Good Evening,

Oil turned up and brought stocks up with it. Our AMP allocation was going to have a positive day either way. But, had stocks not turned around, TSP would have suffered a loss on the day. God was good to our group again! That said, let me play the critic for the moment. I believe the secular world uses the phrase “devil’s advocate” but I will never refer to myself in that manner. The devil is a defeated foe and I only want to emulate winners. I have written a lot in recent years about why the market is doing what it is doing and while that is interesting, it is somewhat irrelevant to what we do. It is not really necessary that we totally understand every detail of what is shaping the market. There are traders that operate that way, but that is not our system. In our system we need to focus on the pricing action that we see before us, not on what we think or what the talking heads on CNBC speculate is going to happen.

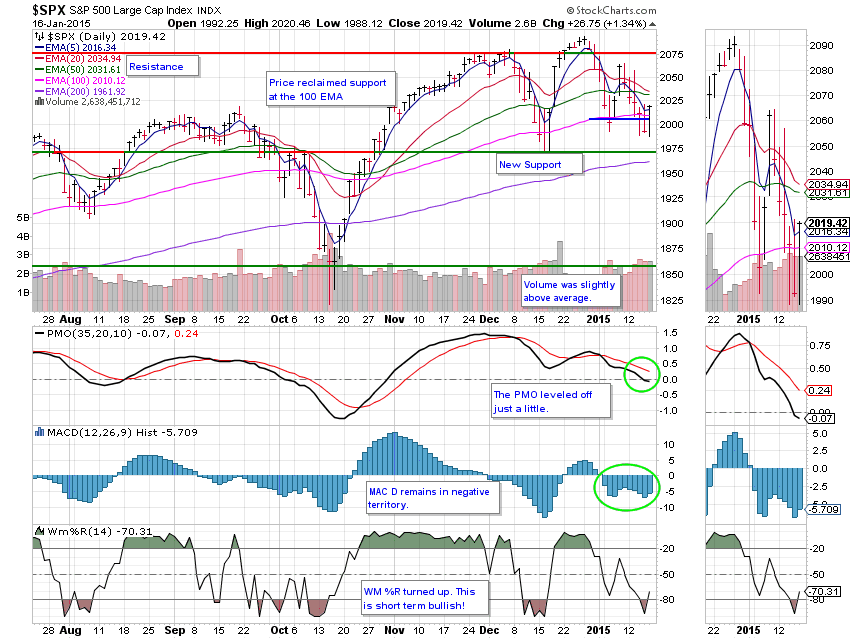

I haven’t taken a look at the charts yet. We will do that in a minute and decide what our plan of action is. I can tell you this even before I look at the charts: the pressure to sell is starting to rise. This market certainly is beginning to exhibit some of the traits of a market the has changed directions. Even though we had a nice oversold bounce today, it is still possible that we could have a true 10% correction. Given the situation in Europe (that has been further exposed by the cap being removed from the Swiss Frank), it is possible that we could have a deeper pullback than that. The question you have to answer is can the US economy cruise along unscathed if the rest of the world economy suffers deflation? I seriously doubt it; the world economy is so interlocked these days that it would be nearly impossible for the US markets to go unaffected. Am I saying sell? No. I am saying watch your charts and do what they tell you to do. Don’t let the fact that you under-performed or made nice gains last year effect your decisions.

There is only one correct thing to do when the time comes. The fact that your portfolio is up or down should never effect your decision. What the market did in the last year with all the quick recoveries shouldn’t effect your decision either. As I have often repeated, the peopel that have become dependent on these quick recoveries to bail them out are going to take big losses when normal trading returns. There have been bear markets since the trading began and there will be more. Is this one of them? I don’t think so. I have already gone on record as saying I think it’s a correction. In the event that it is not, we have to be prepared to do the right thing and not let our emotions suck is into watching half of our portfolios fade away. That’s buying and holding and that’s not what we do here…There’s and old saying that somewhat applies to this situation: Two wrongs don’t make a right. Doing the wrong thing even longer doesn’t make it right. If you find yourself in a hole, then quit digging! Remember, in our system sell is not a dirty word. A long time ago, when I started this newsletter for a few friends, it was very simple. We said a few words about what took place in the market, our results for the day, and where we were invested. I try to keep these things brief, but write a little more when the market is crazy and it has been really crazy. I hope to get back to the simple format in the future, if things will just allow it. Today’s action left us with the following results: both TSP and AMP posted strong gains with TSP at +1.366% and AMP at +1.132. For comparison the Dow closed up +1.10%, the Nasdaq +1.39%, and the S&P finished +1.34%. I must admit, the day ended up much better than I first thought it would. God is good! Give Him all the praise!

Wall Street rallies after five down days; ends down for week

| 01/15/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6292 | 17.0704 | 26.3111 | 35.1039 | 23.9768 |

| $ Change | 0.0008 | 0.0419 | -0.2449 | -0.5021 | 0.2380 |

| % Change day | +0.01% | +0.25% | -0.92% | -1.41% | +1.00% |

| % Change week | +0.03% | +0.76% | -2.53% | -2.31% | +0.90% |

| % Change month | +0.09% | +1.60% | -3.15% | -3.29% | -1.00% |

| % Change year | +0.09% | +1.60% | -3.15% | -3.29% | -1.00% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.388 | 22.6358 | 24.4239 | 25.8972 | 14.6458 |

| $ Change | -0.0145 | -0.0452 | -0.0685 | -0.0912 | -0.0560 |

| % Change day | -0.08% | -0.20% | -0.28% | -0.35% | -0.38% |

| % Change week | -0.26% | -0.69% | -0.93% | -1.10% | -1.23% |

| % Change month | -0.36% | -1.15% | -1.54% | -1.83% | -2.09% |

| % Change year | -0.36% | -1.15% | -1.54% | -1.83% | -2.09% |