the same message that I’ve been trying to get across….

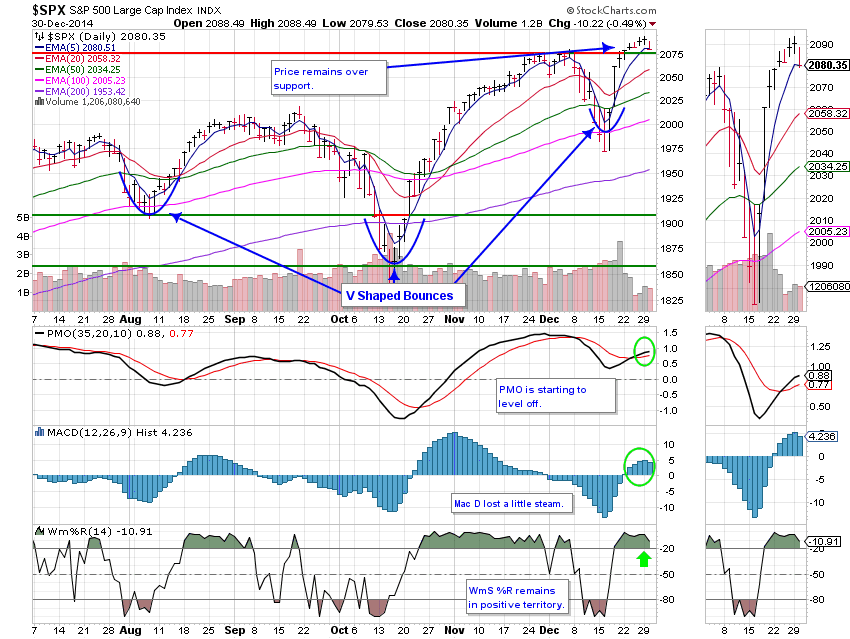

“For many traders the biggest challenge of the last few years has been dealing with endless dip buying and V-shaped bounces. It often was not ‘normal’ action and it required a suspension of some of the basic beliefs about the market if you wanted to navigate it effectively. Quite often the standard rules about volume, resistance and overbought readings were deemed irrelevant as we continued to trend upward far beyond what might seem reasonable.

The most successful traders in 2014 stayed with trends as long as possible but it was particularly important to be in the right stocks. There were plenty of landmines in momentum and small cap names and four or five times this year they sold off hard while the indices showed few signs of underlying weakness.

What surprised me most about trading in 2014 was how similar it was to 2013. I thought it was unlikely we would have such strong V-shaped bounces but, in some cases, they were even stronger than what we had seen in prior years.

Will 2015 see this tendency toward V-shaped bounces shift? With the Fed becoming more hawkish that would seem to be the case but the biggest surprise in this market has tended to be how the same patterns continue.”

Amen Rev Shark. How many ways can we say the same thing? That’s what’s so hard about writing about this market. It has been in the same pattern so long that it is hard to find new ways to write about it and in 2014, the only thing that really surprised us was how much it remained the same…

Wall St. pulls back from record; utilities slump

| 12/29/14 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6149 | 16.7635 | 27.5798 | 36.7379 | 24.6472 |

| $ Change | 0.0024 | 0.0350 | 0.0286 | 0.1256 | 0.0508 |

| % Change day | +0.02% | +0.21% | +0.10% | +0.34% | +0.21% |

| % Change week | +0.02% | +0.21% | +0.10% | +0.34% | +0.21% |

| % Change month | +0.17% | -0.02% | +1.28% | +2.22% | -2.43% |

| % Change year | +2.30% | +6.49% | +15.52% | +9.11% | -3.59% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.5001 | 23.0747 | 25.0519 | 26.6793 | 15.1531 |

| $ Change | 0.0101 | 0.0246 | 0.0335 | 0.0409 | 0.0254 |

| % Change day | +0.06% | +0.11% | +0.13% | +0.15% | +0.17% |

| % Change week | +0.06% | +0.11% | +0.13% | +0.15% | +0.17% |

| % Change month | +0.24% | +0.26% | +0.31% | +0.37% | +0.35% |

| % Change year | +4.06% | +5.87% | +6.79% | +7.43% | +7.75% |