Good Evening,

This is not the same market that it was in 2014. Volatility has returned and lot of it has to do with oil. Every time oil drops, the high speed trading machines sell. That would be great if all they did was sell oil related stocks, but that’s not what they do. No, they sell everything! Stocks such as transportation, housing, real estate, and tech are sold too.

If you have good stocks, such as airline stocks right now, don’t panic when they are sold off with everything else. Just hold them and buy more. There is no way that areas [like housing- with record low interest rates, or transportation- with bargain basement fuel prices, or retail- with the average American having an extra $1000.00 in their pocket as a result of low fuel prices] are not going to make money! Absolutely no way! This market may go down, but that’s not how it’s going to happen. I’m still betting against it at this point in time. Yes, oil and oil related plays should drop, but there are many areas that will not.

What are the machines going to do when they start reporting their increased profits as a result of cheap oil? Sorry. I’m just not buying it, not now, not ever. Businesses such as retailers, restaurants, and airlines are going to have a field day as a result of cheap fuel prices. Others such as Home Builders and Real Estate are going to live well off the low interest rates. While a few jobs will be lost in oil, many more will be gained from the benefits of low oil. The machines best get used to it because low oil will be with us for a while!

When I speculate, I’m just like anybody else. I can be wrong! That said, I feel that (for the above reasons) the market has too much support to fall into bear territory at this time. Maybe sometime later as the market is indeed extended, but not now. We’ll look at it again, say in May…..

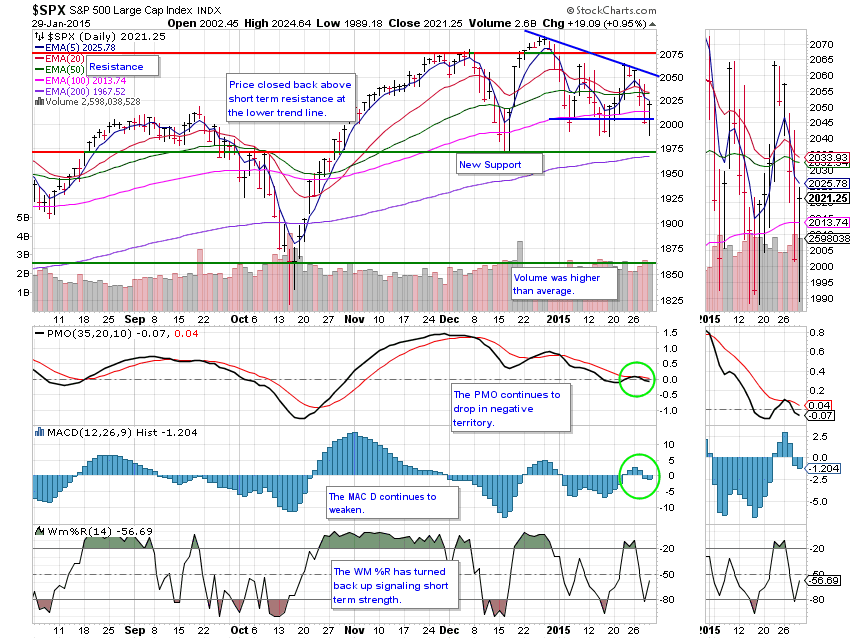

Today the market dropped in the early going, but rebounded later rising into the close. That action bodes well for tomorrow! That is if nothing serious happens with oil! The action today left our TSP allotment with a gain of +0.935% with AMP added +0.3528%. For comparison, the Dow gained +1.31%, the Nasdaq +0.98%, and the S&P +0.95%. Just a note about the AMP Program. You may have noticed that it didn’t add as much as the others did today. It is invested in a different manner than TSP and the big three in that it doesn’t have as much volatility. The end result is that so far it has the best return of any of the aforementioned indices or allotments for the month….

Wall St finishes higher in afternoon rally as oil gains

The day’s action left us with the following signals: C-Neutral, S-Buy, I-Neutral, F-Buy. We are currently invested at 50/C, 50/S. Our allocation is now -1.68% on the year not including today’s results. Here are the latest posted results:

| 01/28/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6403 | 17.1214 | 26.4441 | 35.8522 | 24.5123 |

| $ Change | 0.0008 | 0.0715 | -0.3601 | -0.5395 | -0.3314 |

| % Change day | +0.01% | +0.42% | -1.34% | -1.48% | -1.33% |

| % Change week | +0.03% | +0.40% | -2.41% | -1.01% | +0.28% |

| % Change month | +0.16% | +1.90% | -2.66% | -1.22% | +1.21% |

| % Change year | +0.16% | +1.90% | -2.66% | -1.22% | +1.21% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.4428 | 22.7964 | 24.6452 | 26.1686 | 14.8199 |

| $ Change | -0.0422 | -0.1526 | -0.2157 | -0.2665 | -0.1727 |

| % Change day | -0.24% | -0.66% | -0.87% | -1.01% | -1.15% |

| % Change week | -0.26% | -0.66% | -0.86% | -0.99% | -1.11% |

| % Change month | -0.05% | -0.45% | -0.65% | -0.80% | -0.93% |

| % Change year | -0.05% | -0.45% | -0.65% | -0.80% | -0.93% |