Good Evening,

The market was floating along with a mostly negative bias when a rumor hit the press that the ECB would announce a 50 Billion Euro per month bond buying program that would last for 12 months tomorrow. The market seemed relieved but not impressed as it drifted slightly higher into the close. The Nasdaq finished the day with a negative breadth of 1586 to 1186 for a ratio of 1.37 to 1.00 favoring decliners. That just shows how the day was nothing to write home about. The possibility exists that the market is setting up for a sell the news reaction tomorrow when the ECB actually makes its announcement. If the actual bond purchase ends up being more or less than the published rumor, then the game could change. We’ll man our charts and see what happens.

The day’s trading left us with the following results: Our TSP allotment posted a gain of +0.351%, while AMP took the day off at -0.054%. For comparison, the Dow gained +0.22%, the Nasdaq +0.27%, and the S&P +0.47%.

Wall Street up on ECB bets but details, IBM cap gains

| 01/20/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6335 | 17.0393 | 26.7066 | 35.5331 | 24.2908 |

| $ Change | 0.0034 | 0.0128 | 0.0422 | -0.1010 | 0.1315 |

| % Change day | +0.02% | +0.08% | +0.16% | -0.28% | +0.54% |

| % Change week | +0.02% | +0.08% | +0.16% | -0.28% | +0.54% |

| % Change month | +0.12% | +1.41% | -1.69% | -2.10% | +0.30% |

| % Change year | +0.12% | +1.41% | -1.69% | -2.10% | +0.30% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.4387 | 22.7967 | 24.6457 | 26.1667 | 14.8183 |

| $ Change | 0.0104 | 0.0267 | 0.0331 | 0.0363 | 0.0233 |

| % Change day | +0.06% | +0.12% | +0.13% | +0.14% | +0.16% |

| % Change week | +0.06% | +0.12% | +0.13% | +0.14% | +0.16% |

| % Change month | -0.07% | -0.45% | -0.65% | -0.80% | -0.94% |

| % Change year | -0.07% | -0.45% | -0.65% | -0.80% | -0.94% |

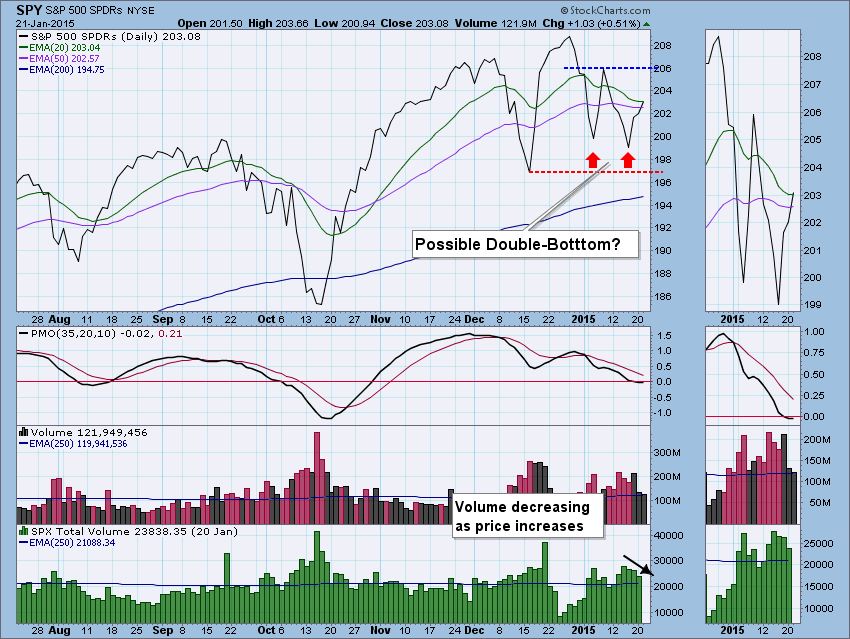

The double-bottom is continuing to form up, I’ve drawn in the neckline in blue. For the pattern to complete and execute, price will need to reach the neckline and penetrate it. Problems are the PMO which is still declining, albeit slower, and dwindling volume as price moves higher.

Conclusion: Short- and intermediate-term indicators agree, there is a potential for higher prices. If they are correct and higher prices are to follow, that would finish the formation of a double-bottom which is bullish.

I agree with the double bottom and also expect price to rise. However, with a large market shaping event like the ECB meeting tomorrow, there are no guarantees one way or the other. We’ll just have to see what the announcement is and how the market responds to it. Of course, we have a possible sell the news reaction that could cloud the picture. The best thing to do is monitor the charts and wait a few days before you make any big moves. We’ll stay put at 34/C, 66/S for now. That’s all for tonight.

God bless and have a wonderful evening!

Scott![]()