Good Evening,

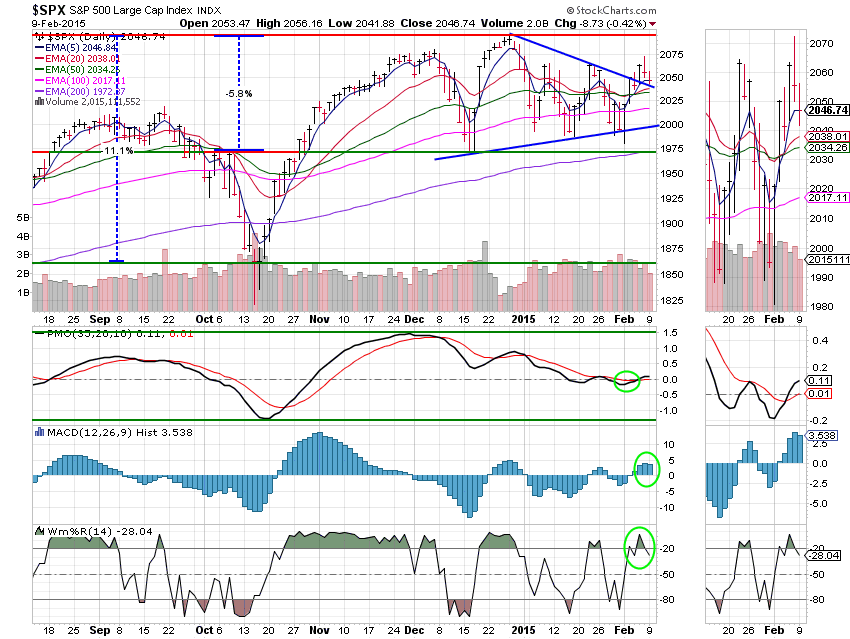

Oil was up, but that was about the only thing. There was a slow drip down through the afternoon and pretty much everything else finished down. The three big concerns according to the media were the Greek situation, the Chinese economy, and renewed concern about rising interest rates.

As a reactive trader, I don’t care as much about the why as I do the what, and right now the what is down. Today, nothing I had worked. I didn’t even have one stock or ETF with a gain. Not that things were really horrendous. It’s just that there weren’t any good opportunities (unless you consider oil and I’m just not convinced that it’s found the bottom yet). Those that tried bottom fishing in oil last time including myself ended up vacating those positions. For that reason, I’m more than just a little skeptical about the run in oil. I’m going to have a see a really good chart in anything related to oil before I’ll buy. Bottom fishing can be lucrative when you hit it. However, most of the time you are better off to wait for a good solid buy signal before you jump. Just consider any missed profits as insurance. Nine times out of ten, that’s the best thing to do.

Today’s action left us with the following results: Our TSP allotment slipped -0.522% and AMP was off -0.53%. For comparison, the Dow lost -0.53%, the Nasdaq -0.39%, the S&P 500 was -0.42%, AT&T was -0.66% and Alaska Air was off -3.66% as Transportation Stocks again took an unfair hit from rising oil.

Wall St. ends down on Greece, China worries

| 02/06/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.6471 | 16.9864 | 27.1735 | 36.8033 | 24.913 |

| $ Change | 0.0006 | -0.0876 | -0.0854 | -0.1009 | -0.2765 |

| % Change day | +0.00% | -0.51% | -0.31% | -0.27% | -1.10% |

| % Change week | +0.03% | -1.01% | +3.12% | +3.31% | +1.65% |

| % Change month | +0.03% | -1.01% | +3.12% | +3.31% | +1.65% |

| % Change year | +0.21% | +1.10% | +0.03% | +1.40% | +2.87% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.5257 | 23.0682 | 25.025 | 26.6359 | 15.1197 |

| $ Change | -0.0226 | -0.0697 | -0.0952 | -0.1137 | -0.0729 |

| % Change day | -0.13% | -0.30% | -0.38% | -0.43% | -0.48% |

| % Change week | +0.51% | +1.33% | +1.73% | +2.02% | +2.29% |

| % Change month | +0.51% | +1.33% | +1.73% | +2.02% | +2.29% |

| % Change year | +0.43% | +0.74% | +0.88% | +0.97% | +1.08% |