Good Evening,

The market backed out of the month with another negative day but finished with one of its strongest months in a while. Things started off weak and followed the recent script improving into the afternoon, but later tailing off for a small to moderate loss. The excuse was a revised report on GDP that showed the the economy growing at a slower rate than first thought.

I don’t like to quote anyone too much as I like to write my own stuff, but when they agree with what I’m saying, it lends credence to my message. I learned to trade under James DePorre ‘RevShark’ so that’s probably the reason that I think just like he does. Our trading styles are not exactly the same, but are extremely similar. The biggest difference is that I mostly use ETF’s (Exchange Traded Funds) while his vehicle of choice is stocks. That comes from the fact that I first learned to trade within the frame work of the Federal Thrift System, which of course uses funds. At the time I started trading, RevShark did a short commentary and allotment for TSP. I studied his charts and commentaries and read his book. Thus, I developed my own trading style based on his system and the rest as they say is history. That is why I so often agree with him. He talks about stocks, which are his vehicle of choice. However, everything he does is readily transferred to ETF’s so always pay attention to what he says. Today he was talking about the current market and whether it is better to time the top or to run with the trend, and why. This is a key point of our trading style that sets us apart from a lot of others. This is where our discipline wins out. Sure the top callers get lucky on occasion, but even a blind squirrel gets a nut every now and then. Our goal is not just to be successful every now and then, but to be successful most of the time. Here is what the RevShark had to say about the current market. Pay attention, it will make you a lot of money over the long run. If you are so inclined you can read more at Sharkinvesting.com.

“In a market with an amazingly persistent trend like we have now there is a major battle between sticking with the momentum and trying to call a turn. Quite often some of the best trend-following gains can come when the market is most extended. I know many momentum traders had a good day yesterday while the calls from the top-calling pundits was becoming even louder.

At this point in a straight up move that is over two-weeks old the question is whether you will make more enough money by sticking with the momentum to offset the inevitable losses that occur when we finally due see a reversal. If you are a momentum trader you know that you are going to suffer some losses when the market finally does reverse. On the other hand, if you are a traders that attempts to call market turns you know that you will have losses right away when your timing turns out to be less than perfect.

So the big question is whether you make more money by sticking with momentum and then getting caught in a turn or do you do better by racking up some short-term losses as you look for a top? The answer obviously depends on your timing. If you can call tops with some precise and manage your short term losses you will do pretty well. If you are a momentum player and manage some big gains as you ride a rally that others are questioning you will have a big cushion to offset any losses that occur with the top finally does come.

It is very tricky question and is at the heart of trading. We are at a point right now where it is impossible to not think we could see some downside but many thought that same things a week ago. I find that the best approach is to intentionally avoid the market timing process. Instead I want my stocks to be my guide to the action. I’ll set stops and manage my gains and losses and let them determine if I’m long.

Ultimately the degree to which I’m invested in the market is a function of how readily I can find new stocks to buy. The idea is that as the market becomes less technically friendly there will be few stocks to buy and a higher level of cash to provide safety when the market works off extended technical conditions.

While it is very easy to keep trying to time a market top it is better to just focus on stocks that are working. When conditions change our stocks will let you know and we can react very fast.”

I could not have said it any better myself. This is what you need to try to do in a market like we are having right now. If you follow the trend as you should, you will have enough profits to weather the storm when the market turn finally does come.

The day’s trading left us with the following results: Our TSP allotment was -0.251% and AMP was -0.32%. For comparison, the Dow lost -0.45%, the Nasdaq -0.49%, the S&P 500 was -0.30%, AT&T +0.17%, Alaska Air Group -0.52%, Facebook -1.79%, and Apple closed at -1.50%.

Wall Street ends down after data; posts strong gains for month

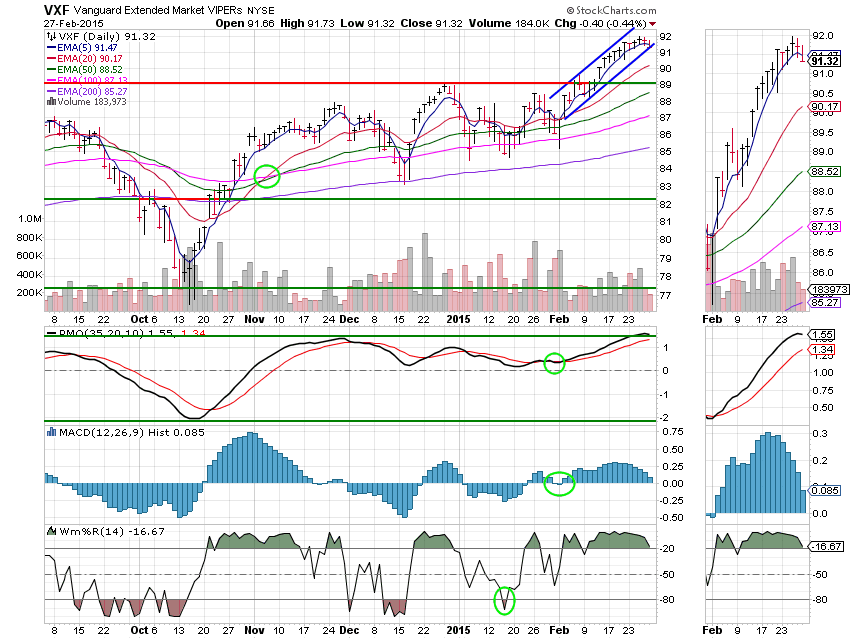

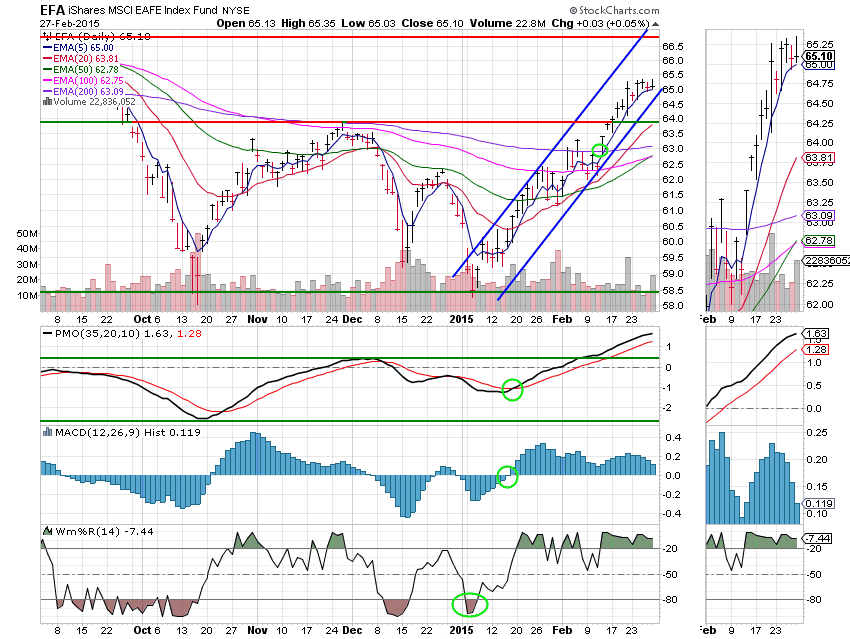

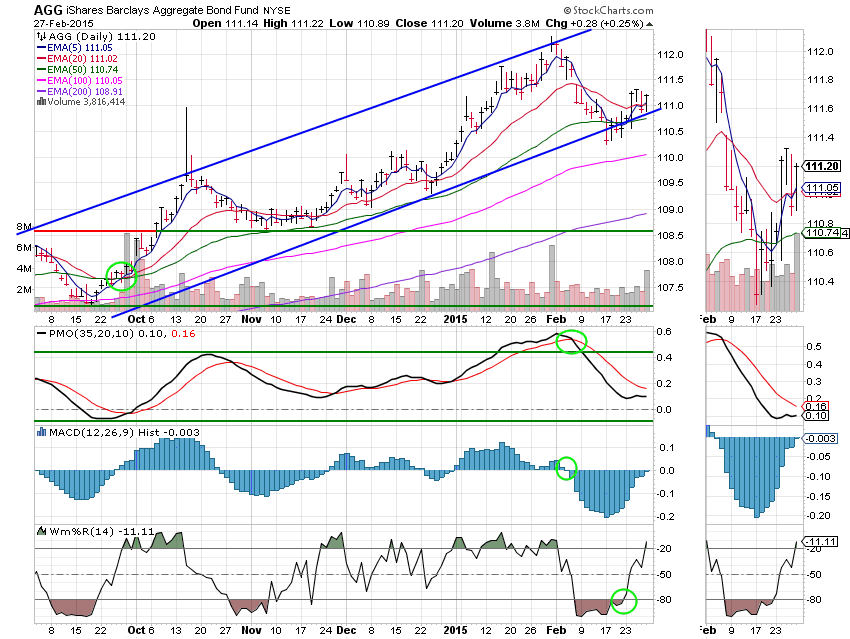

The months action left us with the following signals: C-Buy, S-Buy, I-Buy, F-Neutral. We are currently invested at 30/C, 40/S, 30/I. Our allocation is now +2.86% on the year not including the day’s results. Here are the latest posted results:

| 02/26/15 | |||||

| Fund | G Fund | F Fund | C Fund | S Fund | I Fund |

| Price | 14.66 | 16.9769 | 27.9497 | 37.9526 | 25.8957 |

| $ Change | 0.0006 | -0.0348 | -0.0365 | -0.0167 | -0.0427 |

| % Change day | +0.00% | -0.20% | -0.13% | -0.04% | -0.16% |

| % Change week | +0.03% | +0.55% | +0.06% | +0.13% | +0.20% |

| % Change month | +0.12% | -1.06% | +6.06% | +6.53% | +5.66% |

| % Change year | +0.30% | +1.04% | +2.89% | +4.56% | +6.93% |

| L INC | L 2020 | L 2030 | L 2040 | L 2050 | |

| Price | 17.6469 | 23.4527 | 25.5578 | 27.2859 | 15.5386 |

| $ Change | -0.0060 | -0.0172 | -0.0235 | -0.0281 | -0.0176 |

| % Change day | -0.03% | -0.07% | -0.09% | -0.10% | -0.11% |

| % Change week | +0.07% | +0.10% | +0.11% | +0.12% | +0.12% |

| % Change month | +1.21% | +3.02% | +3.90% | +4.50% | +5.12% |

| % Change year | +1.12% | +2.42% | +3.03% | +3.44% | +3.88% |

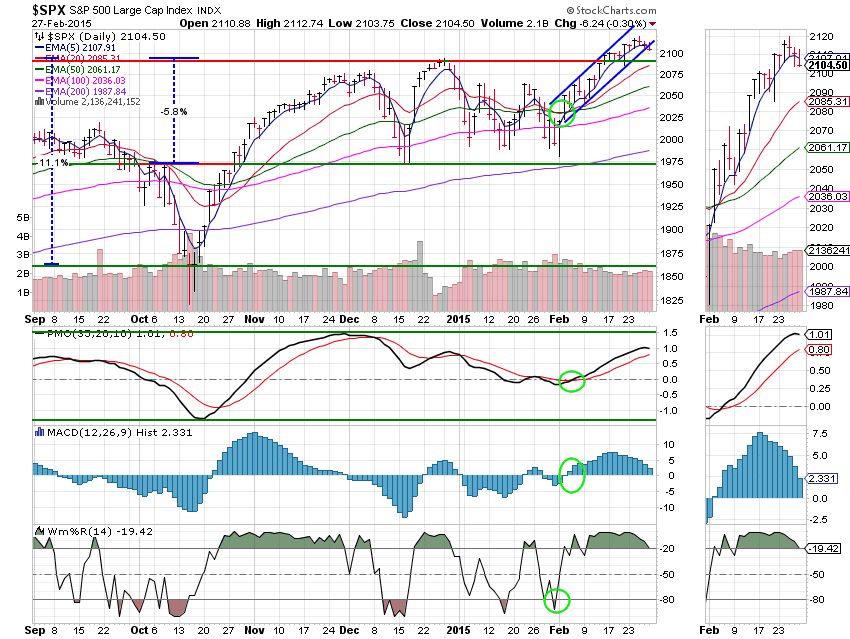

C Fund: Price still remains above support but did manage to drop out of the ascending channel. However, the channel is pretty narrow so price could just be consolidating and creating a wider more sustainable channel for more upside. I’ll redraw the channel if it does indeed head back up. If not, then this was the first sign of a new trend. The PMO turned down, which is slightly bearish as well. In addition, the Williams% R and MAC D are reflecting three days of somewhat negative action. No real damage done yet though. This chart is still a buy.