Good Evening,

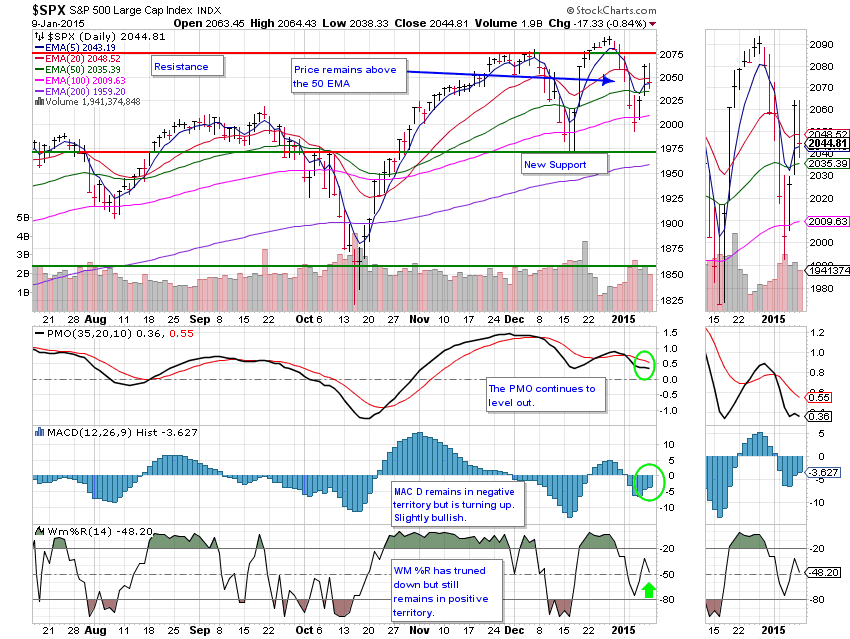

Yesterday the Decision Point crew (I can’t take credit for this one) said in their market analysis that their short term indicators showed that there would be a small pullback in the market after which the rally would resume. This morning we had a better than expected jobs report with a lower unemployment number (5.6%). The market responded with a sell the news reaction. Bottom line, Erin Heim at Decision Point called it right. Now, if both she and I are correct again, the rally will resume. This market has enough under invested bulls to fuel the upside a good bit longer. However, the level of volatility has definitely increased in 2015 so we may have to work harder to hang onto our gains. Both of our allotments closed down on the session with TSP dipping -0.807% and AMP slipping only -0.295%. For comparison, the Dow lost -0.95%, the S&P 500 -0.84%, and the Nasdaq -0.68%. You probably figured it out by now. AMP usually comes out on top when the market is down. Remember, it’s what you keep that’s the most important!

Wall St. retreats after two-day advance; jobs data mixed

| 01/08/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6232 | 16.9082 | 27.2233 | 36.2177 | 23.826 |

| $ Change | 0.0008 | -0.0375 | 0.4790 | 0.5826 | 0.3419 |

| % Change day | +0.01% | -0.22% | +1.79% | +1.63% | +1.46% |

| % Change week | +0.03% | +0.46% | +0.23% | -0.04% | -1.62% |

| % Change month | +0.05% | +0.63% | +0.21% | -0.22% | -1.62% |

| % Change year | +0.05% | +0.63% | +0.21% | -0.22% | -1.62% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.4545 | 22.8676 | 24.7568 | 26.3155 | 14.9108 |

| $ Change | 0.0575 | 0.1904 | 0.2652 | 0.3243 | 0.2077 |

| % Change day | +0.33% | +0.84% | +1.08% | +1.25% | +1.41% |

| % Change week | +0.01% | -0.13% | -0.18% | -0.22% | -0.29% |

| % Change month | +0.02% | -0.14% | -0.20% | -0.24% | -0.32% |

| % Change year | +0.02% | -0.14% | -0.20% | -0.24% | -0.32% |