Good Evening,

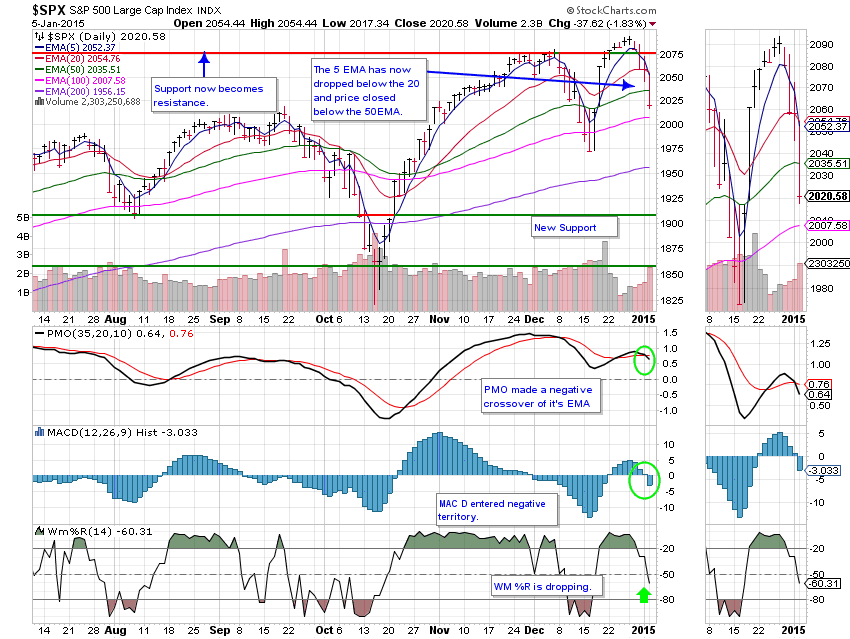

On the first real trading day of 2015 and we find ourselves in a recently familiar position…down. The market sold off and sold off hard today. It was the function of a couple of different factors. First, there were a lot of big winners from 2014 that were sold today for tax purposes. The tax bills for stocks sold today won’t be due until next year. Second, oil reversed course dropping to below $50.00 per barrel, which in turn drove energy stocks down at a wicked rate. Both of these factors resulted in the major indices having their worst day since early October.

So the question is will we have a bounce tomorrow? The last few sell offs that we had experienced at least one failed bounce before making strong V Shaped moves back up. While I wouldn’t bet on the V Shaped pattern to occur, I wouldn’t bet against it either. It is a pattern that has been in play for the last 17 pullbacks and has yet to be broken. When it is broken, I would suggest that the entire market atmosphere will change with it. Market players better not count on getting bailed out so easily then! As usual, we’ll watch the charts and see. The truth of the matter is that we must now allow our positions to pull back more than we would normally feel comfortable with as we wait to see if the above mentioned pattern is broken or not. If it is not, then we will avoid being whipsawed. Out of 5 pullbacks that occurred in 2014, we were only able to avoid being whipsawed once. This type of action forces you to bend but not break. You can translate that into a 7-10% drop before you will get a sell signal. The indicators that I prefer to use are much more forgiving at a 3-5% drop before the sell signal occurs.

Why not just buy and hold you say? We must protect ourselves against a bear market with the potential to drop 40-60% before it finds the bottom. That is simply the price of doing business in the current market. I don’t like it but it can’t be avoided. Today’s market left us with the following results: Our TSP allotment dropped -1.64% and AMP fell back -1.375%. For comparison, the big three closed out with the following losses: Dow -1.86%, Nasdaq -1.57%, and the S&P was -1.83%. TSP bested the DOW and S&P 500 while AMP beat all three. That said, a loss is a loss…

Energy shares lead Wall Street to worst day since early October

| 01/02/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6181 | 16.8315 | 27.1599 | 36.2327 | 24.2173 |

| $ Change | 0.0016 | 0.0298 | -0.0056 | -0.0637 | -0.0010 |

| % Change day | +0.01% | +0.18% | -0.02% | -0.18% | +0.00% |

| % Change week | +0.01% | +0.18% | -0.02% | -0.18% | +0.00% |

| % Change month | +0.01% | +0.18% | -0.02% | -0.18% | +0.00% |

| % Change year | +0.01% | +0.18% | -0.02% | -0.18% | +0.00% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.4527 | 22.8972 | 24.8022 | 26.3724 | 14.9535 |

| $ Change | 0.0019 | -0.0015 | -0.0040 | -0.0066 | -0.0051 |

| % Change day | +0.01% | -0.01% | -0.02% | -0.03% | -0.03% |

| % Change week | +0.01% | -0.01% | -0.02% | -0.03% | -0.03% |

| % Change month | +0.01% | -0.01% | -0.02% | -0.03% | -0.03% |

| % Change year | +0.01% | -0.01% | -0.02% | -0.03% | -0.03% |