Good Evening,

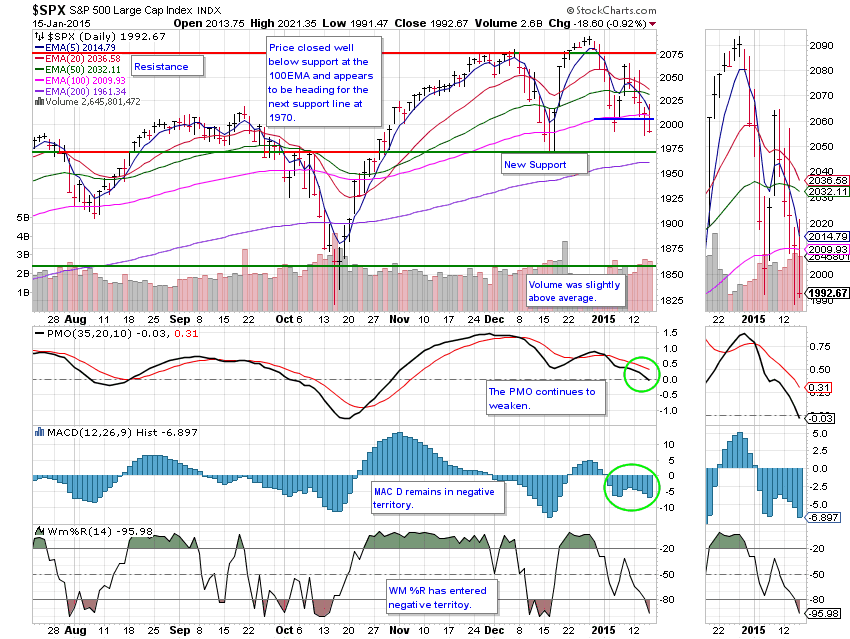

As a result of additional bad news, the major indices lost ground for a fifth day in a row. The S&P 500 is now close to 5% off its December record highs. The main culprits were a bad jobs report, a report that the Swiss took the cap off the Frank (which will allow it to rise against other currencies), and continued concern over a global slow down. We’ll take a look at the charts and see where we’re at with regard to support a little later.

So how do you deal with a downward trending market? You wait for what the market sends your way. After you take a defensive stance, you wait for the right chart set ups to occur. Many folks over-complicate this. They listen to the news that almost always focuses on trying to find the bottoms. Problem is, they are seldom correct. Traders often use their emotions and try to anticipate the bottom. The result is that instead of finding the bottom they end up being cut to pieces as they try to catch a falling knife. The problem is even worse in this market as they have become complacent from the tendency to be rescued by the v-shaped moves. Yes, those are the same v-shaped moves that caused me to under-perform in 2014. Nobody wants to miss out on another one of these v-shaped wonders which they are all so certain will bail them out again. The most important thing that you can remember in a down trending market is that you don’t need to predict what is going to happen. You simply need to wait for it to unfold and react to the action that you see before you. This may mean that you are a little late to the party, but you will more than make up for it in the middle. Waiting in this manner for the market to make the first move is a matter of patience and vigilance. You never set it and forget it. You check it every day. Finally, you remain disciplined! You have a set of indicators that you follow and when they say to sell, you sell; when they say buy, you buy. Just like Kenny Rogers used to sing: There’s time enough to count your money when the dealin is done. In other words, do the right thing and in the end the money will take care of itself. Don’t worry about what price you paid for a stock or fund or about how much more money you can make off of it if the market bounces back or if you’re selling it for a loss. Remember, profits can be lost and losses can grow. Be disciplined and, if necessary, live to fight another day…… The days action left our TSP allotment with a set back of -1.217% while AMP again bested the big three slipping back only -0.125%. For comparison, the Dow stepped back -0.61%, the Nasdaq lost -1.48%, and the S&P 500 dropped -0.92%.

Wall Street drops for fifth day on global economy, earnings concern

| 01/14/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6284 | 17.0285 | 26.556 | 35.606 | 23.7388 |

| $ Change | 0.0009 | 0.0315 | -0.1541 | -0.1514 | -0.1261 |

| % Change day | +0.01% | +0.19% | -0.58% | -0.42% | -0.53% |

| % Change week | +0.03% | +0.51% | -1.62% | -0.91% | -0.10% |

| % Change month | +0.08% | +1.35% | -2.24% | -1.90% | -1.98% |

| % Change year | +0.08% | +1.35% | -2.24% | -1.90% | -1.98% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.4025 | 22.681 | 24.4924 | 25.9884 | 14.7018 |

| $ Change | -0.0161 | -0.0591 | -0.0829 | -0.1015 | -0.0656 |

| % Change day | -0.09% | -0.26% | -0.34% | -0.39% | -0.44% |

| % Change week | -0.17% | -0.49% | -0.65% | -0.75% | -0.85% |

| % Change month | -0.28% | -0.95% | -1.27% | -1.48% | -1.72% |

| % Change year | -0.28% | -0.95% | -1.27% | -1.48% | -1.72% |